Bitcoin may be regaining dominance over altcoins

Ethereum has outperformed the market in the last few months, breaking from a decade-long tradition of Bitcoin dominance. Some see this as market pricing going forward, mergeothers argued that it showed the natural and expected decoupling of the market.

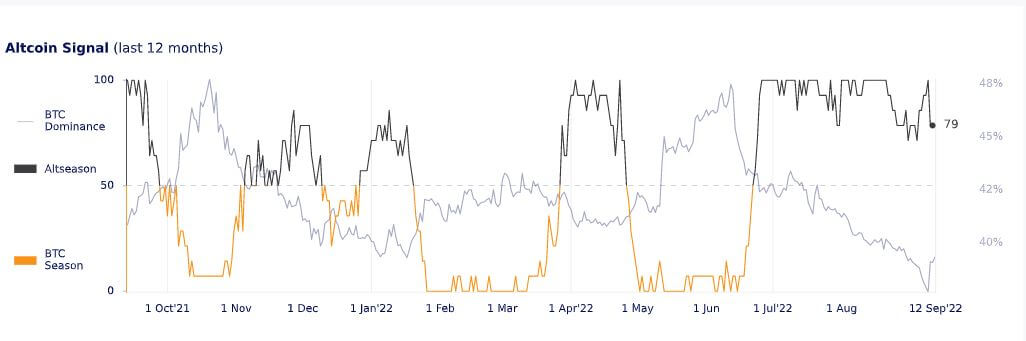

Ethereum’s outperformance was clearly visible through the altcoin cycle signal, the indicator that determines the strength of the altcoin market. Altcoin cycle signals that vary between 0 and 100 indicate Bitcoin season and Altcoin season.

BTC could outperform the overall altcoin market if the signal falls below 50 during the Bitcoin season. During altcoin season (when the signal goes above 50), this dynamic reversal and basket of altcoins led by Ethereum will be the dominant force in the market.

Altcoin Cycle Signals are based on price data for the top 250 altcoins by market cap, excluding stablecoins. A number at or near zero indicates that the market is in Bitcoin season, and BTC is expected to outperform all altcoins. A number at or near 100 clearly indicates an altcoin season, where bitcoin’s dominance is expected to decline. The top 250 altcoins are expected to outperform BTC.

If the altcoin cycle signals fluctuate between 20-50 or 50-80, the market is plagued with uncertainty. A score below 50 indicates a season for Bitcoin and vice versa, while fluctuating readings indicate a high probability of a trend reversal.

The altcoin cycle signal currently at the 79 position shows that the market is currently kneeling in the altcoin season. However, the signal has dropped significantly over the past two months (July-August) and remained at 100 for his first two weeks in September.

Below 80, a rapid drop below 50 usually followed, and Bitcoin’s dominance began. In the past year, there has never been a period of more than a few days with the signal fluctuating below his 80.

However, it is still too early to tell if this is the beginning of another trend reversal.

Large cryptocurrency returns show a steady outflow of funds from Layer 1 tokens. Large cap tokens have performed significantly worse than BTC, a trend that correlates with current altcoin cycle signals.

This means the market may stay in the altcoin season. It’s also too early to tell how the upcoming merge will affect altcoin dominance. Ethereum Likely Leads Altcoin Outperform — ETH Price Post-Merger If C rises, the market could continue the altcoin season for a few more weeks.

However, if the price of ETH falls after the move to the PoS network, the fall in the altcoin cycle signal could drop further, pushing the market back into the Bitcoin season.