A review of bitcoin mining company holdings in 2022

Glassnode data analyzed by crypto slate Bit Digital posted a 134% growth in reserves in 9 months, showing Marathon, Hut8 and Riot building the top 3 largest Bitcoin (BTC) pools.

BTC Miners in 2022

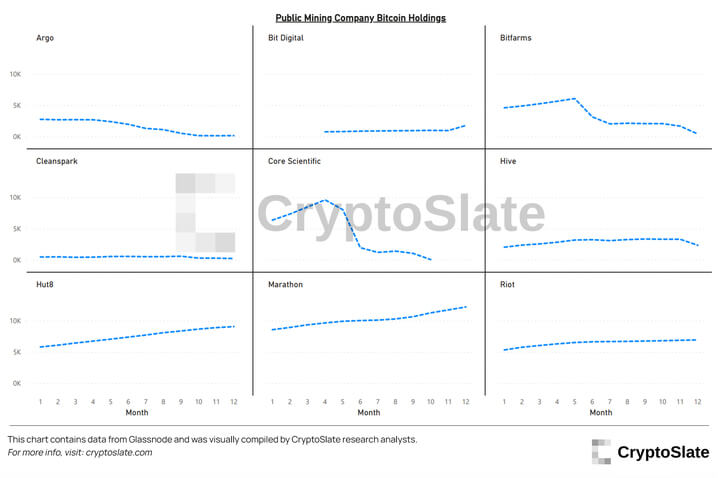

BTC miners have entered 2022 by acquiring resources through cheap debt in 2021. Most of them invested these resources into growing his ASICS and continued to increase their BTC holdings until May.

However, the bear market that started in May brought significant pressure and led to diversification among miners. Competition in Blockspace has increased as the war between Russia and Ukraine has increased energy costs, lowered BTC prices, and increased hashrates.

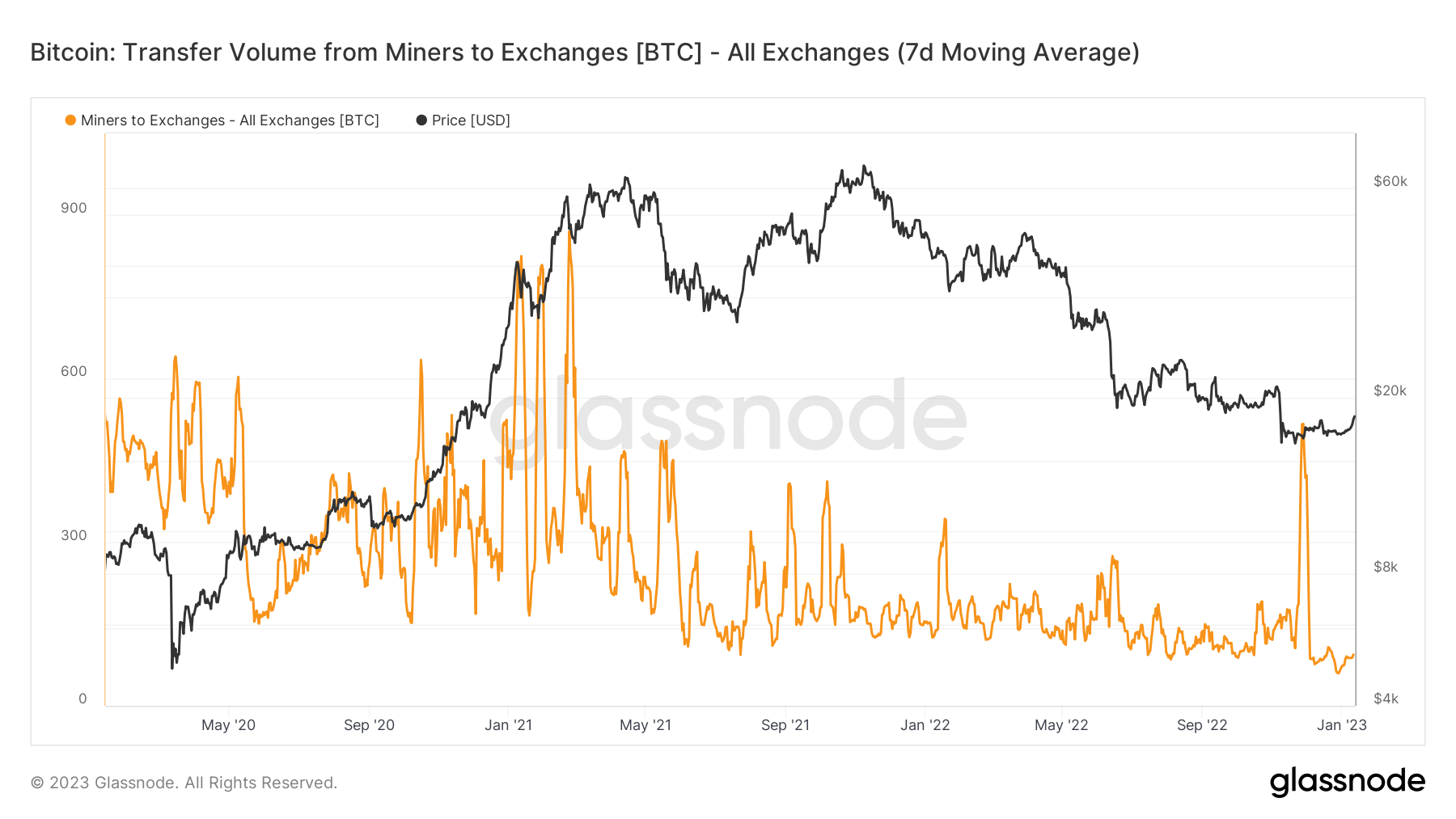

In late 2022, circulation emerged as a major theme for BTC miners. However, his BTC volume on the exchange did not increase. Throughout the year, his BTC transferred to exchanges was less than 60,000.

Year-end reserve

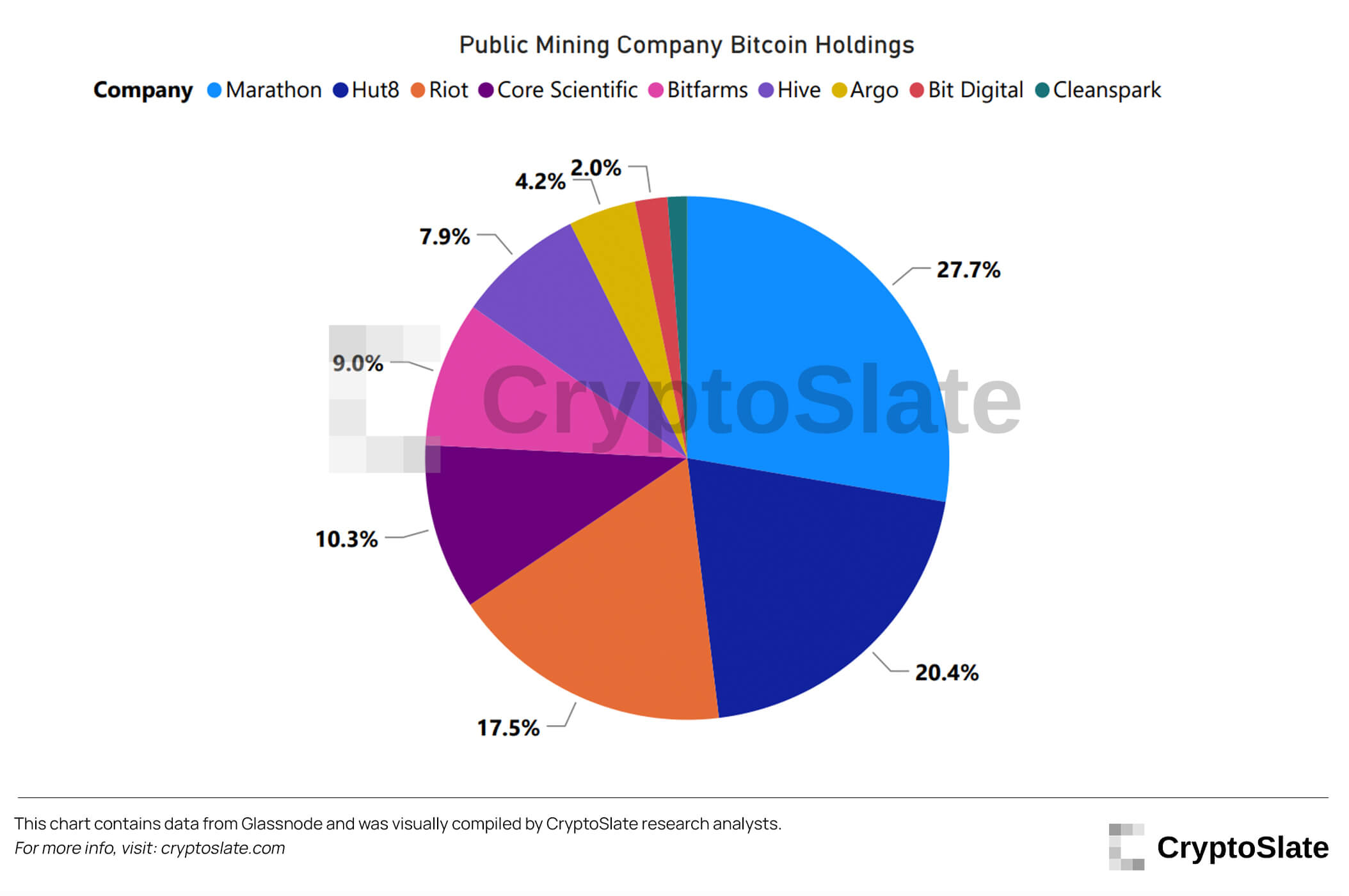

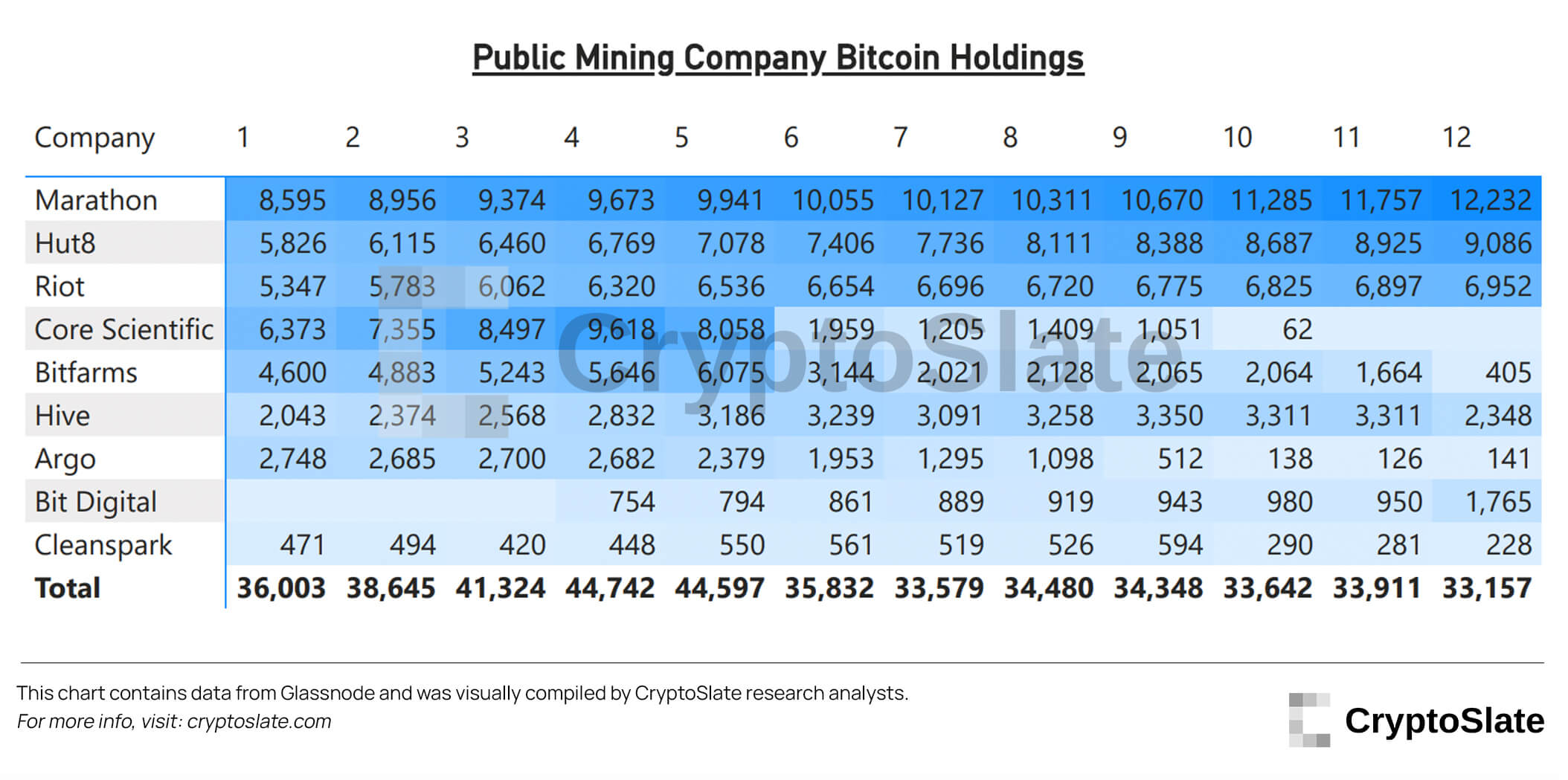

Marathon, Hut8 and Riot were the top three companies with the largest total BTC holdings with 12,232 BTC, 9,086 BTC and 6,952 BTC respectively.

Marathon’s holdings account for 27.7% of the total BTC pool of the top nine mining companies, while Hut8 and Riot account for 20.4% and 17.5% respectively.

Top 9 companies

CryptoSlate has done an in-depth analysis of the top 9 BTC mining companies. Marathon, Hut8, HIVE, Riot and Bit Digital ended the year with increased holdings.

However, Bit Digital recorded the most impressive growth in mining capacity over the course of the year. Bit Digital started operations in his April and mined 754 BTC in his first month. For the rest of the year, the company posted a 134% growth in reserves, and in December he reached 1,765.

Marathon started the year at 8,595 BTC, registering a 42% increase and hitting 12,232 BTC in December. Hut8, which was 5,826 BTC in January, increased to 9,086 in December, reflecting an increase of almost 56%. Finally, HIVE’s January reserves stood at 2,043 BTC, and he increased by 14.9% over the year, reaching 2,348 BTC in December.

Bitfarms started the year at 4,600 BTC, dropping to 405 BTC in December, a 91% decline. Similarly, Argo said that in January he held 2,748 BTC, but in December it dropped to 141 BTC, a 94.8% decline. CleanSpark’s BTC reserves fell 51%, dropping from 471 in January to 228 in December. Finally, Core Scientific didn’t survive the winter. The company ended the year with his 6,373 BTC and went bankrupt in December.

First two weeks of 2023

2023 started with the least selling pressure in three years. The chart below represents the flow of BTC from miner wallets to exchanges.

According to data, only 88 BTC have been transferred to exchanges in the last two weeks.