Coinbase says it has no exposure to Genesis, touts ‘strong capital position’

The chain reaction of events following the collapse of FTX has forced major exchange Coinbase to demonstrate its “strong capital position” and zero exposure to Genesis amid market turmoil. I felt that there was.

2/ We do not comment on every crypto event, but for clarity, Coinbase has no exposure to Genesis Trading.

— Coinbase (@coinbase) November 16, 2022

The exchange tweeted that Document It describes our approach to transparency, risk management and consumer protection, and reminds us to take precautions against implosion. It said its priority is to promote a safe and responsible crypto economy and protect its customers.

Genesis

Similar to the collapse of Terra-Luna, the FTX implosion set off a chain of events that also affected crypto exchange Gemini and crypto lending platform Genesis.

On November 16th, the cryptocurrency lender announced that it would stop all withdrawals due to the collapse of FTX.

Genesis was already taking a hit after the collapse of Three Arrows Capital (3AC) following the Terra Luna crash. The collapse of FTX has forced lenders to the point of halting withdrawals.

coinbase approach

Coinbase released the document on November 8th and posted it on Twitter on November 16th.

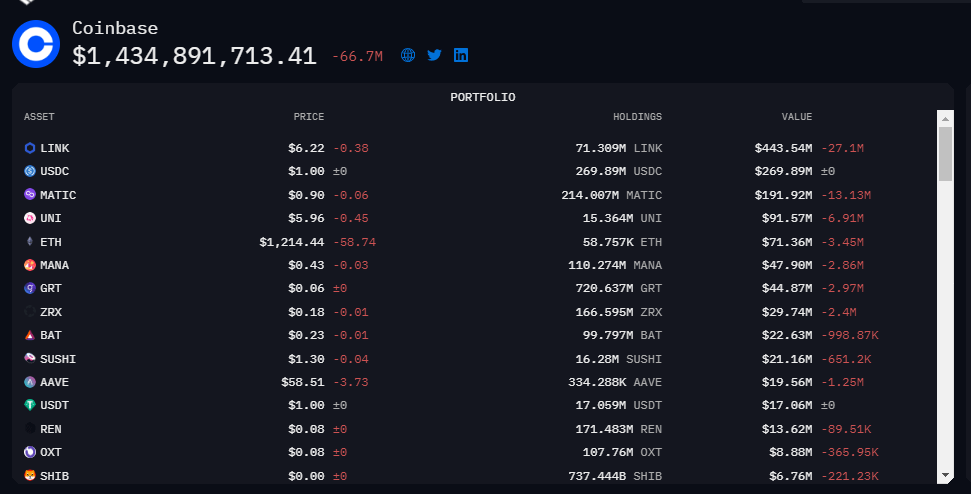

The document explains why a “bank run” can’t happen at Coinbase, shows where the capital is, and details the risk team. Coinbase says it avoids the risk of illiquidity by holding client assets one-for-one with him and backing all institutional loans with collateral.

In terms of capital, Coinbase currently holds $1.5 billion in assets, half of which is in Chainlink. The remaining amount will be held as Bitcoin (BTC).

Additionally, Coinbase says its risk management team has decades of experience in the field, prioritizing sound liquidity management, credit, and counterparty risk.