A look at how long-term holders determine end of bear markets

Long-term holders, defined as addresses holding bitcoin for more than 155 days, are often considered the backbone of the market. They create support because they tend to accumulate BTC when the price is falling, and they distribute the accumulated coins when the market is rising, causing a bullish rally.

Therefore, to determine Bitcoin’s bottom, we need to look at the behavior of long-term holders, as the true bottom is only reached when LTH surrenders.

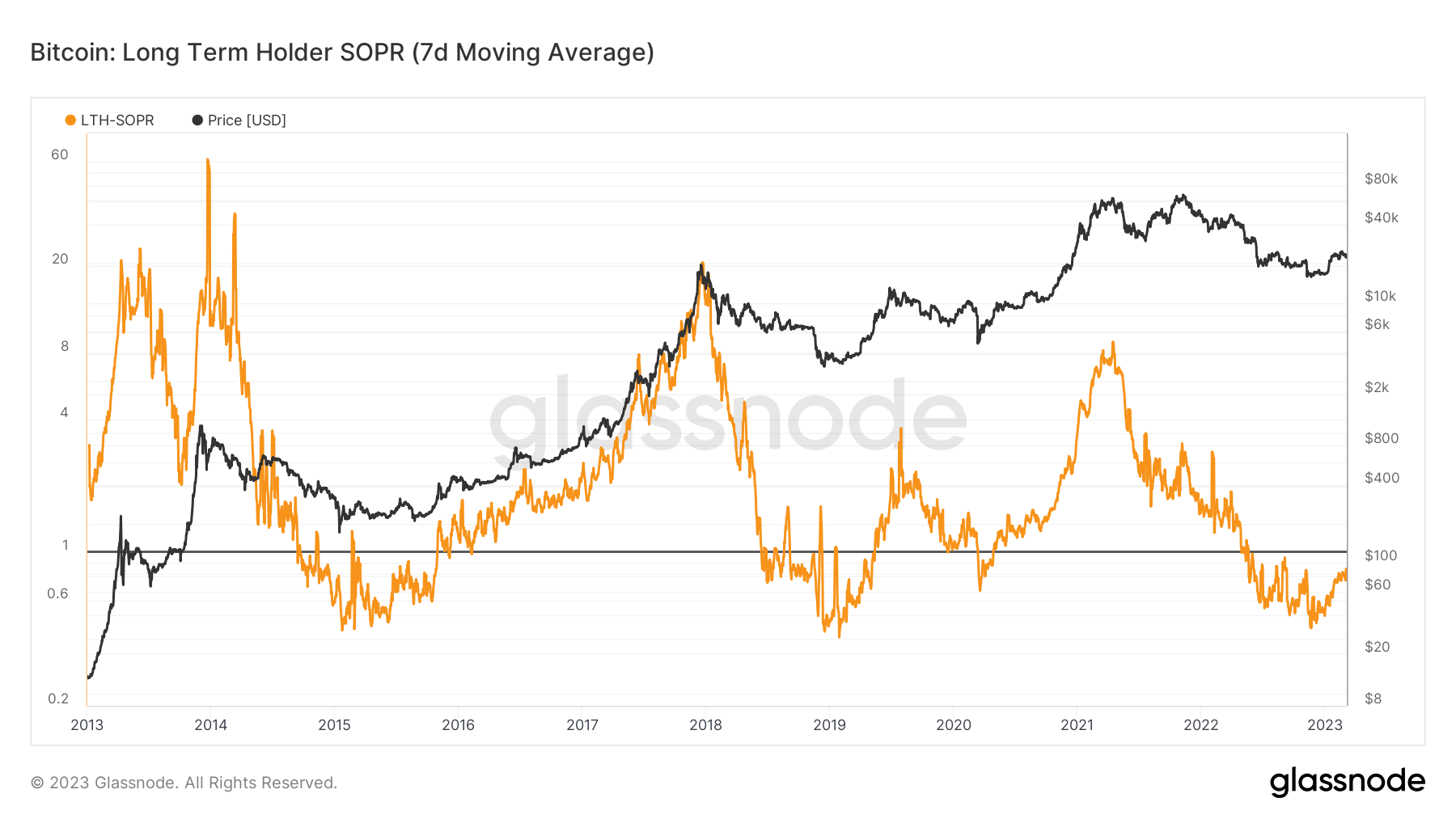

Spent Output Profit Ratio (LTH SOPR) is a metric that provides clear insight into the behavior of Bitcoin holders. Applied to LTH, in a certain timeframe he will be shown the degree of profit realized on all coins that LTH has moved.

A SOPR value greater than 1 means the coin was sold at a profit, while a SOPR value less than 1 means the coin was sold at a loss. An upward trending SOPR indicates that gains are being realized, while a downward trending SOPR indicates losses.

Data analyzed by CryptoSlate shows that the LTH SOPR has been trending upwards since the beginning of the year after hitting a three-year low in December 2022.

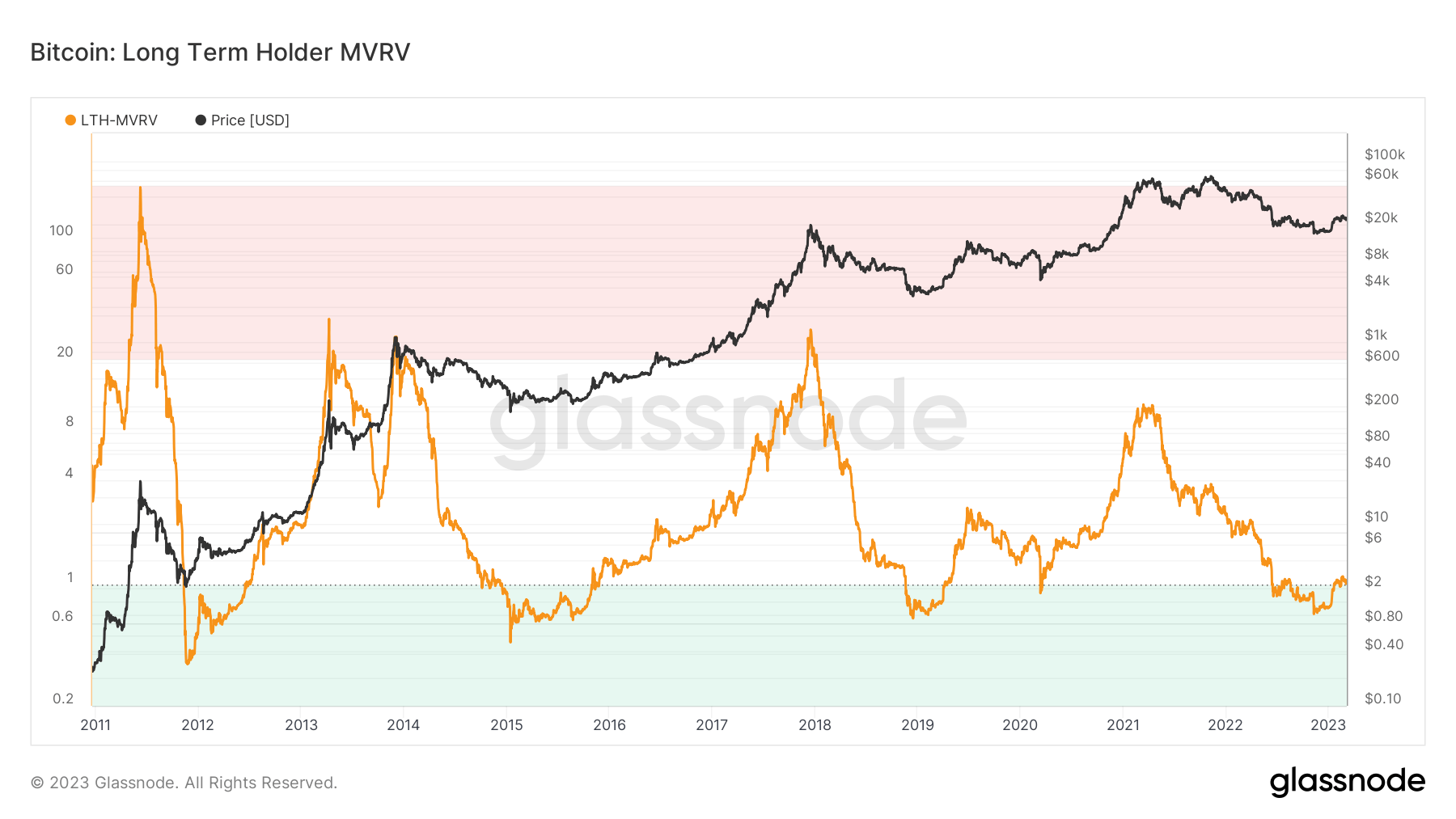

Unlike SOPR, which only considers used output with a shelf life greater than 155 days, LTH MVRV only considers unused output (UTXO).

The MVRV ratio shows the ratio of Bitcoin’s market capitalization to its realized cap and determines whether it is trading above or below its fair value. Similar to SOPR, extreme deviations between market value and realized value can be used to identify market tops and bottoms, thus ensuring market profitability can be assessed.

Rising MVRV ratios indicate a growing degree of unrealized gains and the potential for distribution as investors race to secure profits. Declining or low MVRV indicates a small degree of unrealized gains, which may indicate undervaluation and lack of demand.

When the MVRV ratio is below 1, most of the supply is held at the breakeven price or loss. This is usually a sign of market capitulation and indicates that the bearish accumulation phase may be coming to an end.

CryptoSlate’s analysis shows that the LTH MVRV ratio has just crossed 1, indicating that the bear market may be over.

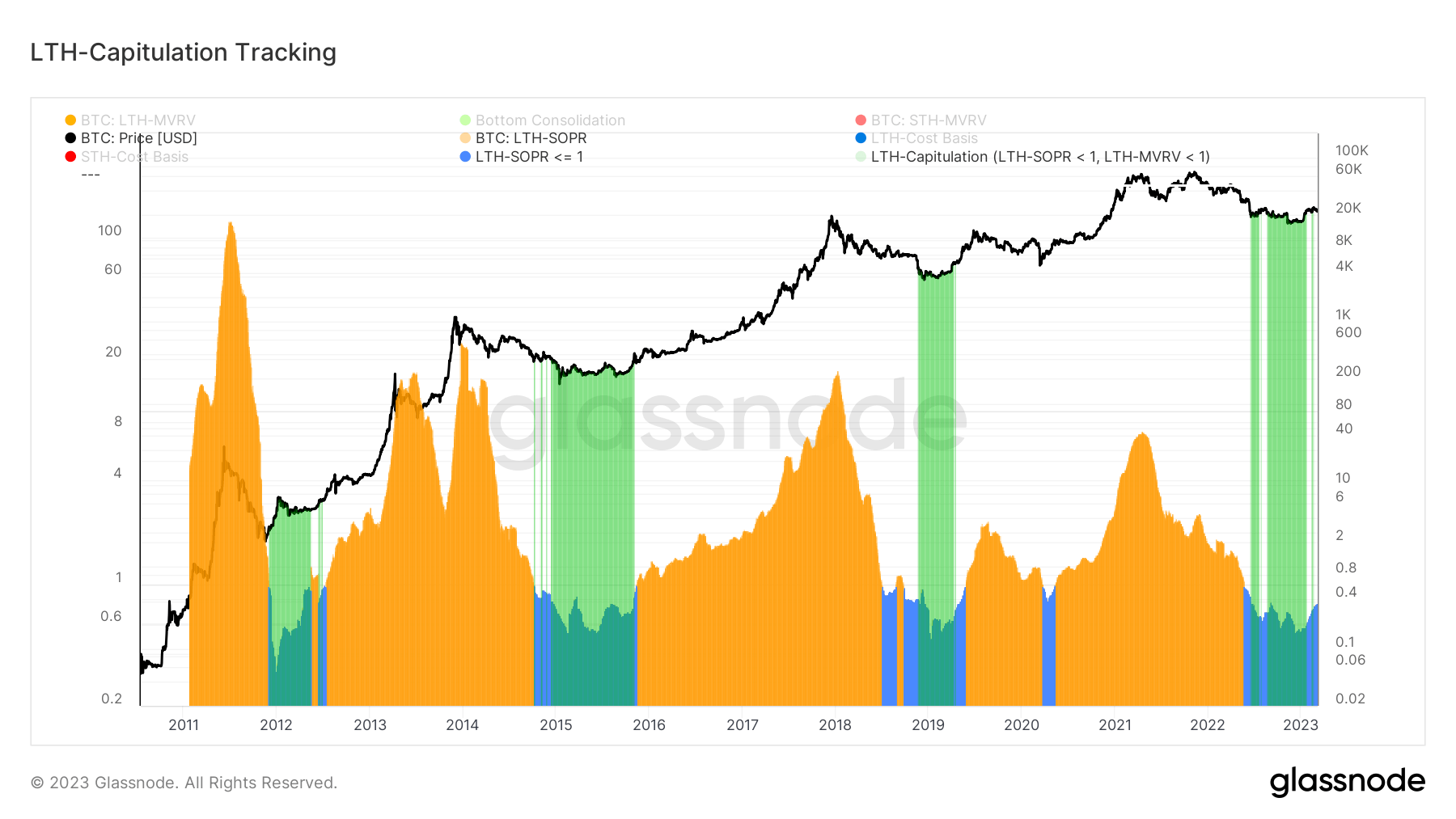

Putting both the SOPR and MVRV ratios together, we find the end of the bear market to be somewhat hesitant.

The green highlights in the graph below indicate periods when both the LTH SOPR and LTH MVRV ratios trended below 1. If the ratio of the two falls below 1, it indicates a surrender of the market as both spent coins are being sold at a loss for the most part. One of the circulating supplies is held at an unrealized loss.

CryptoSlate’s analysis confirms that the market is definitely out of capitulation. However, LTH’s SOPR is still trending slightly below 1, so the market is not confident of entering a full-fledged rally.