BTC miner balances poised for selloff as sell pressure increases

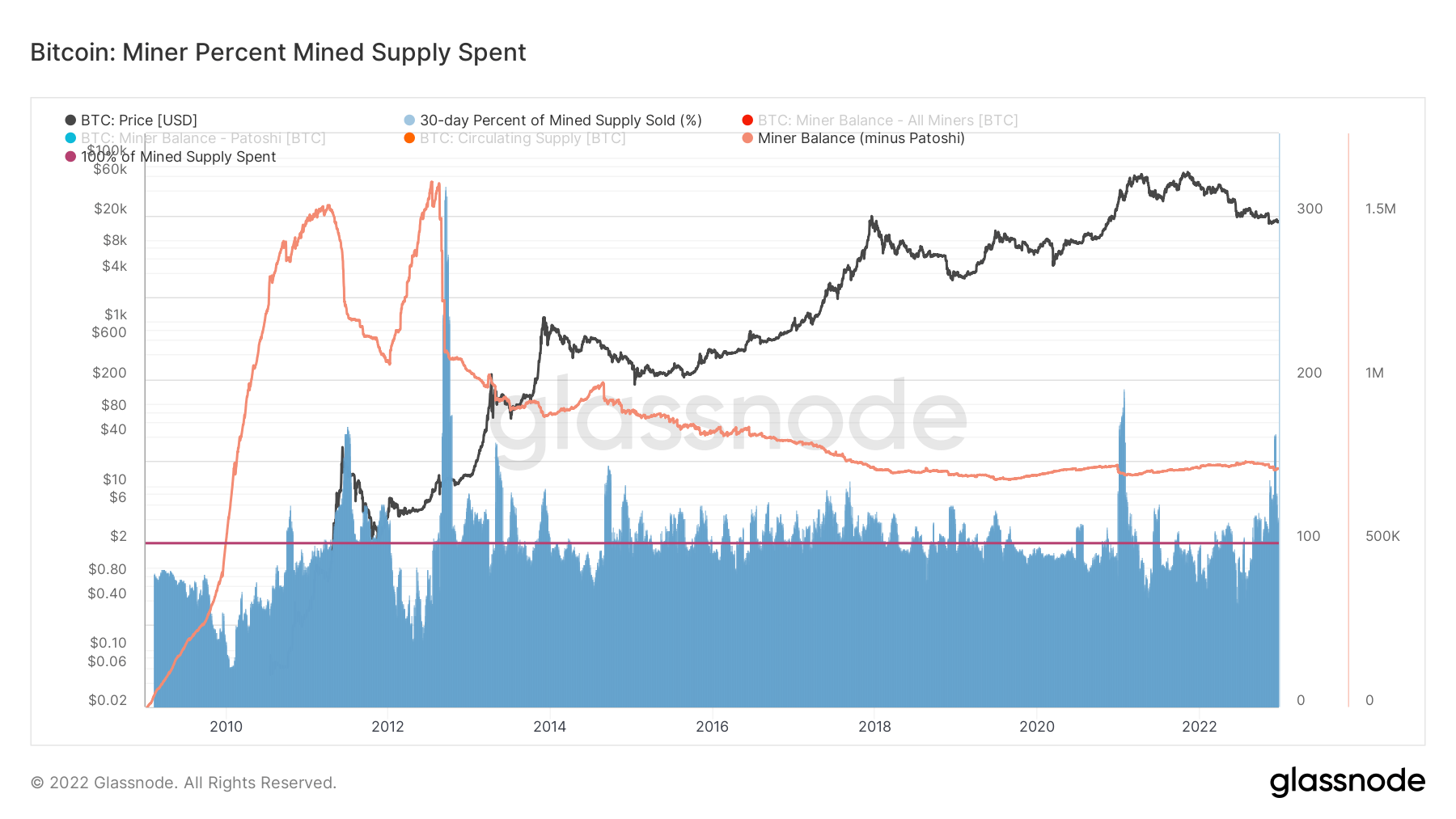

Bitcoin (BTC) miner balances started at 1.82 million BTC at the beginning of the year. Despite peak surrender and significant sales volume, BTC miner wallets still hold 1.8 million BTC.

Mining rewards held in the wallets of BTC miners have dropped sharply since August, likely due to the outflow of Purin. 112% of the supplied supply and state treasury was spent. In contrast, the 2013 and 2021 bull markets saw the first and second largest sell-offs as miners sold BTC at gains rather than losses.

The February 2022 invasion of Ukraine triggered a global energy crisis that resulted in higher costs and lost potential profits for BTC miners.

The miner balance is currently 1.8 million BTC, which has been flat for the past 5 years, excluding the Patosis coin. This suggests significant selling pressure if the miner continues to struggle into his 2023.

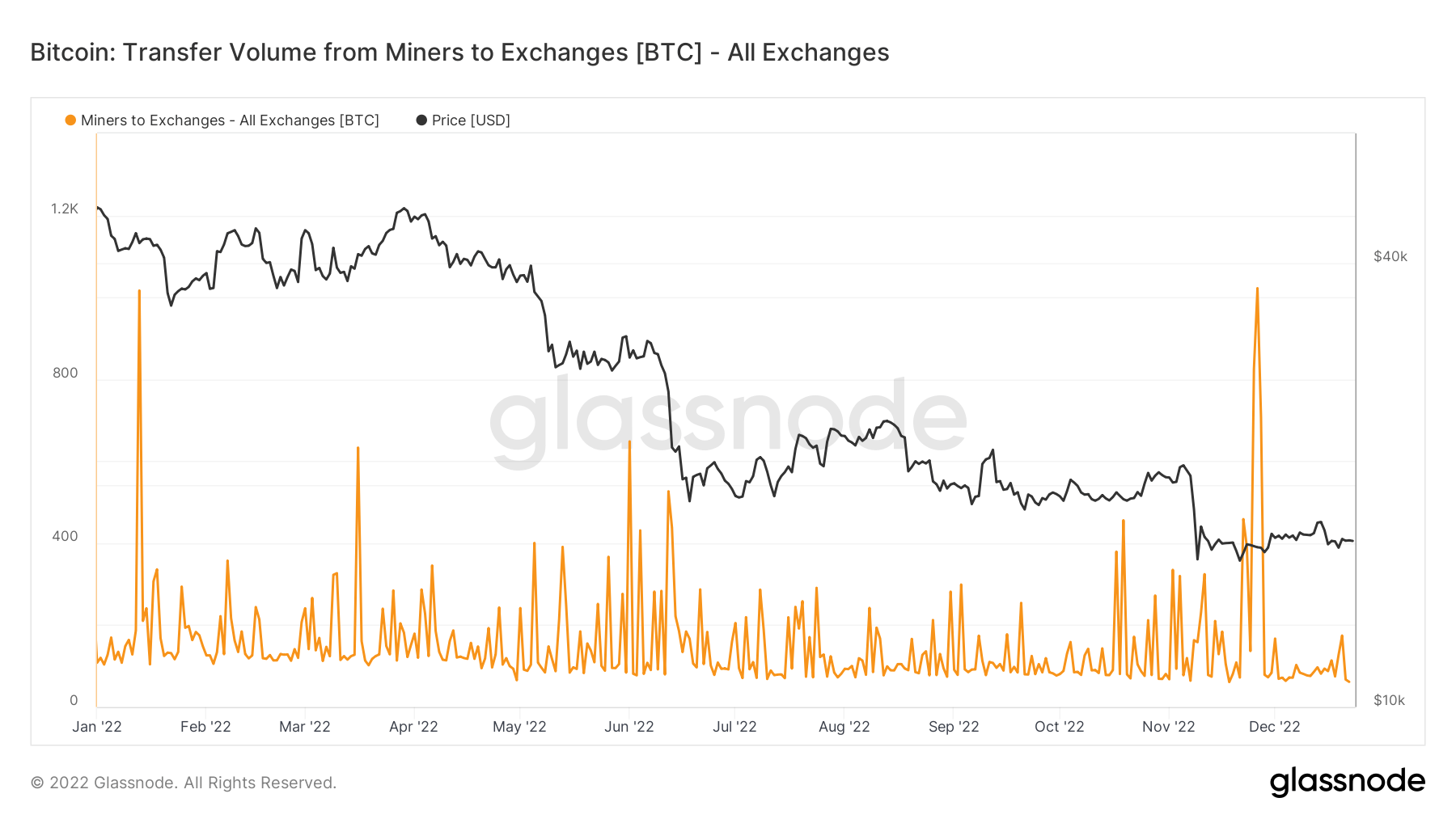

BTC miners are offloading their holdings, but this is simply moving the BTC to another wallet rather than sending it to an exchange for sale by the miners.

About 200 BTC are being spent every day since 1000 BTC went on sale in late November.

Until 2022, miner sales to exchanges were minimal, with around 57,000 BTC sold annually.

With only 57,000 BTC sold out of a total of 1.8 million BTC and selling pressure mounting, it is worth considering whether BTC miners are preparing to sell in 2023.

Amid bankruptcies of BTC mining companies, record-breaking whale BTC sales, and miner profitability crises, a 2023 miner capitulation is geared towards a major sale if selling pressure continues to mount.