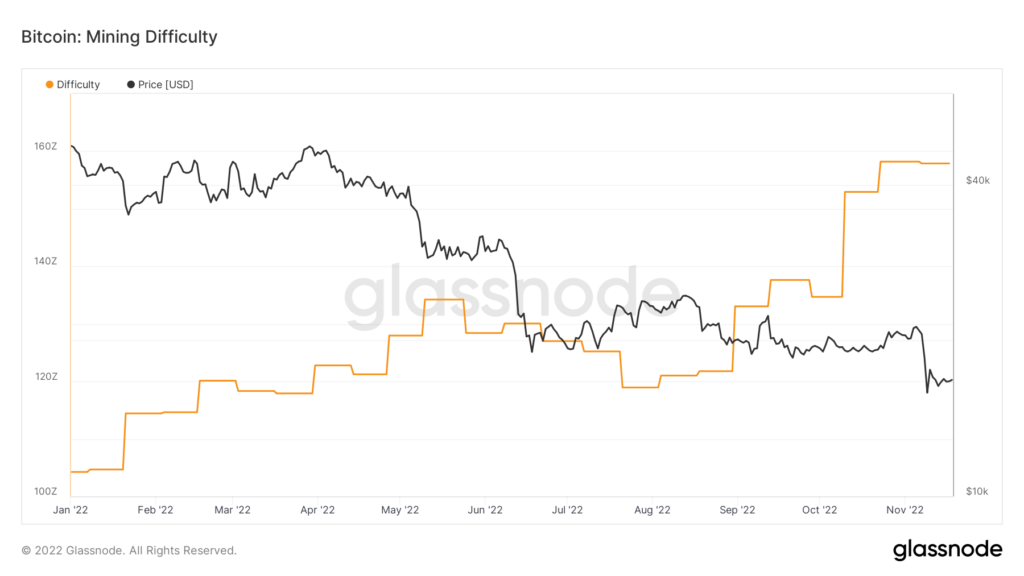

BTC difficulty to adjust over weekend as miners capitulate

Bitcoin mining difficulty will be adjusted on Sunday night/Monday morning (November 20th/21st).

Bitcoin hashrate and difficulty may have reached the top after successive negative or neutral difficulty adjustments. However, the difficulty is expected to adjust again over the weekend, increasing hopes that hashrate has peaked.

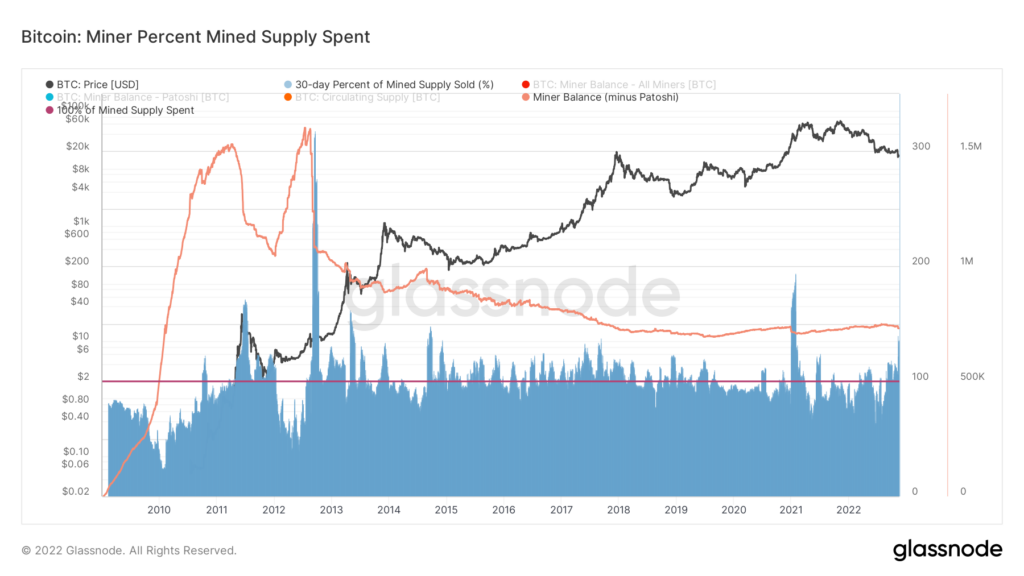

Below is the percentage of bitcoins spent by miners over a 30-day period. The blue section shows the number of coins sold by a miner, which has reached its highest level since 2021. The amount of bitcoins sold by a miner in the last 30 days is his 5th in Bitcoin history. second largest outflow.

Miner balances are also declining, but not at a worrisome rate for now. Discrepancies between used Bitcoin and miner balances suggest mining companies may be selling newly mined coins to cover costs.

The massive rise in global energy costs coupled with the falling Bitcoin price is creating a perfect storm for Bitcoin miners.

However, as the effects of the FTX collapse continue to ripple through the industry, Bitcoin remains below $17,000 for the eighth straight day.

If the price of Bitcoin falls below $18,00, miners will continue to have problems and may sell more. Subsequently, miners selling to cover operating costs could lead to further cycles of downward pressure.