Analyzing the current state of Ethereum, DeFi, stablecoins, NFTs post-FTX fallout

Price drawdown from ATH

2022 is nearing the end of the year. The rapid tightening of global monetary policy and the strength of the US dollar have made this year historic for all asset classes. This has had a severe impact on the crypto ecosystem with various liquidations and margin calls as well as the collapse of FTX and Luna.

September was a complicated year for the Ethereum ecosystem, with a successful consolidation resulting in net deflation for Ethereum in October. However, the size of the loss from an investor’s perspective is monumental in the DeFi ecosystem.

Ethereum is currently down 73% from its all-time high, hovering around $1,200. 2022 saw a major liquidation and deleveraging, with Luna collapsing in May and his FTX in November.

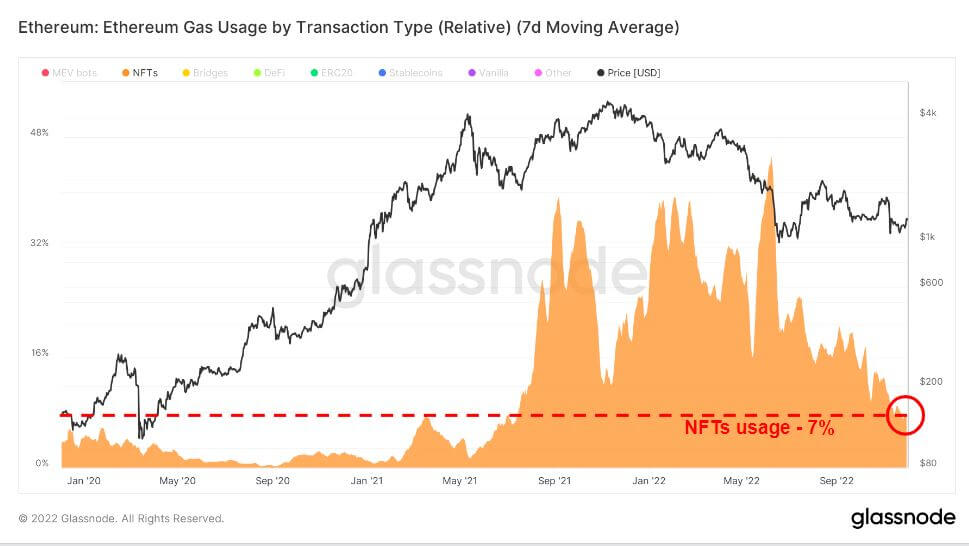

Ethereum gas usage from 2020 to 2022

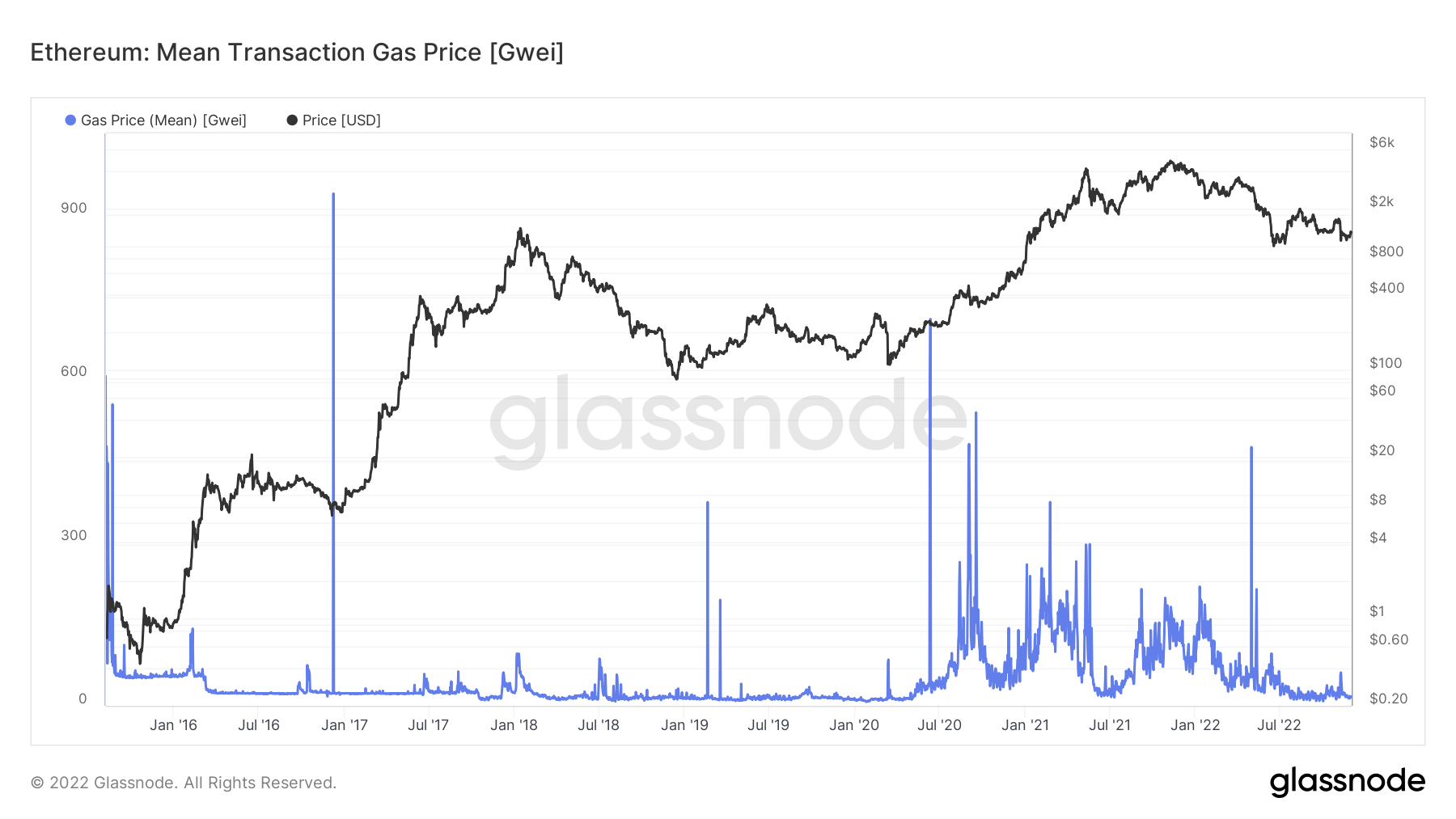

A gas fee is the cost of conducting a transaction or executing a contract. For example, it can be exchanged for stablecoins or issued as NFTs.

Since the summer of 2020, Ethereum gas prices have risen, largely due to the explosive growth of DeFi usage on the chain.

Network activity has decreased significantly since the summer of 2021, but the problem of Ethereum being an expensive chain still prevails.

Ethereum gas prices are priced in Gwei. One billionth of 1 ETH. Gas costs fluctuate depending on network congestion. There are periods during peak demand when high gas prices are required to process transactions.

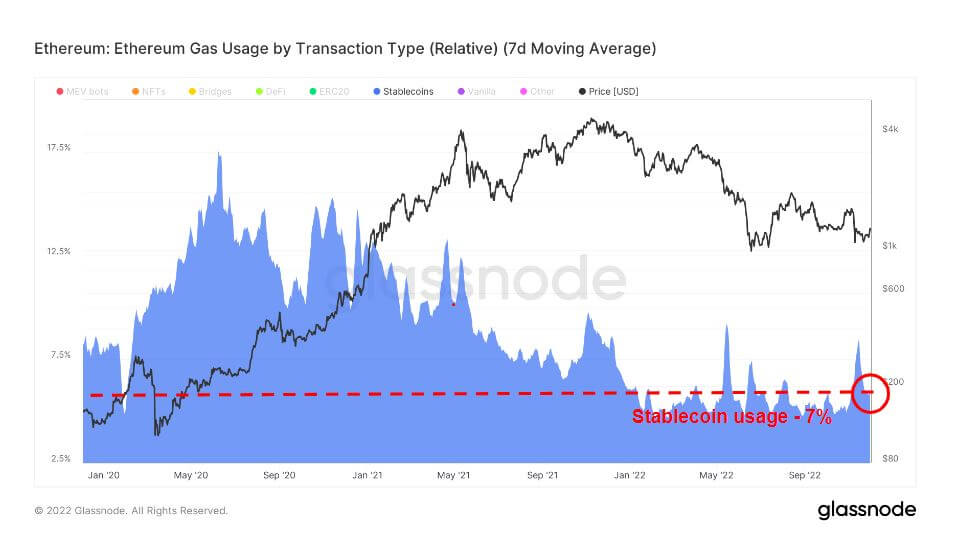

A stablecoin is a cryptocurrency designed to minimize price volatility by being pegged to a reference asset. Reference assets can be commodities, cryptocurrencies, or fiat currencies.

The market offers a variety of stablecoins, including asset-backed versions that include fiat, cryptocurrency, or precious metal assets, and algorithmic versions that increase or decrease the supply of circulating tokens to lock prices at desired levels.

Gas usage for stablecoins is currently at 7% and will remain fairly flat in 2022. However, mass adoption of stablecoins began in early 2020, peaking at almost 20% of Ethereum gas usage.

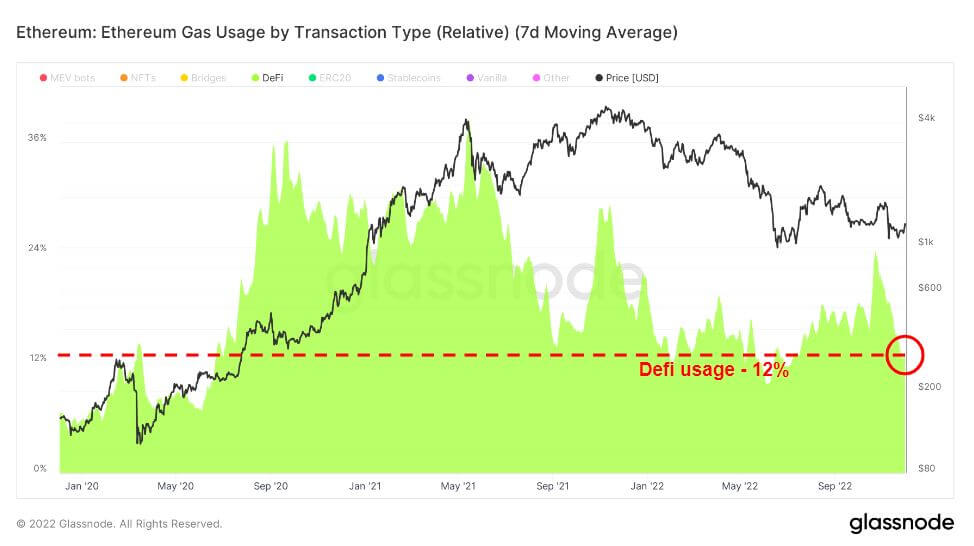

Decentralized finance (DeFi) is a new technology that decouples banks and financial institutions and connects users directly to financial products (usually lending, trading, and borrowing).

DeFi followed shortly after the stablecoin boom. From July 2020, Uniswap emerged as a major DeFi gas user of his, peaking around June 2021 before gradually declining. DeFi usage remains at around 12% average in 2022, higher than it was in early 2020.

Amid the three-game winning streak, NFTs were the last to boom in this cycle, exploding at the end of 2021. As a result, in the 2021 bull market, OpenSea saw the biggest surge in gas usage due to his NFT demand. However, after June 2022, demand has cooled significantly, although it remains slightly higher than usual.

Lower transaction volume and gas prices

Ethereum gas usage and transaction numbers are at year-to-date lows. The average price of gas has been somewhat sluggish over the past four months, having risen slightly due to recent mergers and his FTX demise. Transactions are approaching year-to-date lows, suggesting the bear market is hurting users.

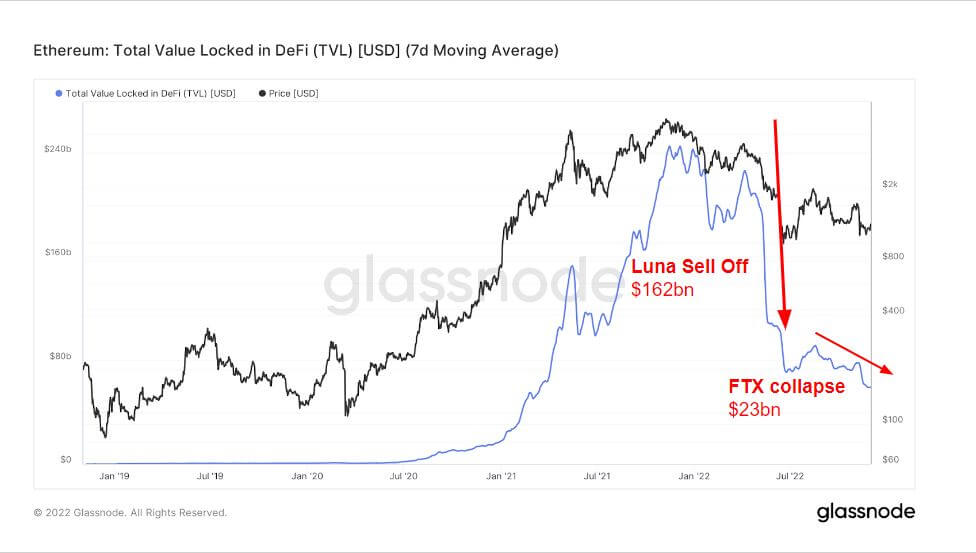

TVL rise and fall in DeFi (USD)

Total Value Locked (TVL) measures the total value of all assets locked to DeFi protocols. TVL is denominated in USD or ETH, while DeFi protocols offer lending, liquidity pools, staking, and more.

The chart below shows the combined value of all DeFi locked beyond $240 billion in the summer of 2021. This is due to the nature of DeFi protocols that allow them to take leverage and borrow cryptocurrencies to use as collateral.

A bull market in 2021 and a bear market in 2022 will be unprecedented as the massive stimulus package delivered by central banks in 2020 wiped out much of the leverage and borrowing in 2022. It has become nothing.

TVL lost more than $160 billion when Luna was sold. Indeed, a sell-off occurred just before Luna at the peak of the bull market in November 2021, presumably with investors exiting the ecosystem. In addition, the collapse of FTX has resulted in another $23 billion sale, bringing TVL to around $70 billion similar to his early 2021.

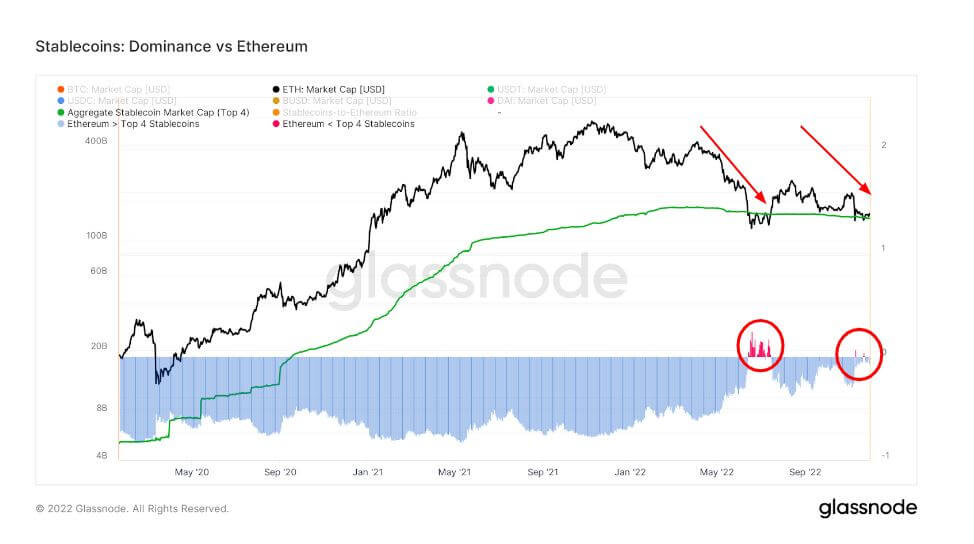

Stablecoin performance as a result of FTX collapse

Ethereum’s dominance over the top four stablecoins has been on a downward trend since May, with stablecoins gaining more dominance in June, with ETH hitting its lowest price of the year.

This chart compares the market cap of Ethereum to the sum of the top four stablecoins USDT, USDC, BUSD and DAI. Note that the supply of these stablecoins is distributed across multiple host blockchains, including Ethereum.

In June, ETH’s market cap fell below the top four stablecoins due to Luna, and the same thing happened during the FTX collapse. However, there is a much smaller drop for a short period of time.

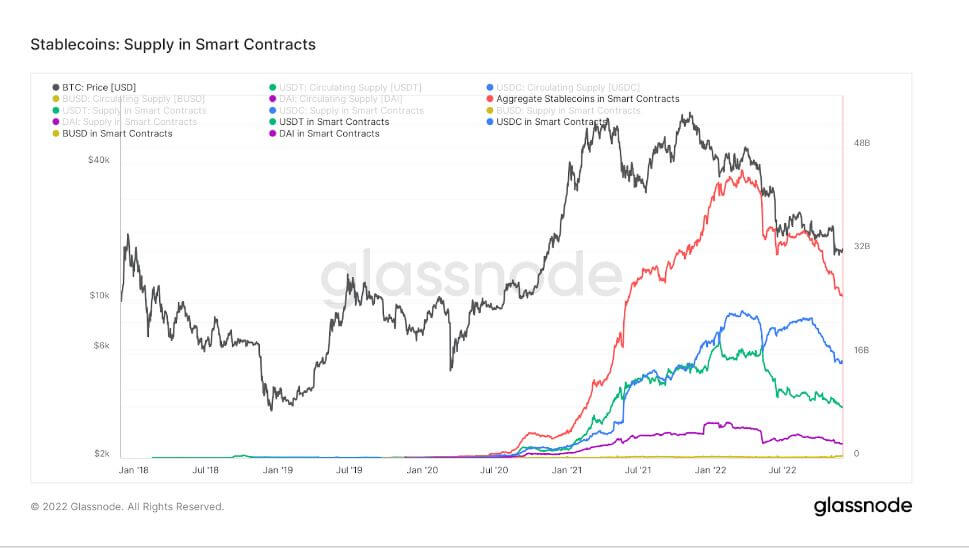

The chart below shows the total supply issued and held within Ethereum smart contracts. This graph shows the total supply held in smart contracts along with individual traces for the top four stablecoins USDT, USDC, BUSD and DAI.

Another notable trend in the stablecoin ecosystem is the significant decline in the supply of smart contracts. Total supply at its peak was $44 billion. It’s now around $25 billion since Luna and FTX collapsed. The top four stablecoins also dropped significantly.

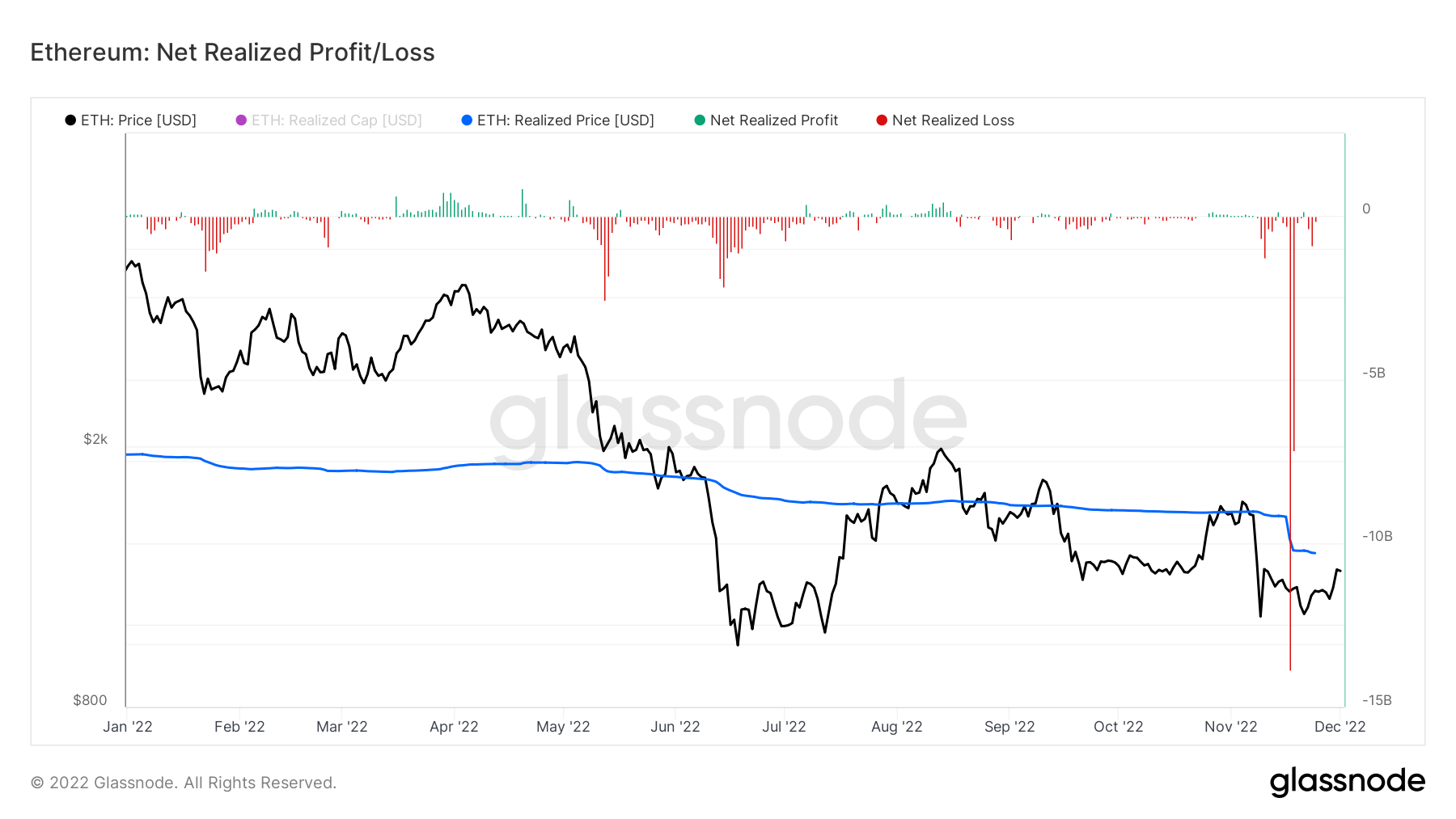

Ethereum Real Loss

Net Realized Gain/Loss is the net profit or loss of all coins used on that day. The price at which each spent coin was last moved and the current price allow us to calculate the USD value realized by the owner in profit or loss.

In the week of the FTX collapse, Ethereum recognized over $20 billion in losses, and on November 17, $14 billion was many times worse for investors than the Luna collapse.