Crypto liquidations top $300M as Bitcoin drops below $20k

Bitcoin (BTC) has broken below $20,000 for the first time since the start of the year, liquidating $123.25 million long positions held in the past 24 hours, according to Coinglass data.

Across the broader crypto markets, the total liquidation volume in the last 24 hours was $323.86 million, according to Coinglass. dataThe sell wiped out all traders who were taking long positions in the market.

Meanwhile, Binance alone liquidated $114.14 million. Other exchanges with top liquidations included OKX and Huobi with $78.1 million and $43 million respectively. During this period, 98,955 traders were liquidated. The most significant liquidation is his $9.49 million long position in BTC.

Bitcoin falls below $20,000

Over the past 24 hours, the flagship digital asset has fallen to $19,968 at the time of writing, according to CryptoSlate data.

Bitcoin posted a negative netflow of $13.7 million during the period.glass node data While $782.9 million of BTC was transferred to cryptocurrency exchanges during the reporting period, investors withdrew $796.6 million as the bears took over the market.

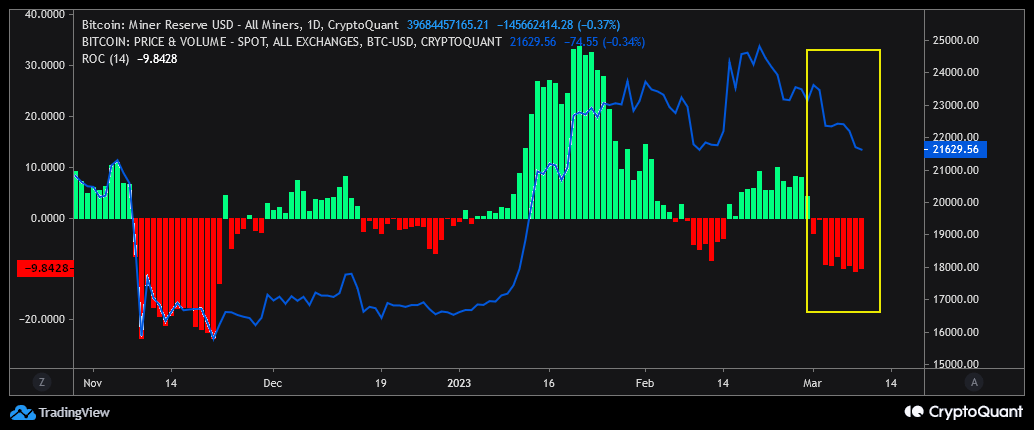

Meanwhile, BTC analyst Barovirtual cites CryptoQuant as data, He said BTC miners are putting pressure on assets. Miners have been increasing pressure since March 1, which could drop the value of the asset to $19,500 or $16,600.

In addition, BTC sAccording to CryptoQuant, short-term holders cashed out their profits as the profit margin exceeded 5%. data.

Silvergate, KuCoin Factor

The recent market turmoil is consistent with current issues surrounding crypto-friendly bank Silvergate and a lawsuit filed by New York authorities against crypto exchange KuCoin.

On March 8, Silvergate announced it would “voluntarily liquidate” its assets and cease operations.a crypto slate The report has identified how the bank struggle has affected the depth of the US dollar market in crypto over the past month.

In its lawsuit against KuCoin, New York alleges Ethereum is a security, further fueling fears surrounding digital assets.

Meanwhile, US President Joe Biden has proposed imposing a 30% crypto mining tax on all energy costs involved in crypto mining.