Could Bitcoin be positioned to thrive amid global bearish signals for the US economy?

Global sentiment on macroeconomic conditions has calmed down following the technical downturn and news of a 75bp rate hike by the US Federal Reserve. However, the cryptocurrency market looks stronger than ever and could confuse investors.

In this article, we examine the factors that influence the traditional economy and their impact on the cryptocurrency industry.

recession

A recession is commonly understood to be a period of temporary recession during which trade and industrial activity decline. It’s commonly identified by his second straight quarter of decline in GDP, but the White House recently called for other economic factors to be taken into account.

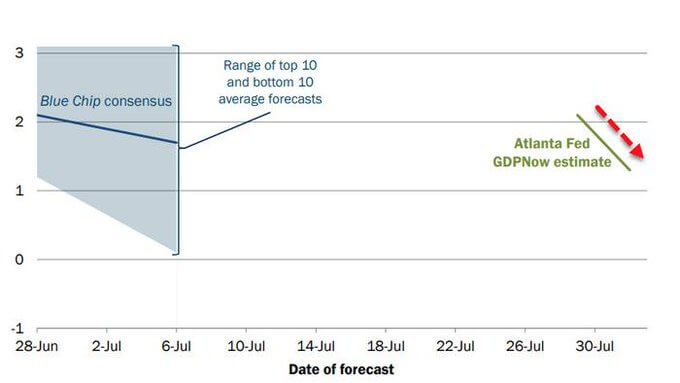

GDP growth in the first quarter of 2022 was negative. The Atlanta Fed predicted further negative GDP before its official announcement on July 28 confirming the decline in GDP.

After two consecutive quarters of negative GDP growth, the Atlanta Fed has modeled its third quarter GDP forecast for the US economy at +2.1%. However, the latest PMI, construction and spending data show an estimate of +1.3%. The same pattern occurred in the second quarter, with a positive outlook at the beginning of the quarter and a negative outlook at the end.

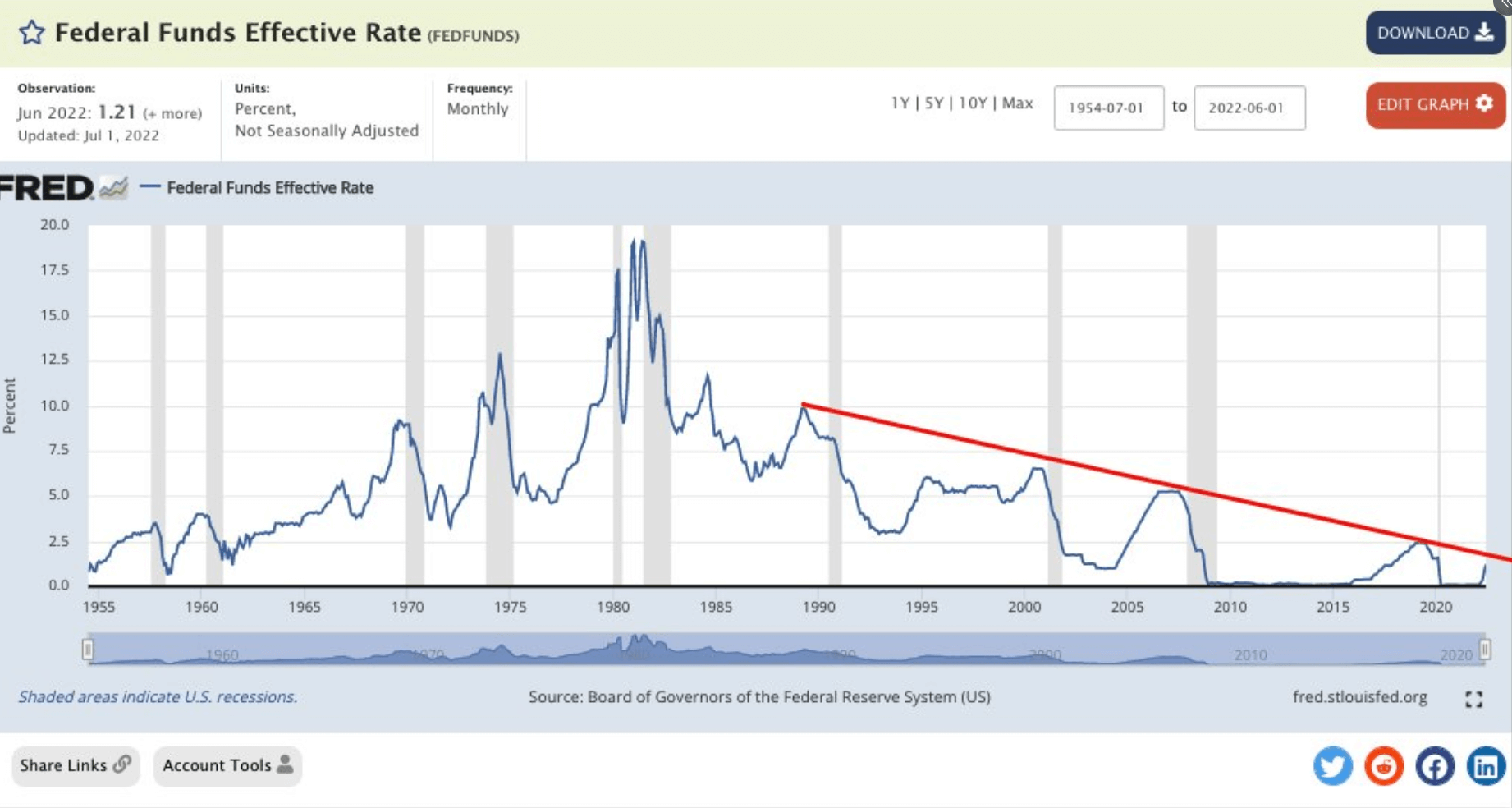

Following last week’s FOMC meeting, the Fed is tightening at its fastest rate of change to control rampant inflation. The question is, how much can the market accept without breaking something?

According to the Federal Funds Rate, the market may only have one more rate hike chance before something breaks. Since 1987, whenever the funds rate hits the red line, he has backed down, lowering lows in the process.

a severe slowdown in the economy

There are some warning signs of a severe economic slowdown, but they could be the tip of the iceberg.

- The S&P Global Flash PMI Composite Output Index turned negative for the first time since the last recession.

- Existing home sales fell nearly 6% in June, marking the fifth straight month of decline.

- 35% of US small business owners “did not pay their rent in full or on time in June.”

- 45% of all small businesses in the US have already decided to freeze the hiring of new employees.

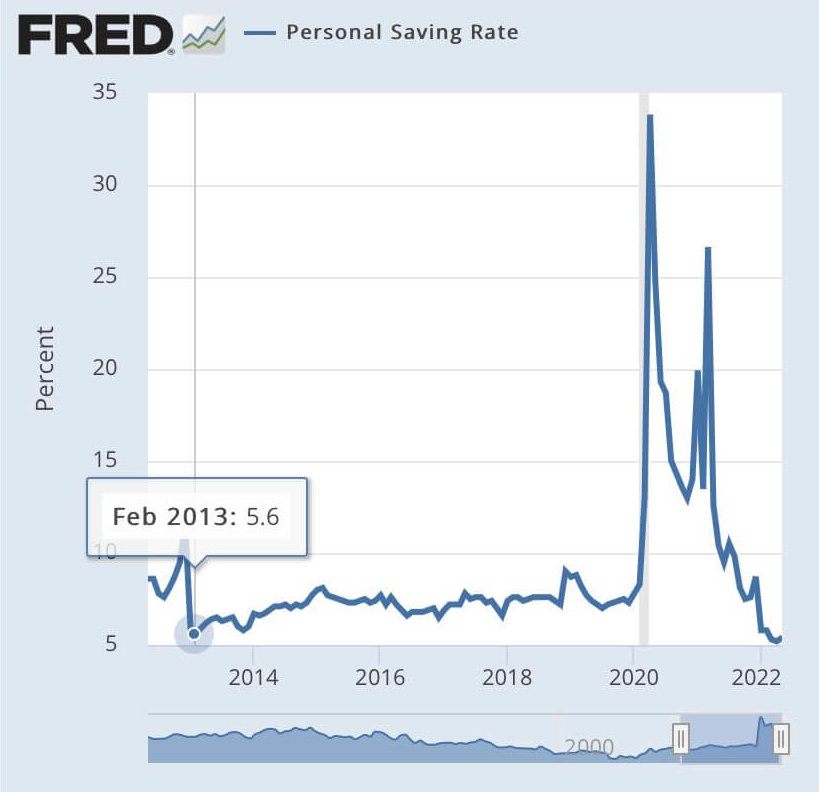

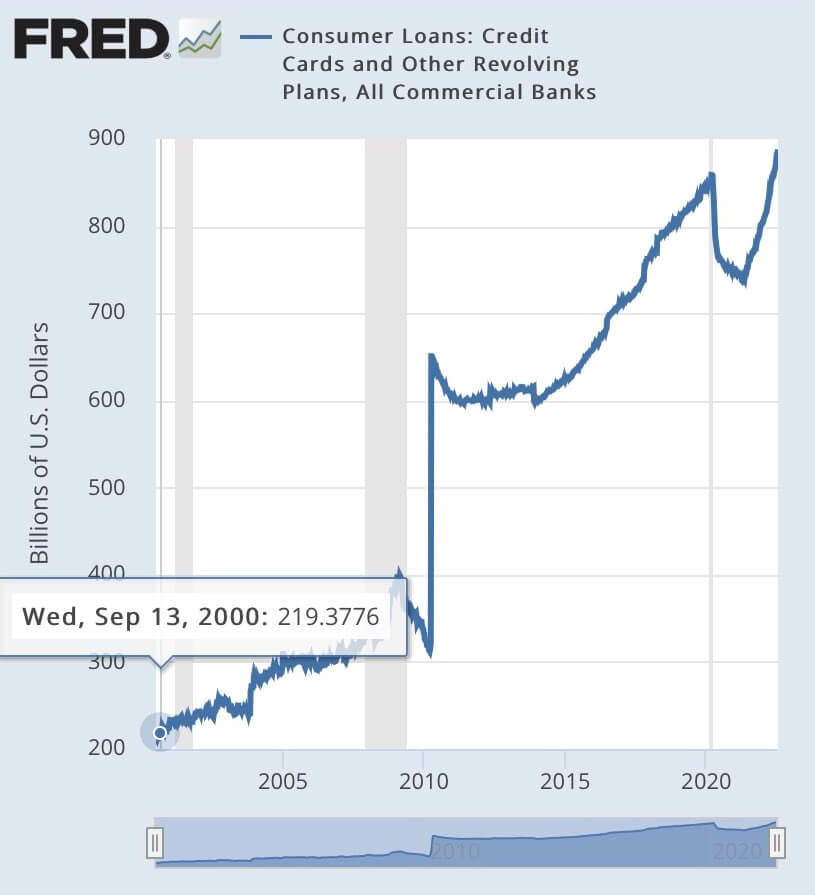

- Personal savings are at their lowest in over a decade and revolving credit (credit card debt) is at their highest in 22 years.

U.S. consumer savings at their lowest level in more than a decade and interest rates rising alongside consumer debt indicate low public liquidity. The Federal Reserve chart below shows the magnitude of the problem.

Inflation of daily needed goods and services alongside asset price deflation can cause significant volatility in global markets.

Luke Gromen, founder and president of Forest for the Trees, emphasized that the FED is stuck between a rock and a hard place.

The consensus repeatedly ignores that the Federal Reserve has never initiated a tightening cycle in which the U.S. federal government’s debt/GDP or deficit/GDP has never been this high.

This is why we say, “The Fed is no longer doing the dialing. off 👇 https://t.co/ShEs5ttaIh

— Luke Gromen (@LukeGromen) July 22, 2022

Is Bitcoin Perfectly Positioned?

Bitcoin’s price surged in the days following the Fed’s announcement, but saw a 7% correction over the weekend entering its first trading session on Monday. Bitcoin has given up on its rally since news of a technical recession broke on Thursday, July 28th, but at the time of writing, it has been on a downward trend since the FOMC meeting announced a 75bp rate hike on July 27th. It’s still up 7.5%.

However, local trends are not indicative of long-term market performance, and Bitcoin’s price action over the past week does not necessarily mean the bull market is back on the cards. Ethereum has taken the lead in the recent positive crypto market move, rising 10% against Bitcoin since July 27.

Bitcoin maximalist Michael Thaler amid global concerns said That the need for bitcoin has reached an “all-time high” in a tweet on Friday. Earlier this week, he cites Bitcoin’s ability to act as a “global payments network,” hinting at its potential as a global reserve currency.

All goods require energy.ever since #bitcoin It is a product that functions as global digital money. Bitcoin’s economic function is to provide property rights to 8 billion people and a global payment network that has settled $17 trillion so far this year. pic.twitter.com/kJz6sCLlCU

— Michael Saylor ⚡️ (@saylor) July 25, 2022

As Bitcoin becomes the global payments layer of the world economy, the economy will adopt a predefined monetary policy as described in the Bitcoin whitepaper. The ability to assign property rights to individuals and print additional money on behalf of the central bank is removed.

Bitcoin Magazine’s Austin added to the argument that the fiat currency system is failing in a recent post highlighting that the US dollar is among the “top 10 worst debt/GDP ratios”.

The world’s reserve currency countries are in the top 10 with the worst debt/GDP ratios. #bitcoin Insurance to that fiat system. pic.twitter.com/jj28Gjl6DM

— Austin 👨🏼💻| ₿itcoinMagazine (@_AustinHerbert) July 29, 2022

DeFi analyst The Genie says the Fed may be under pressure to print more money before the next Bitcoin halving leads to another Bitcoin bull market. Commented. CryptoSlate analyzed this scenario in April 2022 and analyzed the chances of Bitcoin reaching $120,000 by 2025.

Cryptocurrencies will be fine.The federal government will print more dollars by 2024 and #Crypt Pump a lot again. The main goal is to keep the dollar as the world’s reserve currency.

Democrats will have to face a lot of political pressure to prop up the economy ahead of the next election. #bitcoin

— Genie 🧞♂️🕯 (@genie_trades) July 30, 2022

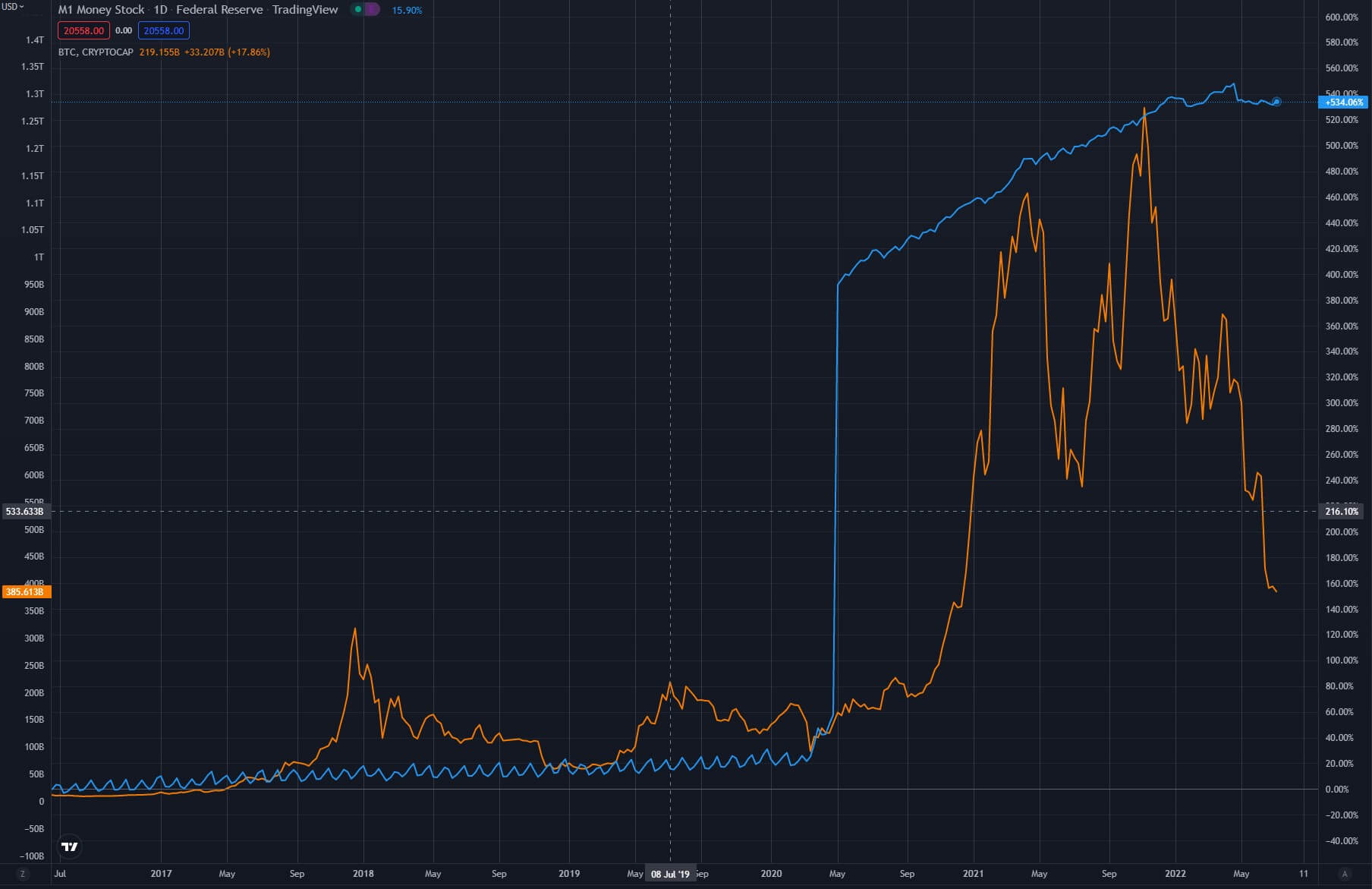

The chart below shows the impact of US money printers alongside the price of Bitcoin. The top cryptocurrencies have registered a 600% increase since late 2020, when the Federal Reserve significantly increased the money supply. In the same period from September 2020 to September 2021, the M1 money supply increased by 440% of his.

2018 Allianz examination The dollar may lose its position as the world’s reserve currency. The article said, “Maybe it’s only a matter of time before the dollar becomes like the denarius, the ducat, the guilder and the pound.

Many believe that Bitcoin has the potential to fill this gap.

“Abandoning reserve currency status may help balance the country’s trade relations, but it could hurt the value of the dollar and create inflationary pressure on the prices of consumer goods.”

Losing reserve currency status at a time when “inflationary pressure” is at its highest in 40 years could be disastrous for the US economy.

Economist Karl Menger commented on July 26 that Jerome Powell has confirmed that the emergence of a new candidate for a global reserve currency will not be felt “immediately.” Is Bitcoin already on its way to becoming a reserve currency? Some might say yes, but others say it’s too early.

What if someone came up with a better currency that was more liquid than the US dollar and that people liked?

“I don’t think we will feel it any time soon, but over time it will degrade the US dollar’s status as a reserve currency.” – JP, Fed Chair interim

Luckily we already have #bitcoin. pic.twitter.com/NnkaVDXupY

— Carl ₿ MENGER ⚡️. (@CarlBMenger) July 26, 2022