BTC price surge increases miner profitability, indicating market bottom

Glassnode data analyzed by crypto slate Analysts suggest that as the Bitcoin (BTC) price rises, so will miner profitability and earnings.

crypto slate To assess the profitability of miners, we examined a difficulty regression model and a comparative metric of miner revenues and annual averages. Both metrics agree that things are going well for BTC miners, but ASIC Rig’s profitability metric revealed that hashrate has reached an all-time high.

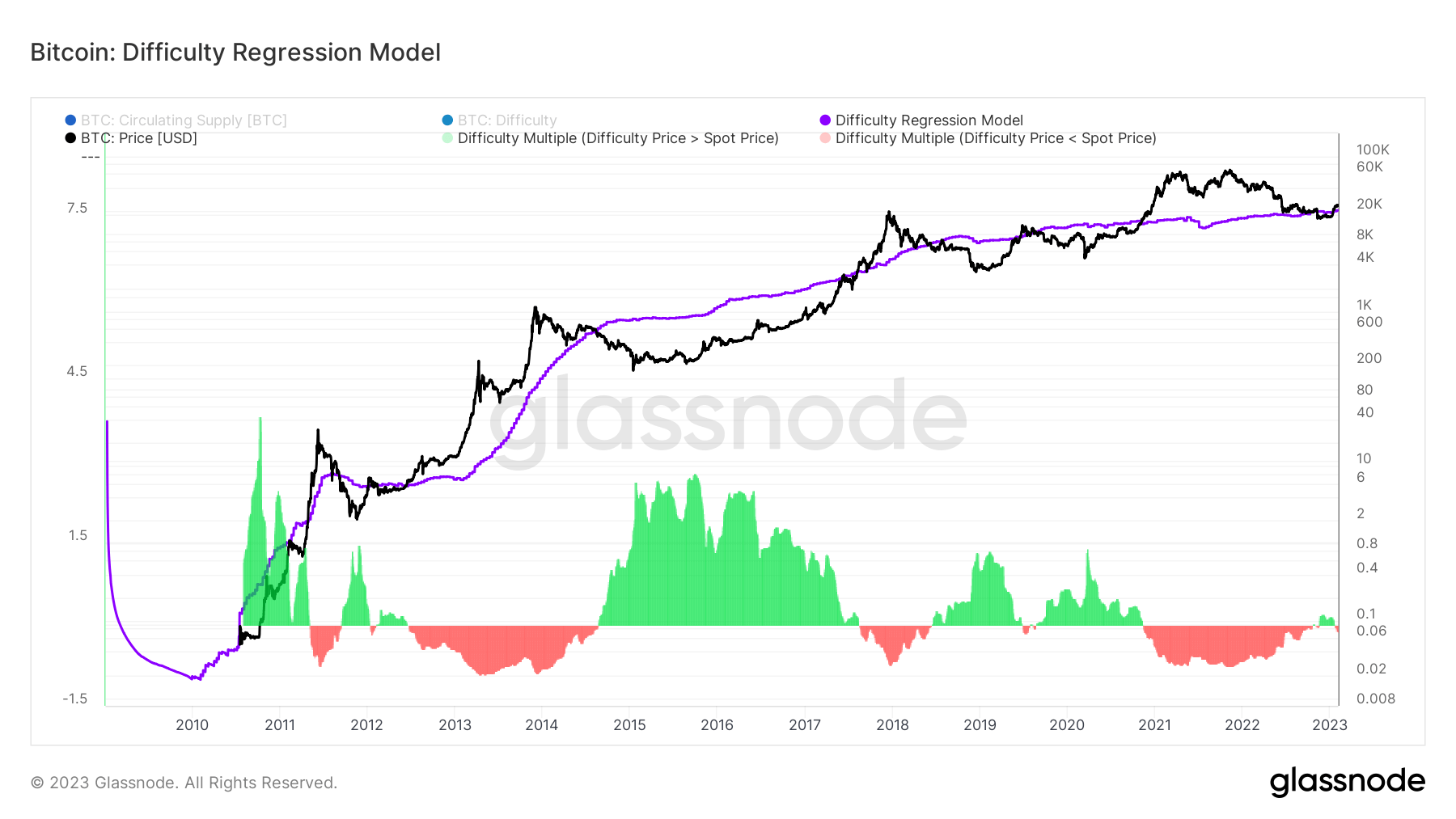

Difficulty regression model

A difficulty regression model is used to understand the cost of maintaining everything to produce 1 BTC. Mining difficulty is the final extraction of the cost of mining, which combines all mining variables into one number. The calculated value therefore reflects the estimated average production cost to mine 1 BTC.

The chart below shows the BTC difficulty regression model since 2010 as the purple line and the BTC price as the black line. BTC mining is profitable if the purple line shows a lower cost than his BTC price. This is shown in the red area below. Similarly, if the purple line crosses the black line, it means that BTC mining is not profitable, creating a green zone on the chart.

Currently, the data shows the total maintenance cost to generate one BTC is $20,000. value.

In addition to mining profitability, this chart shows the historical relationship between the cost of keeping everything to produce one BTC and the market bottom. On five different occasions since 2010, 2011, 2012, 2018, 2019, and 2021, the total maintenance cost to produce 1 BTC has been lower than the price of BTC, and all subsequent The value of BTC has risen. Historically, this situation could indicate a market bottom.

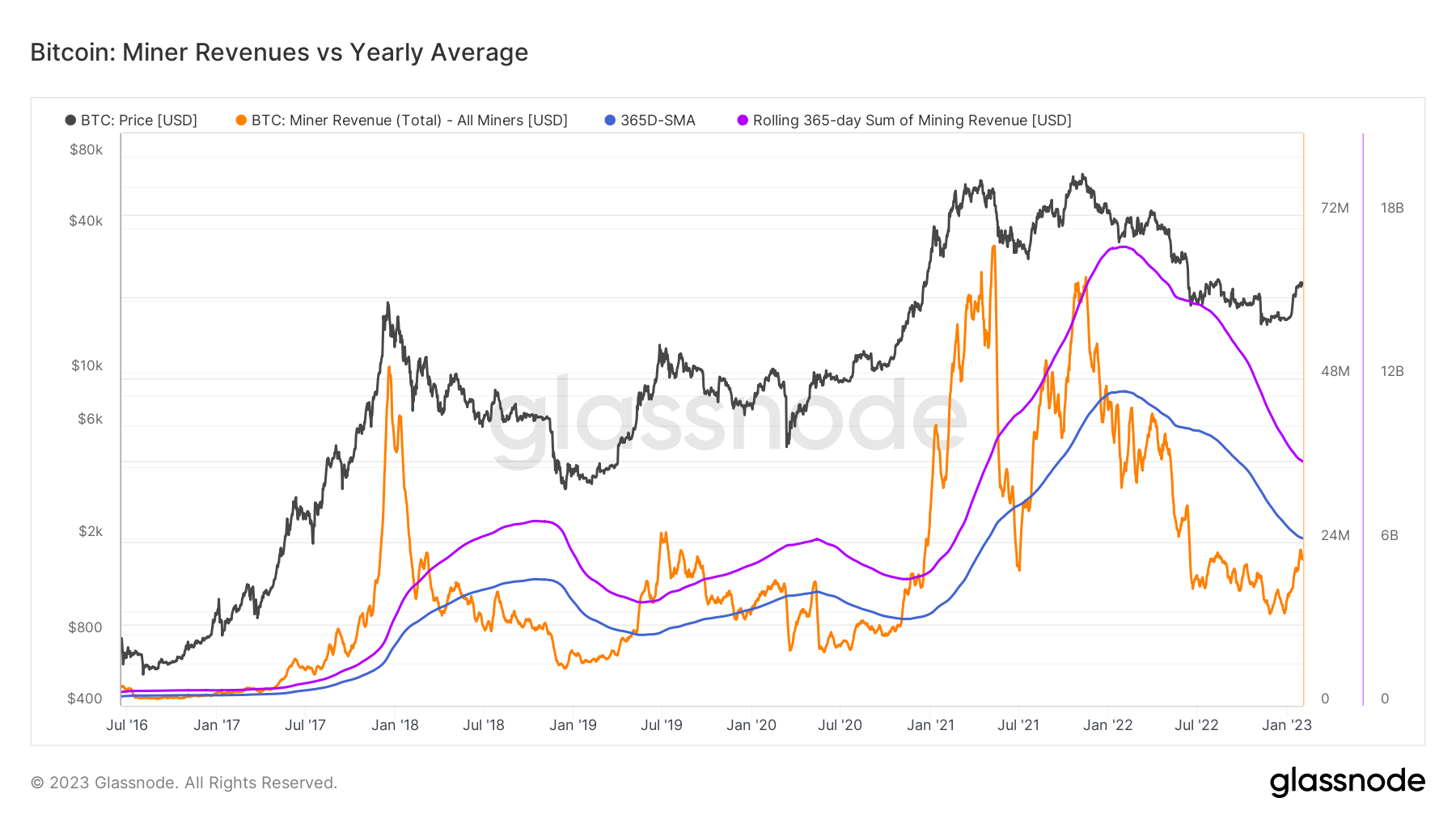

Minor Earnings vs Annual Average

A comparison of minor returns and yearly averages is used by analysts who want to measure daily volatility relative to long-term trends. This metric takes his total daily earnings generated by a BTC miner in USD and compares it to a 365-day simple moving average.

The graph below starts in mid-2016 and shows the total revenue paid to miners and the 365-day simple moving average in orange and blue lines respectively.

Total revenue generated by miners is below the 365-day simple moving average level from the beginning of 2022. According to the chart, the total revenue generated by miners is currently around $22.5 million, while the 365-day simple moving average is roughly $24.6 million.

This relationship also marks the bottom of the market. A spike in BTC price was recorded whenever the total miner earnings exceeded the 365-day simple moving average. The data also shows that miner income has been increasing since early 2023. If this increase continues, total income could break through the 365-day simple moving average resistance line, giving the green light to a market surge.

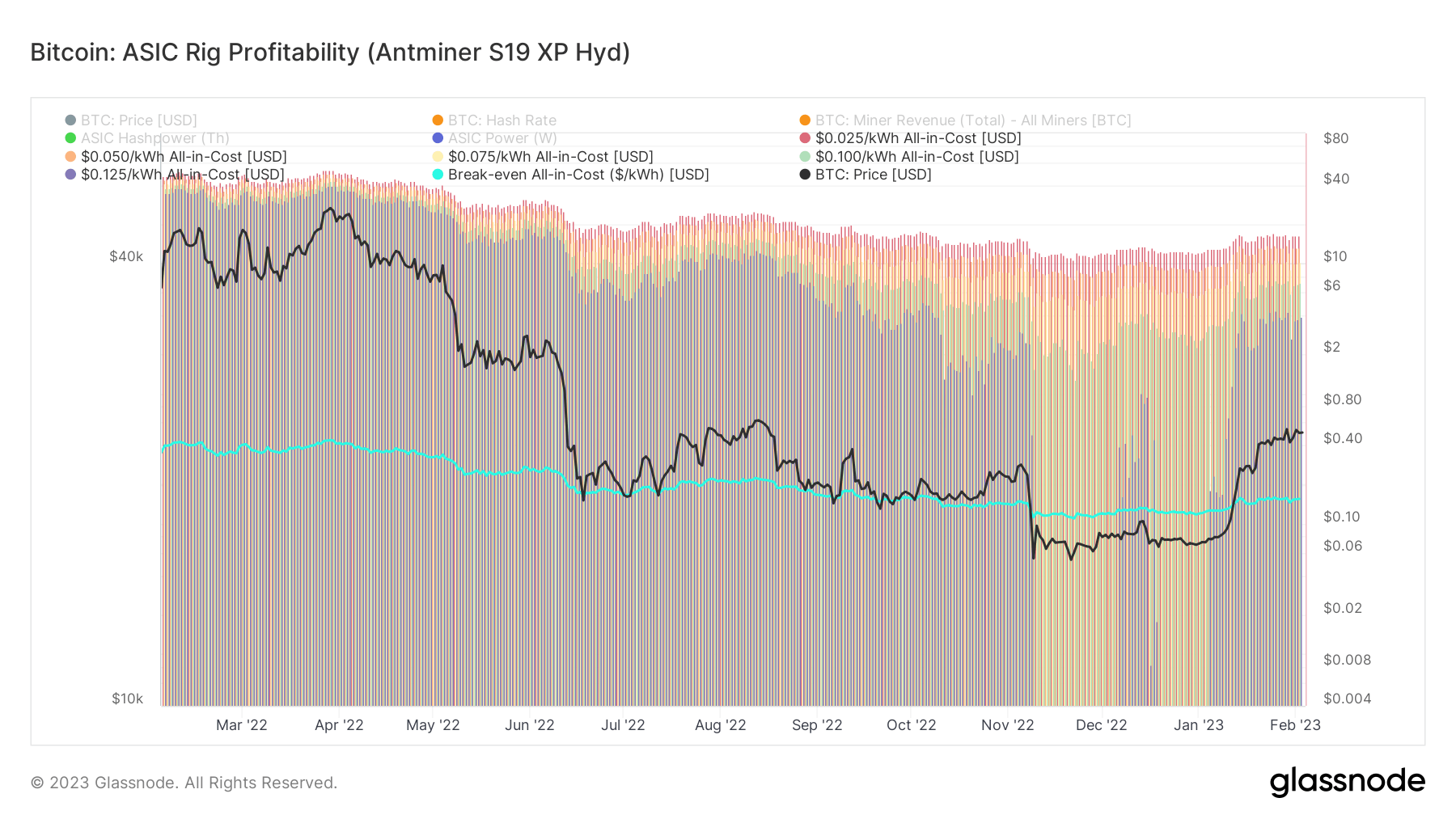

ASIC rig profitability

This metric estimates the USD value of the daily profit earned by an Antminer S19 XP Hyd ASIC rig under various all cost of ownership AISC assumptions.

The Antminer S19 XP Hyd ASIC rig will be released in October 2022, reaching a hash rate of 255 Th/h and consuming 5304 Watts.

The chart below shows BTC’s ASIC rig profitability from early 2022 onwards in the turquoise line. A line indicates profitability if it marks a point lower than the BTC price.

According to the graph, Antminer S19 will be profitable in early 2023. The cost to maintain everything is about $0.15. This sent the miner back to his Antminer S19s rig and the hashrate climbed to all-time highs.

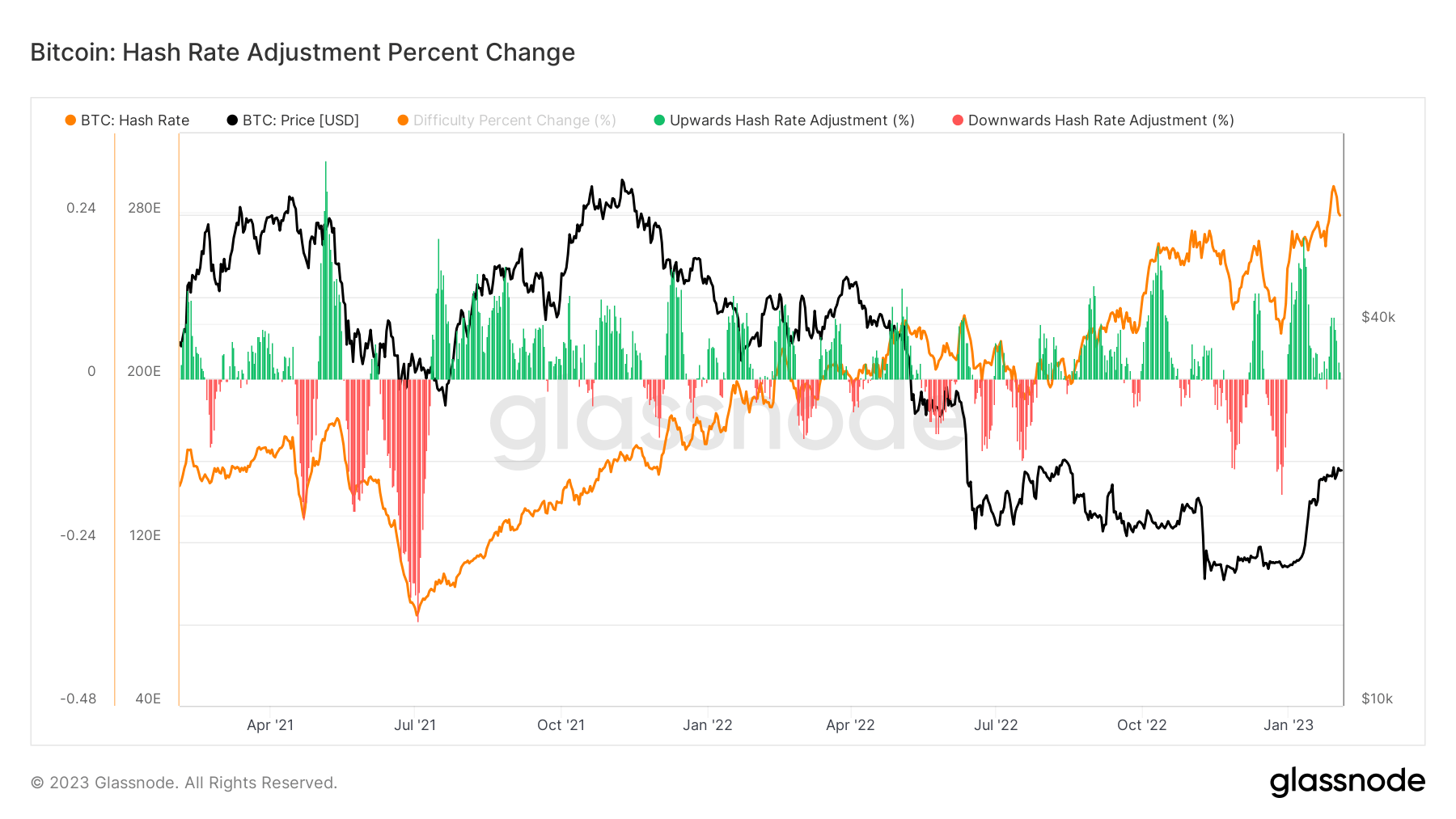

The graph above shows the BTC hash rate from early 2021 as an orange line. Hashrate has increased exponentially since his early 2023, and network security has also increased.