August 2022 GameFi Report

Number of new users coming in game phi Despite a sharp decline, the average number of transactions per user has steadily increased. Therefore, users in today’s market are likely to be actively gaming, so his GameFi data for August could be useful in understanding which projects and ecosystems are sustainable in the long term. Helpful.

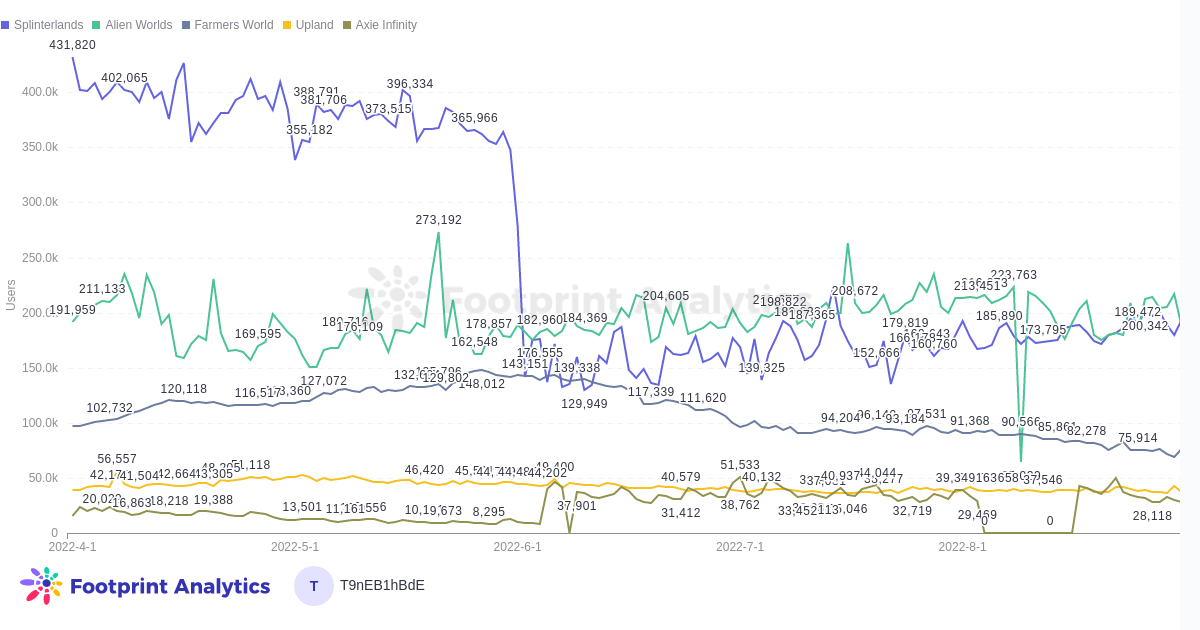

Despite the market, Splinterlands and Alien Worlds continue to battle for the top spot with steady user growth since June. In contrast, the once-promising Farmers World continues to make users bleed.

A massive $200 million funding round for stealth-mode Web3 game studio Limit Break, as well as other big rounds for other developers like Animoca and Gunzilla Games, will help investors torch when markets reverse. It shows that we rely on the studio to carry the

Main findings

whole market

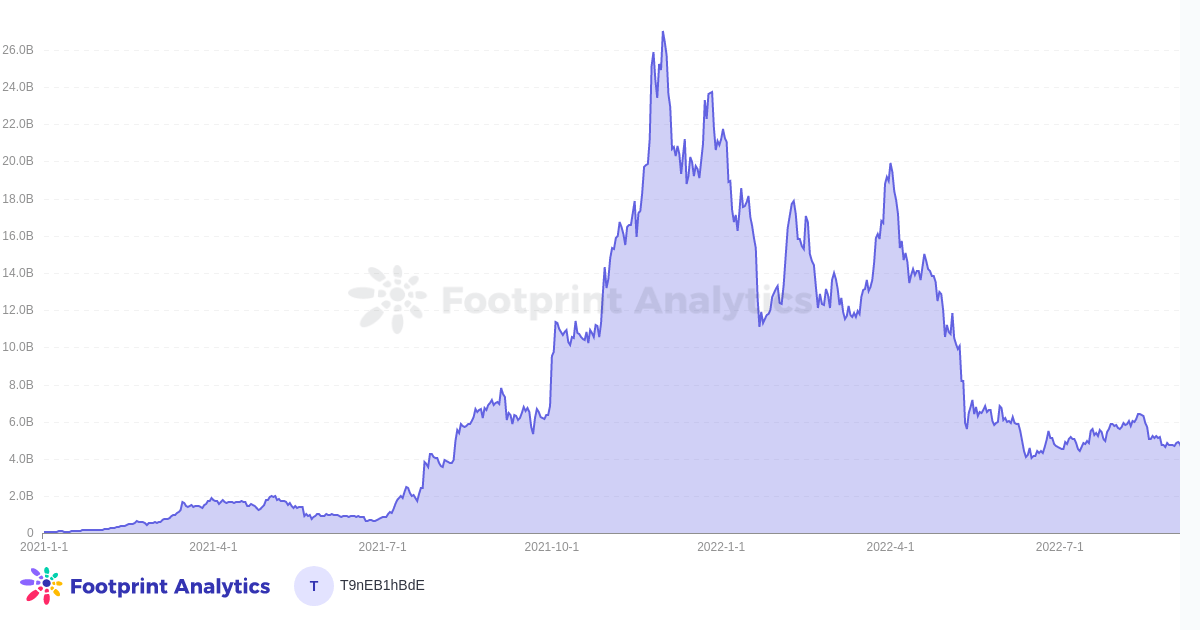

- GameFi’s total volume increased 28%, marking its first MoM hiatus after nine consecutive months of decline. Still not enough to break the overall downtrend or celebrate.

- In overview, August volume was 93.5% below the December 2021 high at the peak of the bear market

- Transactions per user increase while transaction volume per user decreases. There are no simple conclusions. Still, it could mean that today’s market participants are more likely to actively participate in and enjoy the game.

- Despite having the most projects, BNB has a relatively small percentage of volume (10.6%) and game transactions (less than 5%), and the chain is full of vaporware games that no one wants to play. It lends credence to the claim that there is.

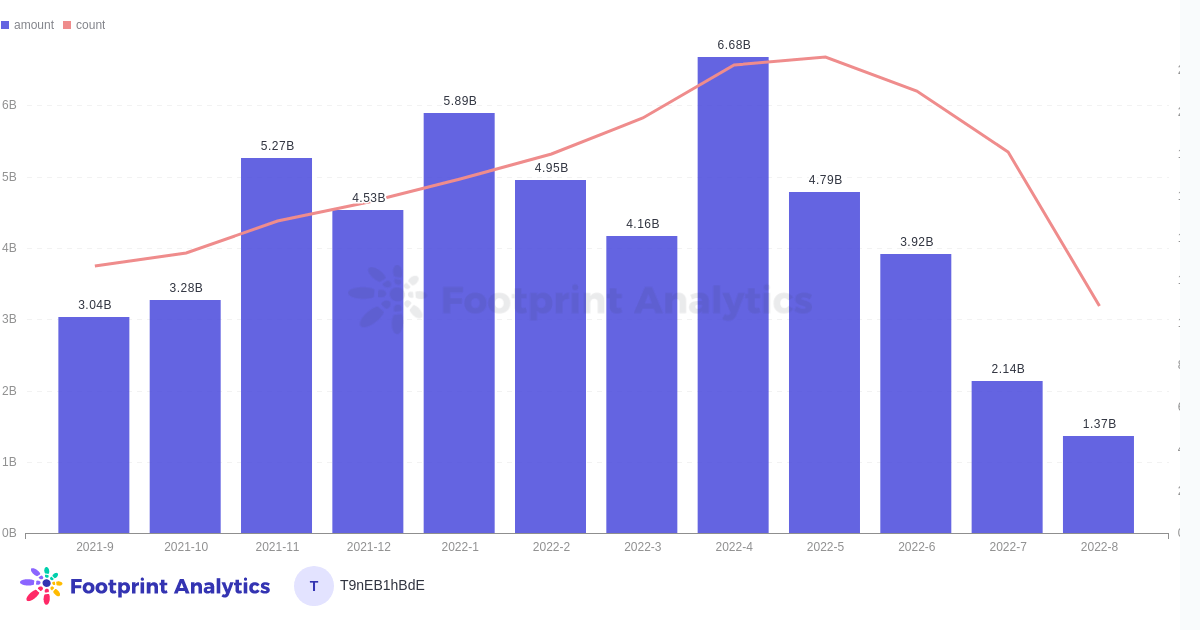

Financing and investment

- Funding raised in the GameFi space fell 36% month-on-month to $1.37 billion from $2.14 billion. Round numbers continue to collapse precipitously.

- Game developers and studios closed four of their top 10 largest investment rounds in August.

- This reflects an ongoing trend in this bear market where investors are betting big on Web3 game studios and traditional developers and looking to get into GameFi.

- Included in the August round was another $45 million to Animoca Brands, which has dozens of blockchain games in its portfolio, including Sandbox, Crazy Defense Heroes and the upcoming Phantom Galaxies. The round brings the company’s total investment capital to his $775.3 million.

GameFi user

- While MAU decreased for the sixth month in a row (down 9.4%), GameFi’s new users/entrants increased 19.8% month-over-month.

- There was no significant change in user distribution between major chains. However, ThunderCore quickly made up his 4.5% of users. The biggest game on ThunderCore is JellySquish, and in August he averaged around 400-600 users per day.

project overview

- Since Splinterlands’ user numbers collapsed in June, the game has been steadily rebuilding, growing 54% from a low on June 6th to a high on August 26th.

- Alien Worlds continued to battle Splinterlands for the top spot, vying for the most popular blockchain game spot.

- Interestingly, both Splinterlands and Alien Worlds are relatively basic card and text based games that do not allow the user to control characters or interact with the 3D world. This shows the primitiveness of the current GameFi industry.

- Farmers World continues to see its user numbers drop, hitting an August low of 66,228 active users on the 30th, down 55% from May’s ATH.

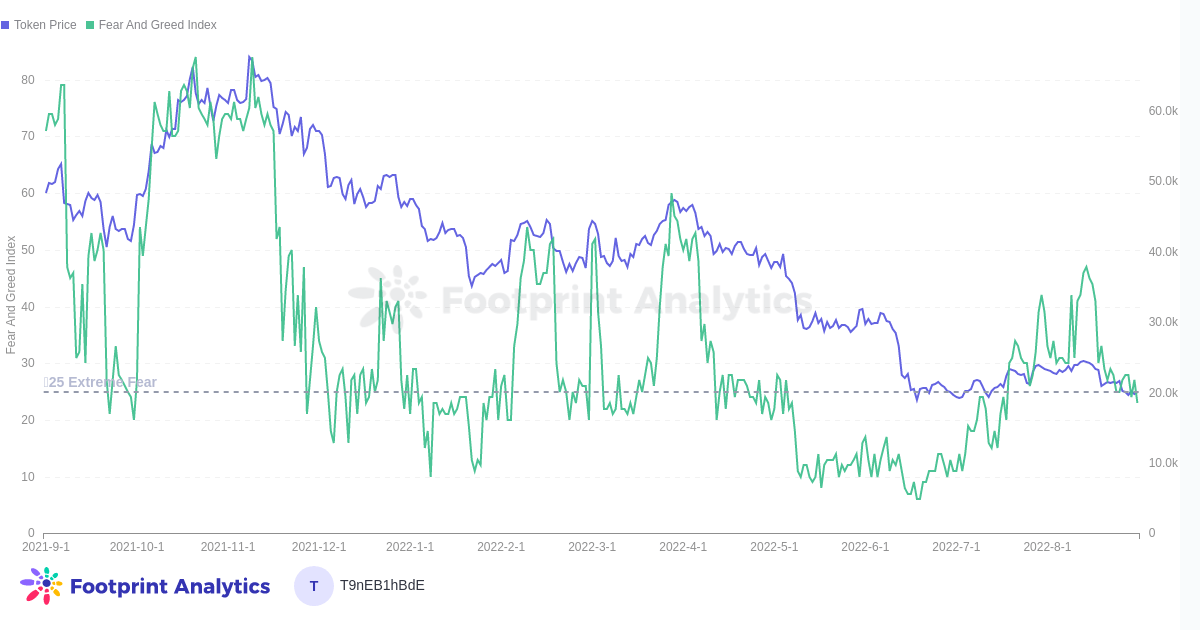

Overview of Crypto Macros

The cryptocurrency market saw its biggest gain in the six months from mid-July to August, led by Ethereum breaking $2,000 in mid-August.

Here is the explanation:

- Expectations for The Merge move Ethereum to Proof of Stake (and eventually burn supply).

- Possible beginning of less aggressive monetary tightening by the Federal Reserve.

- It just bounces dead cats on the way to lower lows.

GameFi won’t recover soon on macro news

In any case, this trend did not lead to significant increases in market capitalization or users for most games. The total market cap of GameFi tokens climbed precariously to $6.43 billion in mid-August, but fell 26% by the end of the month.

Most worryingly, the number of new GameFi users continues to be extremely low. This is because the GameFi sector requires more resources and time investment than other sectors to re-enter, requires active participation to generate yield and is still highly speculative. is.

Splinterlands and Alien Worlds Show Sustainable Player Bases

In addition to the steep drop in Splinterlands user numbers in June, Splinterlands and Alien Worlds user numbers are steadily increasing.

Interestingly, both Splinterlands and Alien Worlds are relatively basic card and text-based games that do not allow the user to control characters in their immersive worlds. However, it requires a strategy on the part of the player to win and achieve profitability.

Both are far from what people imagine games will look like in 2022 (the next major gaming cohort, including Illuvium and Phantom Galaxies, aims to rectify this).

Investors bet big on game developers and studios

Overall funding is bottoming out, but investors are still closing rounds on proven teams with a record of viable products on either Web3 or Web2.

August’s top funding round reflects a long-established trend of investors exiting funding for Web3 game studios and traditional developers looking to enter GameFi. I’m here. Studios and developers have had far more success in this bear market than GameFi infrastructure projects and individual games.

Among the August rounds was $45 million from Animoca Brands, which has dozens of blockchain games in its portfolio, including Sandbox, Crazy Defense Heroes and the upcoming Phantom Galaxies. The round brings the company’s total investment capital to his $775.3 million.

This month’s top round went to Limit Break, the studio behind the DigiDaiku NFT collection, which plans to launch a free-to-play blockchain game.

Overview

The numbers show the GameFi industry had a bad month in August, and its rut continues, with little relief from this month’s Ethereum-driven rally.

Overall volumes, number of new projects, and investments will be close to or even lower than July levels.

But now is the perfect time to build. Proven developers and studios with ideas for future blockchain games and Metaverse projects continue to receive record funding rounds. The healthiest games right now are relatively basic Splinterlands and Alien Worlds, with lots of room for improvement.

The Footprint Analytics community contributed to this work.

The Footprint Community is a place to help data and crypto enthusiasts around the world understand and gain insights about Web3, the Metaverse, DeFi, GameFi, or any other area of the emerging blockchain world. Here you’ll find vibrant and diverse voices who support each other and move the community forward.