Breakdown of current FTX assets shows $3.5B in crypto, $250M in real estate

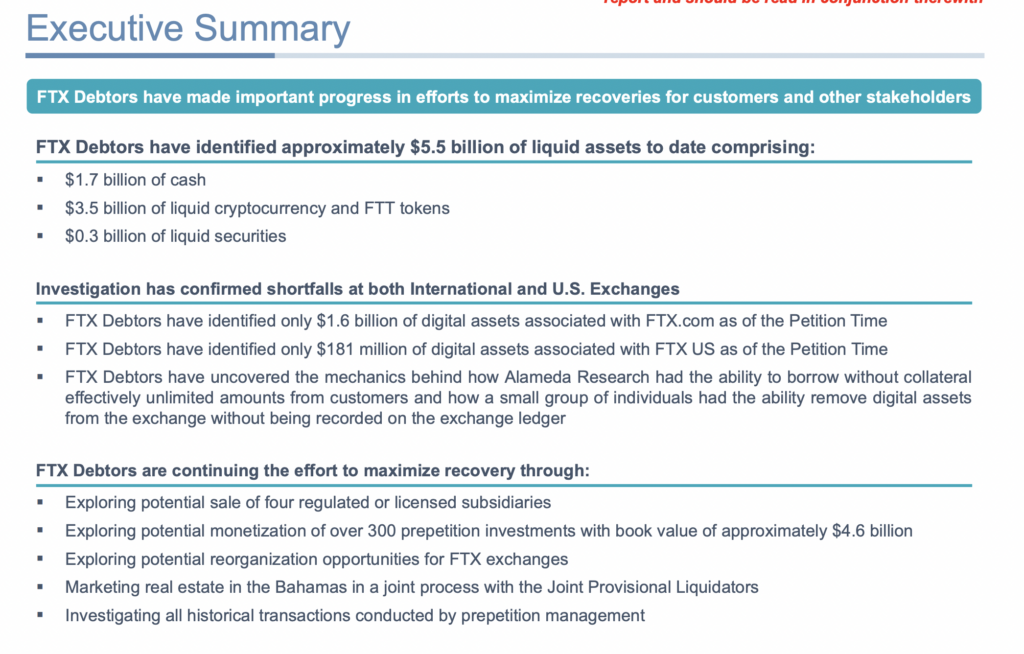

A recently released court investigation revealed that FTX.com had $1.6 billion in crypto assets at the time it filed for bankruptcy.

However, the total value of all assets recovered by FTX Debtors reached $5.5 billion, including cash, cryptocurrencies and illiquid securities.

With $5.5 billion in total assets recovered and only $1.6 billion linked to FTX.com, investigators declared a shortfall. Additionally, approximately $1.9 billion of cryptocurrency was attributed to Alameda between hot wallets and BitGo’s custody.

Another $181 million was recovered from FTX US associated with BitGo custody accounts, along with $90 million that was “hacked” by an alleged SBF insider. SBF denied this accusation on his Twitter Spaces before the arrest.

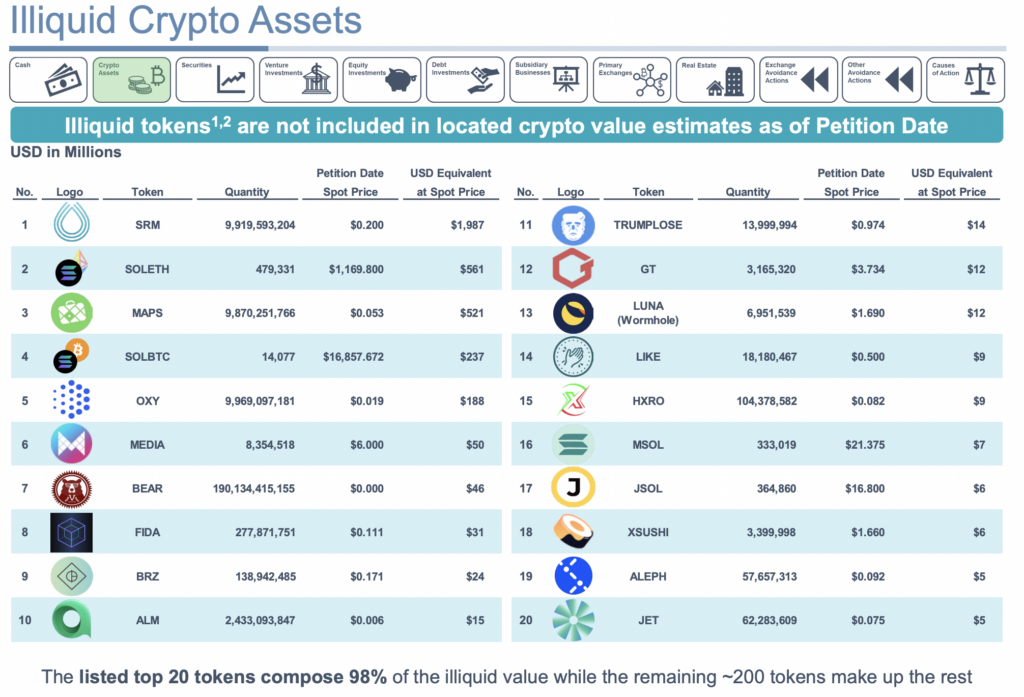

A slide from the deck revealed all crypto assets held by FTX that were deemed “illiquid”. The largest holding of such tokens is Serum (SRM), worth $1.9 billion. The next most significant holdings were SOLETH and MAPS, at $561 million and $521 million, respectively.

While these holdings were deemed “illiquid” by investigators, some tokens have active trading volume. However, with his $521 million in MAPS tokens, FTX accounted for 15% of the project’s total market cap. Therefore, the offloading of MAPS tokens will have a serious impact on the market value of MAPS.

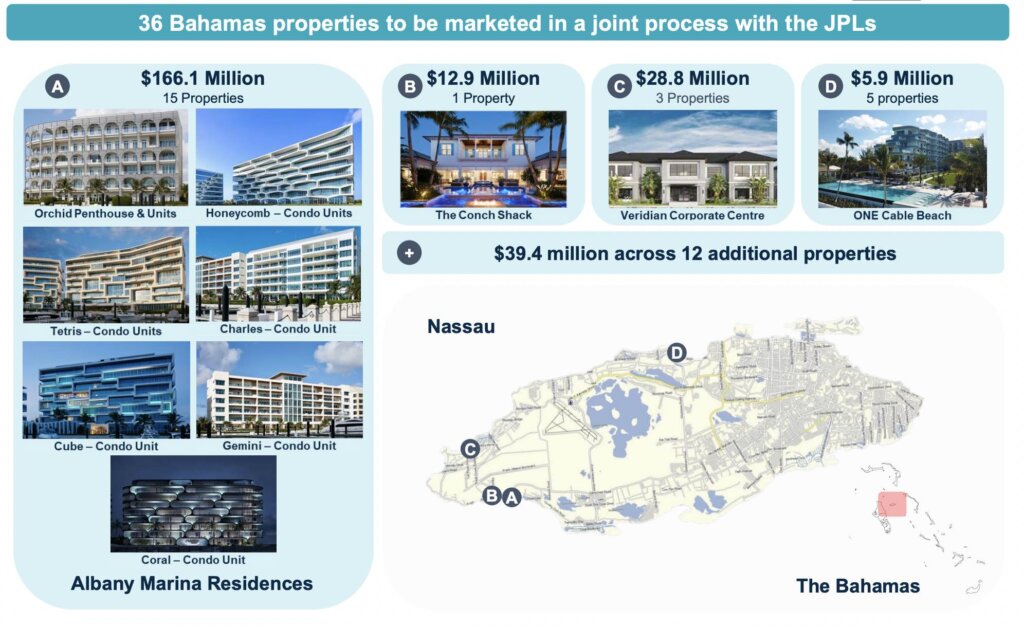

In the slide below, investigators have released further listings of properties owned by FTX. In addition, 36 properties across the Bahamas have been acquired through his FTX fund with a total value of $253 million.

Properties ranged from luxury penthouse accommodations to villas worth up to $12.9 million. As detailed throughout the investigation, many of these properties were allegedly privately owned.

The document also listed $93 million in political contributions, $2.1 billion in FTT token payments to Binance, $2 billion in insider loans, $446 million in transfers to Voyager, and $400 million in investments from Voyager. We have confirmed that several transactions are currently ‘in review’, including: Modulo Capital, and numerous Robinhood stocks.