Bitcoin’s rising illiquid supply can spur more price volatility, data suggests

It is undeniable that the last seven months have been very bearish for the crypto market. Bitcoin is the world’s largest cryptocurrency by market capitalization and has only witnessed year-to-date (YTD) money. Inflow Worth only $ 14 million.

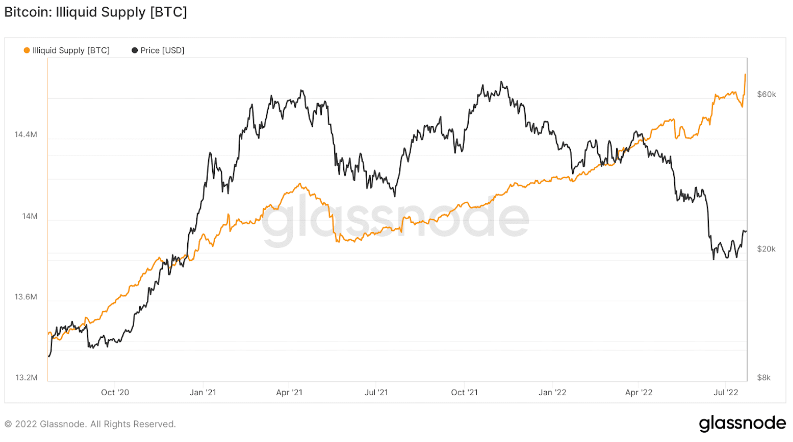

In addition, the illiquid supply ratio of the flagship cryptocurrencies, that is, the number of Bitcoins transferred from exchanges to hardware “cold storage” wallets or app-based “hot” wallets, will be from the beginning of 2022. Increased has.

In detail, there are currently over 14.8 million illiquid BTC tokens, which have increased very rapidly (about 500,000) in the first half of this year alone. This is primarily due to many macroeconomic factors surrounding the global economy, including the recent invasion of Ukraine by Russia, increased cryptocurrency clearing, inflation and spikes in interest rate levels.

Also note that the total number of BTC currently in circulation is about 19 million, and about 900 coins have been mined and added to the total daily supply pool of currencies.

Overall, it is estimated that 76% of the total supply of cryptocurrencies is currently classified as illiquid. This is quite astonishing given that over 90% of all Bitcoins that may ever exist have already been mined.

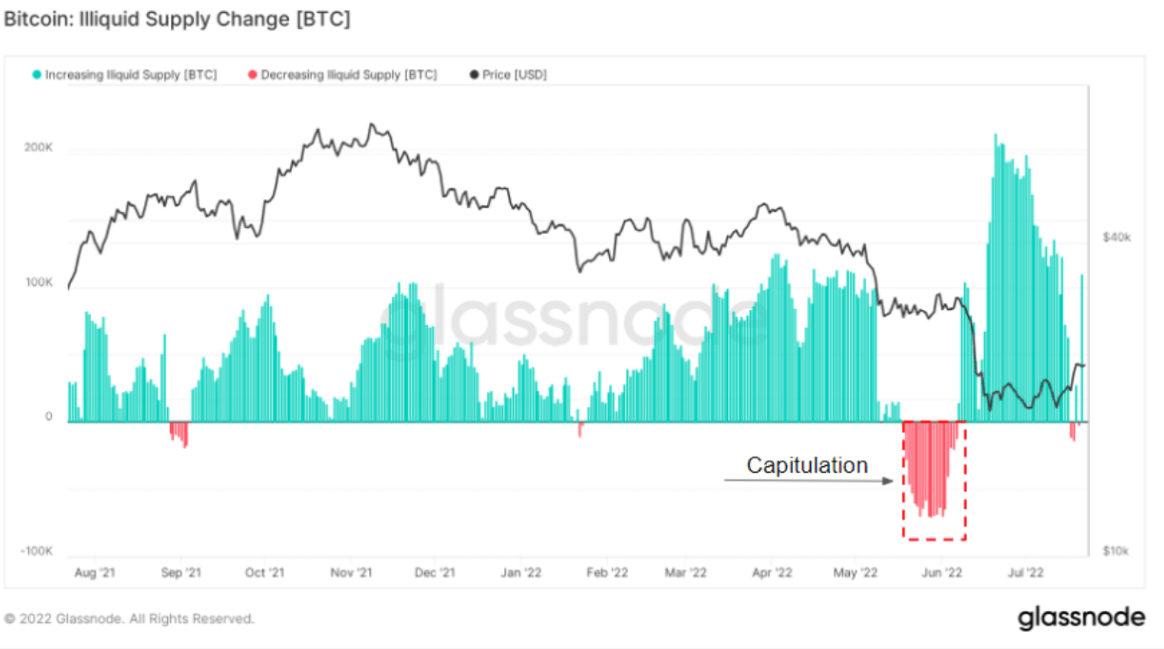

This increase in illiquid supply is also supported by relevant indicators such as Bitcoin’s “change in illiquid supply.” This is a monthly (30th) net change in the supply of digital currencies held by illiquid entities. This is important because recent macro-level events surrounding the market, such as the bankruptcy of major market players such as Three Arrows Capital, Celsius, Bold and Zipmex, have taught consumers the importance of self-management. .. Key, not your coin’).

So far, the graph below clearly shows that there is a growing general trend around investors moving Bitcoin to external wallets, especially after the above capitulation in June. increase.

The illiquid supply of Bitcoin, which has been accumulating for more than 6 months, was suspended last month. However, as mentioned above, the trend is turning around again and is more positive than ever. These sudden surges can adversely affect Bitcoin’s supply dynamics, which can result in large fluctuations in asset prices over the medium term. Therefore, it is not yet known what the future of Bitcoin will be.