Celsius spikes 18% higher on release of ‘Project Kelvin’ recovery plan

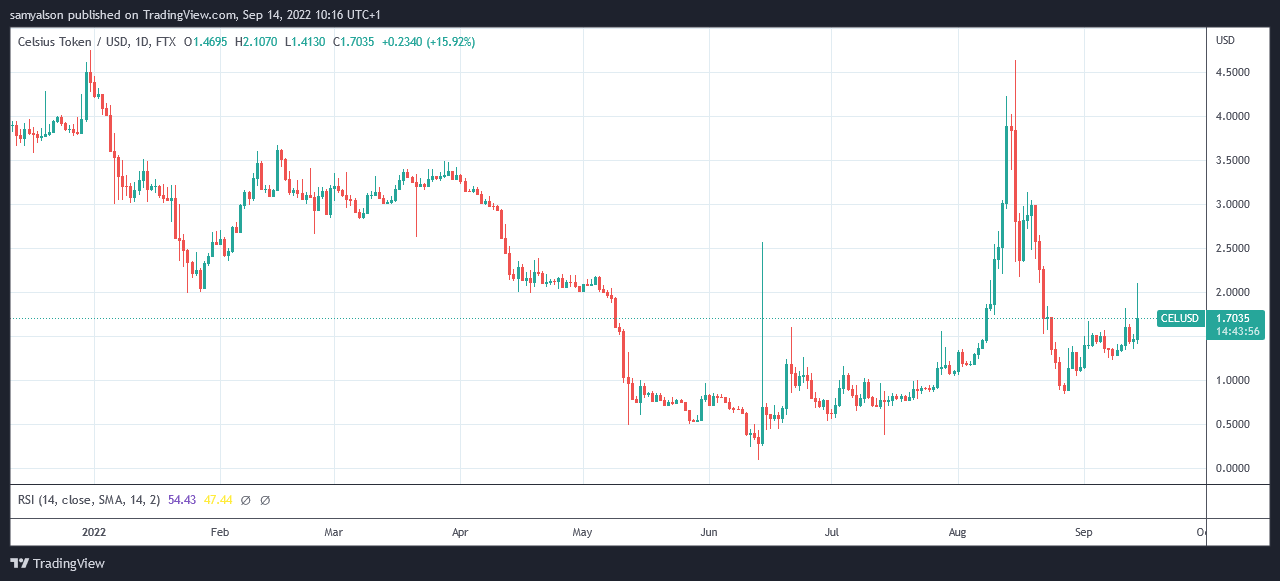

The Celsius (CEL) token is up 18% over the past 24 hours and is trading at $1.70 as of this writing on September 14th.

according to new york timesThe bankrupt CeFi lender plans a bold comeback based on offering crypto custody services.

“…they wanted to restructure the company with an emphasis on custody: storing people’s cryptocurrencies and charging fees for certain types of transactions.”

Celsius froze customer accounts in June, citing “extreme market conditions.” Rumors that the company was insolvent had been circulating for weeks before the announcement, but Alex Masinsky, the CEO at the time, denied the rumors.

Since then, revelations about the company showed it was playing quickly and loosely with client funds, especially when it came to high-risk, high-leverage trading.

CEL on the Roll

Even before the company froze customer accounts, the Celsius token was hit by a plunge in price.

CEL hits all-time high of $8.05 on June 4, 2021. By the end of the year, the token was almost halved. This trend continued for him through 2022, after which he bottomed out at $0.086 on June 13th.

Despite declaring Chapter 11 bankruptcy on July 13, the overall trend has been on the rise since then, jumping to $4.66 just two months after bottoming out. This equates to his 5,300% increase.

However, sharp selling continued before hitting a local bottom at $0.8650 towards the end of August. The cause of the increase remains unknown.

Recently, the hashtag #CelShortSqueeze has been trending and the price appreciation is back. Since the end of August’s local bottom, the CEL has surged 145% of his, and on Sept. 14 he topped out at $2.10.

Another sharp sell-off followed, wiping out most of today’s gains. However, the upward trend remains unchanged.

Celsius Recovery Plan “Project Kelvin”

Celsius customer Tiffany Fong said, transcript At the company’s all-hands meeting on September 8, Mashinski laid out a three-part plan to “get out of this situation.”

The first part is returning customer deposits, according to Celsius CEO. Mashinsky detailed that disagreements among depositor groups are slowing the process.

“Contrary to what I read in the news and elsewhere, it’s not that I don’t want my coins back or that I’m delaying the process in any way. It is our greatest concern.“

The next part is “return remaining coins” refers to the withdrawal of investor funds. Again, Mashinsky cited disagreements between the parties as a factor in resolving this.

The third part, “Kelvin,” is a business resumption plan based on a strategy that does not ask customers to “leave everything to us.”

“So basically we plan to restart with a process where you don’t have to trust us.“

It was then explained that Crypto Management was the “foundational product” of Project Kelvin or Celsius 2.0, as Mashinsky called it.

Celsius’ unsecured creditors’ committee expressed its disapproval of Mr Kelvin, saying that the current more pressing issue, namely the return of user funds, has not yet been finalized.

No, we do not support Kelvin or any other specific exit plan. We support closing the ongoing investigation and initiating a complete, open and transparent process that benefits account holders, not insiders. More will be revealed at today’s hearing at 2:00.

— Official Celsius Committee of Unsecured Creditors (@CelsiusUcc) September 14, 2022