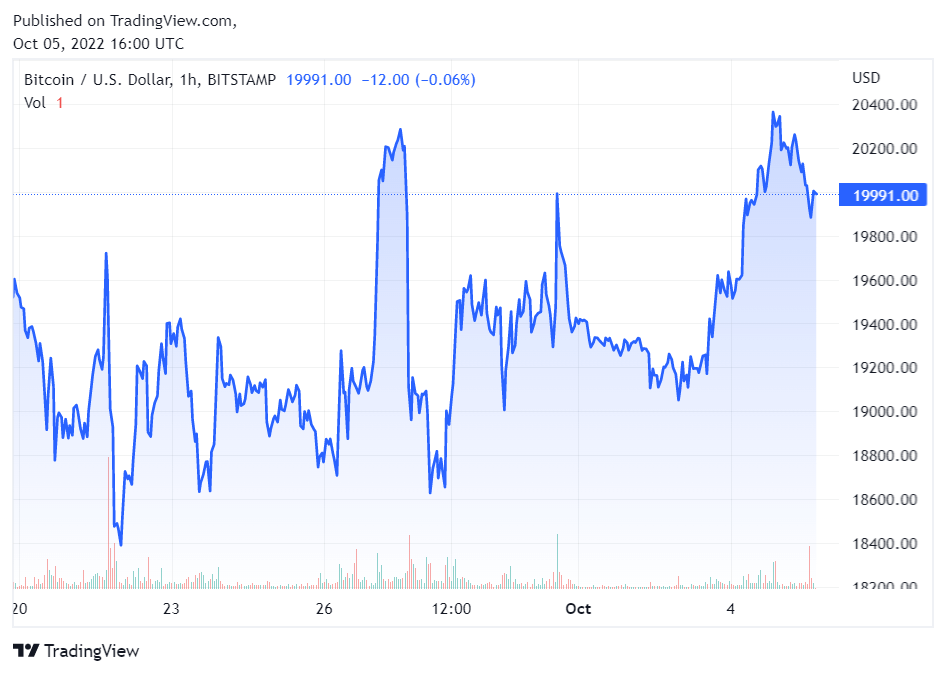

Bitcoin briefly trades above $20k as traders ape into futures

Bitcoin (BTC) briefly climbed above the $20,000 level today for the first time since Sept. 28 after gaining 4.6% last week. However, the euphoria was short-lived as he was rejected around $20,400, dropping him to $19,991 at the time of writing.

Price-performance comes at a time when the US dollar index rises reached A 20-year high of 114.78 before declining to 111 today. The Federal Reserve’s hawkish policies hurt bitcoin and equities but helped strengthen the dollar.

The recent sell-off has given cryptocurrency and stock markets a temporary rally. The Nasdaq, S&P 500 and Dow have traded for the first time in a while with a few points up.

Macroeconomic concerns such as the possible bankruptcy of Credit Suisse and further escalation of the Ukraine crisis also currently do not appear to affect Bitcoin’s performance.

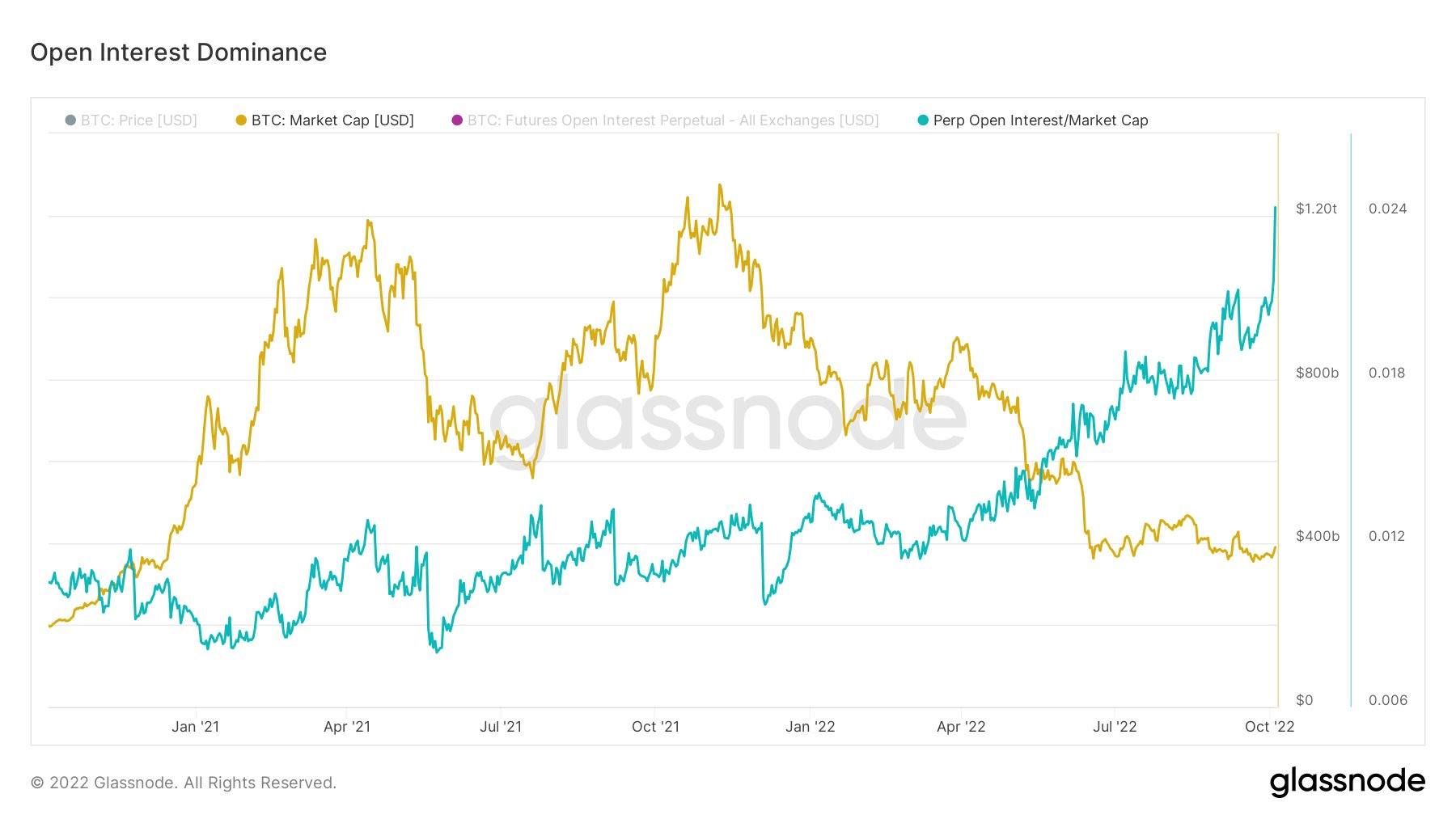

Traders flock to futures

Glassnode data analyzed by CryptoSlate shows that most traders are mimicking BTC futures trading, which is currently at an all-time high.

Traders are leveraging USD/stablecoin on futures open and non-expiring futures contracts, but very little physical trading occurs.

trader We are using stablecoins as leverage to push the BTC price higher, but this is not sustainable given that there is very little spot BTC trading. It also means that the BTC price may fall once investors start making profits.

On the other hand, BTC’s volatility may drop as traders use stablecoins as an underlying asset. It should be added that liquidation cascades can occur for either short or long positions if open interest continues to build up.

Should traders be bullish?

Popular crypto trader il Capo Of Crypto told his followers not to get too bullish when the price of Bitcoin hits the $20,500 to $21,000 level as it is a selling zone.

20500-21000 is the selling zone. Don’t get too bullish if the price gets there.

— il Capo Of Crypto (@CryptoCapo_) October 4, 2022

On the other hand, despite BTC’s performance and volatility, more people are buying the asset. IntoTheBlock’s data will be used by BTC holders reached 42 million September 27th, an increase of 4.5 million from last year.

the number of #bitcoin Holders are growing in a bear market 📈

Over 42 million addresses are currently held $BTCover a year ago to 4.5 million pic.twitter.com/BEx4HjVCeW

— IntoTheBlock (@intotheblock) September 27, 2022