Coinbase bankrolls Tornado Cash users’ lawsuit; Terra Classic makes 1,900% comeback led by community

The biggest news in the cryptocurrency industry on Sept. 8 included Coinbase funding a lawsuit against the U.S. Treasury over Tornado Cash, the community-driven revival of Terra Classic, and an attack on the New Free DAO protocol. I’m here.

CryptoSlate Top Stories

Bitcoin Stable As ECB Raises Rates By 75bps

Bitcoin continued to trade flat despite the European Central Bank’s (ECB) announcement of a 75 basis point price hike.

Economists had expected a 50 basis point rise after euro zone inflation hit 9.1%, but several Wall Street banks said the ECB would be hit hard by a 75 basis point rise. I predicted.

Community-led Terra Classic (LUNC) is worth 12x more than Do Kwon-led Terra LUNA

The community’s plans for the revival of Terra Classic (LUNC), which has become the 26th largest project by market capitalization, are starting to pay off.

LUNC’s current market capitalization is $3.3 billion, about 12 times more than Do Kwon’s Terra (Luna)’s $258 million.

LUNC hit a record low of $0.00004885 on June 8 and is trading at $0.00052851 at the time of writing, marking a price increase of 1,900%.

Coinbase funds Tornado Cash user lawsuit against US Treasury

Cryptocurrency exchange Coinbase is funding a lawsuit against the U.S. Treasury over Tornado Cash sanctions.

Six Tornado Cash users claimed the sanctions were a “violation of the rights guaranteed by the US Constitution.”

Coinbase CEO Brian Armstrong has criticized the ban, saying it restricts the rights of regular users to access the protocol, adding that “the Treasury Department used a hammer instead of a scalpel.” added.

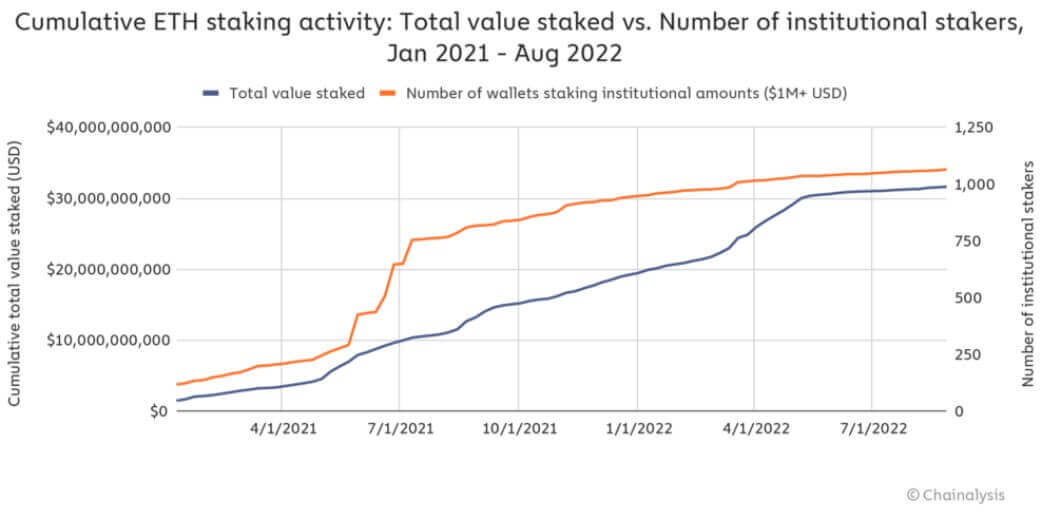

Ethereum Staking Attracts More Institutional Investors After Merger – Chainalysis

After the merger, Ethereum staking could offer yields of up to 15% per annum, according to a Chainaysis report. This is a huge return on investment compared to US Treasuries which offer about 3.5%.

This figure shows that the number of wallets staked over $1 million in ETH has increased 5x over the past year.

Institutional investors holding more than $1 million in ETH are more likely to bet more, according to the report, as energy requirements for ETH are expected to drop by 99% after the merger.

New Free DAO Crashes 99% After $1.25 Million Flash Loan Attack

The attackers borrowed 4481 WBNB from the New Free DAO protocol and exchanged it for the protocol’s native token, NFD.

This amount was worth $1.25 million, and NFD crashed 99% after the attackers sold everything.

Chainalysis Helps US Government Seize $30 Million Related to Axie Infinity Hack

Chainalysis has revealed that attackers use DeFi services to chain tops or switch multiple coins in a single transaction. This information helped the U.S. government seize his $30 million outTrustee’s million stolen during his attack on Axie infinity.

2/ With the help of law enforcement and key organizations #Crypt valued at over $30 million in the industry #Crypt Items stolen by North Korea-linked hackers have been seized.

This thread describes how the Chainalysis Crypto Incident Response team played a role. https://t.co/lpbFUlXNJt

— Chainalysis (@chainalysis) September 8, 2022

North Korea-linked hacker group Lazarus attacked the Axie protocol in early 2022, stealing more than $600 million in total.

Ethereum Lead Developer Saves Avalanche From Ecosystem Crash of Over $24 Billion

Ethereum developer Péter Szilágyi said on March 29 that he identified a bug in Avalanche’s PeerList package. He said he contacted Ava Labs on Sept. 8 to warn Avalanche of a possible exploit that he could cause more than $24 billion in damage.

SEC Chairman Wants CFTC To Regulate Bitcoin, Ethereum

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler said he wanted to give the Commodity Futures Trading Commission (CFTC) greater powers “without sacrificing the SEC’s authority over the markets.”

Gensler said achieving a balance of regulatory oversight is essential. But the SEC must ensure that the CFTC’s high powers do not “inadvertently undermine the securities laws” of the United States, he added.

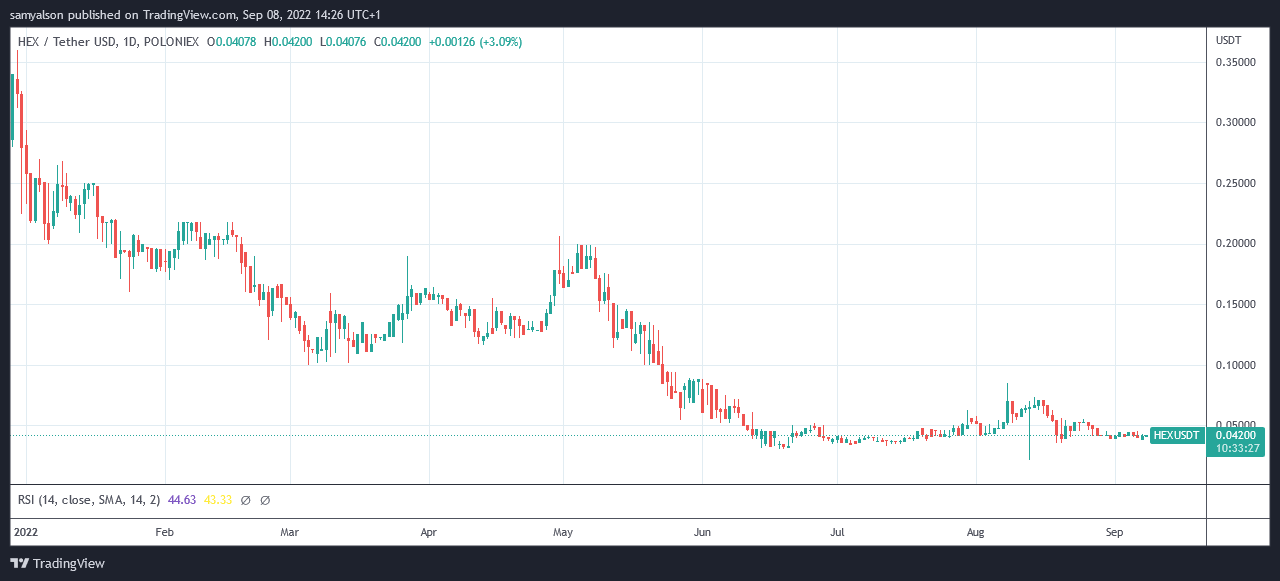

Investor Mike Alfred has his sights set on the HEX below $0.04.

HEX briefly dipped below $0.04 on Sept. 8. The token started rising again, but he still lost 85% of its year-to-date value. $0.04 marks a new low for the token, 92% below the all-time high of $0.51.

The HEX project was launched in 2019 and is defined as the first blockchain proof of deposit token. However, the community debates whether his HEX project is a scam.

Following the fall, Alfred stated that HEX “skillfully uses FOMO marketing tactics, building cult-like groups around itself, and using deceptive numbers and comparisons to make itself appear legitimate.” It’s a great scam,” he said.

Crypto Slate Exclusive

Ethereum merger tax implications and what to do to prepare

Koinly’s Head of Tax, Tony Dhanjal, said: crypto slate He said the merger is unlikely to be taxable unless a hard fork occurs.

In the case of hard forks, users may be taxed according to their place of residence.

research highlights

Study: Cryptocurrencies Are at Risk as New UK Prime Minister Tackles Economic Challenges

Liz Truss, who appeared to be crypto-friendly during her campaign, became Britain’s new Prime Minister (PM) with a majority vote of 57.4% on Sept. 5.

But the current situation shows that she may have taken on a lot to deal with the cost of living crisis, double-digit inflation and a possible recession in 2023.

German Crypto Tax Policy Is One of the Best in the World – Coincub Report

According to Coincub’s annual tax ranking, Germany offers the highest tax rates in the world. The country does not require a citizen to pay capital gains tax on assets held by her for more than one year so that she can maintain her domestic population.

German cryptocurrency adoption rates are very high and tend to increase due to Dubai’s friendly tax rates.

news From around Cryptoverse

White House wants to control mining

The Biden-Harris administration report It was called “The Climate and Energy Impact of Crypto Assets in the United States,” and explained the environmental and power consumption issues of crypto assets.

The report called for appropriate mining standards that can minimize environmental damage and contribute to national sustainability.

Coinberry loses 120 bitcoins due to glitch

Toronto-based cryptocurrency exchange Coinberry lost 120 bitcoins due to a technical glitch. financial post.

The exchange has filed a lawsuit, demanding that all 50 users return the bitcoins they have not received. Coinberry also included the name of cryptocurrency exchange giant Binance in the lawsuit to seek help after discovering that some users were quickly transferring new bitcoins to their Binance accounts.