Bitcoin falls to June lows after Binance announces FTX deal; Coinbase, Kraken undergo downtime

The biggest cryptoverse news on Nov. 8 included Binance’s plans to buy FTX, Coinbase, and Kraken’s downtime after the market plunged, a two-hour trading halt put FTX’s bankruptcy in doubt. including being

CryptoSlate Top Stories

Binance plans to acquire FTX outright

Binance CEO Changpeng Zhao tweeted that FTX was struggling with liquidity on the platform and approached exchanges for help.

CZ said it has signed a non-binding letter of intent for Binance to acquire FTX.

Coinbase, Kraken Fall as Bitcoin Falls Below June Lows

Bitcoin retreats to its lowest level since June as Coinbase and Kraken collapse. Both exchanges reported experiencing connectivity issues around 19:00 UTC.

These reports led the community to conspire if the exchange went down due to bank runs.

Bitcoin Balance on FTX Exchange Goes Negative – Coinglass

Over 20,000 Bitcoins have been removed from FTX reserves in the last 24 hours, leaving FTX with a negative -197.95 Bitcoins.

This puts FTX at the bottom of the list of exchanges with the lowest Bitcoin balances. The second lowest is Poloniex with 127.14 BTC, while exchange giant Binance holds 573.452 Bitcoins.

Two hours without withdrawals casts doubt on FTX liquidity

FTX stopped processing transactions on the Ethereum (ETH) blockchain for two hours on November 8th. The last transaction was recorded around 6:18 AM EST. The suspension of trading sparked rumors of bankruptcy given the liquidity crisis FTX has been experiencing recently.

A total of $1.2 billion in cryptocurrency was withdrawn from FTX in the last 24 hours, while only $540 million was deposited. This leaves FTX with a negative netflow of $653 million.

Risk signals flash red as Bitcoin loses $20,000 amid Binance and FTX feud

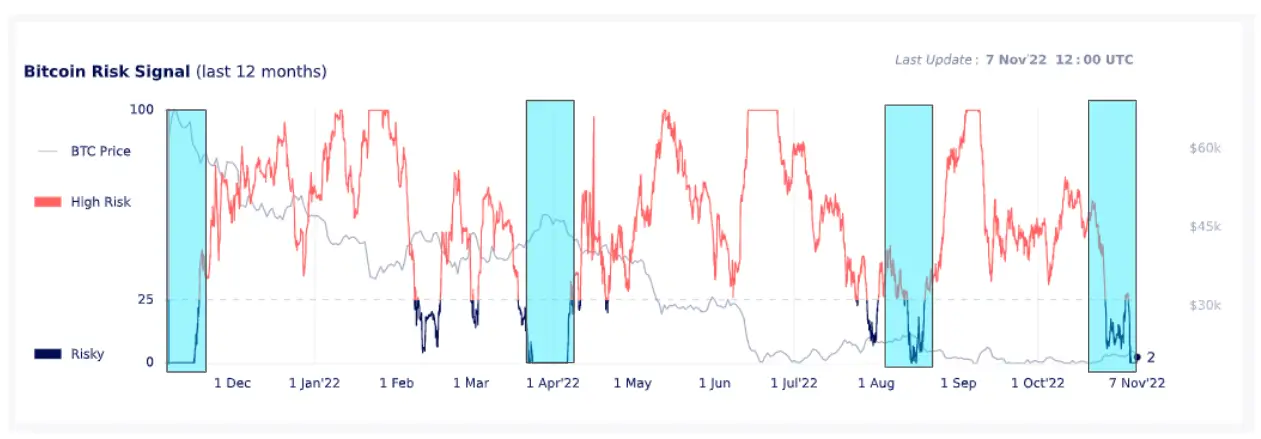

Bitcoin, like the rest of the market, fell following the FTT plunge. In response to the drop, Bitcoin’s risk signal sank to a low of 2.

The risk signal has only hit two on three other occasions since November 2021, each time recording a significant price decline.

Nearly 20,000 Bitcoin Moved from FTX to Binance in 48 Hours

Bitcoin holdings on FTX have been declining since the beginning of November. It accelerated after November 6th, with over 20,000 bitcoins moving from FTX to Binance since then.

FTX treasury loses over $3 billion in a week, Binance treasury gains $2 billion

FTX’s Ethereum and Bitcoin reserves have lost over $3 billion since the beginning of November. Binance’s reserves are increasing while FTX is losing money at an accelerating rate.

Binance’s financials increased to $43 billion from $41 billion at the end of October in the week that FTX lost $3 billion.

BitDAO Suspects Alameda Dumping BIT Tokens, Demands Proof of Funds

BitDAO (BIT) and Alameda have agreed to exchange tokens with each other in November 2021 and have pledged not to sell tokens until November 2024. According to the deal, BitDAO acquired 3,362.315 of his FTT tokens and Alameda acquired his 100 million BIT.

Both BIT and FTT plunged 20% on Nov. 8, leading BitDAO to suspect that Alameda broke its promise and liquidated its BIT holdings. The BitDAO community asked for proof of funds, and Alameda responded by moving over 100 million of his BIT tokens from his FTX wallet to Alameda addresses.

BUSD’s supply advantage grows as USDT supply declines by 4%

Binance USD (BUSD) has emerged as the best performing stablecoin with a 6% increase in dominance in the year-to-date indicators to 16%.

Meanwhile, Tether (USDT)’s dominance has retreated from 54% to 50%. Meanwhile, USD Coin (USDC) remained the second largest stablecoin by market capitalization.

SEC Victory Over LBRY Impacts Ripple And Broader Crypto Markets

The US District Court in New Hampshire granted the SEC’s motion for summary judgment against LBRY on November 7. The allegation showed that LBRY received a total of $12.2 million in cash and cryptocurrencies from the sale of his LBRY credits.

The nature of this case has implications for the ongoing Ripple (XRP) v. SEC litigation. According to the founder of Crypto-Law. In the US, the SEC could point to her LBRY decision to strengthen its hand on Ripple’s allegations.

research highlights

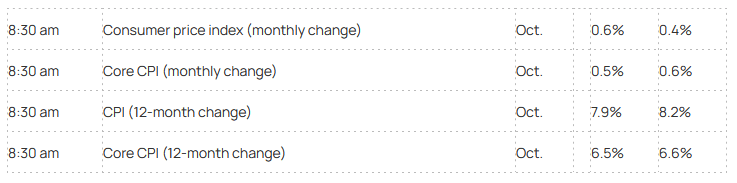

Cryptocurrencies, Stocks Brace Ahead of Thursday’s CPI Announcement

Investors expect the Fed to ease rate hikes if inflation shows signs of slowing, but indicators show the U.S. economy is far from cooling.

The data show that the overall CPI is expected to register a 0.6% rise in October, a change of 7.9% year-on-year.

As a result, investors are worried that the stock could fall further. They may be right, but Bitcoin was showing signs of becoming a safe haven, detached from equities. However, it is still unclear how he will respond to the overall CPI rise.

News around Cryptoverse

crypto market

Over the past 24 hours, Bitcoin (BTC) has fallen -11.81% to $18,364, while Ethereum (ETH) has also fallen -17.15% to trade at $1,326.