Alameda-owned RenVM confirms it’s ‘impossible to launder any assets’ through Ren Bridge, debunking claims of $540M in money laundered

Elliptic Connect, a blockchain data analytics company, report Wednesday—widely covered on both cipher When news media — Entitled “Cross-Chain Crime: Over $500 Million Laundered Through Cross-Chain Bridges”.

The report claims $540 million worth of cryptocurrency was “money laundered.” Ren VM bridge, i.e. part of Sam Bankman-Fried’s Alameda Research.

Elliptic states that “RenBridge facilitated the laundering of at least $540 million in criminal proceeds.”

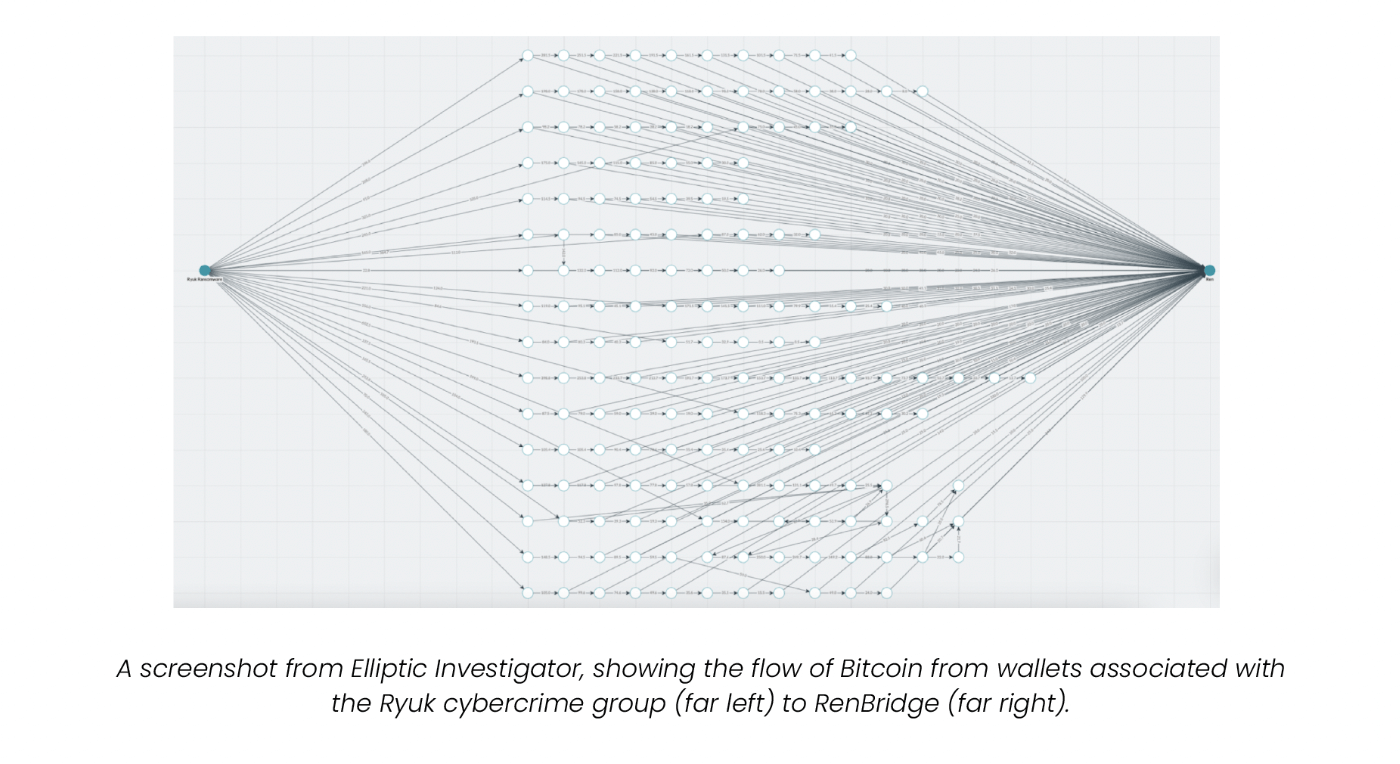

The article also promotes a new analytical tool called “Holistic Screening”. Analytics applications allow “criminal proceeds to be tracked even as they move across blockchains via services like RenBridge.”

Holistic screening visualizations show the ability to map and track transactions between known wallets across blockchains.

However, the language used can be considered misleading in line with the concept of “money laundering”, which requires applications to be able to “launder” money so that it cannot be traced back to its original owner. There is a nature.

Ren runs on public blockchains without mixer technology handling cross-chain bridges. His RenMAX, a core contributor involved in running Ren Labs, told CryptoSlate:

“All transactions through the Ren Bridge are fully public, transparent and on-chain. is created, which means you can always determine which addresses are bound.”

He explained the process by which transactions are publicly verified on-chain, confirming that “it is impossible to hide or launder assets through Ren.”

“So all transactions and interacting addresses are fully traceable, making it impossible to hide or launder assets through Ren.”

In a tweet on August 10th, Elliptic touted its analytics technology and said it would “unify all crypto assets and blockchains into a single financial network.” There are countless potential use cases for analyzing and investigating potential villains with Nexus products.

The Elliptic toolset has the potential to streamline and improve the traceability of blockchain transactions, but it is unclear how it can uncover information that has not yet been made public.

Cross-chain financial crime is the new reality of crypto assets. Elliptic Nexus unites all crypto assets and blockchains into a single financial network composed of hundreds of billions of data points, revealing risks invisible when looking at specific assets alone. pic.twitter.com/5q9uWfrFC7

— Elliptic (@elliptic) August 10, 2022

Ren Bridge allows users to move crypto assets between blockchains via wrapped tokens such as renBTC, renZEC, and renBCH.

Ren uses a node called “Dark Node”. Debris Make it resistant to attacks. The “dark node” secret is irrelevant to on-chain privacy regarding bridged assets.

Amid widespread reports that Ren is being used to launder money, we have released Ren 2.0, an upgraded version of the RenVM protocol. The announcement was overshadowed by his Elliptic article tying the platform to a North Korean hacking group.

Ren 2.0 adds additional security and features to the protocol, but does not mention the privacy features necessary for successful money laundering.

1/ Today we are excited to introduce Ren’s next iteration in this new multi-chain world✨

Ren 2.0: An Open Protocol to Enable New Multi-Chain Application Development with EVM Supporthttps://t.co/LR7rKpYyt0

— Ren (@renprotocol) August 10, 2022

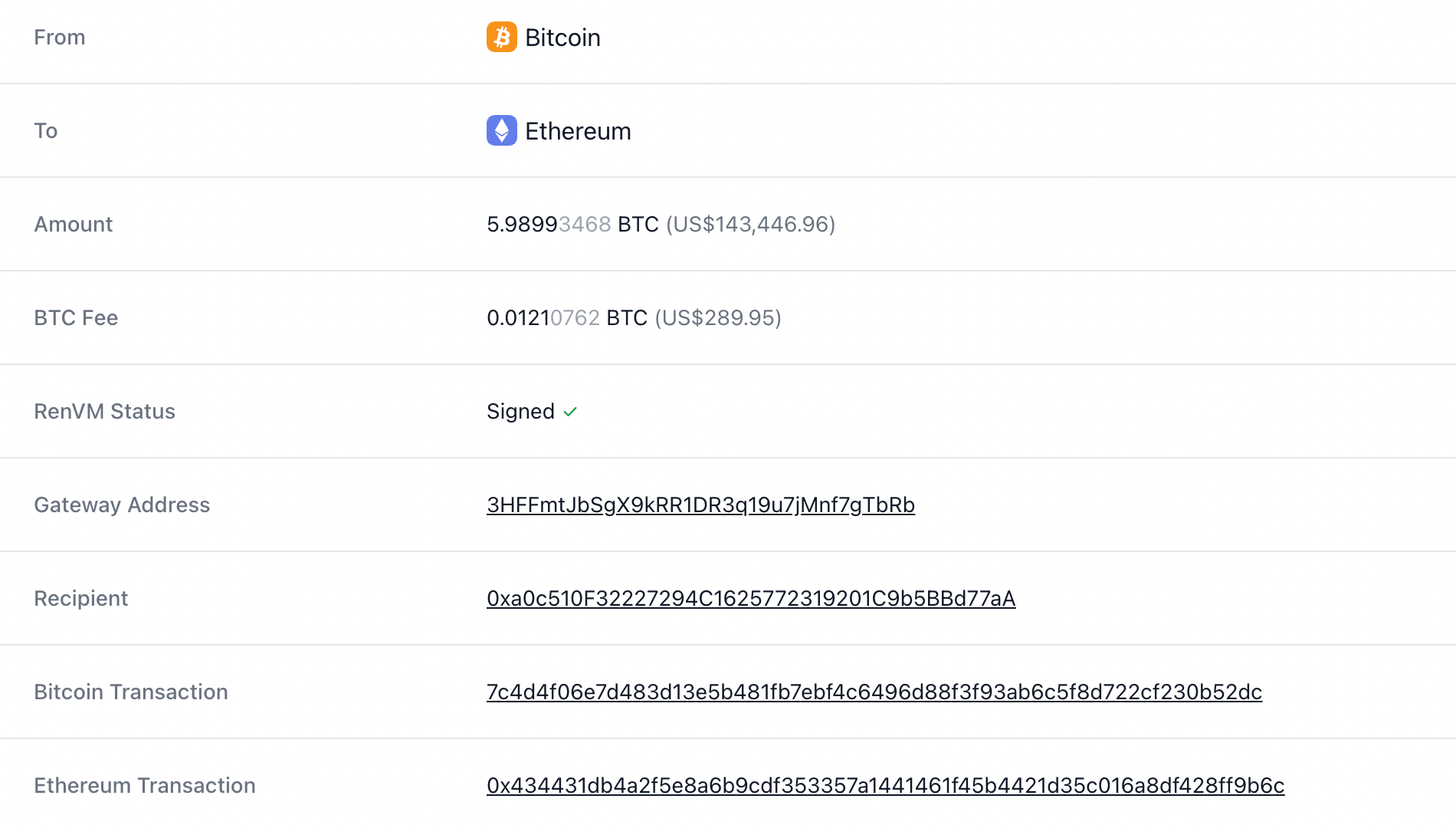

As confirmed by renMAX, all Ren transactions are completely transparent and visible through Ren Explorer. The image below shows a transaction that allows Bitcoin to be moved to the Ethereum blockchain through the bridge. It is of little use to money launderers as it reveals the recipient and sender addresses.

Ren’s Discord community was significantly shaken by the news. As one user told CryptoSlate:

This concern arose when the U.S. Department of the Treasury authorized Tornado Cash, causing Circle to freeze wallets associated with the protocol.

The bridge was reportedly passed $12 billion in assetsmany belong to retail users who want to experience an open and freely interoperable blockchain ecosystem.