Circle, BlockFi may have exposure to Silicon Valley Bank; other firms deny exposure

California-based Silicon Valley Bank (SVB), a division of SVB Financial Group, has closed, according to a financial regulator’s announcement. March 10.

Silicon Valley Banks Shut Down by Regulators

The Federal Deposit Insurance Corporation (FDIC) announced today that the California Office of Financial Protection and Innovation closed the SVB.

The FDIC said it has been designated as the beneficiary, adding that eligible bank customers will have access to the insured deposits by March 13.

The FDIC has not explained the chain of events leading up to SVB’s closure, but the bank’s collapse was sparked by a proposed sale on March 8 aimed at covering losses of $1.8 billion. rice field. The company’s stock price fell 60% from $267.83 to $106.4 in one day.

This led to a bank run on March 10 after a third party advised the company to withdraw funds. Trading in the company’s stock has since been suspended.

Executives including CEO Gregory BeckerCFO Daniel BeckCMOs Michelle Draper In the weeks leading up to these events, we collectively sold millions of dollars in stock.

At $209 billion, the company is the second largest US bank failure in history and the biggest failure since the 2008 financial crisis.

Crypto companies could be at risk

Silicon Valley Bank has no direct relationship with the cryptocurrency industry, but some cryptocurrency companies may be involved with failed banks.

Circle held funds in various banks, including Silicon Valley Bank. most recently in januaryHowever, the company said it recently moved funds between banks. TechCrunchwhich may or may not currently hold funds in SVB.

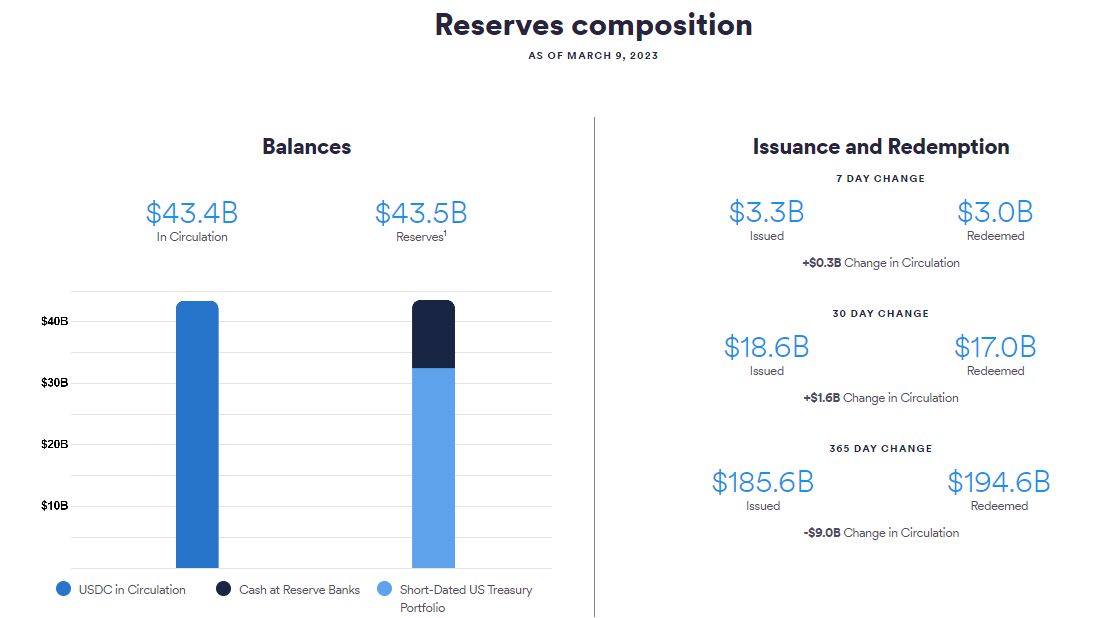

It’s unclear how much money Circle specifically holds in Silicon Valley Bank, but currently Holds a quarter of USDC reserves ($11 billion) to the bank.

Elsewhere, bankrupt lending company BlockFi was reported to be exposed to SVB. The U.S. Trustee said: Filed March 10 BlockFi has $227 million in the bank. It states that these funds are “unprotected” and require a bond or deposit under bankruptcy law.

Other companies deny exposure

Binance CEO Changpeng Zhao said his exchange company is not involved with Silicon Valley Bank.he murmured: “Funding is #SAFU.”

John Wu, president of Avalanche company Ava Labs, also commented on the situation.During the first bank run March 9Wu said Silicon Valley Bank is one of the banks his company relies on. than in previous weeks and months, he said.

Robbie Ferguson, co-founder of Immutable Labs said His company has no affiliation with Silicon Valley Bank, nor with the failed Silvergate Bank. Immutable is known for his Immutable X blockchain, which focuses on Web3 games.

Valkyrie, an asset management company said There is no exposure or banking relationship with Silicon Valley Banks. Nevertheless, it called the news “devastating”.

Blockchain Intelligence Group (BIGG) and its affiliated Canadian cryptocurrency trading platform Netcoins also denied Exposure to failed banks.