Comparing Bitcoin’s spot and derivatives markets in Q1 2023

quick take

- With the first quarter ending with an amazing bitcoin performance of over 70%, it’s worth analyzing the physical vs. derivatives trend in the first quarter.

- The network is much healthier at the end of the quarter than when it started in January.

- Currently, exchange balances are flat year-to-date, with around 2.28 million bitcoins on exchanges, and demand is starting to pick up after the SVB collapse.

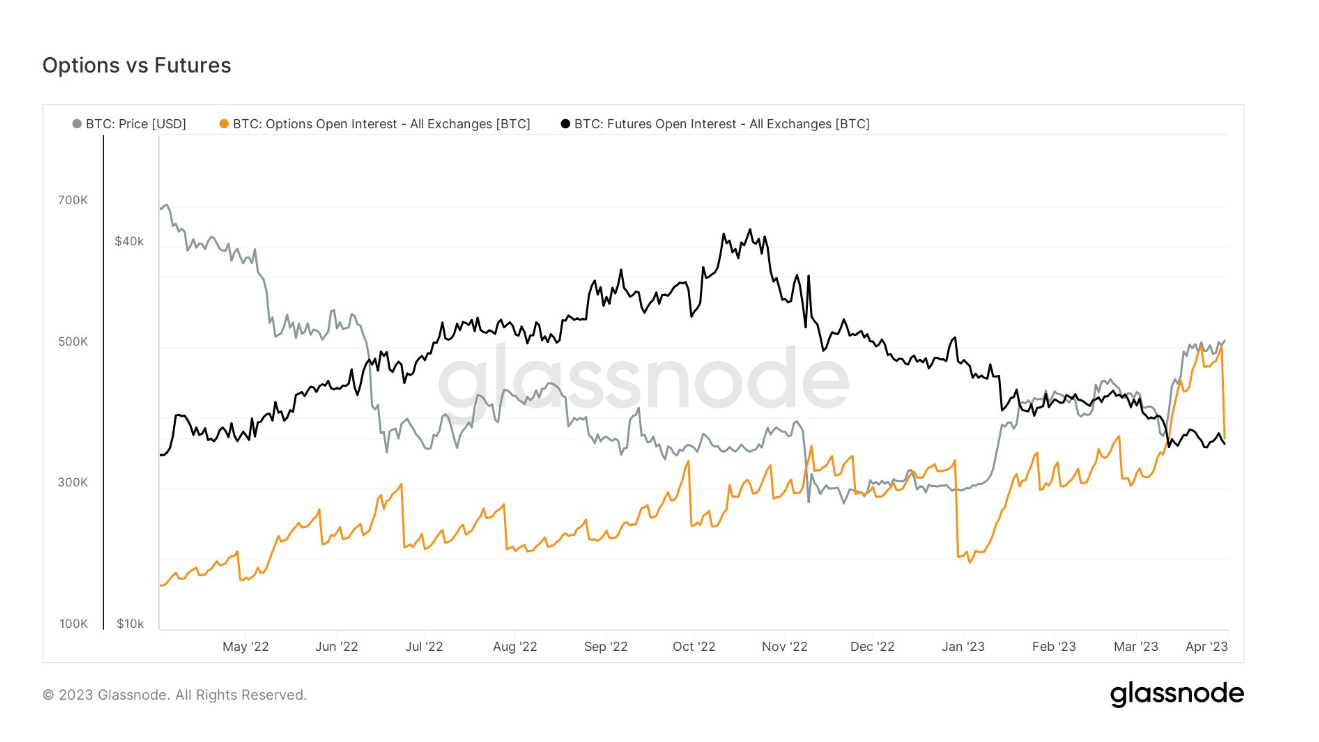

- Futures open interest is currently at its lowest level in a year, with around 300,000 bitcoins liquidated from a 2022 peak in October.

- Finally, options open interest saw a record-breaking amount of $4 billion worth of options expiring on March 31st. About 130,000 bitcoins have been unwound in contracts from exchange Deribit.

- The rise in Bitcoin price has been driven by spot demand in recent weeks.

The post Bitcoin Spot Market vs. Derivatives Market Comparison for Q1 2023 first appeared on CryptoSlate.