Bitcoin remains range bound as Fed enacts 4th consecutive 75 basis point rate hike

The US Federal Reserve Board raised interest rates by 75 basis points (bps) after the Federal Open Market Committee (FOMC) meeting on October 2, bringing the Federal Funds Rate to 3.75-4%.

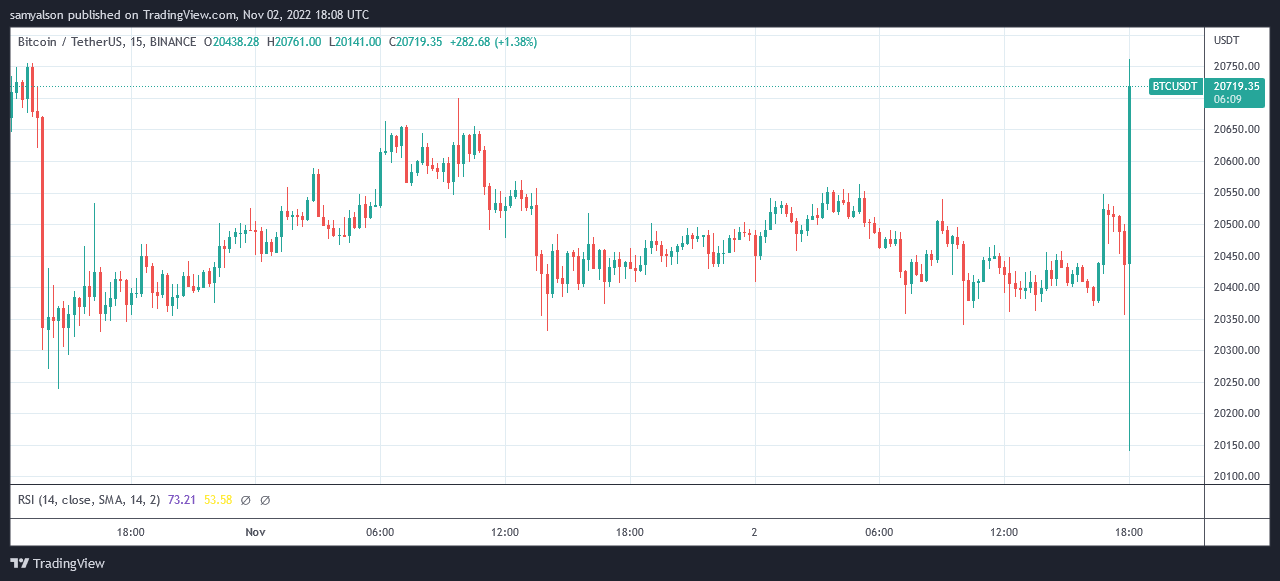

Bitcoin immediately surged 3%, breaking above $20,700 at the 18:00 (UTC) candlestick.

Federal Reserve Advances Hiking Program

After the FOMC meeting on September 21st, the Fed hiked rates by 75 bps three times in a row.

Since then, further pressure to maintain the tempo of rate hikes has come from a strong U.S. job market, which added 263,000 jobs in September, and the latest labor market, which showed worse-than-expected consumer price index (CPI) data. It stems from a report from the Bureau of Statistics.

Bruce Kassman, chief economist and head of global economic research at JP Morgan, recently said: bloomberg Job growth needs to slow to 100,000 per month over the next two to three months before the Federal Reserve will consider stepping out of gas.

Kasman said, in his view, it is reasonable for the Fed to suspend interest rates at 4-4.5%.

According to CryptoSlate analyst James Van Straten, today’s price hike did not materialize as a 75 bps increase was expected prior to today’s announcement.

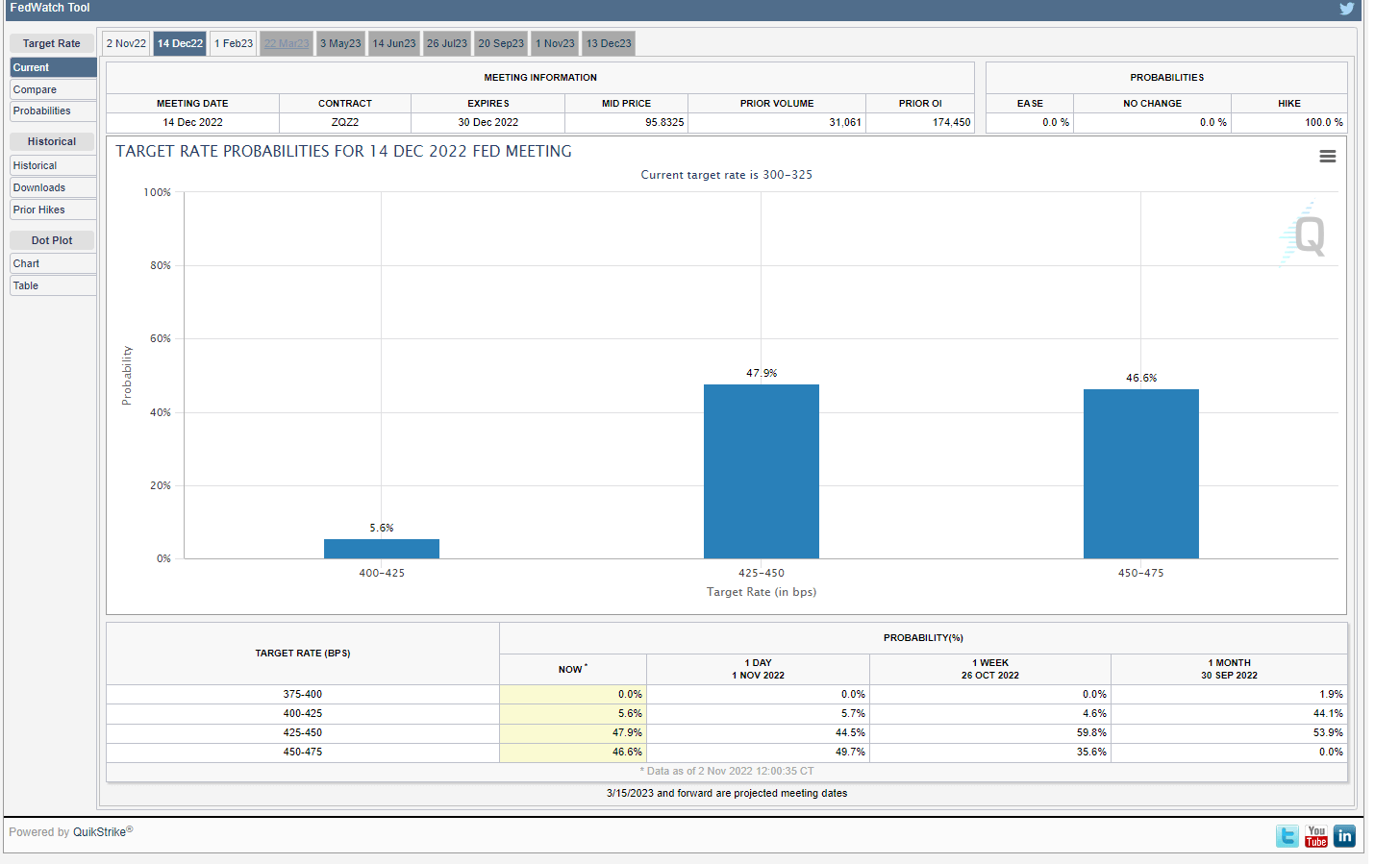

Instead, Van Straten said the focus is on the next FOMC meeting scheduled for December 14-15. Based on this result, the market can judge whether the Fed intends to slow down the pace of rate hikes.

The market is now 50/50 on whether the December decision will result in a 50 or 75 bps gain.

Bitcoin surges to $20,7000

In preparation for the rate announcement, Bitcoin was trending down from the local top of $20,550. This was followed by his previous 15-minute candlestick down to $20,144.

Once the announcement was made, Bitcoin climbed to $20,700, making up for all previous losses.