Chainlink on-chain activity ramps up after news of improved staking system

Chain link only publication The first part of what was branded as “Chainlink Economics 2.0”.

This announcement describes a renewal of the current LINK staking mechanism. The planned roadmap includes new staking features such as stake reduction and redistribution, user fee rewards, node delegation, and reputation tracking.

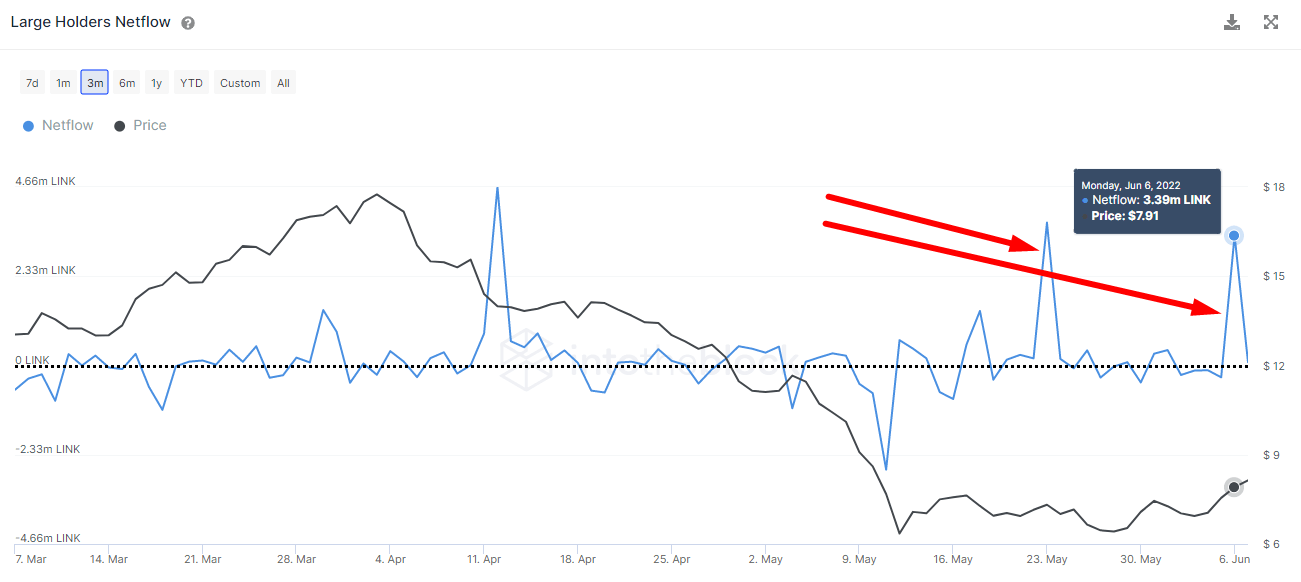

This positive news came at a great moment as the bear market treats LINK like most crypto assets and has had a -65% price drop since the beginning of the year. Large owners (those who own 0.1% or more of the circulating supply) because the price of LINK was stable last month. We are using it to keep accumulating more LINKs.

After the staking news release, more than 3.39 million LINKs were absorbed by these whales. That’s over $ 28 million at current prices.

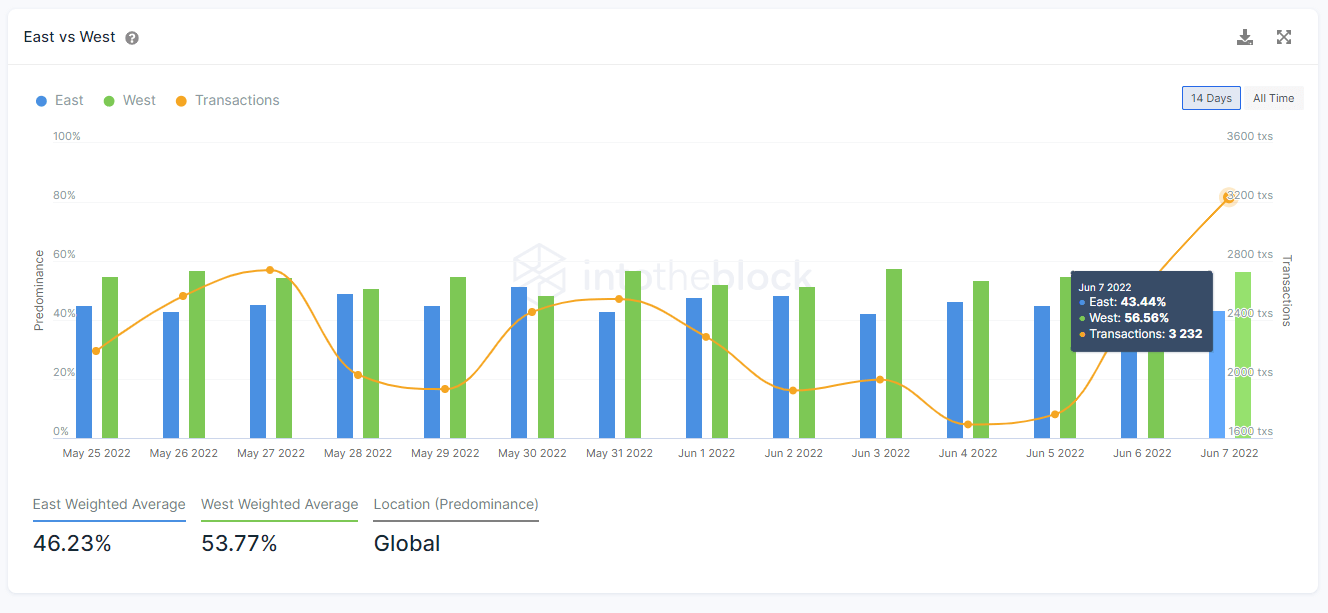

Not only has interest in chainlinks increased significantly among large holders, but as can be seen in the following indicators, daily transactions using LINK increased from an average of 2500 transactions per day to over 3200 as seen yesterday. It increased by 129%. The location advantage is slightly leaning towards the western time zone. This is analyzed by taking into account the date of each transaction and classifying by time zone in the west or east.

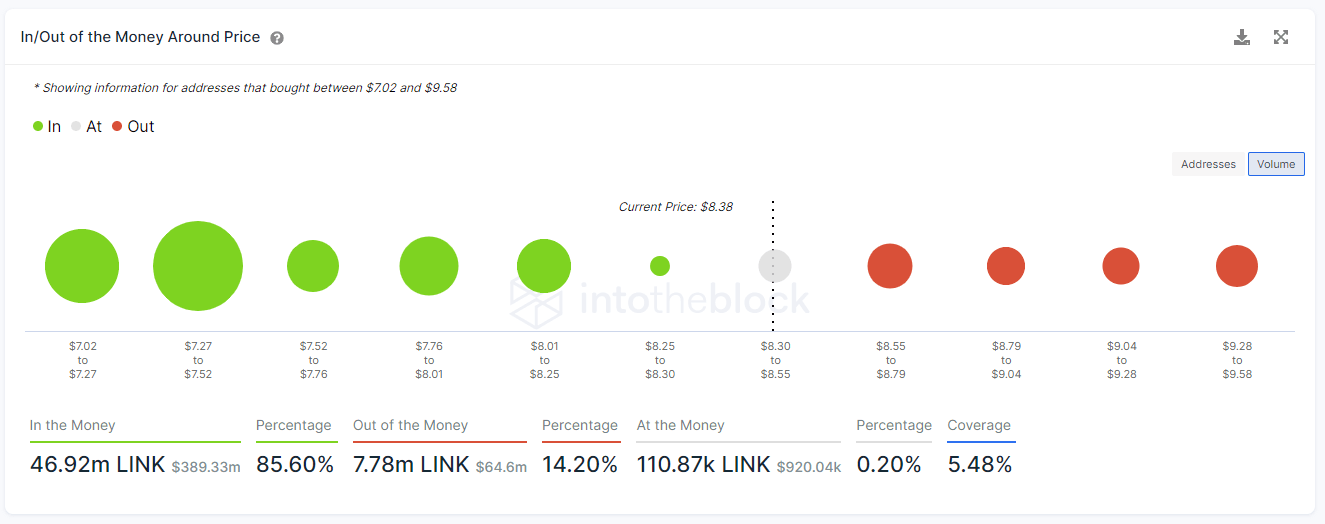

For potential resistance and support price levels, I would like to check on-chain metrics rather than technical analysis signals. The on-chain equivalent of these resistances and supports can be read from an indicator called the In / Out of the Money Around Price (IOMAP).

This indicator covers buckets within 15% of the current price in both directions. In doing so, IOMAP identifies major trading areas that may act as support and resistance levels.

As you can see from the chart above, most of the LINK supplies (85.60%) acquired within 15% of the current price are acquired below and only 14.20% are acquired above.

This may indicate that sales pressure is minimized when the price of LINK rises in order for the majority of the supply to be acquired below and continue to be profitable. As behavioral economics points out, traders are willing to execute positions when they are making a profit.

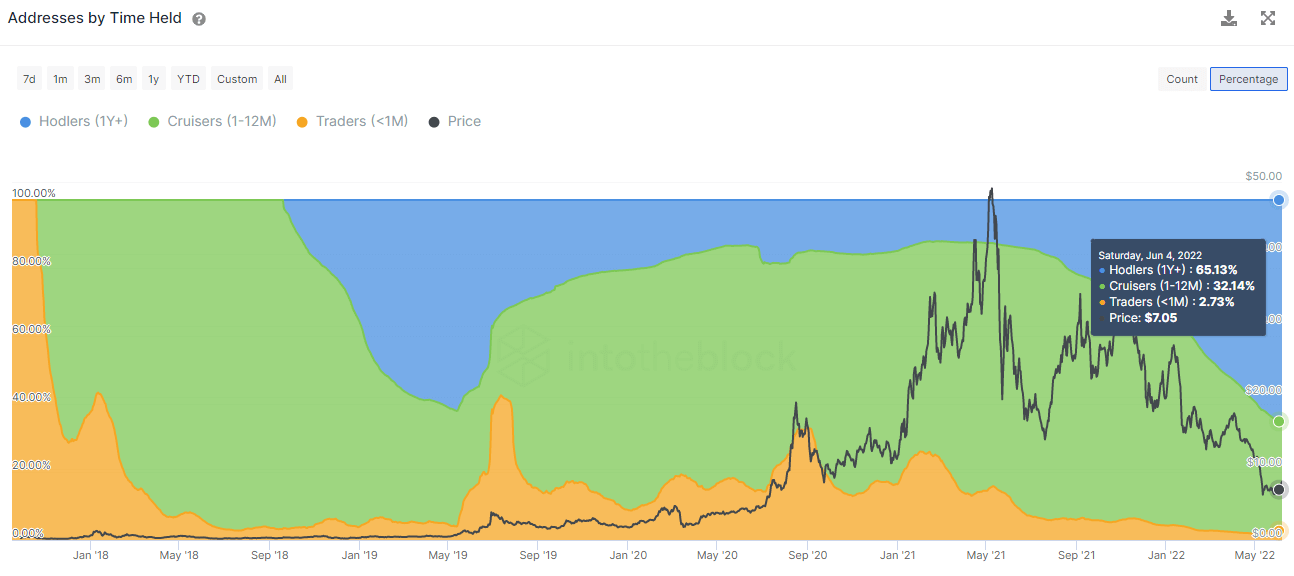

Looking at the long term aside from the short term, LINK shows the specific holding distribution commonly found in crypto assets such as BTC and ETH, which are primarily treated as storage for value assets from investors.

This indicator is the number of addresses that have been held for over a year, representing the largest group of holders today. In the graph below, these are classified as Hodlers, those that have been retained for 1-12 months are called Cruisers, and those that have been retained for less than a month are called Traders.

IntoTheBlockChainlink Indicator address by time as of June 8, 2022.Currently, 65% of addresses with LINK have been retained for over a year. This shows the long-term confidence that most LINK holders have in the Chainlink ecosystem. Similarly, staking news shows a long-term plan, which will take longer to implement and will show its results in the second half of 2022, but the planned features are probably 2022. It will be further expanded. It’s interesting to track development progress and how LINK prices react to it.