A look at similarities between the 2000 dot-com bubble & post-COVID-19 bubble

While there are significant differences between the dot-com bubble of 2000 and the post-COVID-19 bubble, there are still many similarities. The 2000 tech bubble started in his late 1990s and lasted until 2002, while the post-COVID-19 bubble started in 2019 and lasted until 2022.

Let’s look at both eras.

Dotcom bubble:

The dotcom bubble, also known as the internet bubble, emerged from speculative investments, abundant venture capital funding, and the failure of dotcoms to generate a product or real revenue.

As the capital markets poured money into the sector, start-ups raced to get big fast, and those without proprietary technology abdicated financial responsibility. As a result, the majority of the 457 initial public offerings (IPOs) made by Internet companies between 1999 and 2000 were Internet-related. Additionally, in the first quarter of 2000 alone he had 91 of his IPOs.

Eventually the bubble burst and many investors suffered huge losses. But despite the bubble, Amazon, eBay and Priceline survived. In addition, it laid the foundation for Internet applications such as Twitter and Facebook, ushering in a new era of communication and technology.

Covid-19 bubble:

During the Covid-19 lockdown, the narrative shifted from centralized communication technology to one focused on decentralized technology for some on the cutting edge of the tech industry.

Like the 2000 tec bubble, the Covid-19 bubble was also accompanied by a lot of speculation in digital assets and an increase in available capital as a result of quantitative easing and stimulus measures.

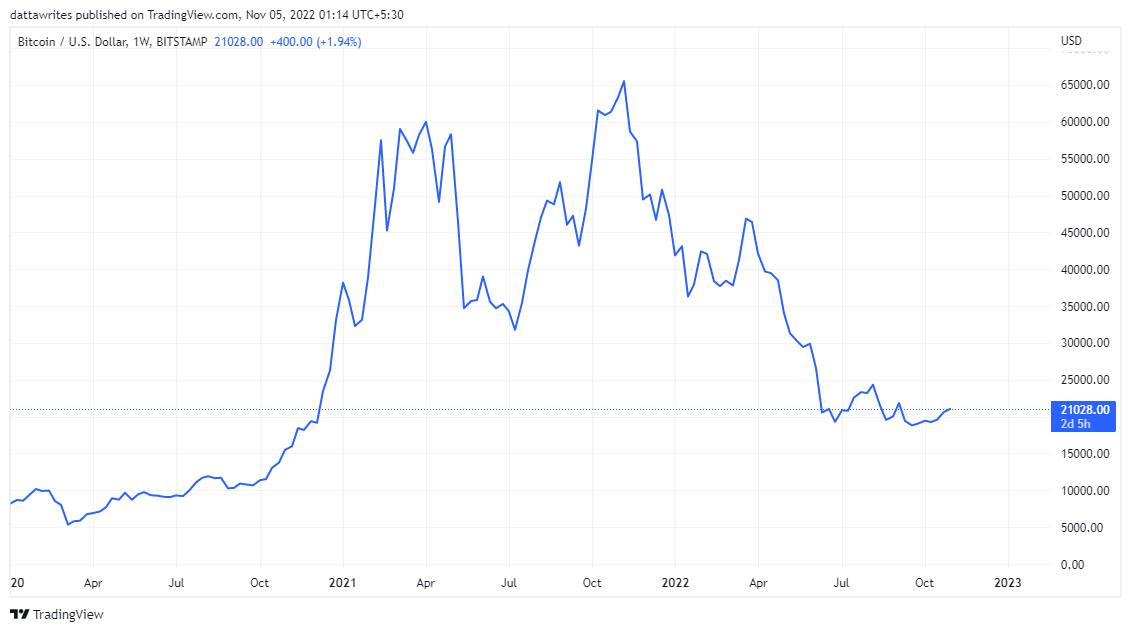

Bitcoin’s price stood at $19,000 in November 2020, but by March 13, 2021, more investment led to an increase in market capitalization, surpassing $61,000 for the first time. Cryptocurrencies such as Ethereum, Solana and Dogecoin also surged. Bitcoin and Ethereum peaked at $67,566.83 and $4,812.09 respectively on November 7, 2021.

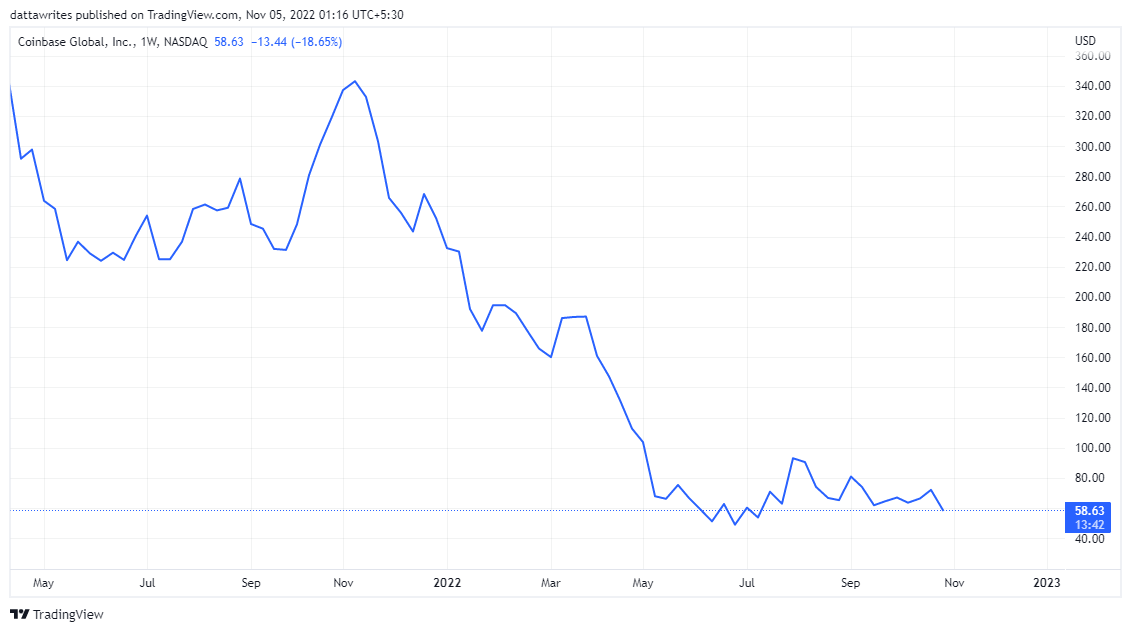

Additionally, the much-hyped cryptocurrency exchange Coinbase went public on the NASDAQ on April 14th. The stock rose 31% to $328.28 on its first day, boosting its market capitalization to $85.8 billion.

By the end of 2021, the cryptocurrency market began to fall along with other markets. In September 2022, Bitcoin fell below $20,000, along with other altcoins and his NFT.

On May 10, 2022, with its stock price down nearly 80% from its peak, Coinbase announced that people would lose their money if it went bankrupt. Additionally, companies such as Celsius Network and SkyBridge Capital have announced suspensions of withdrawals and transfers.

Nevertheless, the COVID-19 bubble has had a significant impact on Bitcoin and Ethereum prices. Now, even after the Fed’s recent rate hike, Bitcoin could be seen as a more stable bet than safer assets like gold and the Nasdaq.

One notable similarity between the two eras is the prevalence of speculation. In the 2000s, intense speculation about dotcoms dominated the global debate. There is currently a lot of speculation about Bitcoin, DeFi, memecoins and NFTs.

Additionally, amid both the tech and COVID-19 bubbles, VCs continued to invest, demonstrating confidence in the future of these industries.

In particular, the economic and financial environment of about 22 years ago was different from today. After that, the US became the undisputed world leader and the market performed well. Global markets are now enduring blistering inflation and the US is struggling to hold its ground.