Crypto shines in spite of dire macro conditions

The recent market recovery is largely astonished by the fact that the macro situation has not definitely improved, and most notably, the latest CPI data was 9.1% year-on-year, well above expectations. rice field.

Nonetheless, inflation expectations from the market have calmed down, according to some studies. This is a major contributor to the recent price increases we are currently experiencing and the generally oversold situation just two weeks ago. In fact, the headlines that 2022 was decades and one of the worst starts of the year for stocks were plentiful.

Returning to cryptocurrencies, the market sees it as a sign of strength as BTC continues to exceed $ 20,000 and ETH is far from below $ 1,000. Both are doing well.

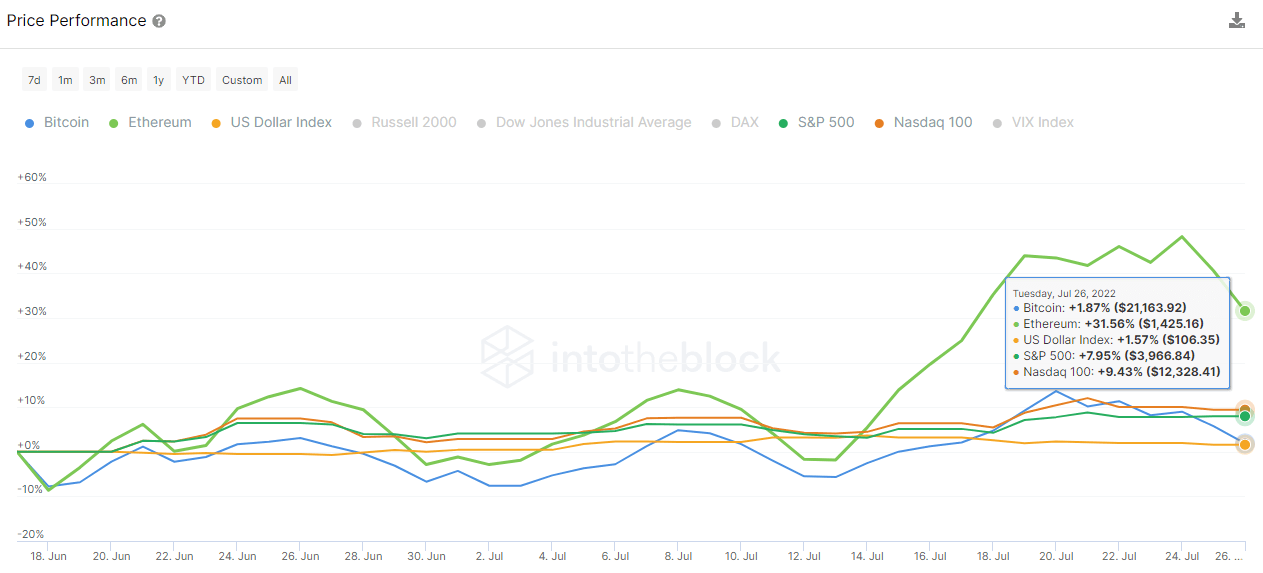

Here you can see how BTC and ETH have been performing against US equities since the market bottomed out on June 17th to this day.

BTC prices have risen almost 2%, while ETH has risen 21%. This is certainly due to the merger of Proof of Stakes. As can be seen above, BTC and ETH were volatile until July 12, when stocks began their current price increases, ahead of the move that followed a few days later.

Some analysts consider the current state of crypto as a proxy for market thirst for risk-assessed assets. In addition to the significant market easing this year, BTC is relatively stable above the $ 20,000 price, which is probably seen as a sign of consolidation and has helped drive the story of recovery. increase.

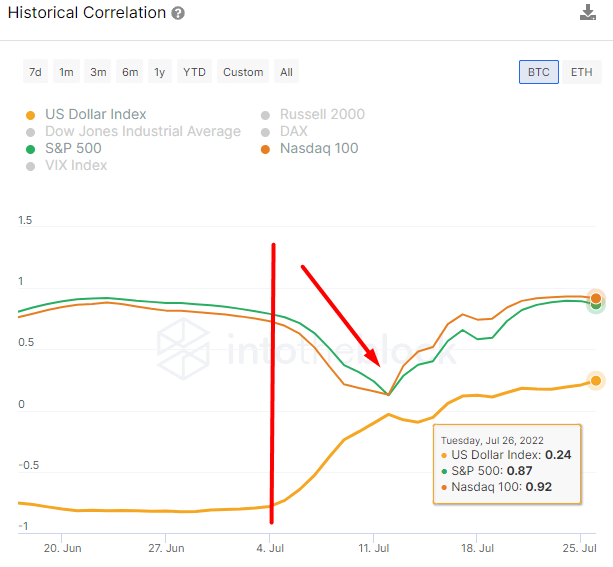

Looking at BTC’s historical correlation to US equity indexes such as the S & P 500 and Nasdaq 100, the aforementioned decoupling can be easily found.

Prior to July 4, the crypto market was essentially a mirror of the US index, maintaining a close correlation of 0.8-0.9.

Then compression started and BTC and ETH performance began to differ. Interestingly, the strength of the dollar, represented by the orange index, has recently been recognized as a reverse mirror of the crypto market.

But so far last month, the correlation has been decoupled, and the correlation between BTC and the dollar is close to 0.2, so the crypto seems to be less correlated with what the dollar is doing. ..

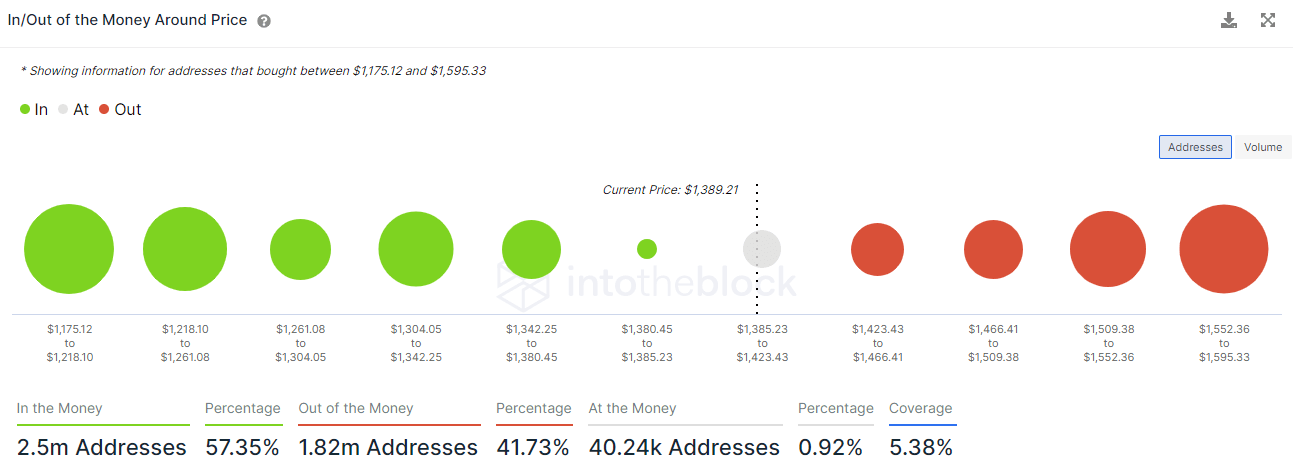

As for Ethereum, everyone wonders if the extraordinary price increases it has will last longer until the September merger date. For the time being, we can point out potential points of support and resistance based on the data on the chain.

For this purpose, we use the on-chain indicator “inside and outside of money around the price”. This indicator covers buckets within 15% of the current price in both directions. In doing so, IOMAP identifies key trading areas that may act as support and resistance levels.

As you can see in the graph below, most of the addresses are buying ETH at their current level ($ 1,304 to $ 1,342). This means that the price is likely to act as a support for that price range, as these traders are neither profiting nor losing. Therefore, selling pressure from them may be negligible.

In the future, the $ 1,552 to $ 1,595 price range is another price range where many addresses have been purchased in the past. It has been submerged for some time and may sell again when prices approach these levels. Therefore, this range can act as a potential resistance level.

The next few days will be interesting to monitor how macro conditions evolve. The ever-recovering stocks could catapult cryptocurrencies towards the continuation of the bull market that many have long sought.