Bitcoin rally fueled by realization trustlessness is the only way forward

Dylan LeClair says Bitcoin’s recent strong performance comes down to the understanding that lack of trust is the only way forward.

Amid challenging geopolitical and macroeconomic conditions, research analysts Bitcoin has been able to buck broader market trends, thanks to a growing perception that there is no counterparty risk.

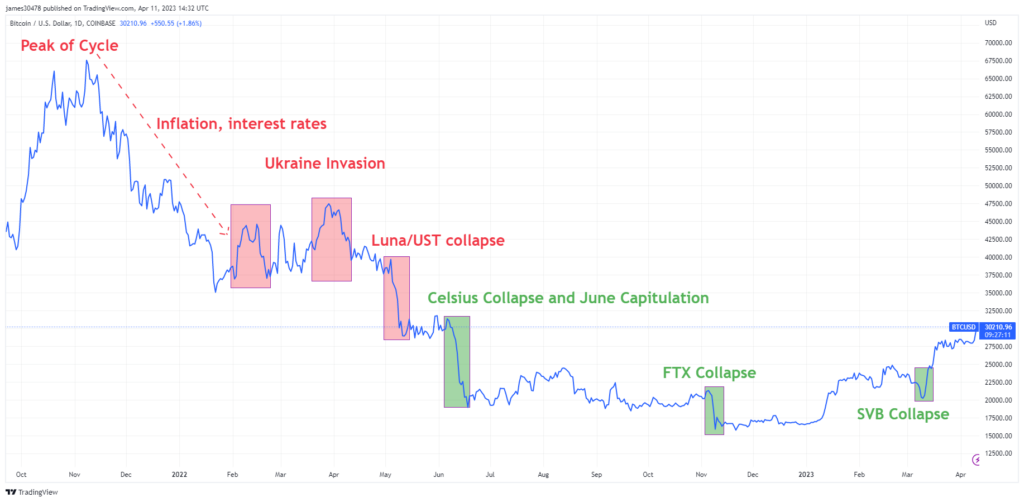

BTC has suffered a sharp price drop since its November 2021 high. Recent events, including a spate of CeFi bankruptcies, have contributed significantly to curbing the recovery.

However, despite the pessimistic situation, Bitcoin hit a 10-month high above $30,000 on April 11th.

Bitcoin’s tough run

Since its November 2021 high, Bitcoin has suffered a 78% peak-to-trough loss before bottoming out at $15,500 in November 2022.

Over the past 18 months, major cryptocurrencies have faced significant headwinds, starting with the onset of inflation and the accompanying shift to quantitative tightening. Further uncertainty took hold as conflict erupted in Eastern Europe in February 2022.

By May 2022, the UST scandal was adding to the sales pressure as the entire LUNA ecosystem was revealed to be a fraud from the start. The event set off a downward spiral, influencing other his CeFi platforms and further exposing parts of the industry as interconnected card houses.

But it wasn’t until the fall of FTX that the market bottomed out. Since then, Bitcoin has shown a strong rise, growing by 94% in the period since March 11, as the bank collapse occurred.

Worst behind us?

In describing Bitcoin’s move, LeClair said, “Every four years, fraud and leverage are completely wiped out,” leaving the market with a majority of long-held followers. .

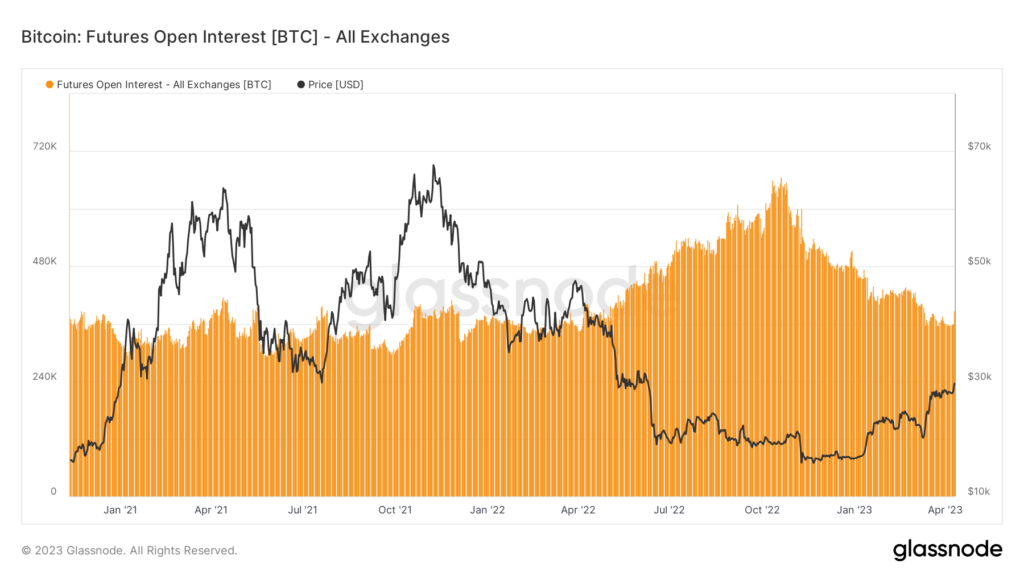

The Glassnode open interest chart below confirms LeClair’s statement. This shows the number of open futures derivatives contracts sliding from a November 2022 peak of around 600,000 to around 400,000 now. This is roughly in line with past levels.

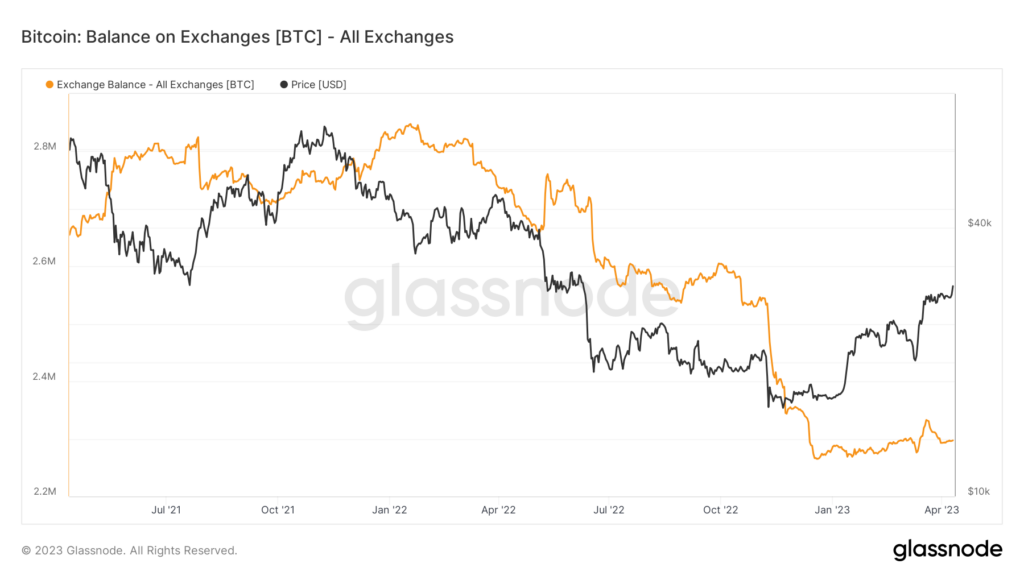

Similarly, the amount of Bitcoin held on exchanges has decreased significantly over the past two years, indicating a trend of long-term holding.

LeClair said what’s happening here is that people want to hold decentralized assets that don’t require trust.

“They don’t want to trust stablecoins. They don’t want to trust crypto protocols or developers. They want to hold decentralized currency assets with no counterparty risk. “

CryptoSlate analyst James Van Straten agreed with LeClair’s analysis, adding that on-chain indicators suggest the worst is over. However, stagflation will continue to be a factor.

Still, we’re nearing the end of the interest rate cycle, with a final 25 basis points of rate hikes still possible. The suspension period will be interesting as we expect unemployment to rise and stocks to fall. If that happens, it will retest the resilience of Bitcoin as a hedge.