Avalanche’s Amazon partnership; Silvergate’s $4.3B bailout

The biggest news in the Cryptoverse on January 11th was Avalanche announcing a partnership with AWS. Silvergate said he received a $4.3 billion bailout from the San Francisco Bank. Meanwhile, Robinhood is proceeding with the delisting and sale of her BSV, WazirX is issuing proof of reserves reports, and FTX is recovering her $5 billion. In addition, we investigate the relationship between the price of Bitcoin and the Consumer Price Index (CPI).

CryptoSlate Top Stories

Avalanche Earns 20% Within Hours of Amazon Partnership Announcement

Avalanche (AVAX) 20% growth Hours after Ava Labs partnership Amazon Web Services is now live.

This partnership will help expand blockchain adoption across businesses, institutions and governments. reportAva Labs’ participation in the AWS Partner Network (APN) enables us to deploy our products on AWS with over 100,000 partners around the world.

Silvergate received $4.3 billion bailout after FTX collapse

Silvergate Bank received $4.3 billion from the San Francisco-based Federal Mortgage Bank last year, the company said. Q4 2022.

Silvergate’s business model is focused on providing banking services to cryptocurrency exchanges and investors. Around 90% of bank deposits come from crypto.

At the end of Q3, Silvergate’s 10 largest depositors, including Coinbase, Paxos, Crypto.com, Gemini, Kraken, Bitstamp and Circle, accounted for about half of the bank’s deposits. As a result of the collapse of FTX, Silvergate held both his FTX and Alameda Research deposits, which put him in a key position.

Robinhood Sells BSV On Market After Delisting Craig Wright’s Bitcoin Variant

Users of popular stock and cryptocurrency trading app Robinhood are reacting to the announcement that the platform will delist Craig Wright’s Bitcoin SV (BSV) on January 25.

A Robinhood spokesperson further said crypto slate Any BCV held by customers on the platform after the deadline will be “sold at the market price and credited to Robinhood’s purchasing power,” it said.

This change is made as part of regular reviews of Robinhood’s crypto products. This means BSV can still be traded on the app until the deadline. However, he also stressed that investors residing in Hawaii, Nevada and New York have limited ability to trade his BSV.

$120 million worth of bitcoin withdrawn from exchanges on January 10

About $120 million worth of Bitcoin (BTC) was withdrawn from cryptocurrency exchanges on January 10, according to Glassnode data.

About $50 million was withdrawn from Binance and $30 million was withdrawn from Coinbase.

Since early 2023, crypto exchanges have seen more BTC outflows than inflows. The most significant BTC inflow was around $80 million on January 4th.

On other days, businesses almost always have more outflows than inflows.

WazirX issues reserve proof of assets worth $285 million

India-based cryptocurrency exchange WazirX has released a Proof-of-Reserves (PoR) report showing it holds approximately $285 million worth of cryptocurrencies.

WazirX noted that approximately 90% of user assets (worth $259.15 million) are held in Binance wallets, with the remaining 10% ($26.54 million) held in hot and warm wallets. bottom.

WazirX said it has enough reserves to meet users’ withdrawal requests at any time as it holds a reserve of more than 1:1 of users’ assets.

FTX Lawyers Announce $5 Billion Asset Recovery

According to Reuters, FTX has recovered more than $5 billion, comprising cash, investment securities and liquid cryptocurrencies.

“We found over $5 billion in cash, liquid cryptocurrencies and liquid investment securities.”

Andy Dietderich — an attorney for FTX — provided an update on the case on January 11, notifying the Delaware bankruptcy judge at the opening of the FTX Senate banking transaction. hearing.

Dietrich also said FTX plans to sell non-strategic investments with a book value of $4.6 billion, but the company’s books are said to be unreliable.

Binance-Voyager Trade Gets Initial Court Approval Despite SEC Objections

The US Bankruptcy Court for the Southern District of New York gave the first green light to a Binance-Voyage deal on Jan. 10, Reuters report.

Judge Michael Wiles approved a disclosure statement outlining various aspects of the transaction.

But Judge Wiles has asked the attorneys working on the deal to amend the proposed order before giving final approval. am. Previously, the judge had asked Voyager to seek a vote of all creditors on selling its $1 billion asset to Binance.

research highlights

Survey: Bitcoin continues to come under pressure ahead of CPI data.Michael Barry declares stagflation

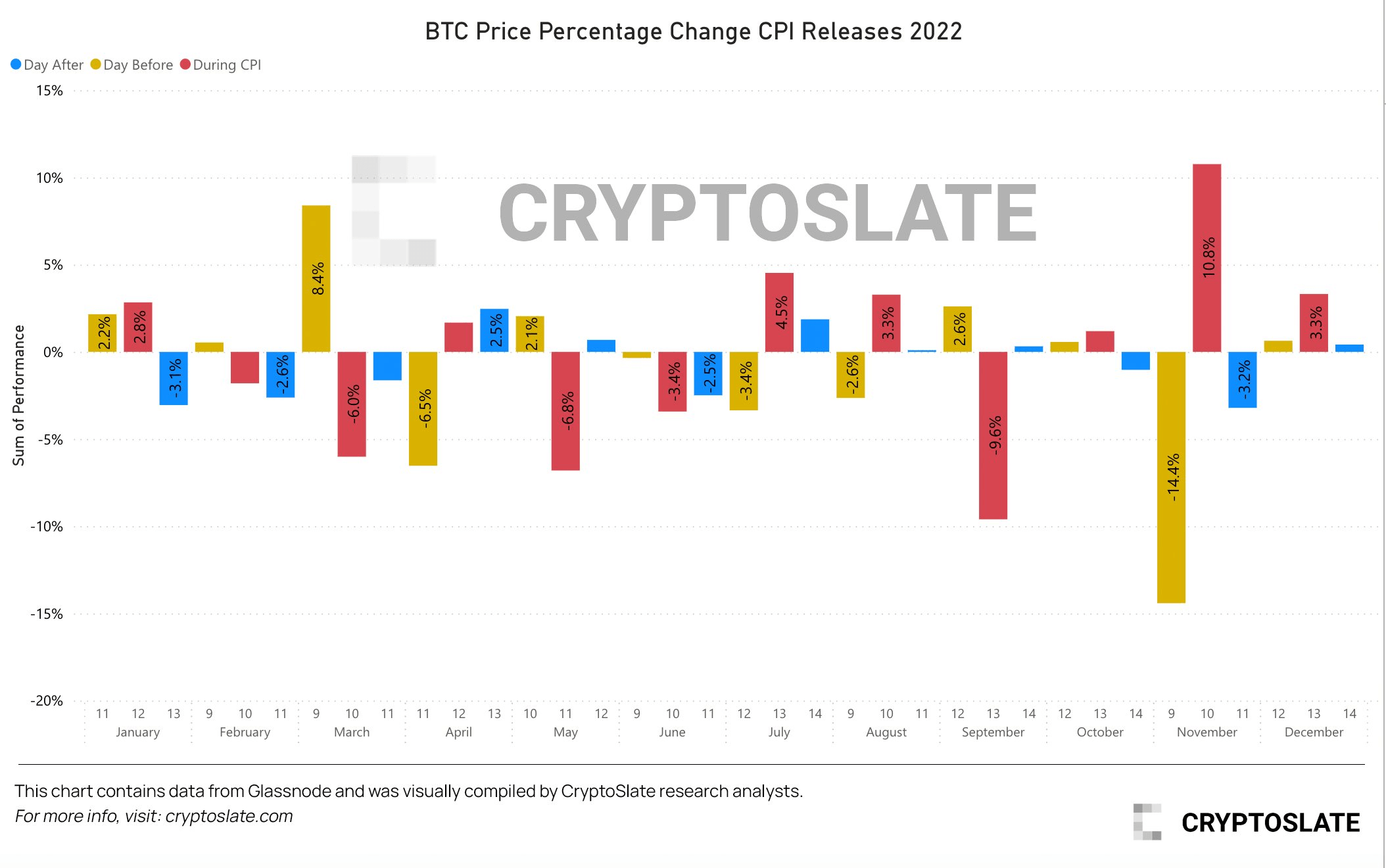

Analysts expect December 2022 U.S. Consumer Price Index (CPI) to rise 6.5% year-on-year — official Bureau of Labor Statistics data released Jan. 12 — but 2023 2019 could see some upside as an investor Michael Barry expects the CPI to fall this year, but warns that a subsequent pivot in interest rates to stimulate economic activity will trigger a second spike in inflation.

The actual CPI for November 2022 was 7.1%, lower than the predicted 7.3%. The better-than-expected result sent the cryptocurrency’s price skyrocketing during the announcement, with Bitcoin quickly surging to $18,000 at that point.

During this bear market, CPI data and interest rate announcements have had a significant impact on pre-, post- and ongoing crypto price volatility. But to what extent?

The chart below shows about half positive and half negative effects on the Bitcoin price before the CPI announcement. This was also the case during the announcement.

In contrast, the day after the announcement tended to have a negative price impact, perhaps as investors had time to absorb the reality of higher consumer prices and subsequent interest rate hikes.

crypto market

Over the past 24 hours, Bitcoin (BTC) rose 0.49% to trade at $17,545.89 while Ethereum (ETH) rose 0.1% to $1,342.12.

Biggest Gainers (24 hours)

- SingularityNET (AGIX): 39.04%

- Ergo (ERO): 27.02%

- Voyager Token (VOY): 24.71%

Biggest Loser (24h)

- GALA: -11.82%

- Lido DAO Token: -10.23%

- Bitcoin SV (BSV): -9.8%