Bitcoin options traders expect price to hit $30,000 in Q4

An option is a financial derivative in which two parties contractually agree to trade an asset at a specified price in advance of a future date.

Glassnode data analyzed by CryptoSlate suggests options traders expect Bitcoin and Ethereum to rise in Q4.

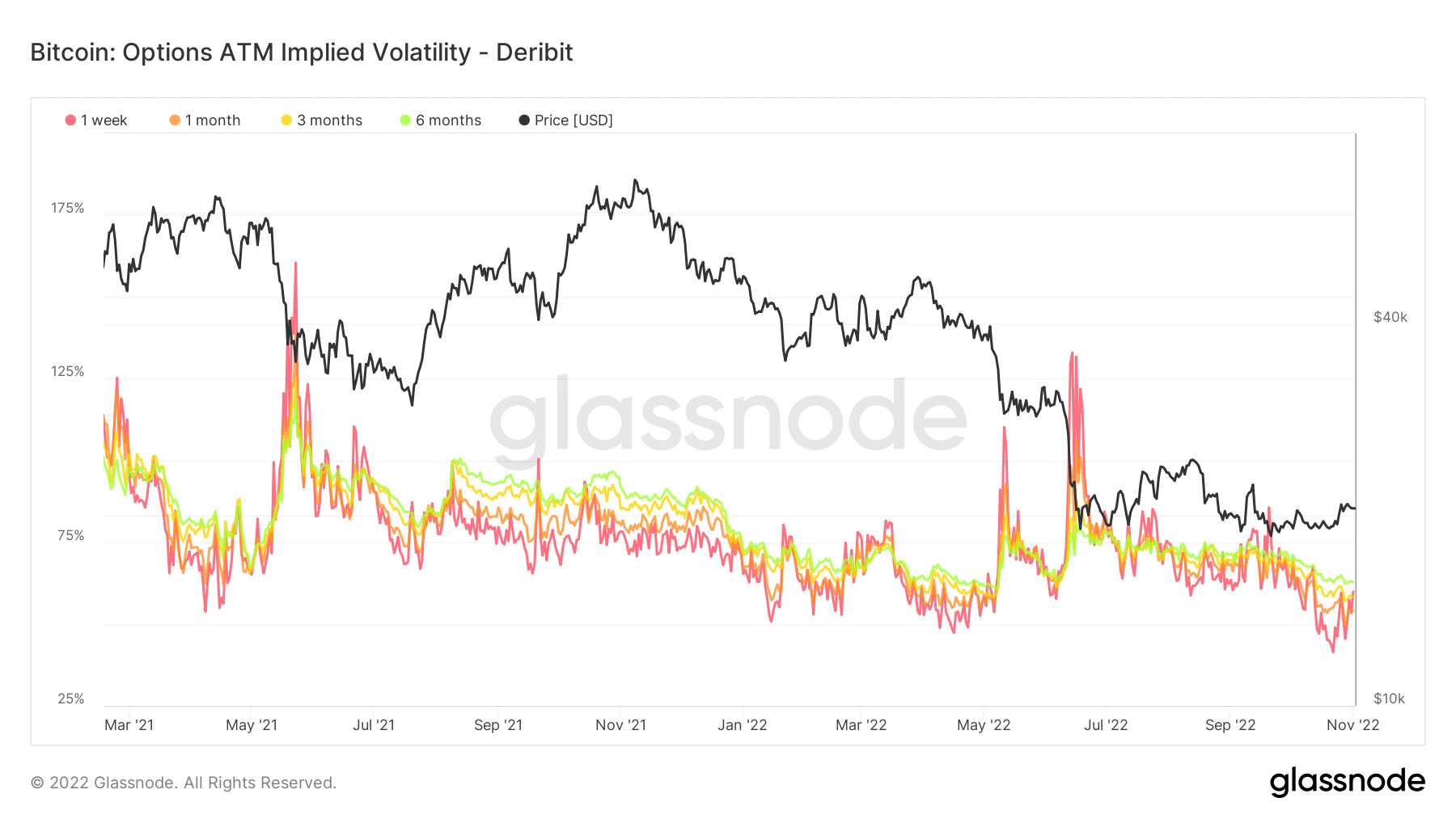

Bitcoin Implied Volatility

Implied volatility (IV) is a measure of market sentiment about the likelihood that a particular asset will change in price and is often used to price option contracts. IV typically increases during market downturns and decreases during bullish market conditions.

It can be viewed as a proxy for market risk and is usually expressed as a percentage and standard deviation over a specific timeframe.

Standard deviation (SD) measures how scattered or distributed the data are about the mean. For example, within a normal distribution, 68% of the data fall within 1 standard deviation of the mean, 95% fall within 2 SDs, and 97.7% fall within 3 SDs.

The IV follows the expected price movement within one SD for one year. This metric is further complemented by representing the IV of option contracts expiring 1 week, 1 month, 3 months, and 6 months from now.

The chart below shows Bitcoin IV falling from its summer highs before stabilizing and becoming less volatile in the second half of the year. Based on past instances of IV declines, this could be a harbinger of bullish conditions brewing in Q4.

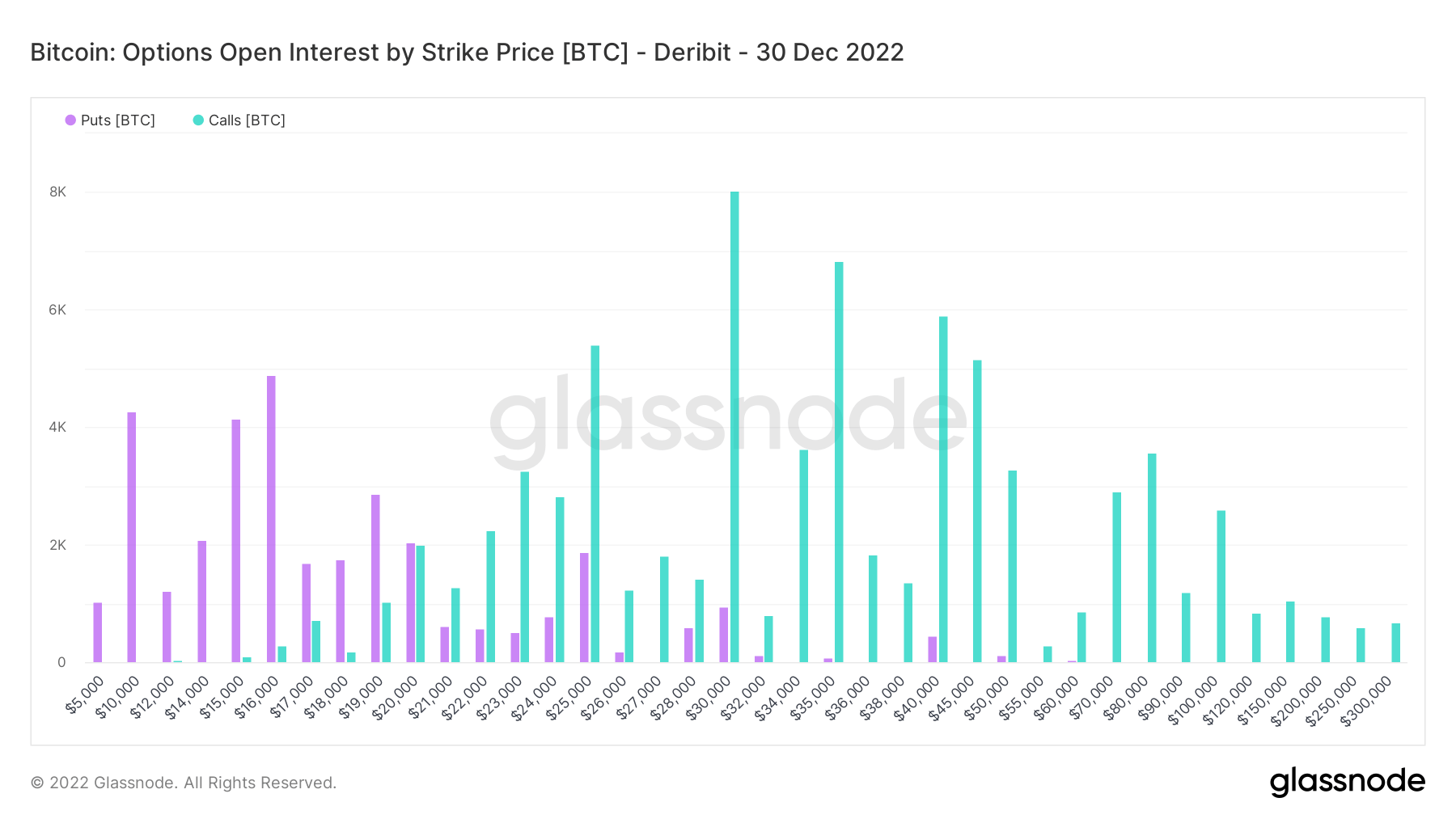

open interest

Open Interest (OI) refers to the total number of derivative contracts (in this case options) that have not yet been settled.

A put is the right to sell a contract at a specified price before maturity. In comparison, a call is the right to buy a contract at a specific price by the expiration date.

The Bitcoin OI chart below shows strong puts at $10,000, $15,000 and $16,000. Traders have signaled a staggering volume of calls in excess of $1 billion against over 30,000 BTC.

The put to call ratio suggests that traders are expecting Bitcoin to move higher, with a mode price target of $30,000.

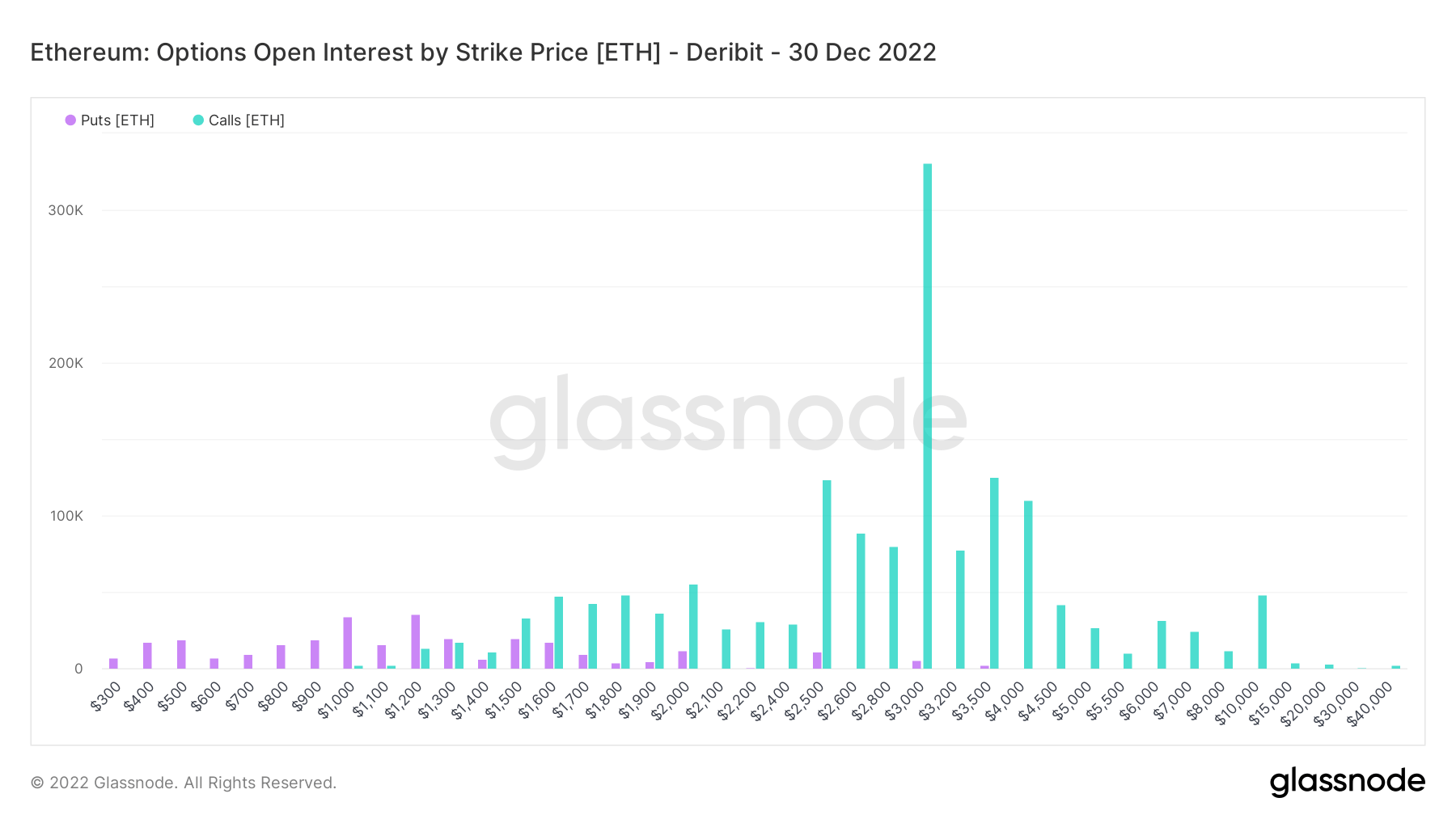

Ethereum OI, on the other hand, shows a similar pattern to Bitcoin as it is dominated by calls. The $3,000 call overwhelms all other prices, both puts and calls.