Circle says substantially all USDC minting, redemption backlogs are resolved after wild week

After the stablecoin peg was lifted over the weekend, USDC issuer Circle declared that virtually all issuance and redemption backlogs have been resolved.

The company reportedly redeemed $3.8 billion USDC and minted $800 million USDC since Monday, with the Silicon Valley Bank (SVB) collapse also shifting banking partners.

Update: As of the close of US banking on Wednesday, March 15, the backlog of USDC issuance and redemption requests has been nearly entirely cleared. Get details. https://t.co/5WEAgPps0E

— Circle (@circle) March 16, 2023

The company’s founder and CEO, Jeremy Allaire, recently appeared on an episode of Bankless. podcastWe talked about the wild weekend following USDC’s unpegging.

“Everyone was talking about the need to save banks from crypto, but now we are talking about trying to save crypto from banks,” Allaire told the podcast. “But right now, USDC is the safest digital dollar with cashback on the internet.”

“I am a strong believer in full reserve banking,” said Allaire. “This idea that there is no need to have a partial reserve is if innovations in the basic layers of government obligations and payment systems are built on the internet using software in these new ways.” , lending can occur otherwise, he says. He said.

circle repeg

Following the events of last weekend, Circle was accumulating a backlog of USDC withdrawal requests. However, the problem was resolved by switching bank partners to prevent disruption to operations.

According to the stablecoin issuer, “On Tuesday, March 14th, we implemented a new transactional banking partner for wire transfers within the United States. In addition, we have started using our existing transaction banking partners for international wire transfers.”

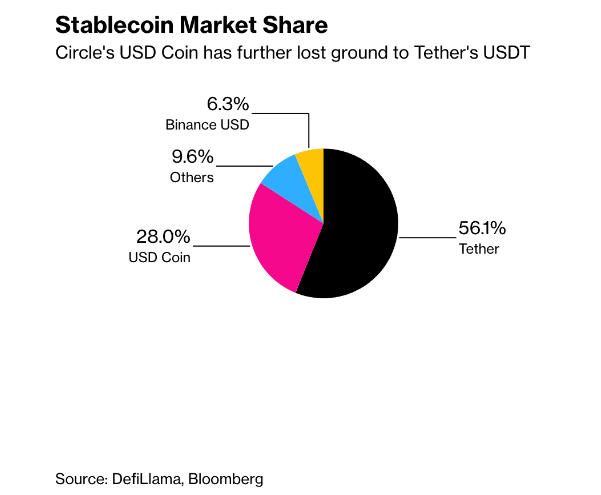

USDC managed to recover its peg, but was overtaken by rival stablecoin USDT following last week’s turmoil. According to a Bloomberg report, USDC’s circulating supply has decreased by his 5.9 billion tokens, while USDT has increased by his 2.5 billion tokens.

USDC traded at 0.88 last weekend, losing nearly 12% in value and losing more than $6 billion in market cap when Circle disclosed its exposure to SVB. However, it became convertible into U.S. dollars again on Monday after the Federal Reserve announced it would fully compensate customers’ deposits in the SVB.

Read more: Circle says USDC operations not affected by SVB, signature closure

close to burning circles

The closure of Silicon Valley Bank and Signature Bank will not affect Circle’s USDC activities.

USDC’s $3.3 billion in reserves held at Silicon Valley banks will be fully accessible when U.S. banks resume operations on Monday, the company said in a statement. The company has revealed that Signature Bank does not have his USDC cash reserves.

After re-establishing the 1:1 peg on Monday, the company reaffirmed that USDC is a regulated payment token, so it can be redeemed 1:1 with the US dollar.

“The trust, security and 1:1 redemption potential of all USDCs in circulation are of paramount importance to the Circle, even in the face of the banking epidemic impacting the cryptocurrency market,” said Allaire. increase.