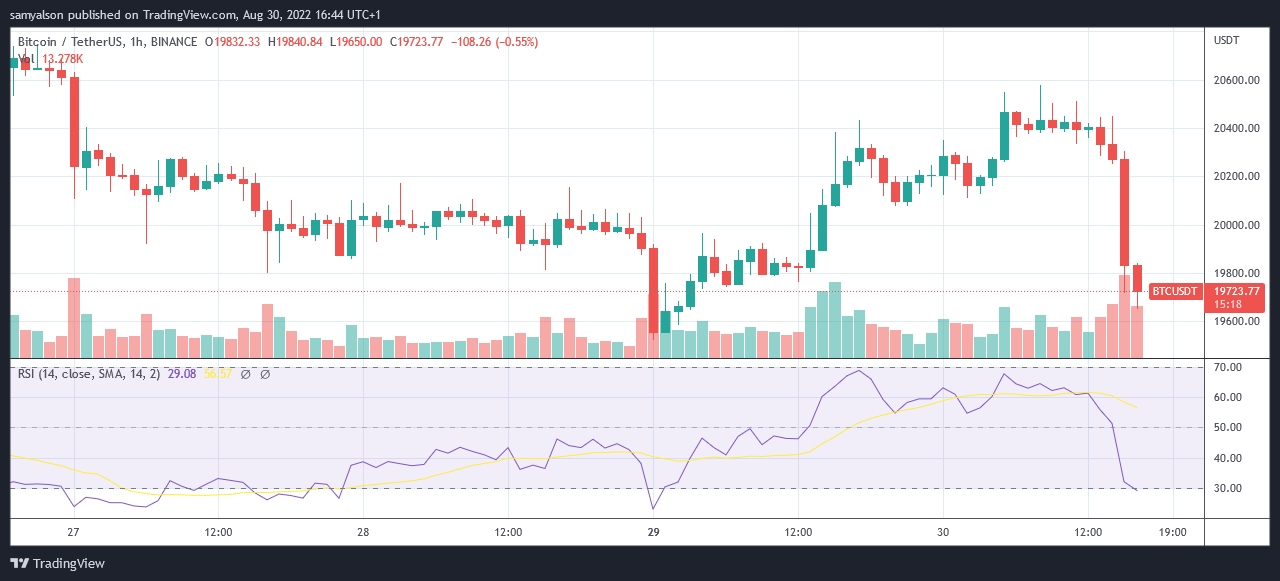

Bitcoin sell off leads to $20M in longs liquidated

Bitcoin bears have recaptured most of yesterday’s gains by lowering the price to $19,600 within the past hour. The next support level is $19,200.

Previous instances of losing the psychological $20,000 level have seen recovery in that area. Concerns have led some analysts to expect BTC to fall below the previous $17,600 local bottom that hit on June 18.

On the other hand, according to glass coin, $2028 million long liquidated on the downside. Choppy price action led to the liquidation of the $9 million short on August 29th.

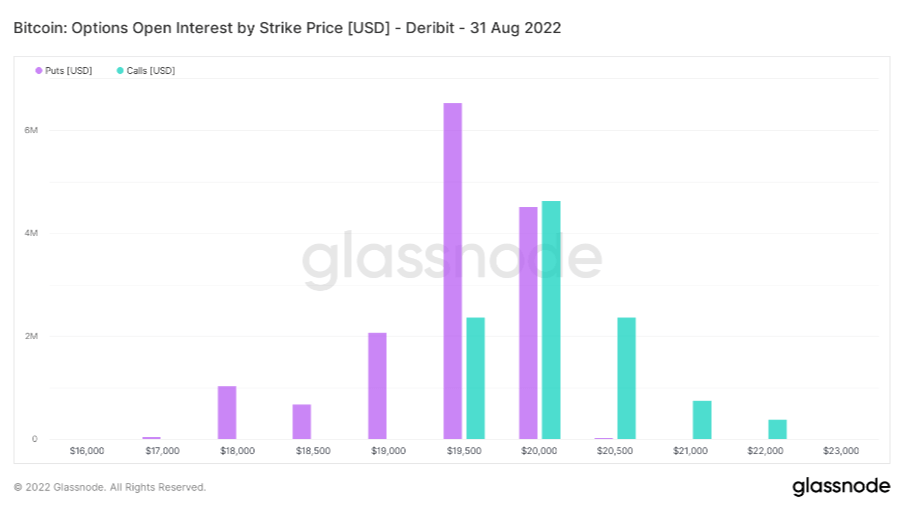

bitcoin open interest

Glassnode data for bitcoin open interest by Deribit strike price on August 31 shows a put at $19,500 as the most popular call by traders.

strike price Refers to the price at which a put or call can be exercised, traders expect the BTC price to drop below $19,500 and want to sell their contract holdings.

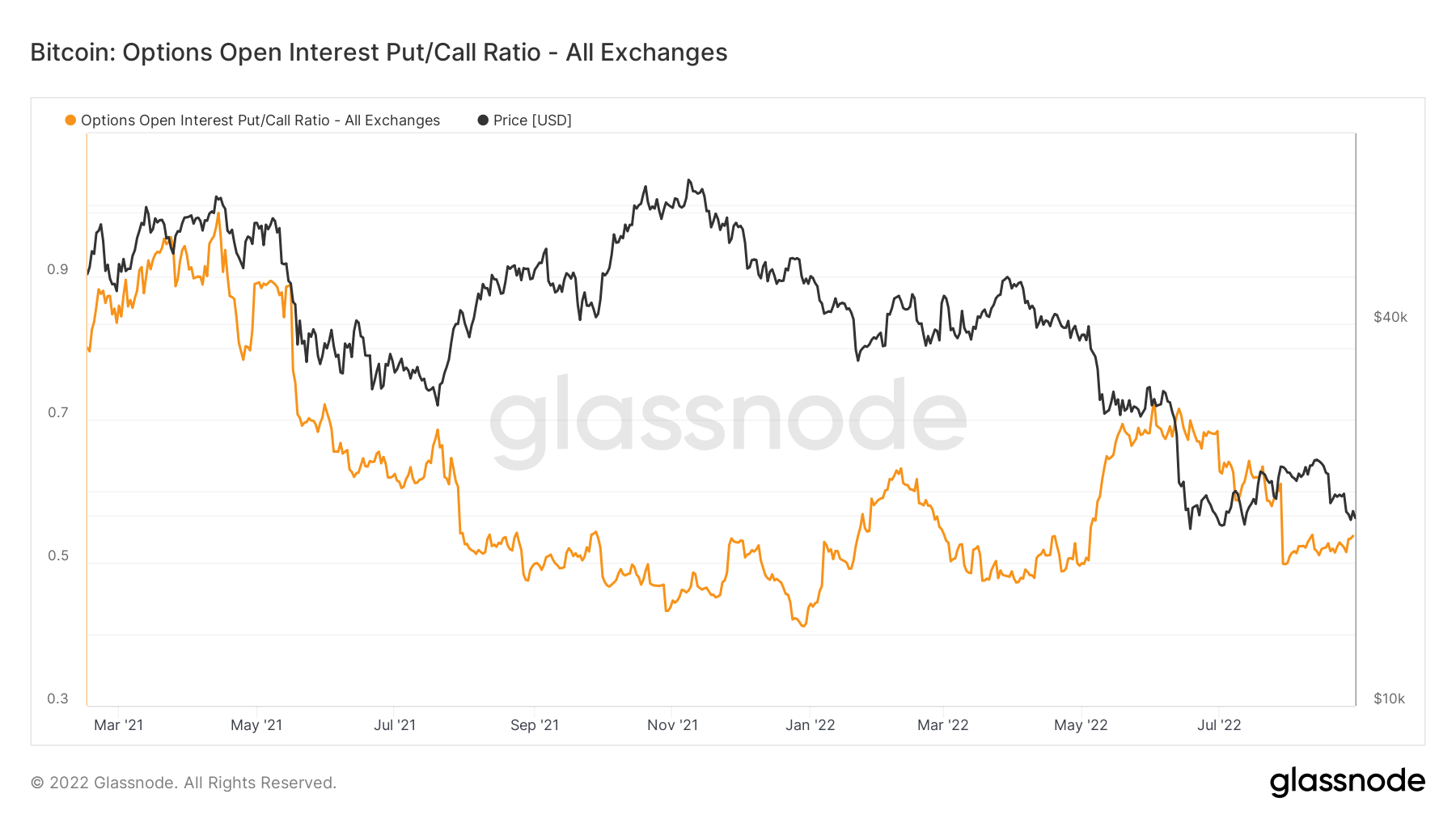

Similarly, the chart below shows a gradual rise in the put/call ratio over the last few weeks, suggesting bearish sentiment among derivatives traders.