Bear market cycles see long-term holders capitulate and then accumulate

Determining the length of a market cycle requires looking at the past behavior of participants. When it comes to Bitcoin, there are two major trends that change the direction of price movement. Long-term holders (LTH) and short-term holders (STH).

Long-term holders are defined as addresses holding bitcoin for 155 days or more. Most of them have managed to withstand market volatility, accumulate at the bottom and sell at the top, so they are often considered “smart investors” in this space.

Short-term holders are addresses that have held Bitcoin for less than 155 days and are considered a price-sensitive group that is highly susceptible to volatility.

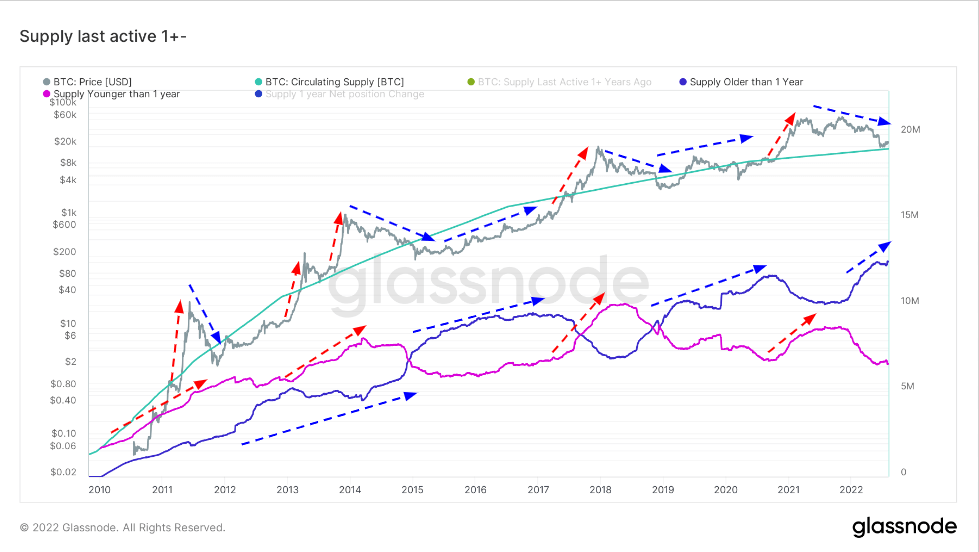

Looking at the behavior of LTH and STH further supports this. Since 2010, long-term holders have bought BTC every time the price dipped and sold at nearly every peak.

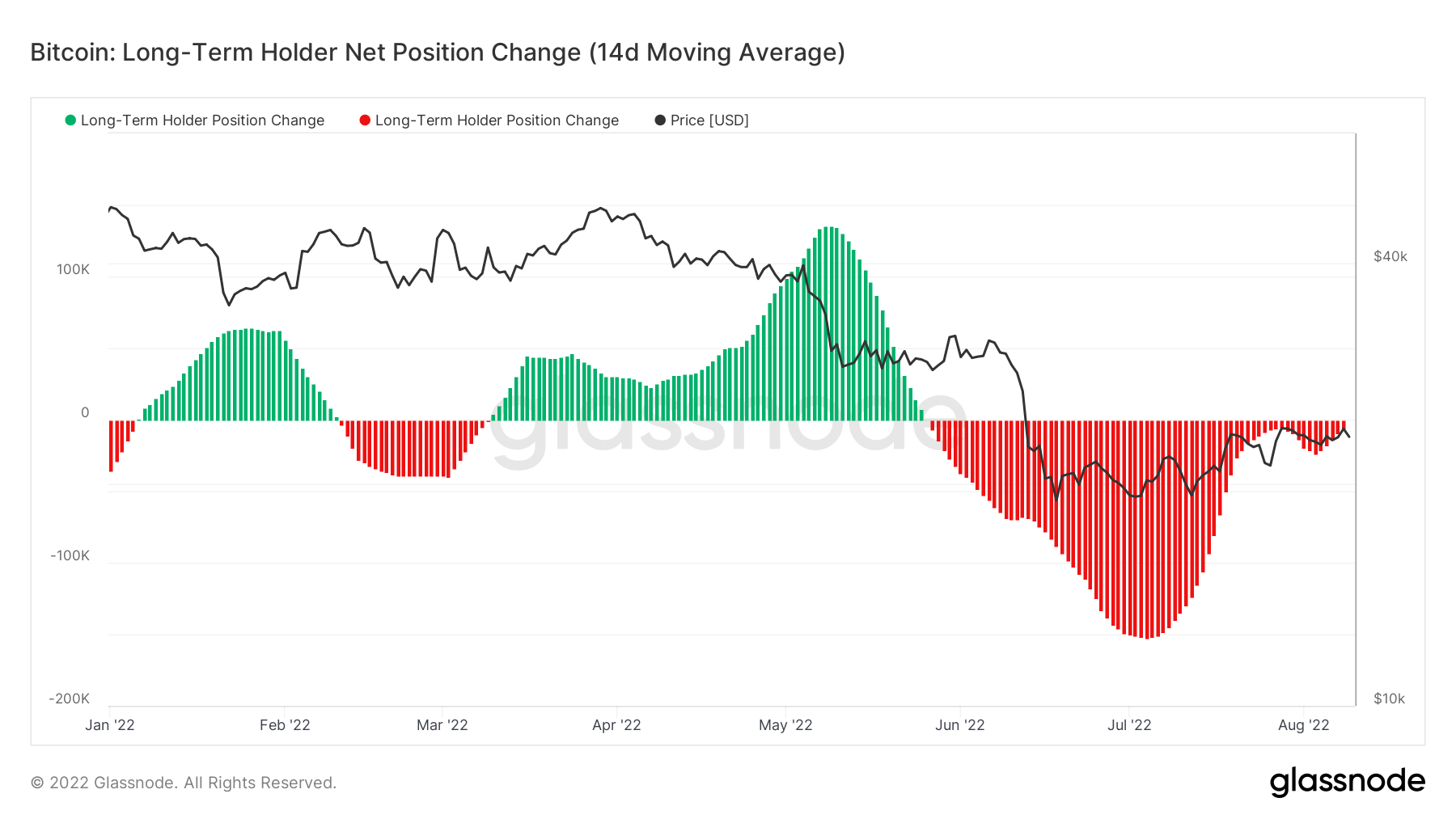

Recent changes in long-term holders’ net positions show that long-term holders are surrendering. Bitcoin drop triggered by Terra (LUNA) blowback and Celsius crisis prompted many LTHs to sell their positions.

However, LTH selling positions is usually taken as a sign of a market bottom.

According to data from glass node, the sale that began in May peaked in July and is now on the decline. The graph below shows the evolution of long-term holder positions. Red highlights indicate a decrease in overall position and green highlights indicate an increase in holdings.

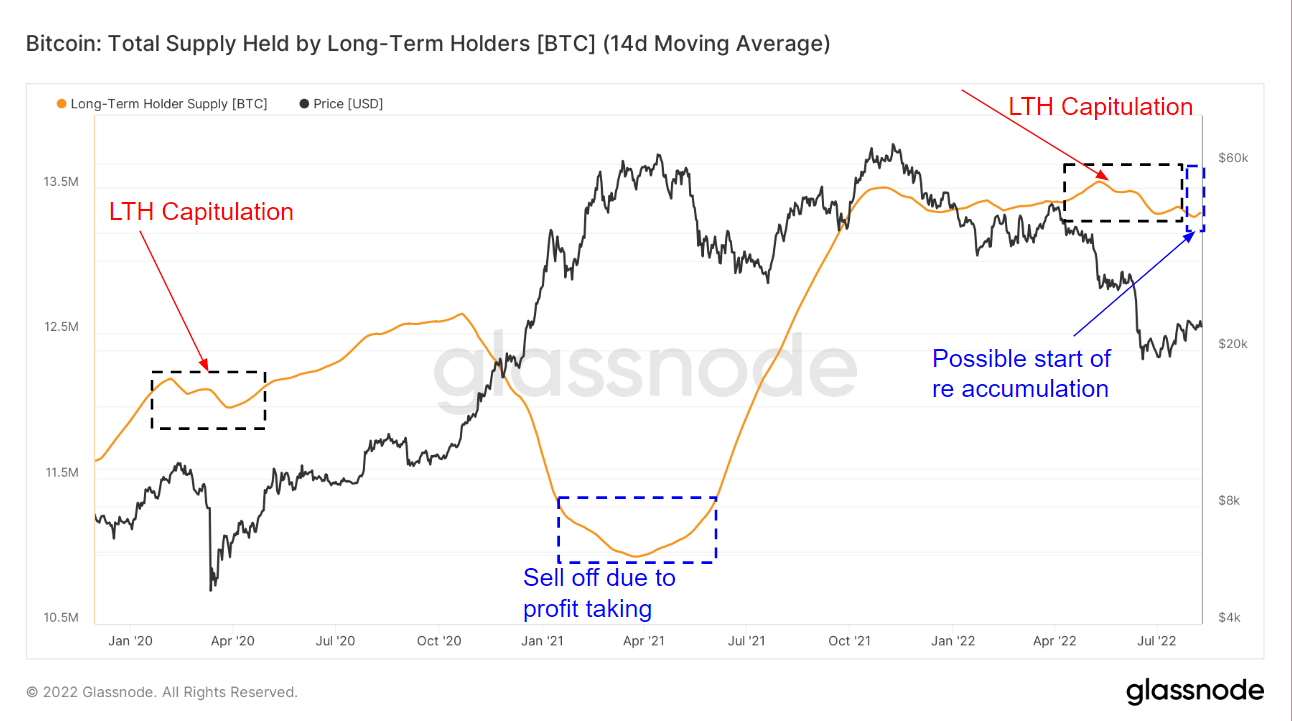

Zooming out reveals other time periods when long-term holders began to sell their holdings. In March 2020, long-term holders surrendered in fear and uncertainty as global markets were devastated by the outbreak of the COVID-19 pandemic. Their surrender caused a sharp price drop that took until July of that year to recover.

The next big sell occurred between January 2021 and May 2021. But as Bitcoin entered a bull market, the sell off meant big gains for long-term holders.

The surrender that began in April 2022 is still ongoing. As in March 2020, this surrender also triggered a significant price drop, pushing Bitcoin down to $20,000 for much of the summer. In addition, sales have calmed down since the beginning of August, but the accumulation rate remains small.

It remains to be seen if this is the beginning of a new accumulation period, or if a slight increase in the accumulation rate will overtake selling. If the previous bearish cycle repeats, Bitcoin price could rise gradually, followed by an increase in the amount of his BTC accumulated by LTH.