Analyzing the WBTC FUD after the FTX collapse and its depeg

Wrapped Bitcoin is the primary form of Bitcoin “wrapped” in smart contracts on the Ethereum network. This allows it to be used in Ethereum-based Decentralized Finance (DeFi) applications. WBTC is backed 1:1 to the value of Bitcoin, so one WBTC is theoretically equivalent to one BTC.

BitGo is a major WBTC issuer and is responsible for backing and custody of BTC. Sam Bankman-Fried’s Prop Fund, Alameda Research, was his top merchant at WBTC. So they took his BTC from a customer and sent it to BitGo where he created WBTC.

Being a merchant does not provide access to custody, but in the wake of Fear, Uncertainty and Doubt (FUD) over the collapse of FTX, WBTC decided to depeg under the assumption that its reserves were incomplete. have started. This article analyzes his FUD on the WBTC on-chain indicator and asset depeg.

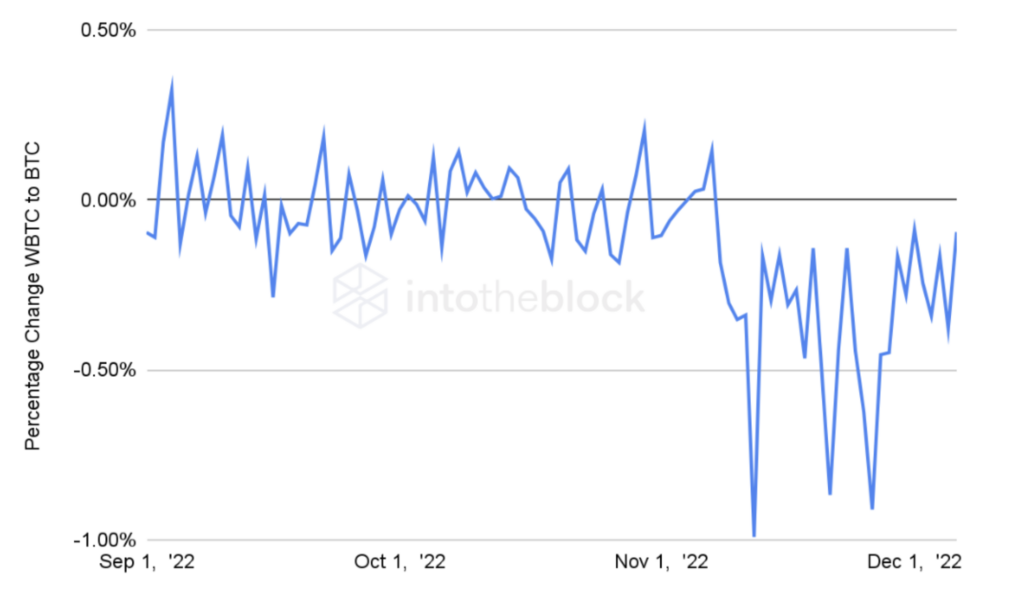

WBTC prices fell 1.5%, raising FUD on storage. A small depeg can raise significant concerns as it can cause users to lose confidence in the pegged asset and issuer. A depeg asset may be perceived as a less stable and less reliable store of value, causing people to lose trust in it, potentially leading to reduced demand.

This makes it more difficult for the issuer to maintain the peg, potentially leading to further redemptions and loss of value.

Furthermore, in the case of WBTC, which is widely used as a medium of exchange across DeFi, its loss of value could cause disruption across the ecosystem. can be returned. BitGo team We have confirmed the full backing of the reserves and processed the redemption submitted.

Additionally, volatility during this time also affected the market as traders sought to protect their assets from the uncertainty.

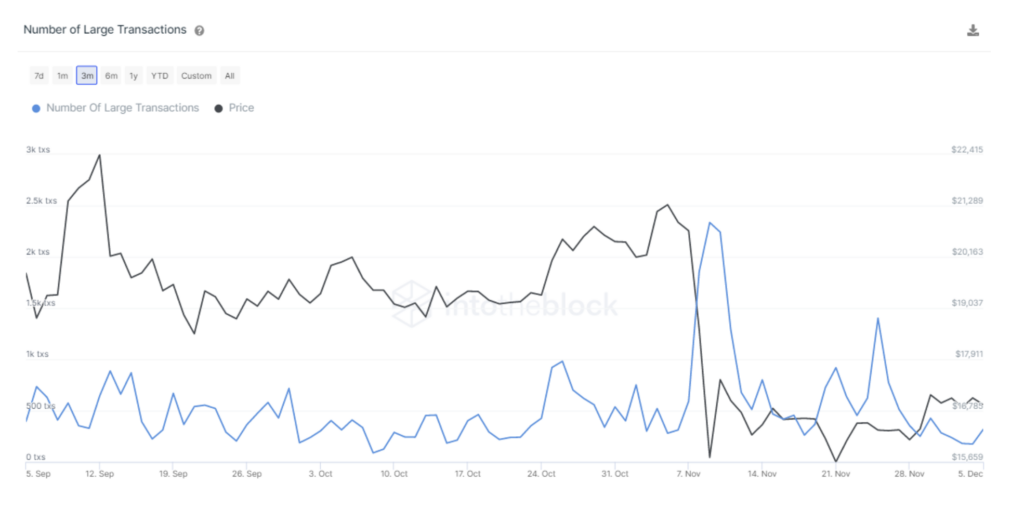

The indicator above shows the number of trades above $100,000. This amount is not available to the average retailer on-chain, so this metric serves as a proxy for the number of whales and institutions that have processed transactions.

This helps us understand the behavior of key token holders. As you can see, November 25 marked his second highest number of transactions after the date FTX collapsed in his 3-month spam. In this case, a transaction can represent the sale or transfer of an asset for sale by the user.

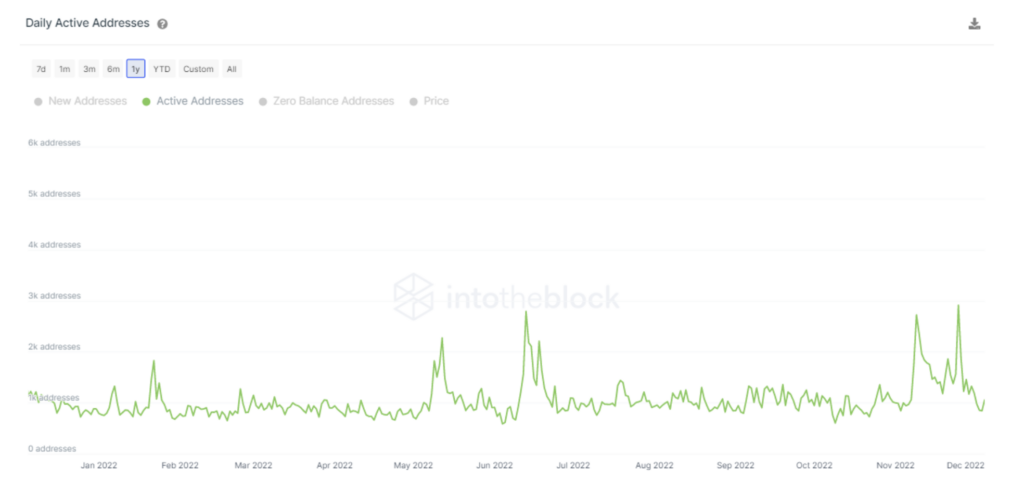

Whales and institutions weren’t the only ones worried about the potential value of WBTC, as the number of ‘active addresses’ on November 25 hit a record high in over a year.

An “active address” represents an address that has one or more on-chain transactions on a given day. This is useful for viewing network activity. In this case, it shows how people have taken precautions against asset depeg.

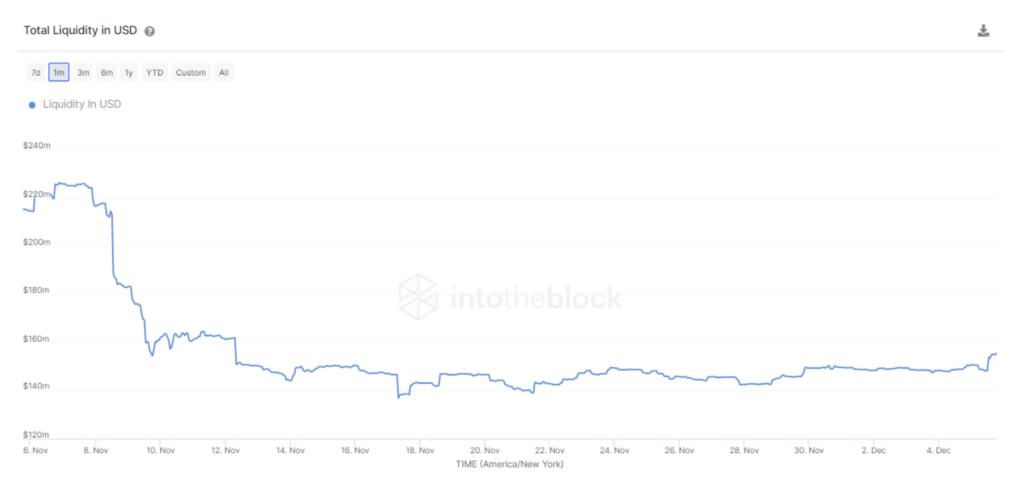

Despite many WBTC holders transferring and selling assets, on-chain data reveals that Curb’s Tricypto2 pool liquidity has not been affected by these events. Rather than being affected by BitGo FUD, Poole experienced massive withdrawals during his FTX collapse. Tricypto2 is currently the largest market in terms of deposited liquidity for WBTC on-chain trading.

Liquidity is a key factor in DEX functionality as it determines how easily users can buy and sell assets on the platform. A highly liquid DEX pool has a large number of tradable assets, so users can easily buy and sell the assets they want.

This makes DEX pools more attractive to traders and more widely used. In this case, the higher the liquidity in the pool, the more likely it will be available to users who want to let go of their WBTC positions.

All in all, when a fixed asset starts to lose its value, it can create some problems for both issuers and holders. Loss of trust in the issuer makes users doubt the value of pegged assets. Moreover, that depeg could cause a lot of chaos across the DeFi ecosystem. In this case, BitGo was able to clarify and provide proof of the misconceptions that were widespread around the tweeters. storage reserve.