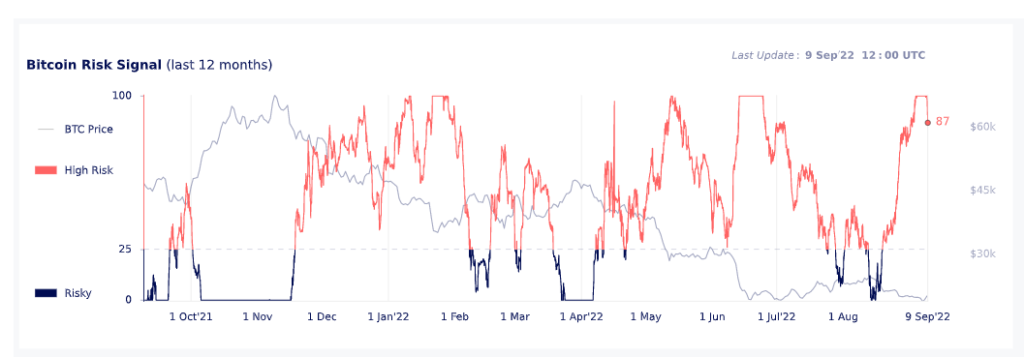

Bitcoin Risk Signal suggests further downside in coming weeks

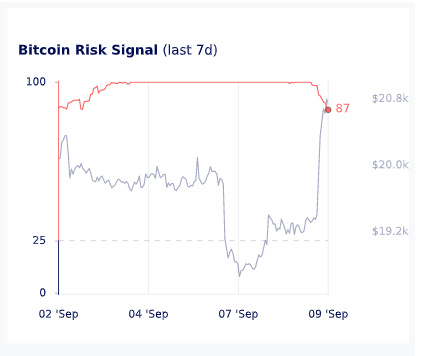

Bitcoin has rallied to retest the $21,000 resistance, but Bitcoin risk signals provided by Glassnode and Swissblock technology hit a yearly high on Sept. 5, following today’s rise. It remains 87 out of 100.

The Bitcoin Risk Signal measures the amount of risk of a significant drop in the Bitcoin price. Scores vary between 0 and 100. Between 0 and 25 is a high risk environment and above 25 is a high risk environment. A reading of 0 indicates a shallow relative risk of significant drawdowns.

Historically, Bitcoin has led the market in terms of price direction and relative safety. However, in the weeks leading up to the merger, Ethereum dominated the market and the industry followed his ETH price.

Over the past seven days, Bitcoin has been at 100 on the Bitcoin Risk Signals, suggesting that the risk is high and further down. However, Bitcoin fell 7.5% on Sept. 6, when the signal was at its highest. Still, although the score is well above the 25 safety zone, the chart suggests traders to act cautiously.