Bitcoin options traders swing bearish as FTX fallout takes hold

More recently, market volatility has increased as the FTX saga exploded.

Binance’s offer to buy FTX gives the beleaguered exchange a lifeline. However, as revealed by Binance CEO Changpeng Zhao (CZ), the transaction is subject to ample due diligence.

Crypto Twitter is flooded with speculation that CZ will pull out of the deal after the FTX book is reviewed and cost-benefit analysis considered.

Meanwhile, an analysis conducted using Glassnode data showed that the Bitcoin derivatives market reacted accordingly.

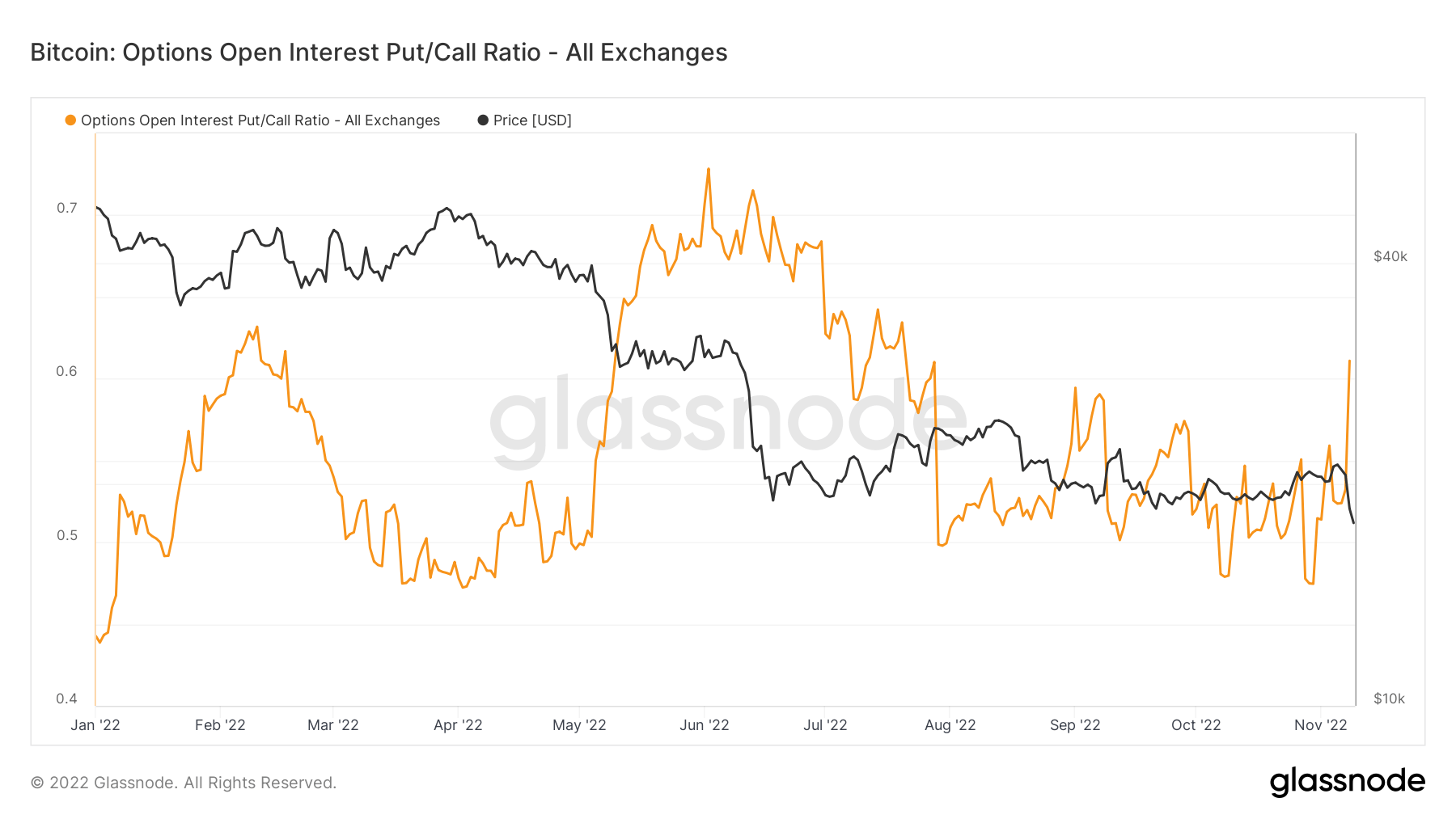

Bitcoin open interest put/call ratio

A put is the right to sell an asset at a set price by a specified maturity date. A call, on the other hand, refers to the right to purchase an asset at a set price by a specified expiration date.

The open interest put/call ratio (OIPCR) is It is calculated by dividing the total number of put positions on a given day by the total number of call positions.

Open interest is the number of contracts, either puts or calls, outstanding in the derivatives market. That is, it is unsettled and open. This can be seen as an indicator of money flow.

The chart below shows that the OIPCR surged as the FTX situation took hold. The leaning to buy puts suggests bearish sentiment among option traders.

Importantly, the OIPCR has not (yet) reached the extremes seen during the Terra Luna collapse in June. Nonetheless, the developing situation leaves room for further expansion of puts.

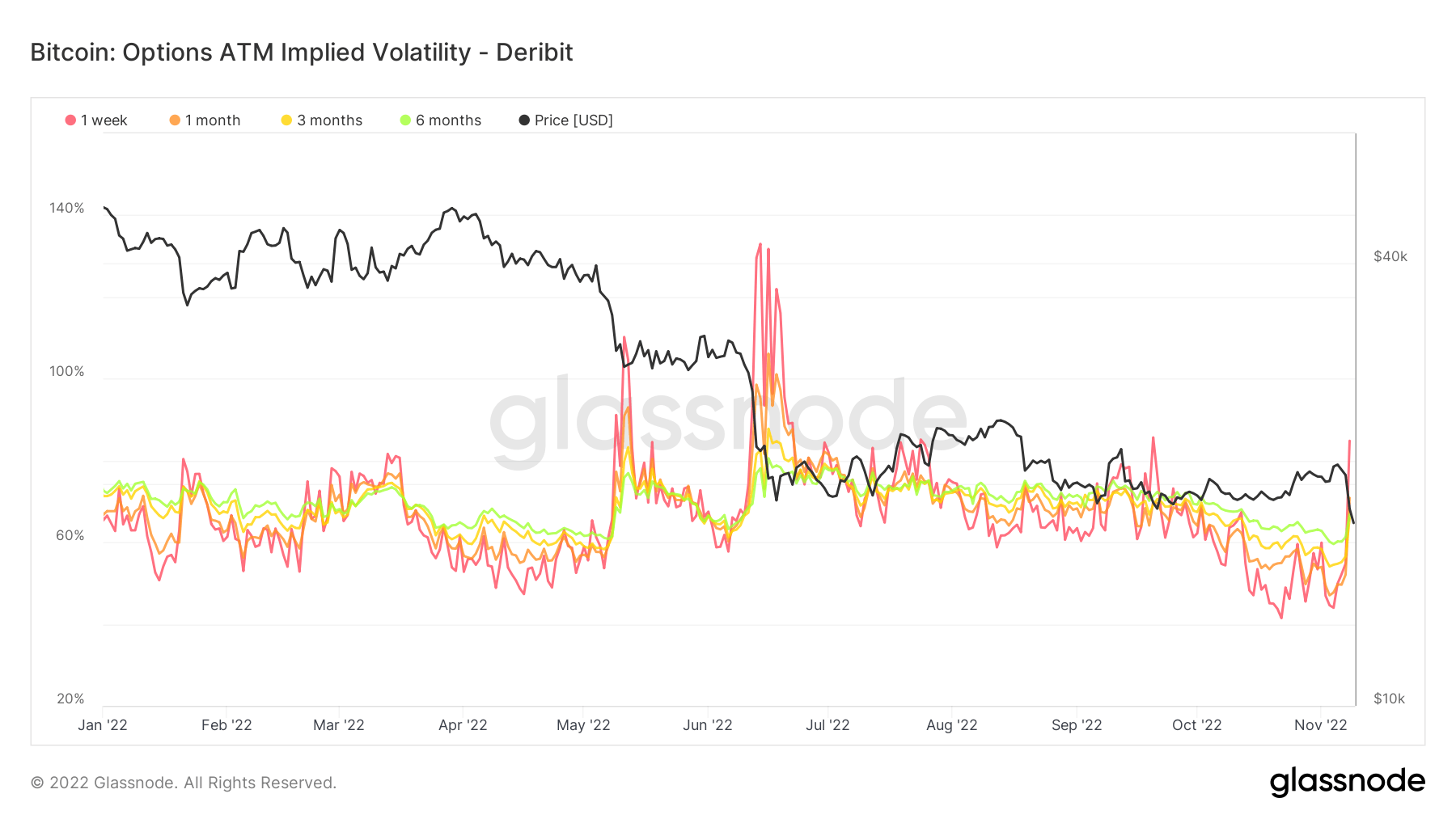

ATM Implied Volatility

Implied volatility (IV) measures the market’s sentiment about the likelihood that a particular asset’s price will change. Often used for pricing option contracts. IV typically increases during market downturns and decreases during bullish market conditions.

It can be viewed as a proxy for market risk and is usually expressed as a percentage over a specific timeframe.

IV follows the expected price movement within one standard deviation over a one-year period. The metric can be further supplemented by showing the IVs of option contracts expiring 1 week, 1 month, 3 months and 6 months from now.

The chart below shows a sharp reversal from previous bullish lows, suggesting options traders are anticipating higher volatility ahead.

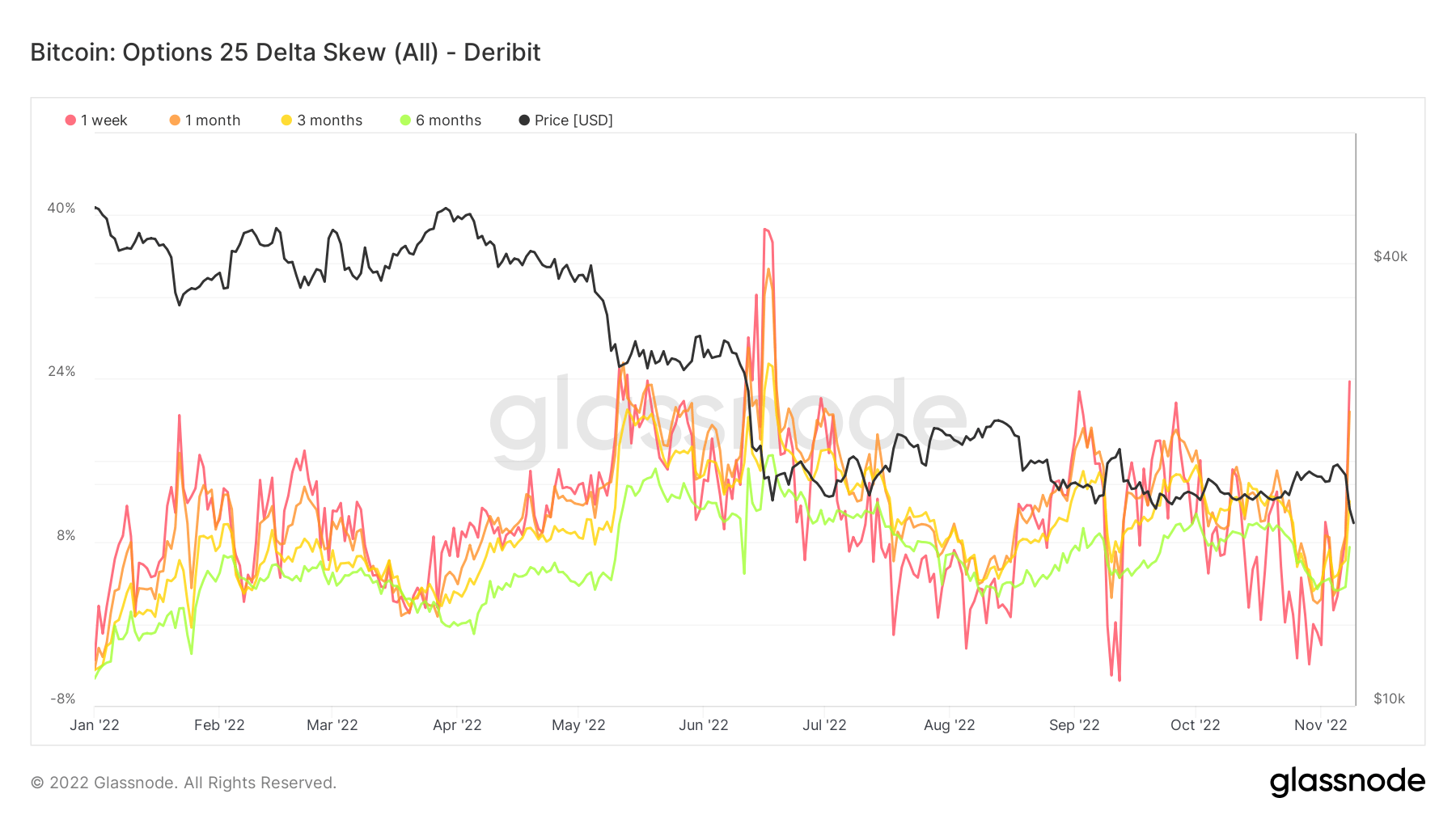

Option 25 delta skew

The Option 25 Delta Skew metric looks at the ratio of put-to-call options expressed in terms of implied volatility (IV).

For a given expiring option, this metric looks at puts with a delta of -25% and calls with a delta of +25% and nets off to reach the data point. In other words, this is a measure of an option’s price sensitivity to changes in the Bitcoin spot price.

Individual terms refer to option contracts that expire 1 week, 1 month, 3 months, and 6 months from now, respectively.

A rise in 25 Delta Skew indicates that traders are fighting for puts, indicating a U-turn in sentiment confirmed by the OIPCR data.