Asia, EU, US are bullish on Bitcoin, Ethereum

Glassnode data analyzed by crypto slate Analysts show Asia, the US, and the EU have been bullish on Bitcoin (BTC) and Ethereum (ETH) since late January.

Investors in all three regions are more bullish on BTC than ETH, as the regional price indicators show. Meanwhile, year-over-year BTC supply in Asia means BTC will continue to grow in the short term.

Regional price

The regional price index used in this study shows 30-day changes in regional prices for Asia, the EU, and the US. Before calculating the regional price index, we need to record price changes during regional business hours. A region’s price can then be determined by calculating the cumulative sum of price changes recorded during that region’s business hours.

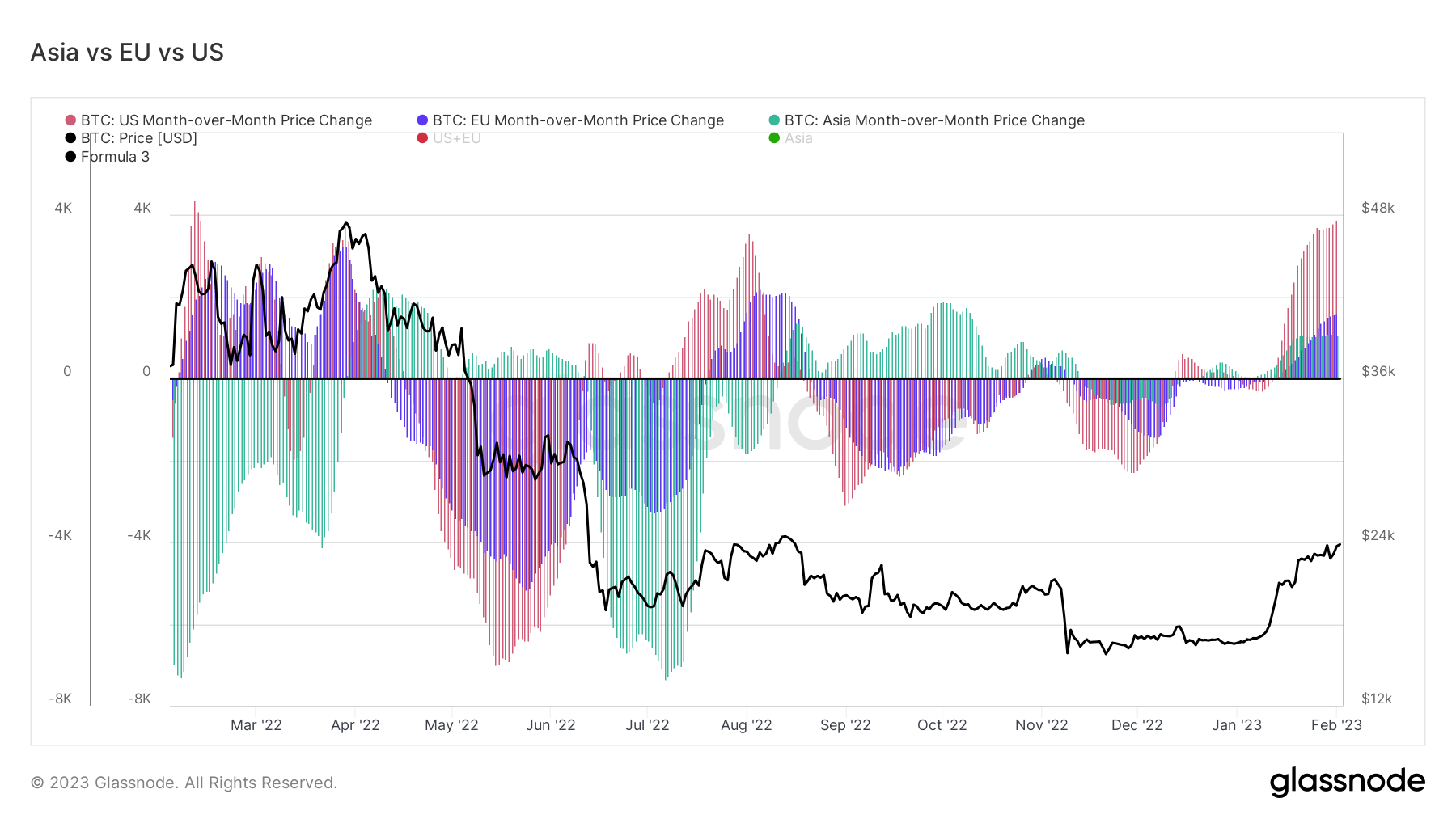

The chart below reflects the regional BTC price for all three regions since early 2022. Red bars represent US regional prices, while blue and green bars represent EU and Asia, respectively.

If the metric breaks below the zero line, this indicates that the region is bearish on BTC.If it is above the line, it represents bullish sentiment in the region.

According to the chart, all three regions turned bullish in late January 2023 and have been bullish since then, with the US the most bullish. It was a short time in August 2022.

ethereum

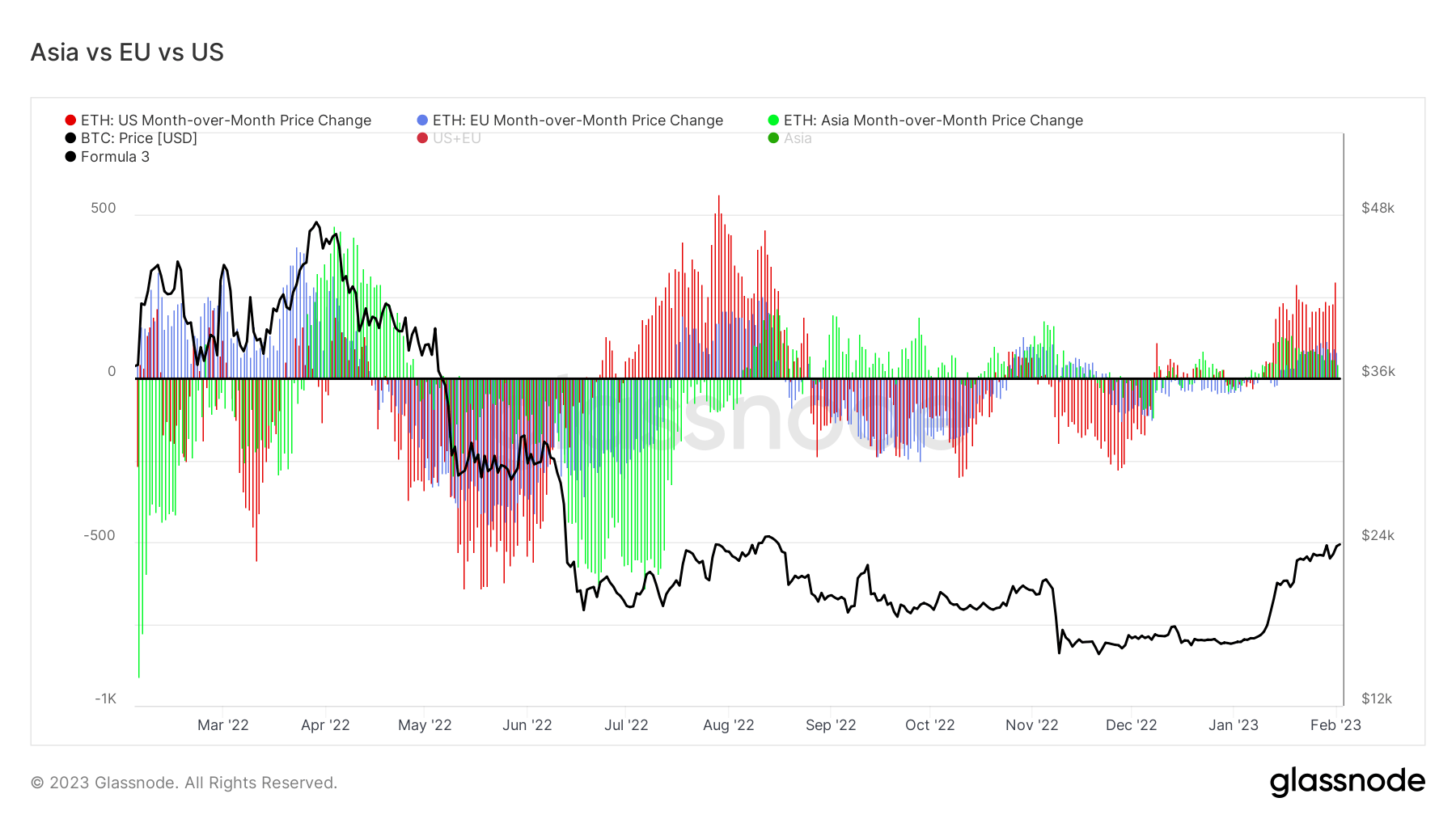

ETH prices in the Asia, US, and EU regions also display similar bullish sentiment. The chart below shows his ETH price in each region from early 2022. The US, EU, and Asia are represented in red, blue, and green, respectively.

As with regional BTC prices, all three regions currently appear bullish on ETH, with the US being the most bullish.

Asia year-over-year supply

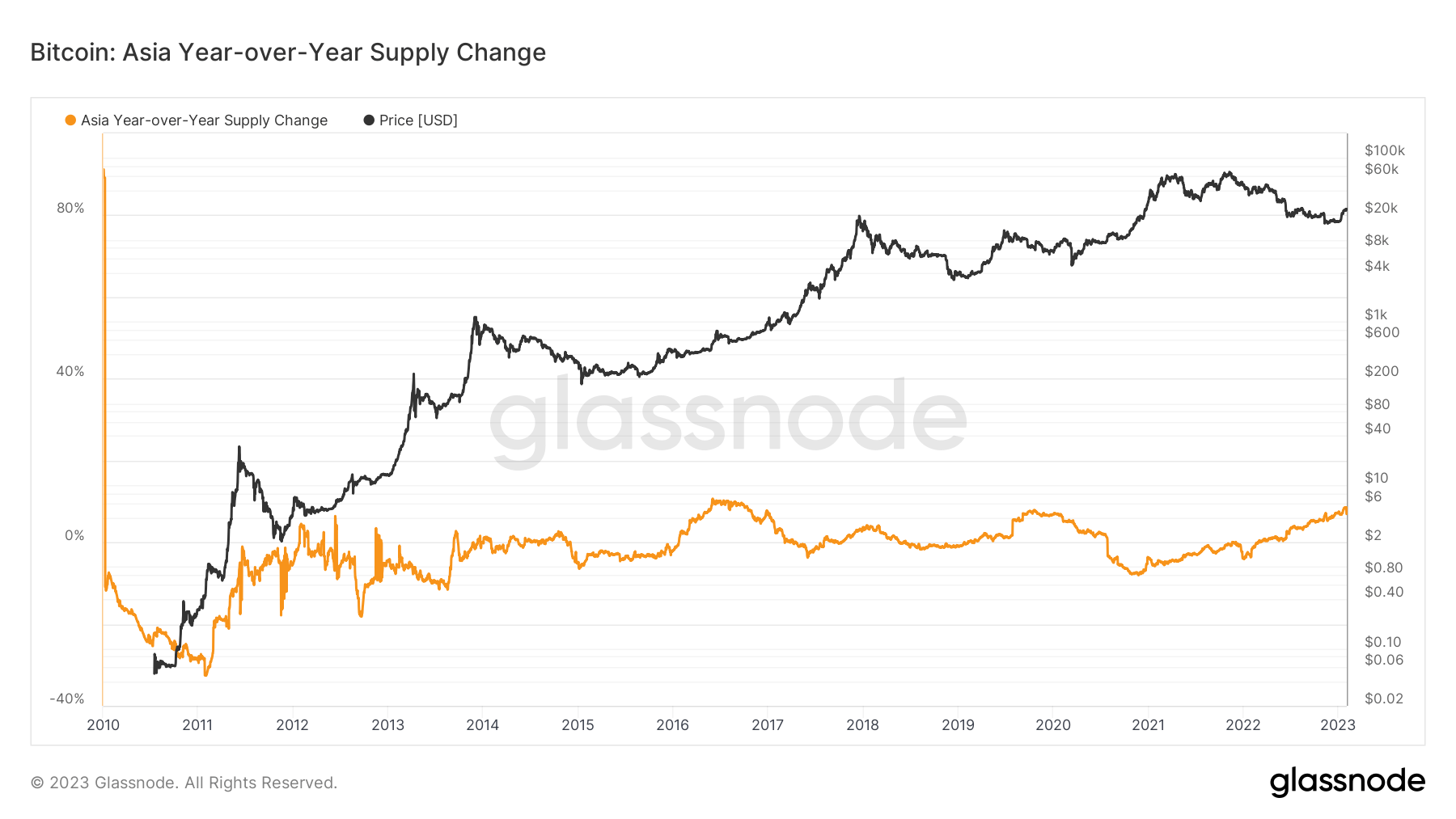

This metric provides an estimate of the year-over-year (YoY) change in market share between held and traded BTC supply. The chart below shows year-over-year supply in the Asia region since early 2010.

Data show that the region’s year-on-year supply is now above 8.5%. This percentage shows that Asia is at its highest bullish point yet.

Before crypto slate Research reveals that Asian investors build and maintain smart money’s reputation by consistently buying low and selling high. Assuming Asia continues to act “smart”, their bullish sentiment indicates that BTC will continue to rise, at least in the short term.