Analytics suggest it is doing little to attract new users

On-chain and off-chain metrics show that one of the biggest events happening in crypto has gone unnoticed outside the crypto community.

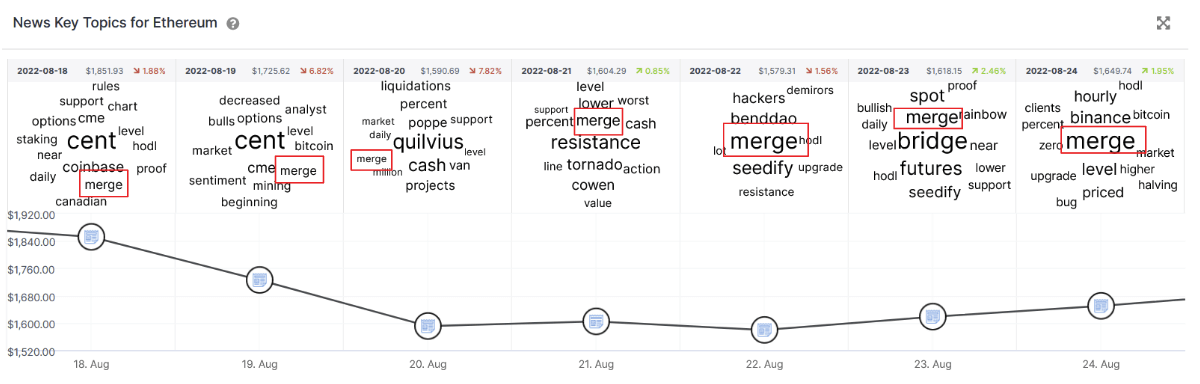

As nearly all cryptocurrency users are aware by now, the Ethereum merge is set to take place in mid-September, moving the chain from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus model. increase. This high-profile event has been in the works for years, and now he’s less than a month old. Aside from the hacks and token collapse this year, the consolidation was one of the most discussed events and was everywhere last week, as seen in IntoTheBlock’s Ethereum news word cloud.

Off-chain social metrics

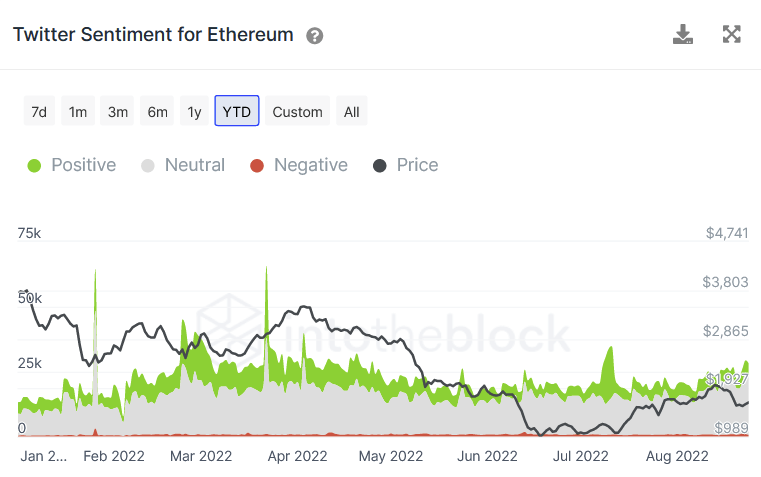

Additionally, Twitter’s sentiment model shows that the volume of recent tweets on Ethereum is approaching the year’s highs (excluding outliers) last seen in late February and early March. .

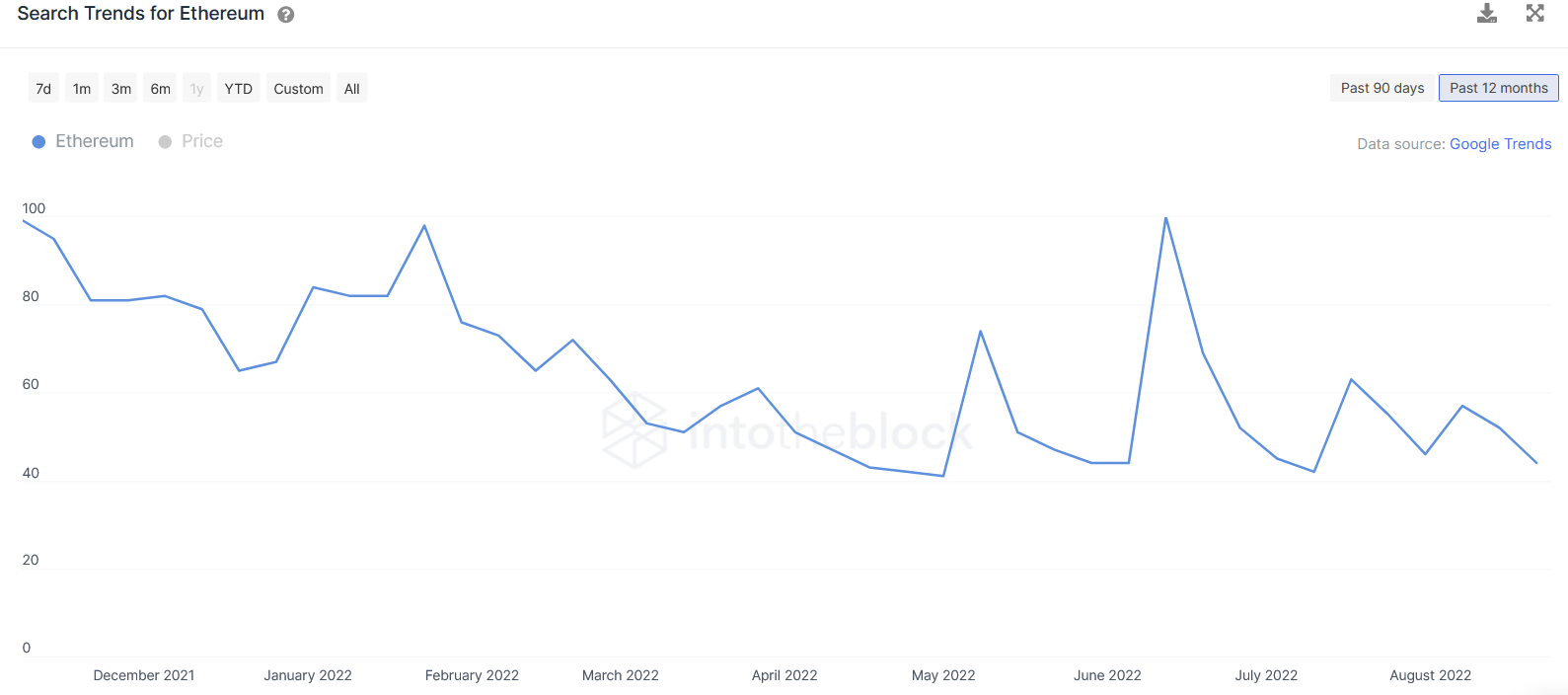

However, Twitter data shows that while tweets about Ethereum are on the rise, positive sentiment is significantly lower than earlier this year, with the increase in tweets coming only from sentiment-neutral tweets. The lack of excitement is borne out by Ethereum’s search trends since November’s all-time high. Apart from a few peaks, we can see that the Ethereum search metric has a gentle downward trend.

on-chain indicator

The social data highlighted above show that there is a macro downtrend of interest to Ethereum and consolidation does not appear to be able to change the direction of that trend.

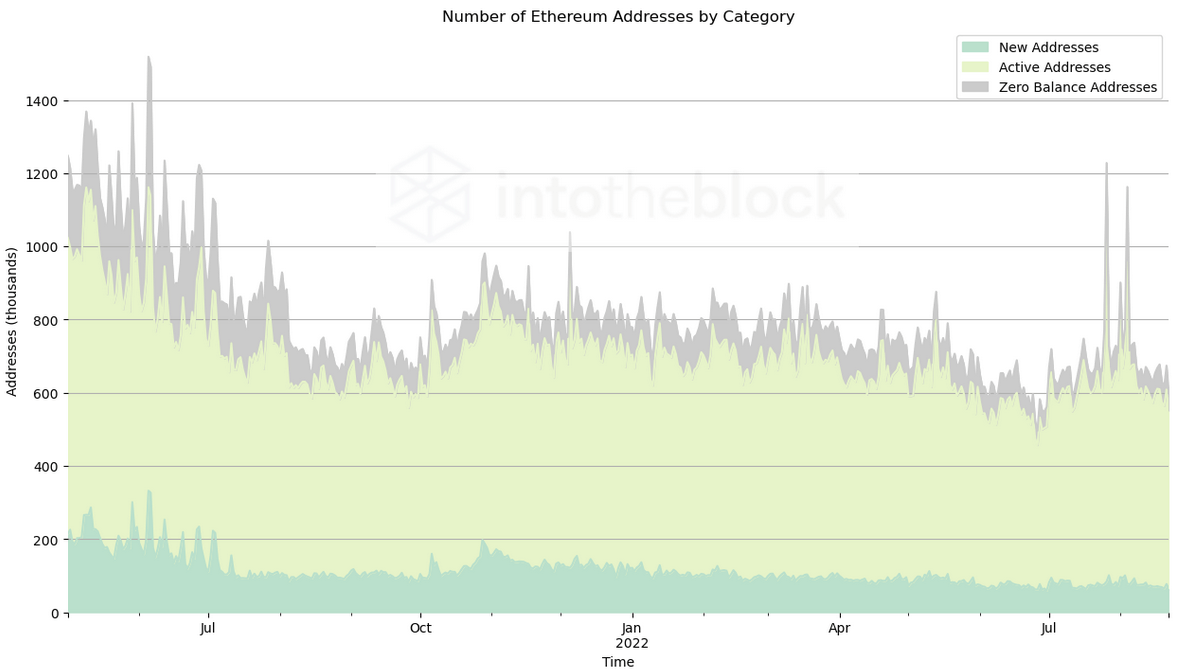

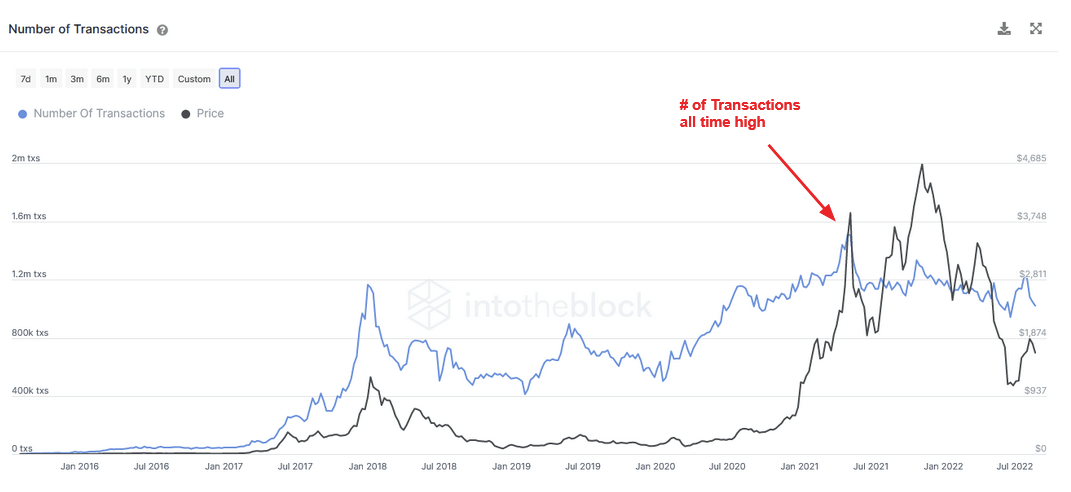

This lack of interest is also confirmed through on-chain metrics. New addresses created per day have been trending downward since the initial market peak in May. This suggests that there are fewer new entrants entering the market. In addition to the drop in new addresses, total weekly transactions also peaked in May. Taken together, these two metrics point to weak growth and low interest in Ethereum.

The metric shows that the current trend moved well before the all-time high in November. Observing a low number of new addresses and stagnant transaction volumes after the peak in May, new retail investors lost interest, leaving the market (or not entering at all), and institutional and virtual It is suggested that only currency veterans remain in this field.When Global inflation hits 40-year high In many countries, retail investors will most likely have less disposable income to devote to investments such as cryptocurrencies.

final thoughts

The merger is being talked about all over the cryptocurrency community. At this point, I don’t think it will spark enthusiasm among investors outside the industry. Integrations can be too abstract for those not yet in the space, making it difficult to attract new entrants.

But if it becomes clear how switching to the PoS consensus model could significantly reduce Ethereum’s energy use, we may see renewed interest. The L2 ecosystem, with its rollup and significantly lower gas prices, could be the catalyst to bring Ethereum back into the spotlight.