Bitcoin HODL waves show that this cycle is completely the same as all others

If you look at the Bitcoin (BTC) price performance graph over the past few months, you will see a seesaw chart, but it has fallen more than risen.

While the current market cycle may look different from previous cycles, the HODL wave indicator shows that it’s not much different from previous cycles.

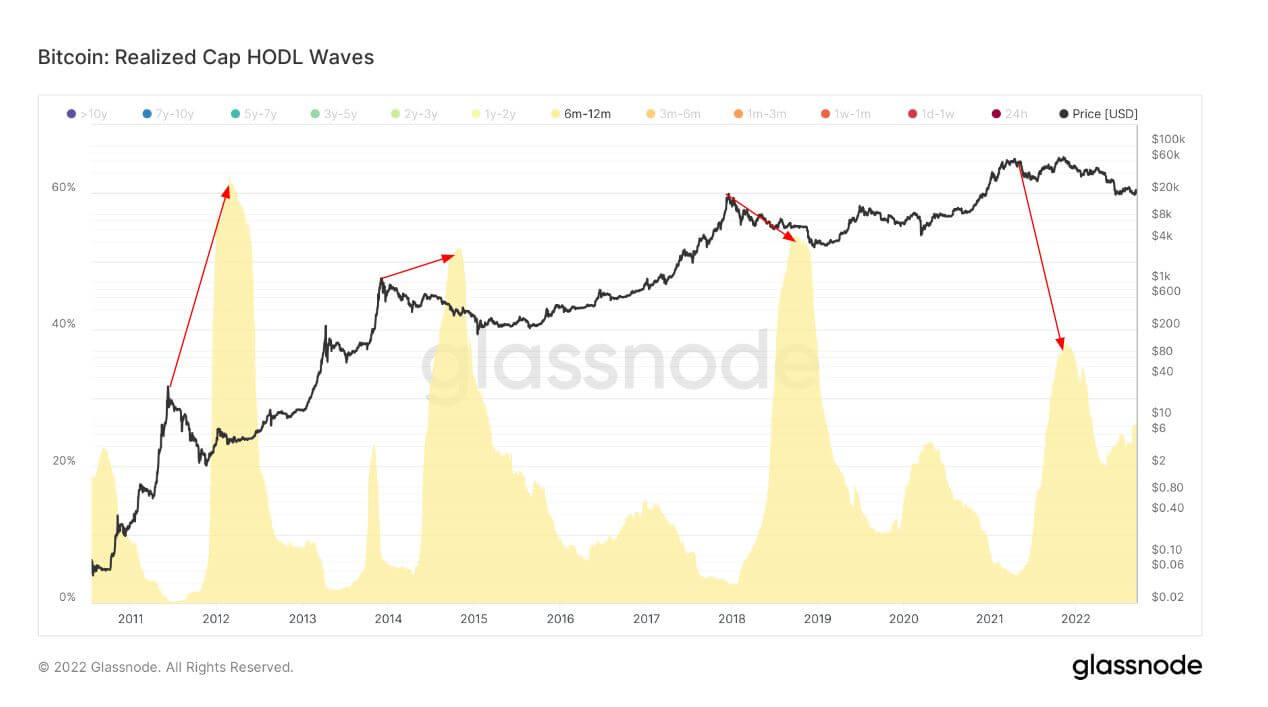

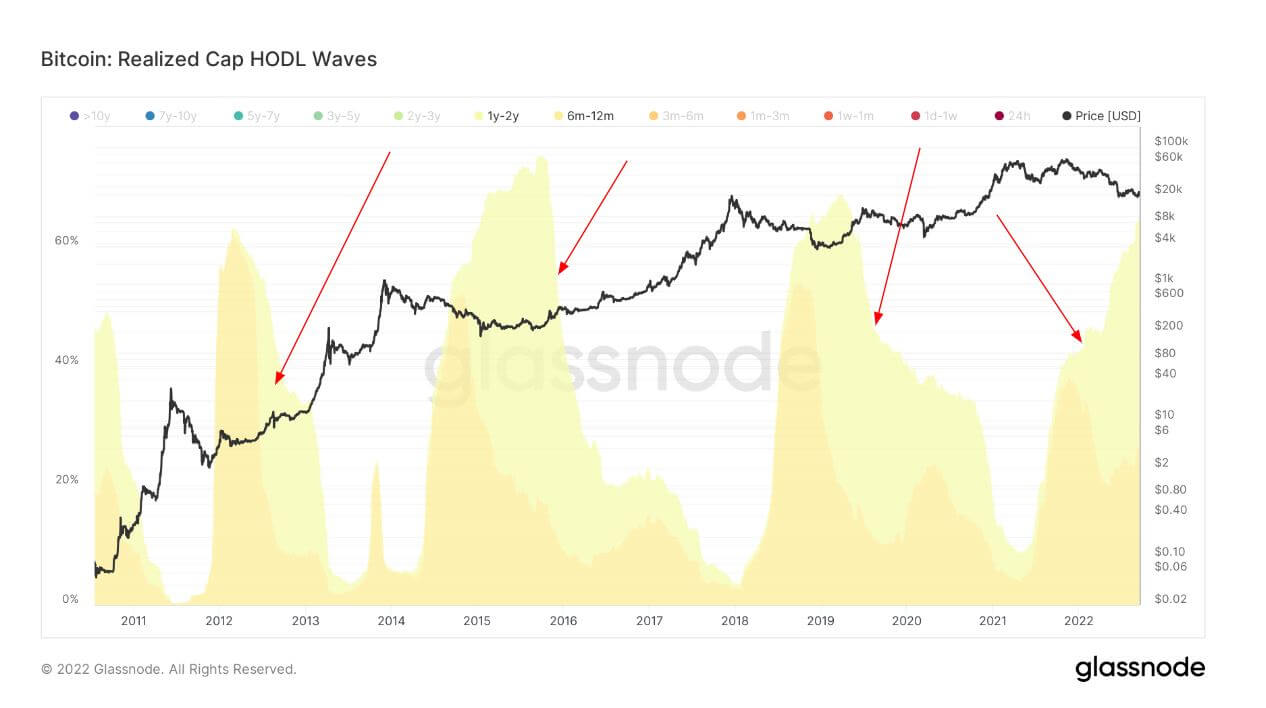

The HODL Wave Metric is a graph that groups the Bitcoin supply in circulation into different age groups and shows how these age groups have changed over time.

Charts allow you to see what each group of market participants is doing with Bitcoin and identify which groups are selling.

Looking at Glassnode’s Bitcoin Realized Cap HODL wave chart analyzed by CryptoSlate research, short-term holders of 6 to 12 months typically buy flagship assets during bull markets when prices are near or at the high end. You can see that

Most of these holders bought about six months after the market peaked.

Bitcoin prices usually fall quickly, and these short-term holders suffer unrealized losses.

Buying short-term holders means long-term holders are selling to new market participants. This unfolds in most market cycles, especially he in 2013, 2017 and 2021.

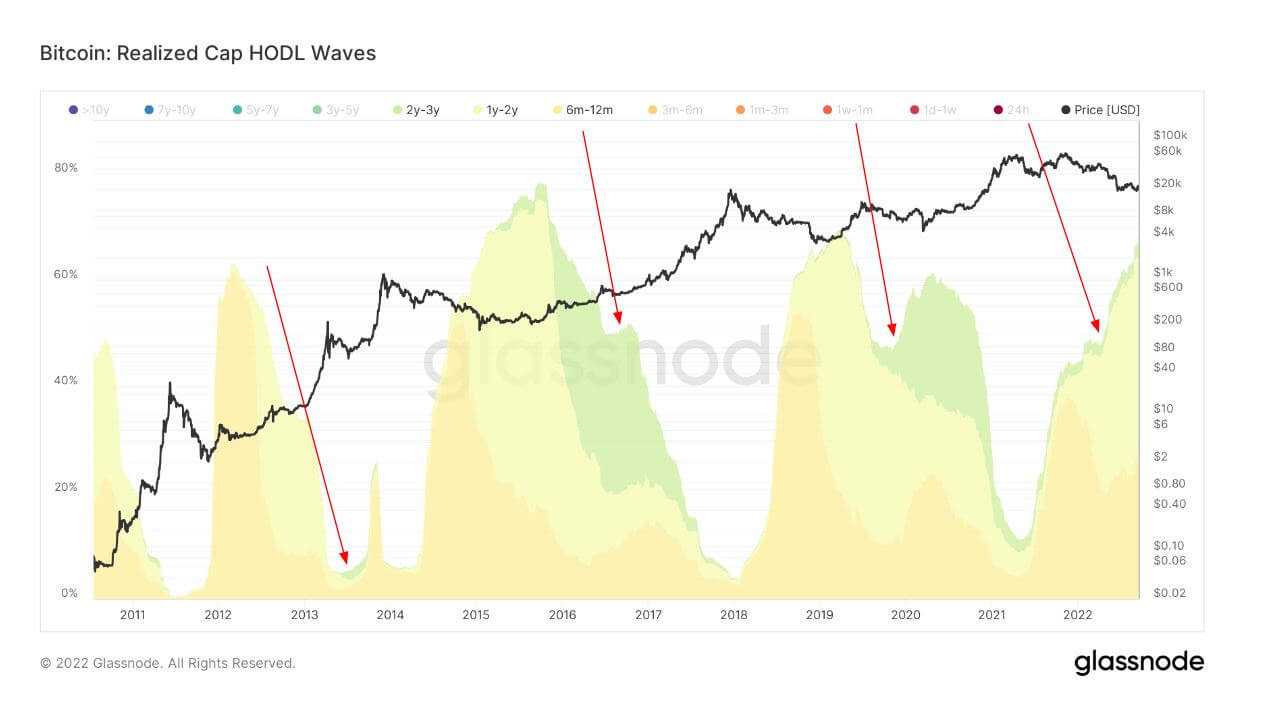

However, the 1-2 year HODL wave after 2021 is different. The HODL wave also decreased, although some indicated that it was sold during the peak of the bull market, but at a much lower percentage.

About 60% of the supply remained, even as prices plummeted. An explanation for this could be due to long-term holders’ beliefs, or it could be that BTC was submerged because it bought at the highest price when it approached ATH.

On the other hand, 2-3 year holders make up a large percentage of the holding supply. However, this cycle is significantly smaller than his two previous cycles. Therefore, we have to wait for this cohort to mature. This will further strengthen our network with those who purchased the 2021 Peak Top.

In conclusion, the HODL wave metric shows that this cycle is the same as the others and there are no differences.