Bitcoin, Gold correlation nears 1 over past year, indicating a bottom

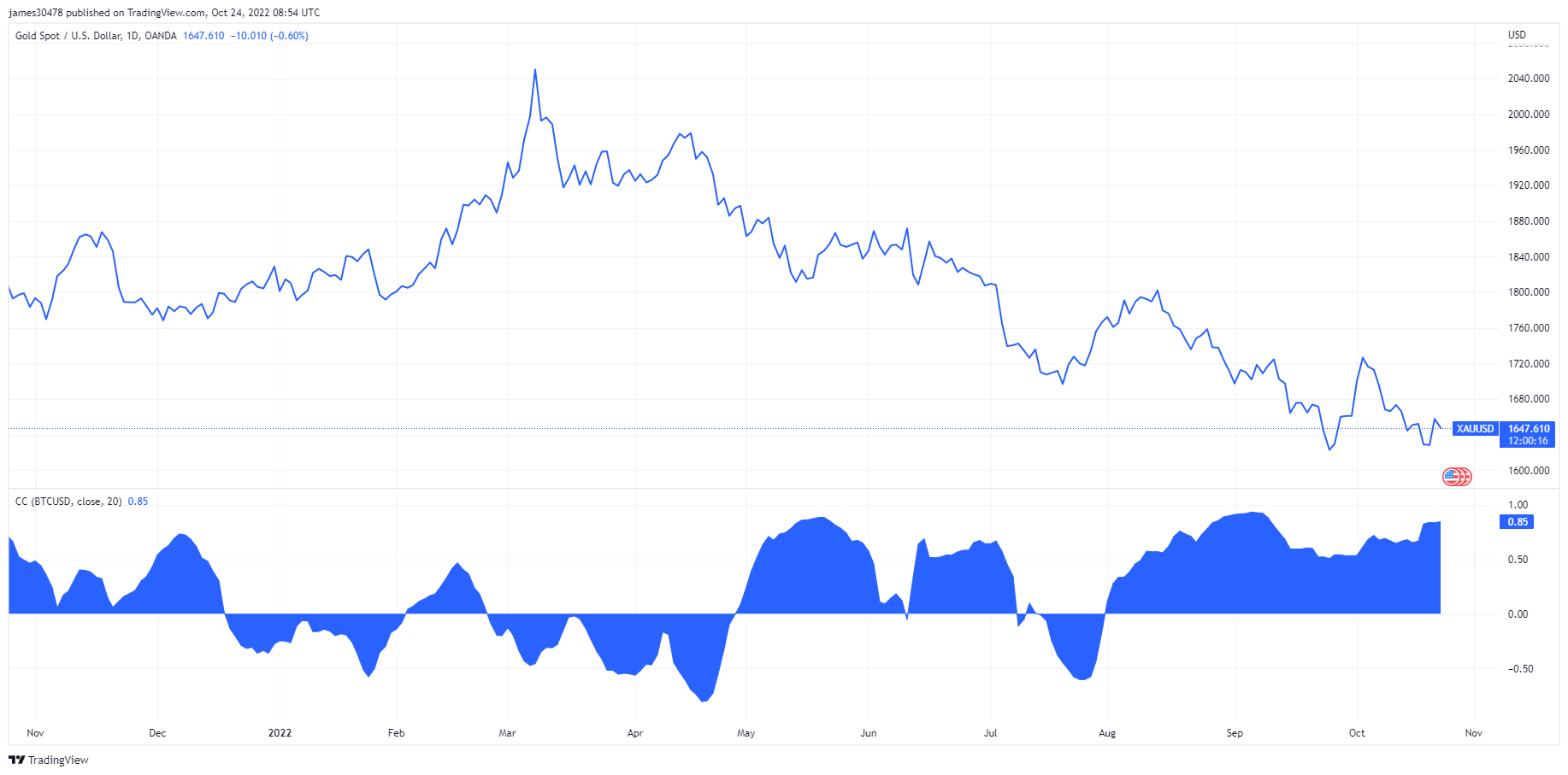

The biggest cryptocurrency has become less risky as the adoption of Bitcoin (BTC) has increased, reaching an 85% correlation with gold over the past year. This indicates that the BTC price bottom may be near.

Asset correlation measures how one asset performs relative to another and is scored between 1 and 0. If both assets move together in the same direction, they are considered highly correlated and have a correlation rate of 1. Similarly, if they move in opposite directions, their correlation rate will be 0.

The current correlation between Bitcoin and gold is 0.85, which means that these assets move in the same direction with 85% accuracy.

As also shown in the chart above, the Bitcoin-Gold price correlation has been above 0.50 since early May, except for a brief period from mid-July to early August.

This increase in correlation indicates an increase in Bitcoin adoption. Going in the same direction as gold could mean that investors have started to see Bitcoin as digital gold as the fundamentals are already similar.

Peter Wall, CEO of Bitcoin mining company Argo, noted this increase in adoption when correlation rates began to rise. In his May 30 interview, Wall called Bitcoin Gold 2.0 and said Bitcoin’s limited cap is similar to gold’s limited nature.

Bitcoin is nearing the bottom

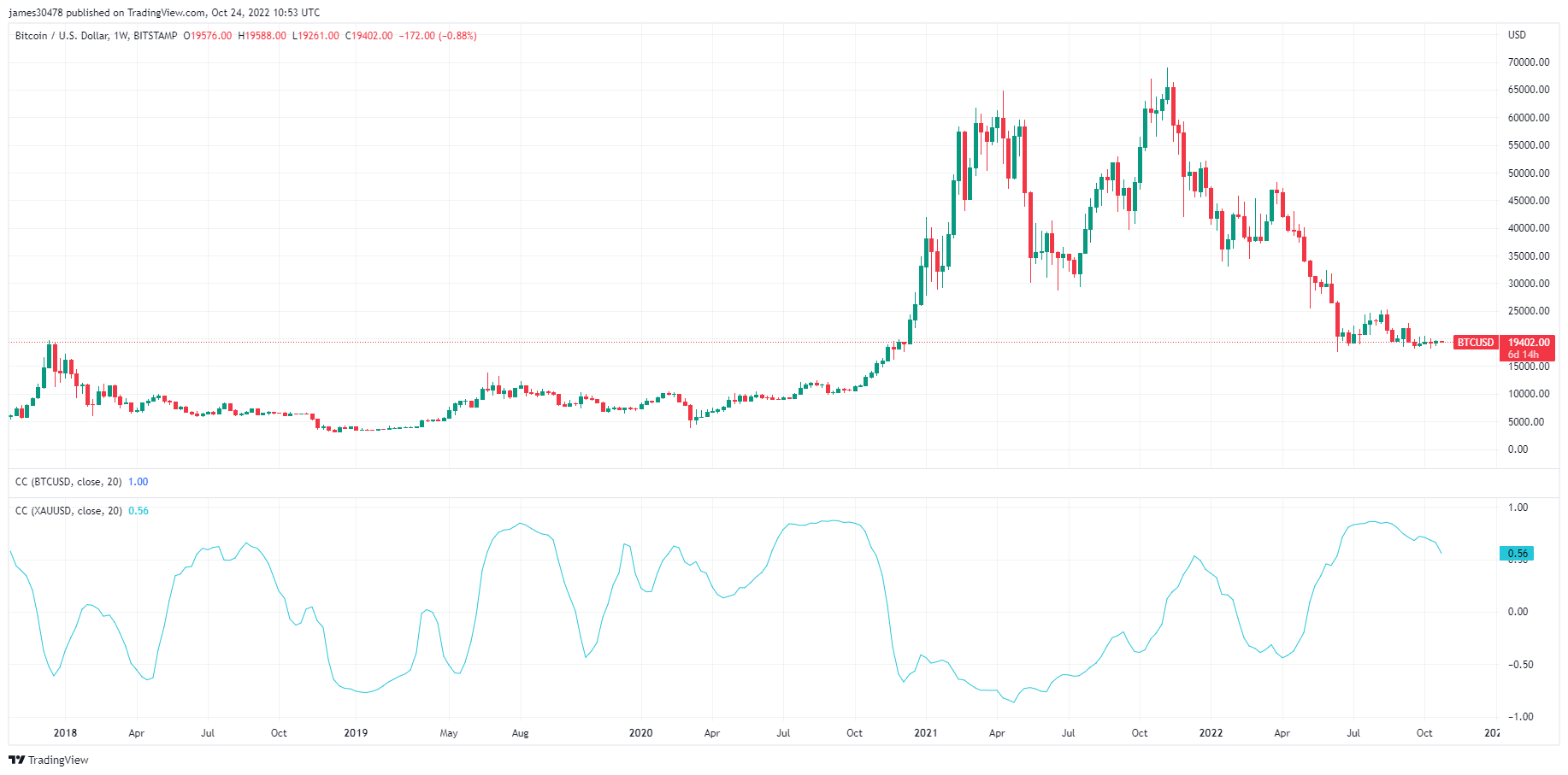

Historical data on the correlation between Bitcoin and gold suggests that periods of high correlation portend a bottom for Bitcoin’s price.

The chart above shows the price of Bitcoin against the US dollar since 2018, with the blue line showing the correlation between gold and Bitcoin.

Second half of 2017, July 2018, September 2018, August 2019, January 2020, March 2020, July-October 2020, December 2021, July 2022 The section of the chart shown corresponds to the relatively high price correlation between gold and bitcoin.