Binance reportedly didn’t follow procedures for BUSD reserves in 2020, 2021

According to a Bloomberg report, Binance did not follow the BUSD reserve procedure as it failed to maintain sufficient reserves to support the BUSD stablecoin during 2020-2021.

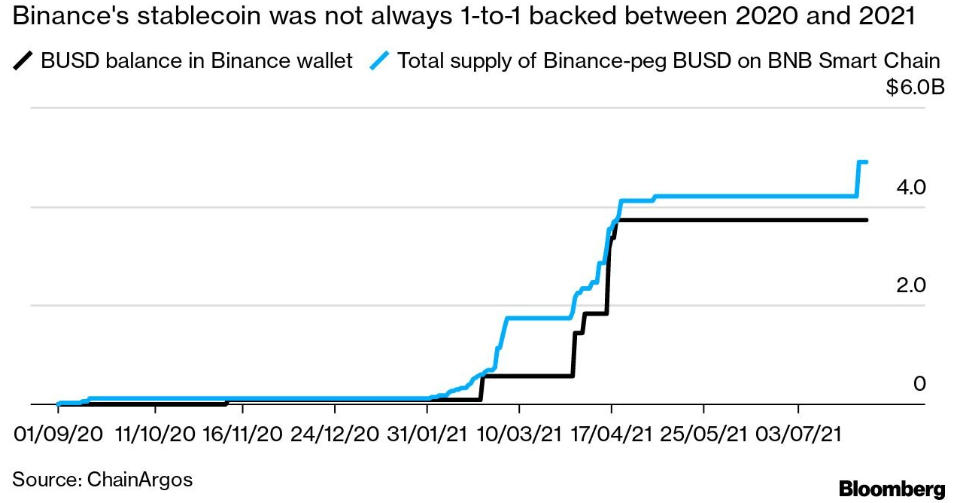

According to data shared by Jonathan Reiter, co-founder of blockchain analytics firm ChainArgos, due to mismanagement, Binance-peg BUSD has been undercollateralized three times between 2020 and 2021, with a collateral gap of 10 each time. over a billion dollars.

Additionally, the writer’s analysis shows that the amount of Binance peg BUSD issued on Binance’s BNB Smart Chain network has increased over time as the exchange continues to invest in new Binance pegs over the period without locking the equivalent amount of Paxos-issued BUSD tokens in Ethereum wallets. We have indicated that we have issued BUSD tokens. as collateral.

When a user buys Binance-Peg BUSD, Binance buys BUSD from Paxos and creates an equal amount of Binance-Peg BUSD tokens on the chosen blockchain. After that, the user will receive Binance-Peg BUSD and the same amount of her BUSD will be locked in Ethereum.

Nevertheless, a Binance spokesperson confirmed that Binance-peg BUSD is now fully backed and Paxos BUSD was unaffected. He also claimed that the previous incident was due to operational delays. A spokesperson said:

“Recently, the process has been significantly improved, with stronger discrepancy checking and always sticking to 1:1.”

After the collapse of FTX last year, Binance faced an increase in customer withdrawals and a decrease in trading volume. According to a December 14 report, his withdrawal of BUSD from the exchange saw the supply of stablecoins drop by more than 15% within 24 hours.

However, Binance CEO Changpeng Zhao has defended the exchange, Become stronger from that task.