Crypto’s utility driving adoption in Sub-saharan Africa – Chainalysis

Between July 2021 and June 2022, $100.6 billion worth of cryptocurrency transactions were recorded on-chain in sub-Saharan Africa, according to Chainalysis. report.

It showed a 16% year-on-year growth, but still accounts for just 2% of global crypto trading, making it the lowest in the world.

However, the latest Chainalysis report shows that the region has some of the most well-developed crypto markets.

“The deep penetration and integration of cryptocurrencies into everyday financial activities.”

Leader in Small Retail Crypto Trading

In sub-Saharan Africa, small-value cryptocurrency remittances account for 95% of all crypto-related transactions in the region, according to a report.

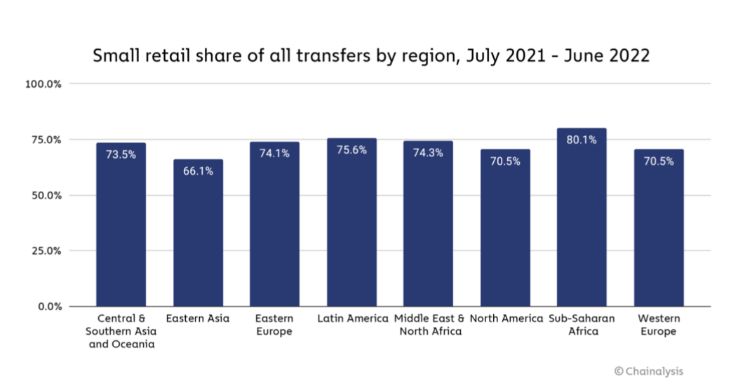

Small retail transfers under $1,000 will account for 80% of cryptocurrency transactions between July 2021 and June 2022, more than any other region in the world. By comparison, the share of small retail cryptocurrency transfers in North America was 70.5% over the same period.

Adedeji Owonibi, founder of Convexity, a Nigerian blockchain consultant and product studio, told Chainalysis that there are no crypto institutional investors in Sub-Saharan Africa. Instead, the region’s cryptocurrency market is driven by the use of retail trade, where day-to-day traders try to make a living amid high unemployment. he added:

“this [crypto] It’s a way to feed your family and solve your daily financial needs. ”

Therefore, sub-Saharan Africa is adopting cryptocurrencies out of necessity. This is why the number of small retail transactions in the region increased when the bear market started in May 2022, according to Chainalysis data.

The report further states that the fluctuating value of fiat currencies in some countries in the region, such as Kenya and Nigeria, provides further incentives to trade cryptocurrencies, especially stablecoins. Many investors in the region are turning to stablecoins to preserve their savings amid local currency volatility.

Peer-to-peer trading is key

P2P exchanges account for 6% of all cryptocurrency trading in the region, according to a Chainalysis report.

Anti-crypto regulations, such as Nigeria banning banks from interacting with crypto businesses in 2021, have led more and more people to turn to P2P trading.

Moreover, P2P trading is not confined to regional P2P exchanges like Paxful, which saw a 55% year-on-year increase in customers in Nigeria.

According to the report, cryptocurrency traders in the region are also conducting private trading through groups on social media platforms such as WhatsApp and Telegram.

Crypto for Remittances and International Business Payments

The Sub-Saharan region has thousands of payment systems without interoperability or intercommunication.

Remittances to regional countries can be very expensive compared to cryptocurrencies.

Local businesses with international suppliers are also using crypto to make payments.