Crypto markets brace for impact as US debt ceiling debate threatens liquidity crunch

Market attention is focused on the debate over the US debt ceiling, but less is discussed about its potential impact on the cryptocurrency market.

The U.S. Treasury Department’s primary operating account, the Treasury General Account (TGA), has played a key role in offsetting the Federal Reserve’s quantitative tightening policy.

Historically, the primary purpose of the TGA has been to help the federal government manage payments efficiently. But against the backdrop of the impending debt ceiling crisis, the accounts have gradually dried up to ensure continued repayment of government bills.

TGA balances fell from about $1.8 trillion in June 2020 to $61.9 billion in May 2023, a 96% decline. Since the beginning of the year, TGA balances have decreased by more than 85%.

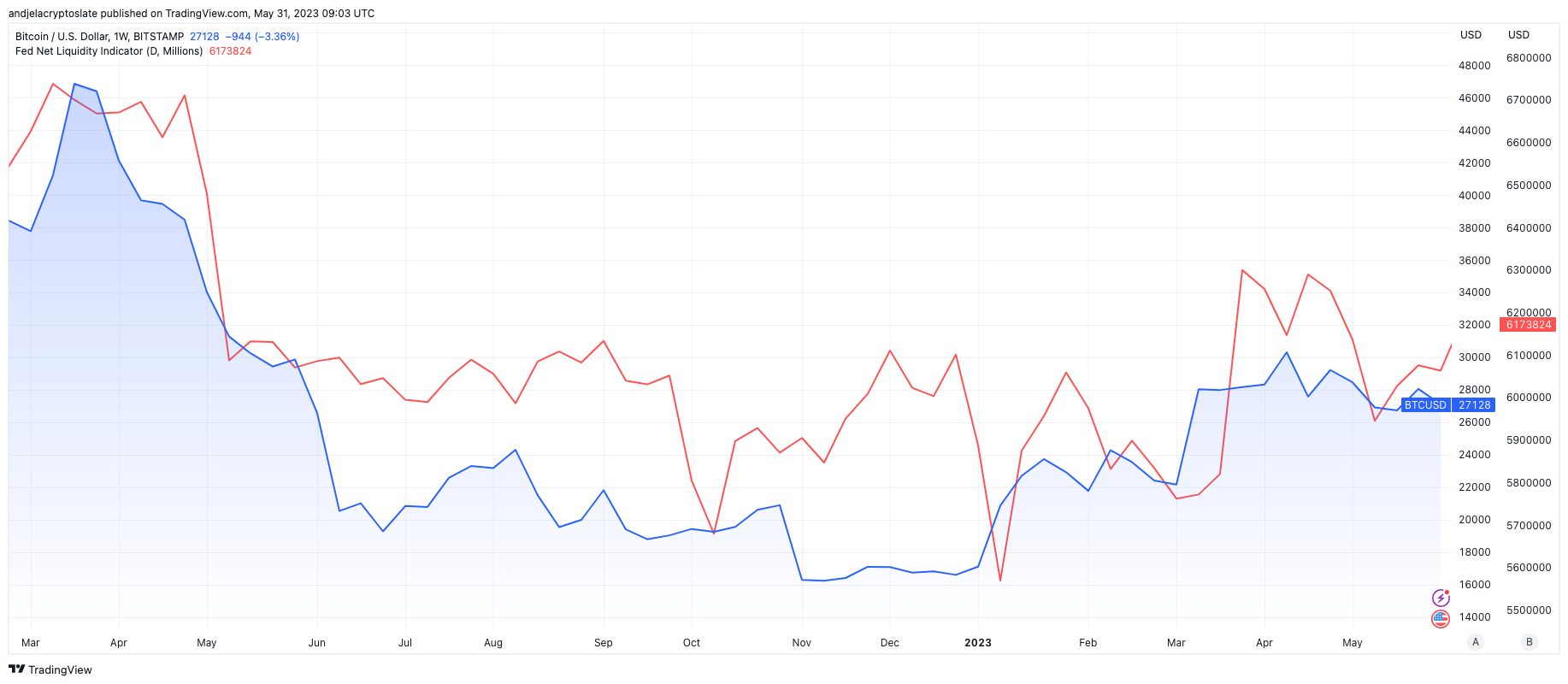

The Fed’s quantitative tightening policy aims to reduce the amount of money in circulation, putting upward pressure on interest rates to curb borrowing activity. However, the TGA outflow offset these tightening measures, effectively injecting liquidity into the market and to some extent counteracting the tightening effect.

The Treasury Department has said it intends to increase the TGA balance to its target of $500 billion once the debt ceiling is raised. It needs to raise about $440 billion to achieve this. The primary method of raising these funds is through the issuance of treasury bills (T-bills), which will inevitably siphon additional liquidity from the market.

according to data According to the Treasury Department, the average monthly treasury bill issuance over the past three years has hovered around $220 billion. This suggests that, given normal issuance volumes, the Treasury will need to ramp up its T-bill issuance over two months to raise the required $440 billion.

However, this estimate is subject to change as the exact schedule depends on various factors such as market demand and economic conditions.goldman sachs believe The Treasury could issue up to $700 billion in treasury bills within six to eight weeks of the debt deal. Overall, Goldman expects the Treasury Department to supply the market with more than $1 trillion in treasury bills on a net basis this year.

This T-bill issuance increase could double the quantitative tightening effect and pose a significant threat to the financial and cryptocurrency markets. A contraction in the money supply could lead to a liquidity squeeze that could lead to a general decline in asset prices.Bank of America analyst Said This could have the same impact on the economy as a 25 basis point rate hike.

The impact of this move extends into the future. Short-term government bills, which typically mature within one year, not only absorb a large amount of liquidity at the time of issuance, but also tie up funds for the life of the bill. This means that the impact on market liquidity could be felt for up to a year after the issuance increase, assuming the Treasury mainly uses 1-year government bonds to replenish the TGA.

The cryptocurrency market could experience a notable downturn as investors’ risk tolerance declines as financial conditions tighten.

After 2022, Bitcoin is increasingly correlated with net liquidity.a crypto slate A report dated April 22 this year found that an increase in the total amount of currency available on the market correlated with an increase in the Bitcoin price.

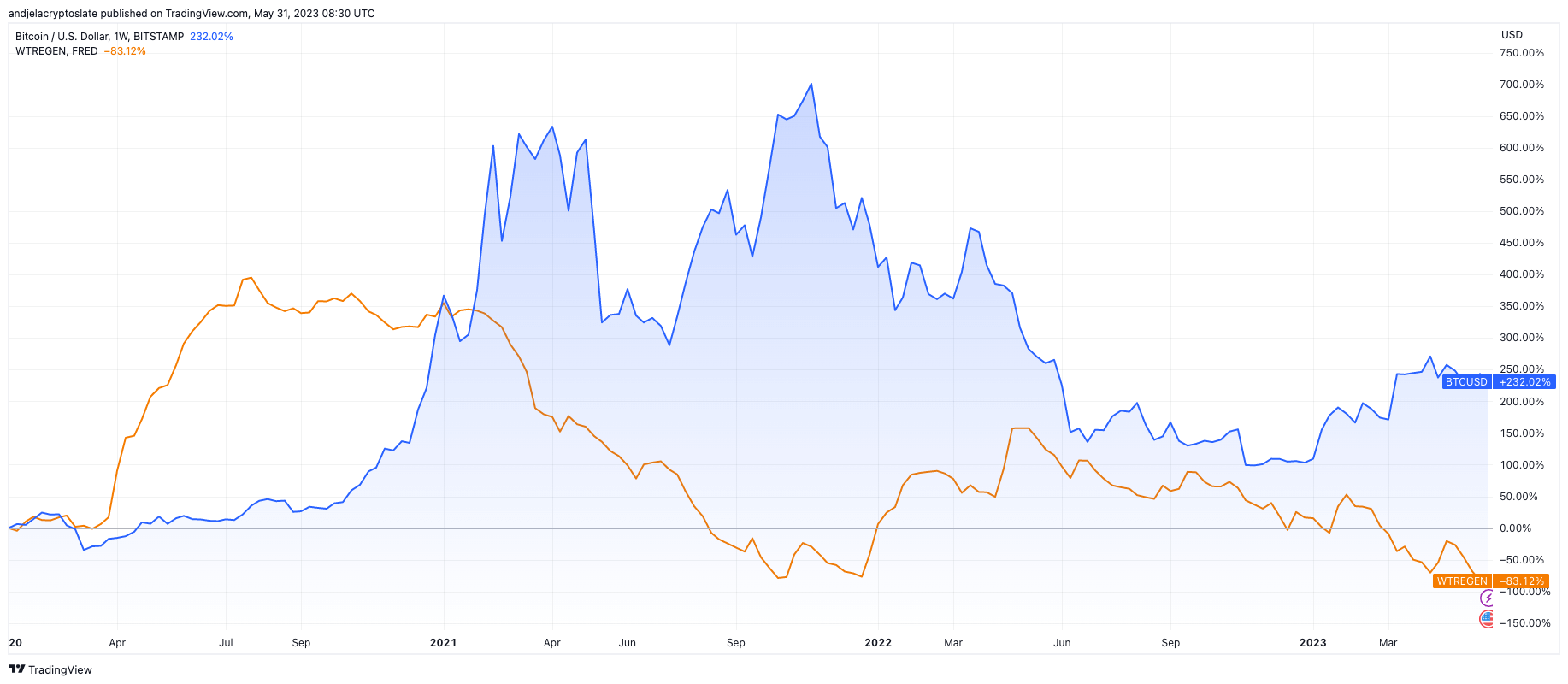

Conversely, Bitcoin also shows an inverse correlation with TGA balances. Since 2020, every increase in the Treasury General Account has been correlated with a decline in the Bitcoin price.

In conclusion, the market is engrossed in the drama of the US debt ceiling debate, but the real story lies in the imminent liquidity crisis. The possible issuance of Treasury bills by the Ministry of Finance to replenish TGA balances could significantly tighten market liquidity and drive asset price declines in both financial and crypto markets. be. Bitcoin is likely to bounce back and buck the overall market trend, but the short-term impact on the market could be severe.

As the U.S. debt ceiling debate threatens liquidity shortages, the post-crypto markets are bracing for the impact, first appearing on CryptoSlate.