Bitcoin held on exchanges reaches its lowest since 4 years

The total amount of Bitcoin (BTC) held by exchanges has reached its lowest level since 2018, while the supply of Ethereum (ETH) on exchanges has increased significantly since June 2022.

The numbers also show that Coinbase prefers investors to buy and hold Bitcoin.

Bitcoin

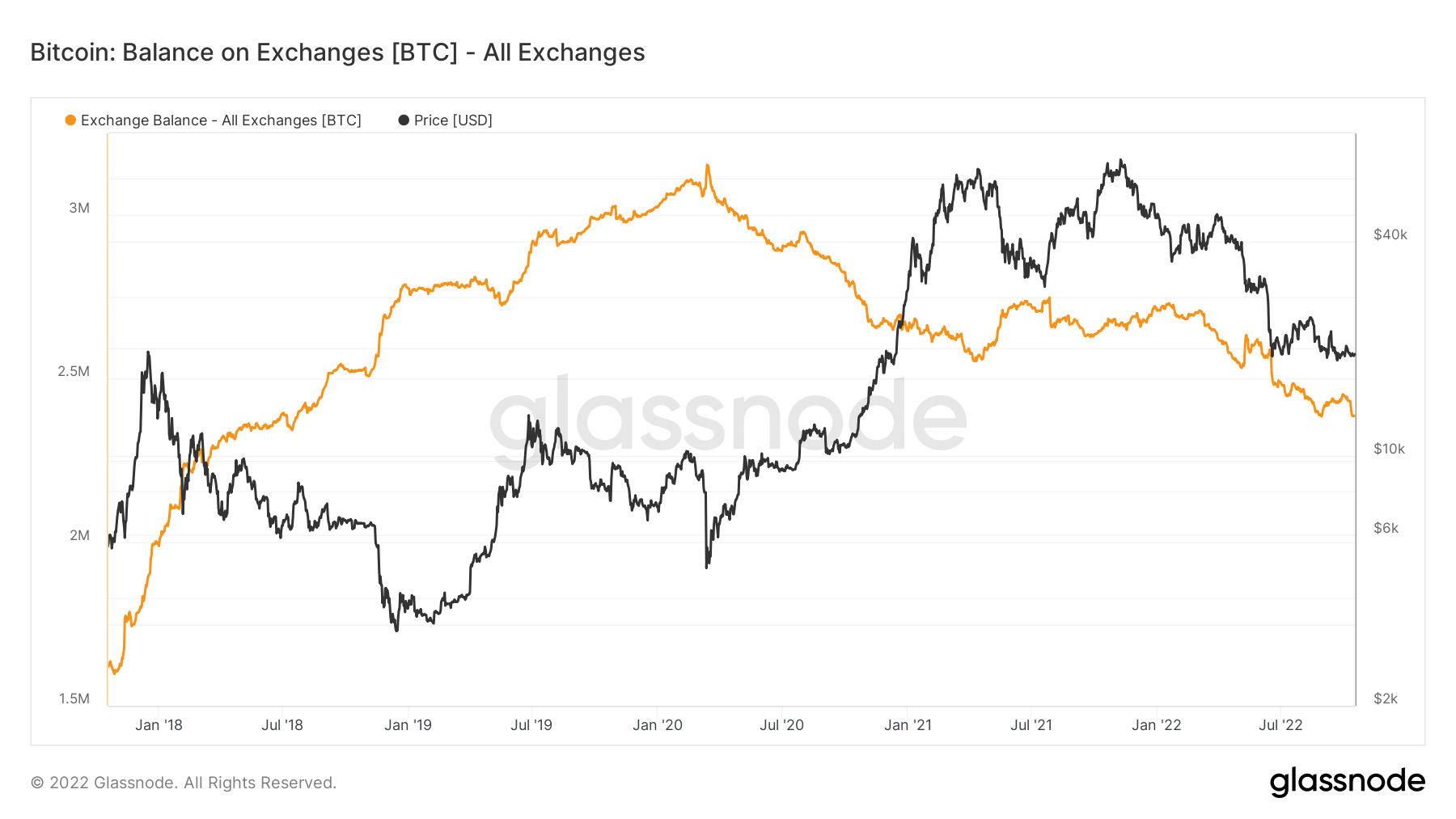

Bitcoin holdings by exchanges have hit a four-year low. The exchange currently holds just under $2.4 million in Bitcoin, represented by the orange line in the graph below.

Over 300,000 bitcoins have been removed from exchanges in the current winter conditions. This indicates a bullish trend among investors. This has reduced the supply held by the exchange to its lowest level in four years. The last time Bitcoin balances on exchanges were around $2.4 million was at the end of 2018.

The $2.4 million currently held on exchanges represents about 12% of the total bitcoin supply in the market.

ethereum

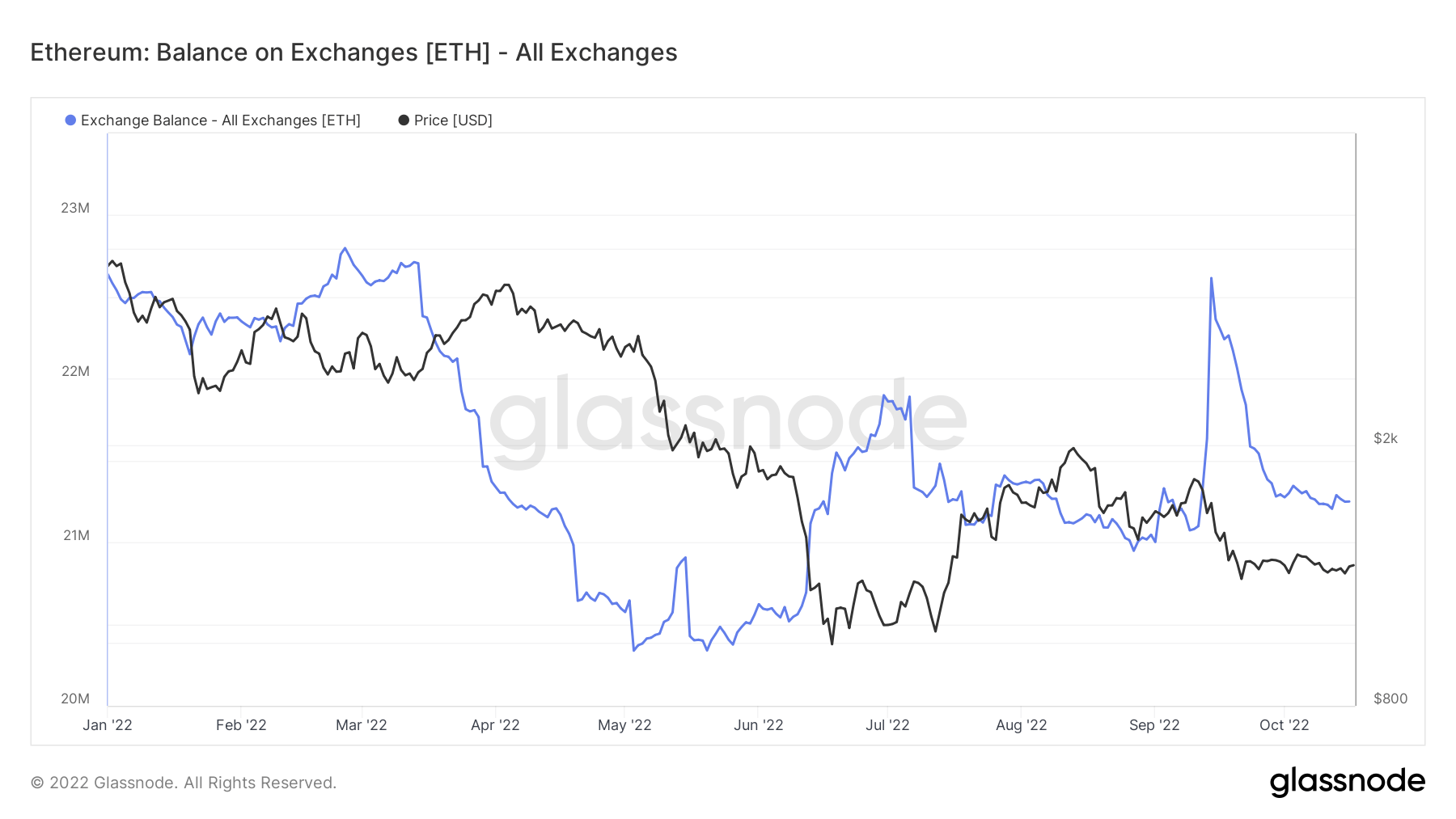

From the beginning of the year to July, Ethereum balances held by exchanges followed the same downward trend as Bitcoin. But things changed for him in July when exchanges began accumulating his Ethereum.

The chart below shows Ethereum balances held by all exchanges in blue lines, showing a sizeable surge recorded after a large drop.

At the beginning of the year, the total amount of Ethereum held by cryptocurrency exchanges was just 22.5 million. Despite a short spike in early March, Ethereum reserves have declined rapidly in the first six months of the year.

Losing nearly 2 million Ethereum in the first half of this year, the total balance held on the exchange fell to just under 20.5 million in June. The downtrend changed in June after Terra-Luna collapsed and Ethereum supply began to return to exchanges.

Currently, the exchange holds approximately 21.2 million Ethereum balances, representing approximately 18% of the total Ethereum supply in the market.

coin base

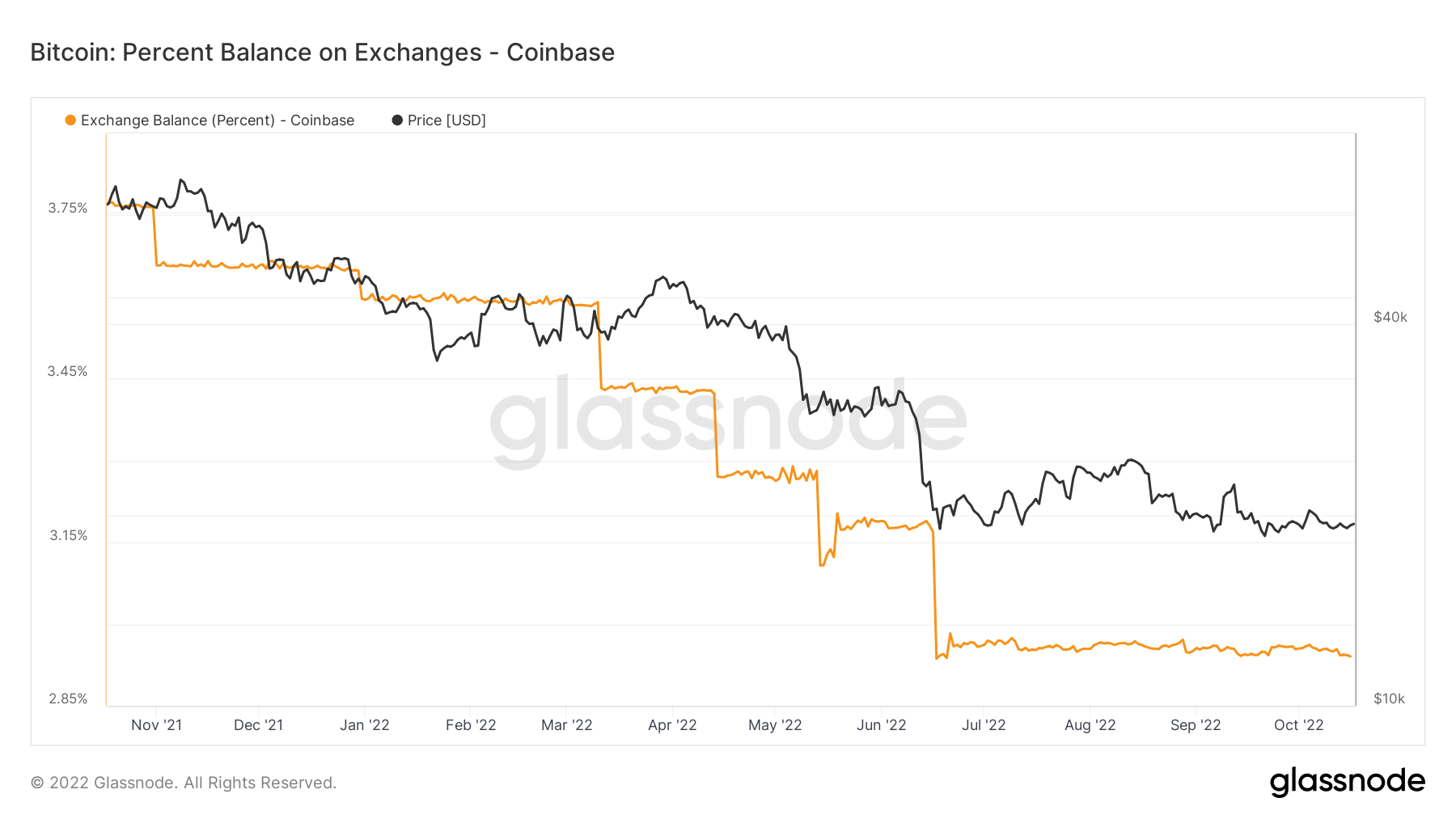

Judging by the number of Bitcoins lost, Coinbase has emerged as the largest exchange platform used by investors to buy and hold. According to the chart below, Coinbase has been rapidly losing its Bitcoin balance since May 2022 when the bear market began.

Since the bull market in November 2021, very little bitcoin has returned to exchanges. At the time, Coinbase accounted for almost 4% of the total Bitcoin supply. The exchange today lost his 1% of all Bitcoin in about a year and now has just under 3% of it.

Coinbase is primarily used by large US institutions known for their tendency to buy and hold. As also shown in the chart above, the exchange lost a large amount of bitcoin after the bear market hit.

Coinbase had about 680,000 bitcoins at the beginning of the year, but that number dropped to 560,000 in the eight months of August. The exchange said he lost another 50,000 bitcoins on Oct. 18, dropping Coinbase’s total holdings to 525,000.