Caught in the crossfire: how long and short liquidations shape the crypto market’s future

quick take

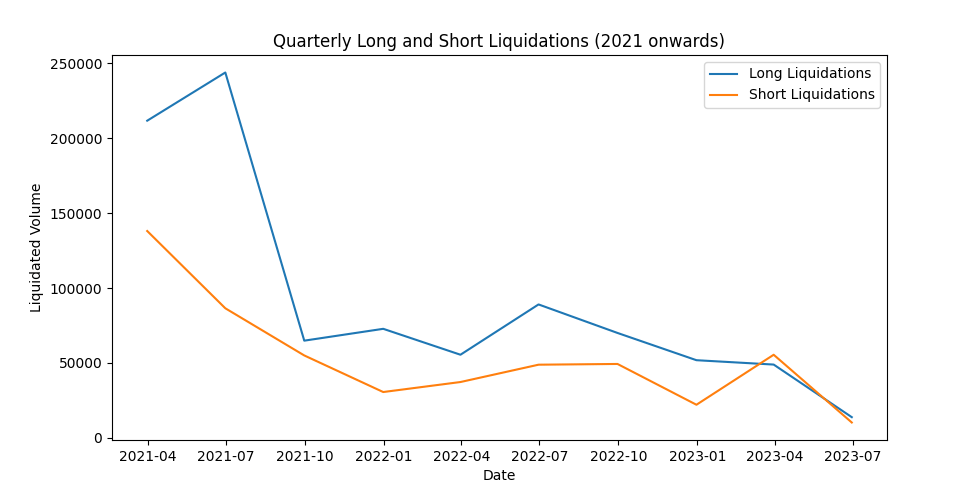

- Liquidation was one of the main points of discussion in the 2021 and 2022 cycles.

- Leverage, whale activity, and market sentiment are a lot of the reason for the higher number of liquidations in 2021 compared to 2022.

- With a bull market in 2021, market sentiment was positive and prices continued to rise. Long-term liquidations on small pullbacks have therefore disappeared.

- Entering the bear market of 2022, prices continued to fall 75% from all-time highs, with investors looking to buy all the time. However, they continued to get burned.

- As we enter 2023, we are seeing a mix of short and long liquidations. The Shorts were on the wrong side, taking pole position in 2023.

Post Caught in Crossfire: How Long- and Short-Term Liquidations Shape the Future of Crypto Markets first appeared on CryptoSlate.