Crypto market sees biggest miner selling pressure since January 2021

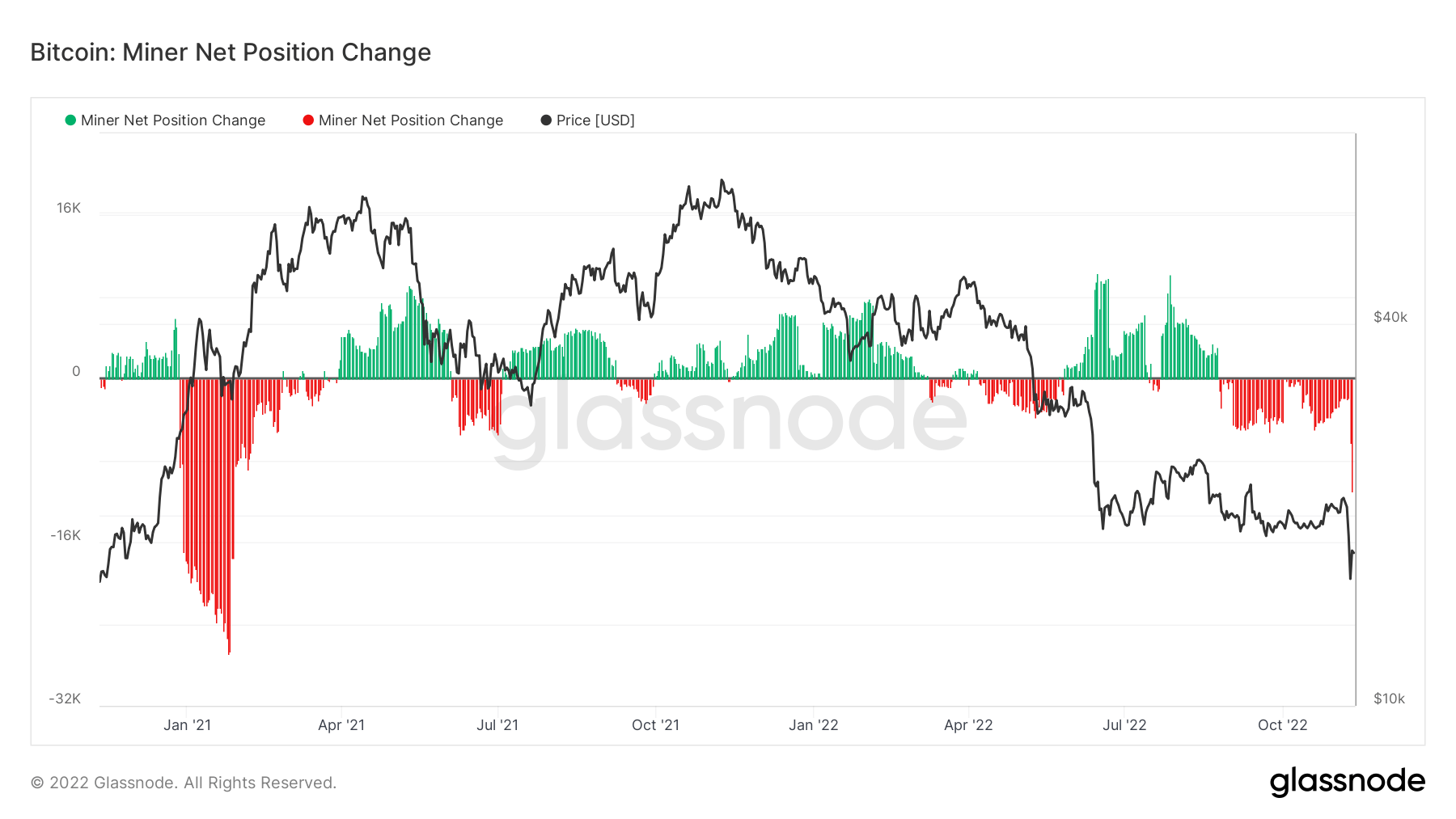

The continued market downturn caused by FTX has not left Bitcoin miners unscathed. The market saw the biggest selling pressure of his 1-day minor since January 2021. Data analyzed by CryptoSlate shows no signs of the selling pressure stopping.

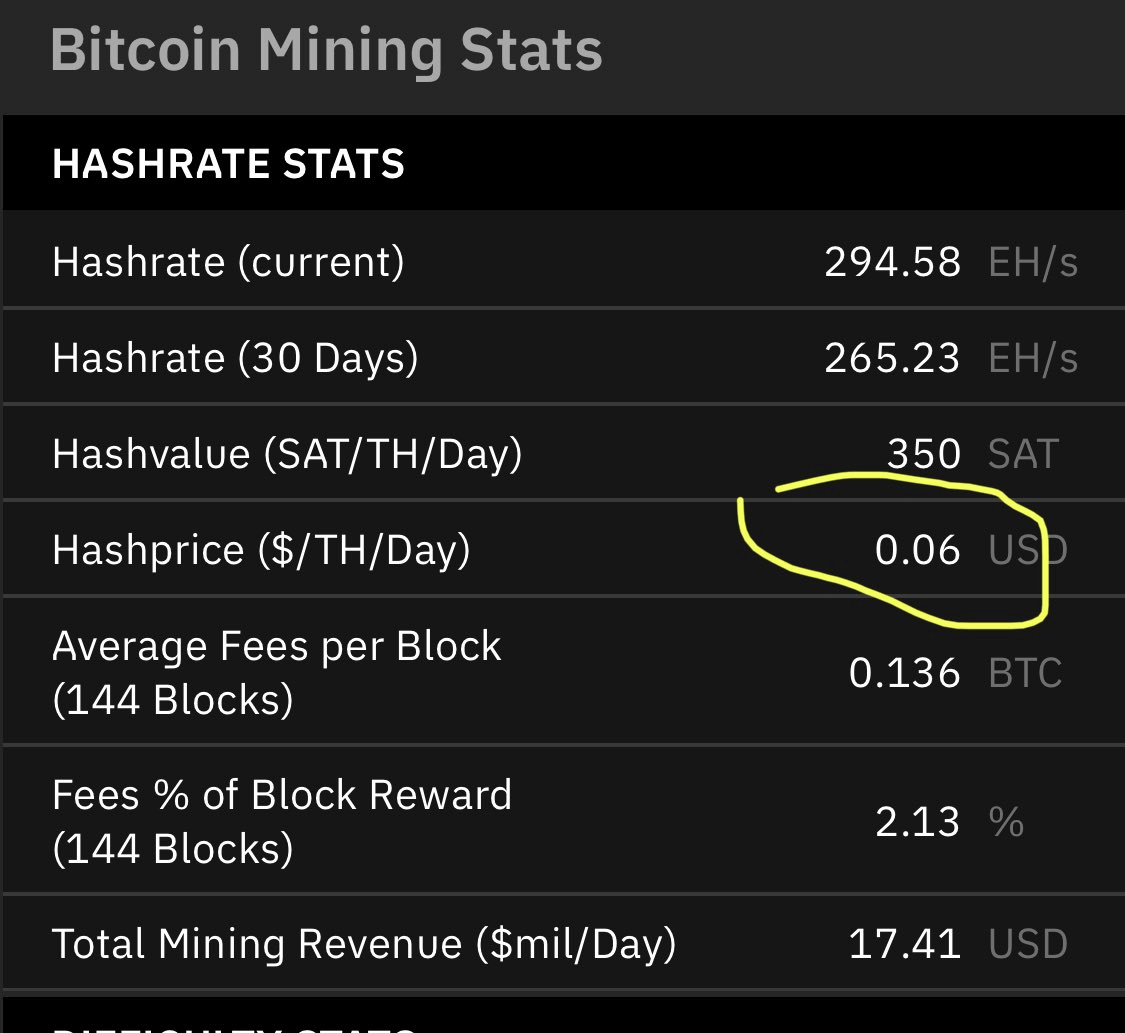

Selling pressure from miners could linger until the average hash price starts to drop. In November 2022, the average hash price reached his $0.05. Bitcoin’s current $17,500 level makes mining borderline unprofitable not only for small miners, but also for large operators.

With tens of thousands of new ASIC miners added to the market over the past year, even the largest mining operations were in the red, and few expected a sharp rise in hash prices.

The latest Bitmain S19Pro ASIC miner is around $9,000 per machine with a payback period of 1,500 days at an average hash price of $0.06.

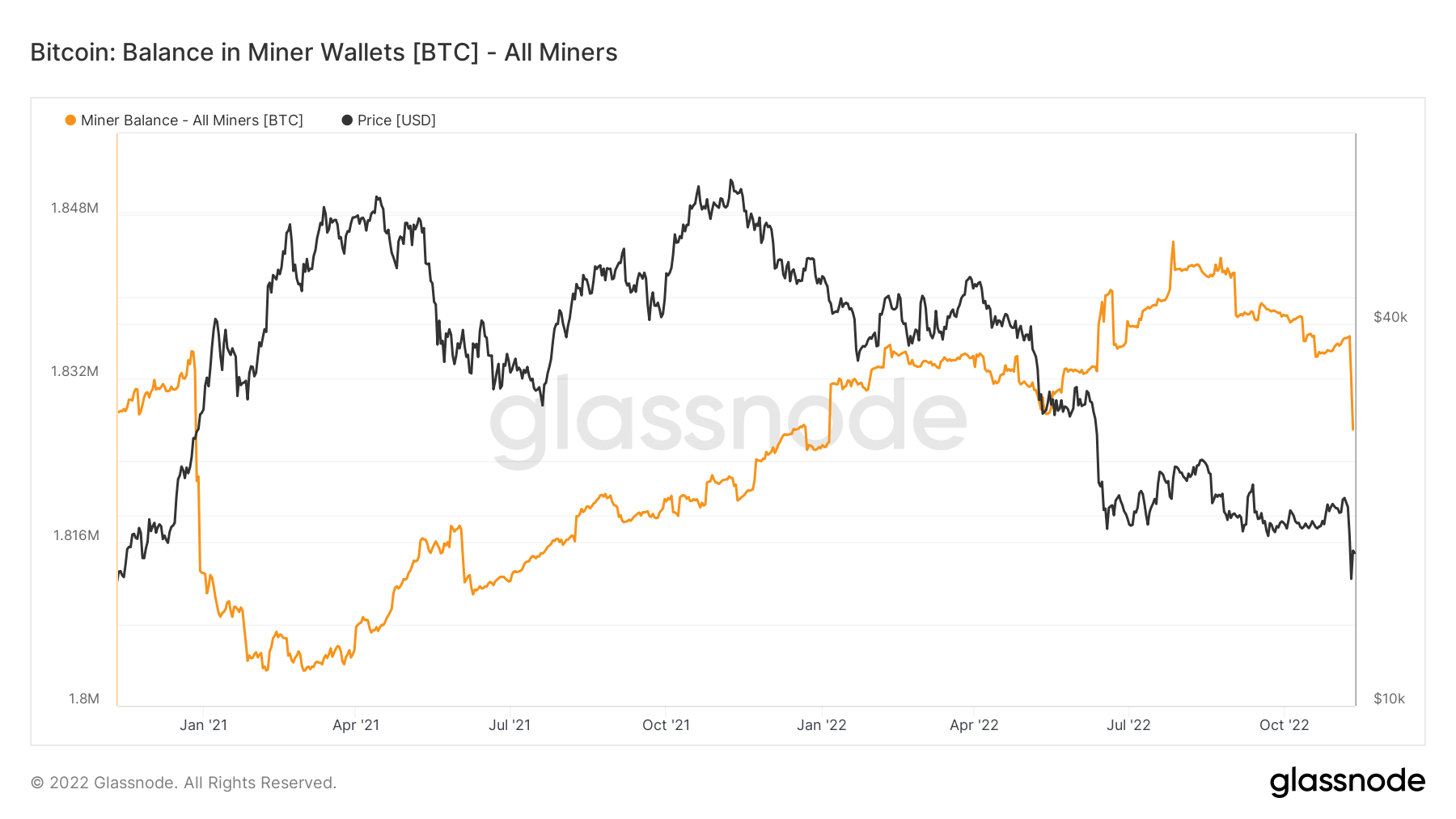

This increase in mining costs and declining profitability has forced miners to sell their bitcoin holdings. Minor wallet balances have declined vertically since his early November, reaching a recorded low in January 2021.

Changes in the net position of miner holdings are perfectly correlated with vertical declines in the Bitcoin price. With energy prices expected to rise all winter and the ongoing bear market with no end in sight, we could see a wave of unprofitable miners shutting down operations.