Aave votes to pause ETH borrowing following concerns of users trying to maximize ETHPoW airdrops

arb has voted Vote with 77.87% in favour, to stop borrowing Ethereum ahead of The Merge. The Governance Proposal states:

“Proposal to suspend Ethereum borrowing in the period leading up to the Ethereum merger…

Ahead of the Ethereum merge, the Aave protocol faces the risk of high usage in the ETH market. You can mitigate the risk of this high utilization by temporarily suspending ETH borrowing. “

The proposal states that the motivation for the move is to protect against “high utilization in the ETH market.” There was concern that this would be caused by “users who may benefit from his forked PoW ETH (ETHW) by borrowing his ETH before the merge”.

Interestingly, Aave did not vote to completely suspend activity on the Ethereum network, simply suspending ETH borrowing. The proposal does not address concerns about The Merge itself, but it does not address the possibility that speculators could artificially increase demand beyond acceptable levels.

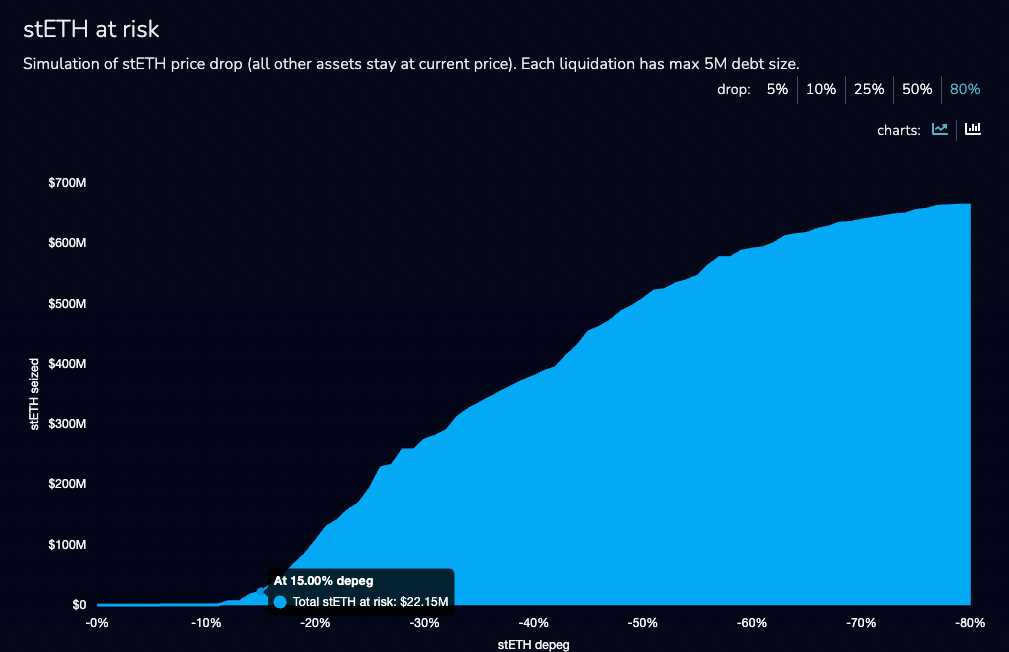

The proposal also explains how high borrowing rates can lead to “stETH/ETH recursive positions”. [becoming] Increases the likelihood of users exiting positions, further promoting stETH/ETH price deviations, causing additional liquidations and bankruptcies. For more information on the proposal, governance forum.

Forum data included simulations of stETH at risk if left unattended. According to the chart, 15% depeg is unlikely to trigger a large liquidation on the Aave platform. However, if the peg establishes a 50% deviation, liquidations of over $500 million can occur.

Additionally, after analyzing wallets using the Aave platform, we discovered “abnormal behavior of users building ETH/ETH recursive positions.” The rationale for such a strategy is to maximize ETH exposure to take advantage of his ETHPoW fork.

For additional risks and scenarios that have resulted in seeking governance proposals to suspend ETH borrowing, please see: governance forumHowever, the DAO seems to work well to protect the DeFI platform and autonomy.

There is no centralized direction to force changes to the platform. Governance Token holders raised potential concerns and the community voted to protect the best interests of the market. The proposal can be deployed starting at 1:00 am on Wednesday.