After September bloodbath, historically bullish Q4 could ease the pain

Since the beginning of the year, traditional financial markets have been in a steady downward spiral. Russia’s invasion of Ukraine appears to have ignited problems that have piled up since the pandemic began, wiping out most assets.

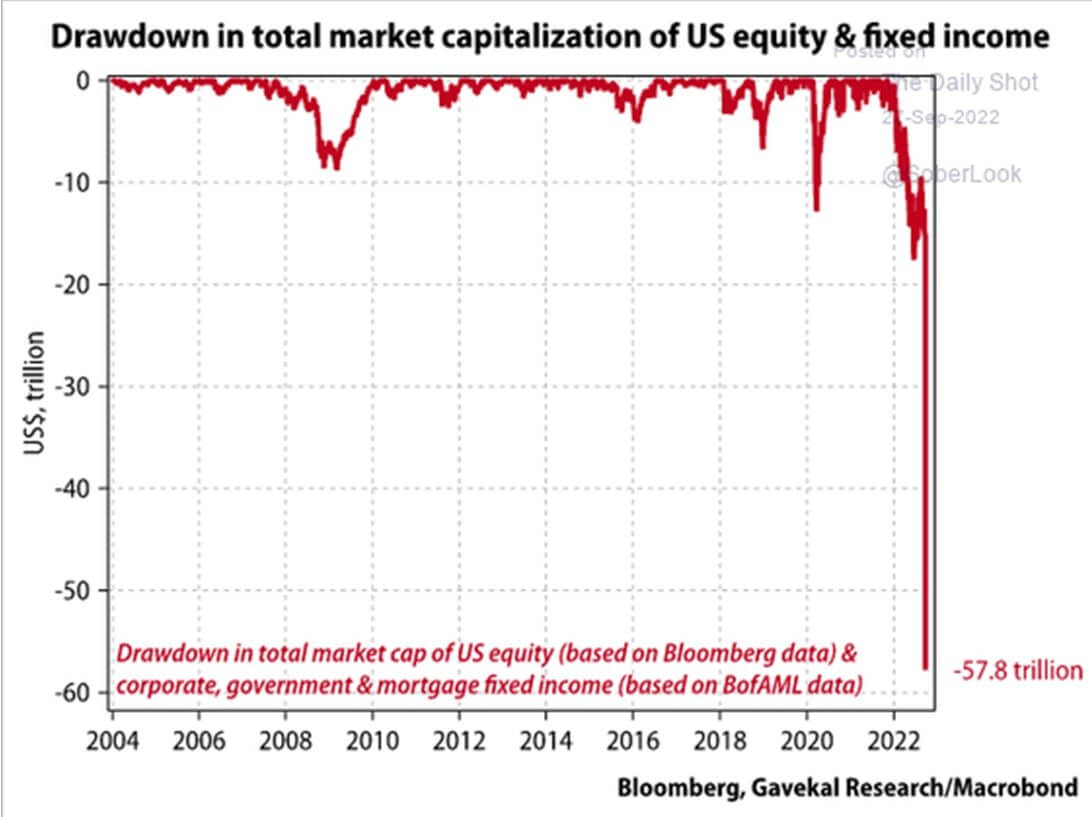

About $60 trillion has been lost from U.S. stock and bond market capitalization since February, according to Bloomberg data. The current drawdown has outpaced the market declines seen early in the 2020 pandemic and during the 2008 global financial crisis.

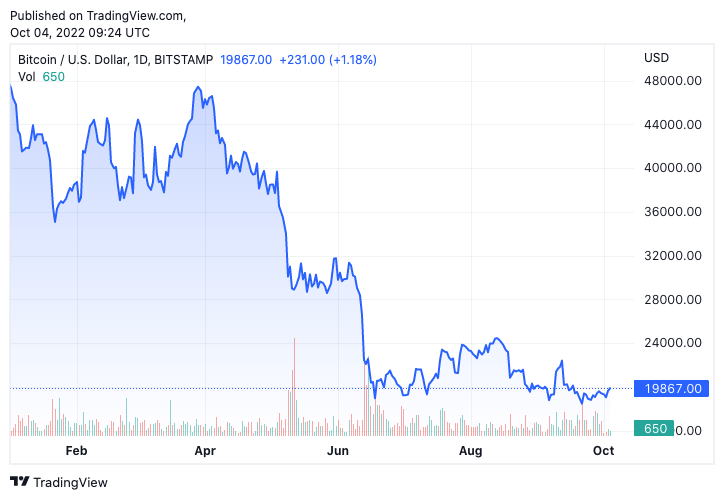

Bitcoin is immune to the macro factors that have decimated the tradiphi market. After Terra (LUNA) crashed in June, Bitcoin failed to recover, following a turbulent path of temporary gains and sharp corrections.

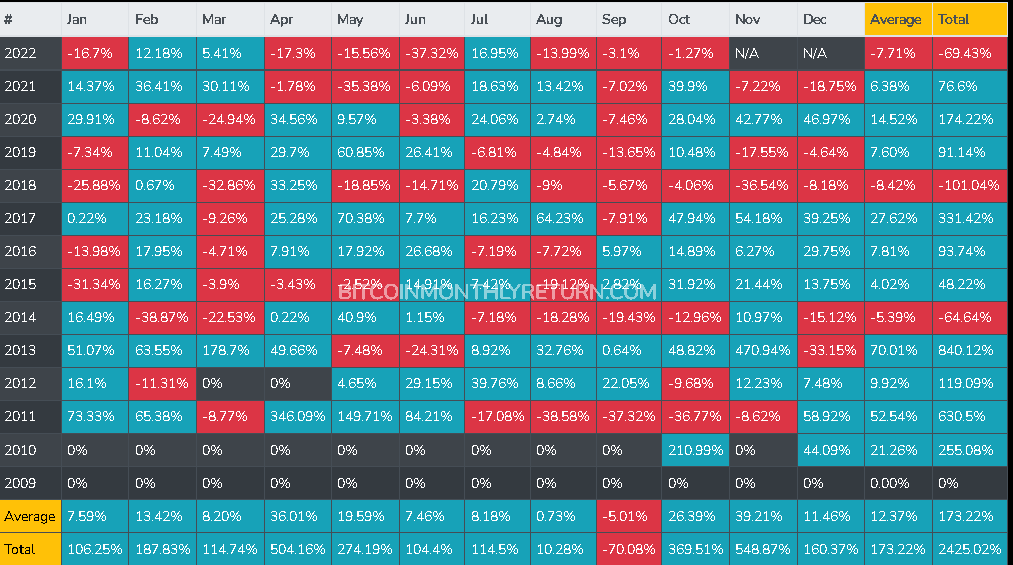

But Bitcoin’s lack of upward momentum may be short-lived. September has historically been Bitcoin’s worst month — it hasn’t finished the month green since 2016.

Meanwhile, October historically marked the beginning of a bullish quarter for cryptocurrencies, with Bitcoin closing at an average monthly close of 26.39%. It was also his second best month for Bitcoin historically, as he recorded a 369.5% increase cumulatively since 2009.

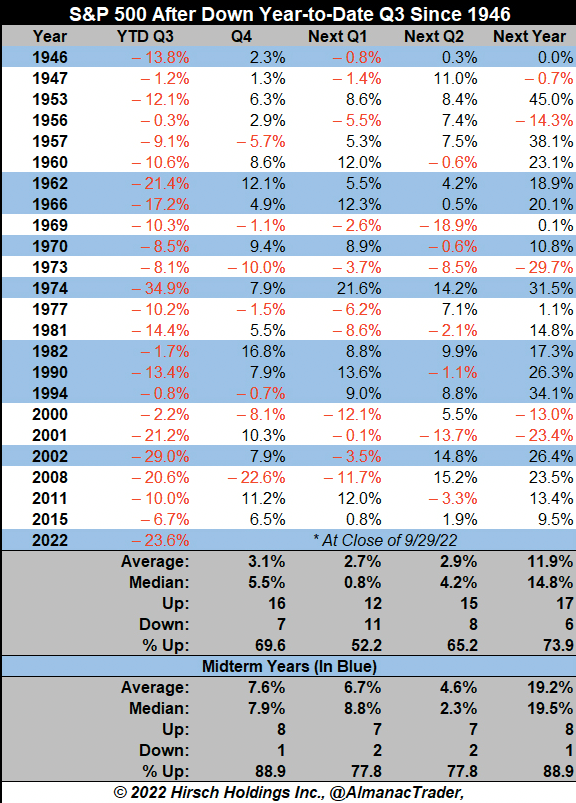

The September carnage is a recurring theme in traditional finance. Since 1946, S&P 500 posted negative year-to-date returns 23 times in the third quarter. Of the 23 negative third quarters the S&P 500 has seen, about 70% followed a positive fourth quarter.the year we spent together midterm electionsthis figure rose to 89%.

If both markets hold onto their historical patterns, the pressure could ease off at the end of October and positive returns could return. However, as global macroeconomic factors continue to deteriorate and pressures on both markets increase, it is equally likely that these patterns will break.