CryptoSlate Daily wMarket Update – Sept. 6

As of 07:00 UTC on September 7, the cryptocurrency market capitalization stood at $938.47 billion, down 5.2% over the past 24 hours.

Bitcoin’s market capitalization fell by almost $20 billion or 6.2% in a single day to $358.94 billion. Meanwhile, Ethereum’s market cap is at $185 billion, down 7.9% from about $6 billion on Sept. 2010.

Data from CryptoSlate shows that the top 10 cryptocurrencies by market cap have all been in the red over the past 24 hours, with Cardano posting the highest loss after falling 9.26%.

Tether (USDT) and USD Coin (USDC) have market caps of $67.55 billion and $51.61 billion respectively, while BinanceUSD (BUSD) has a market cap of $19.74 billion, up slightly from Sept. 5 Did. The cap fell slightly on the previous day.

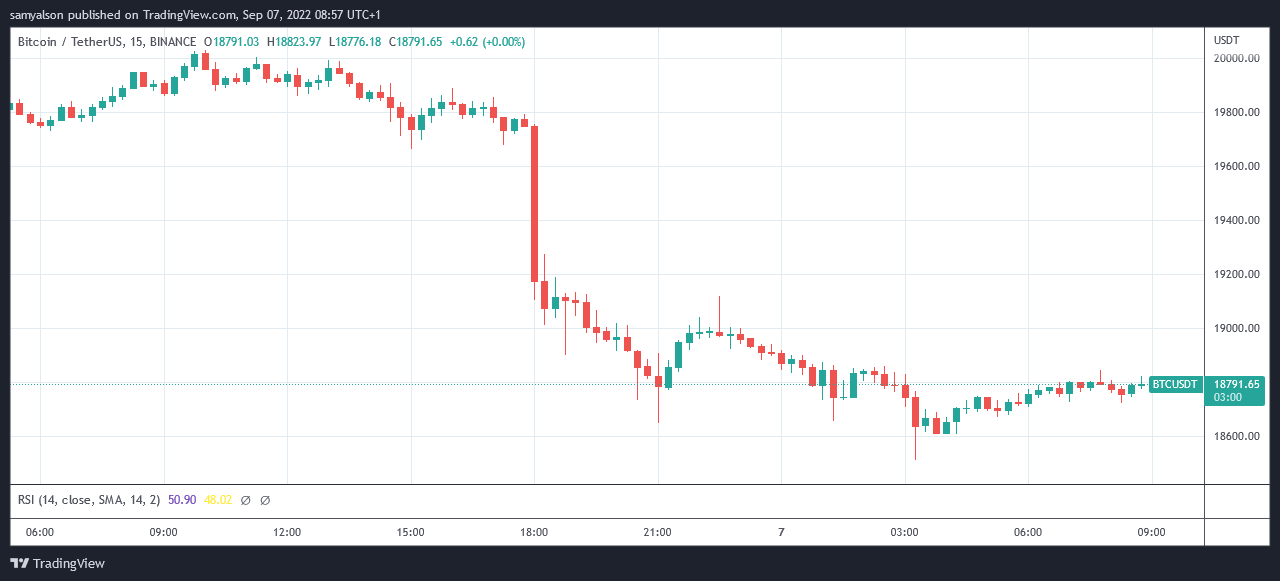

Bitcoin

Bitcoin (BTC) has suffered heavy losses over the past 24 hours, trading at 18,700 as of 07:00 UTC, down 5.21%. This is below the all-time high set in November 2017. BTC’s market share fell to 38.3% after 8am, the lowest since February 2018.

Prices of the biggest cryptocurrencies continue to struggle and lose market share. Market sentiment remains bearish, with Bitcoin Greed and Fear Index showing extreme fear.

BTC was trading flat until around 17:00 UTC on September 6th, when it began to crash significantly. BTC price dropped to $18,715 around 20:00 UTC, then recovered slightly before crashing again, dropping below $18,600 around 02:15 UTC on September 7th.

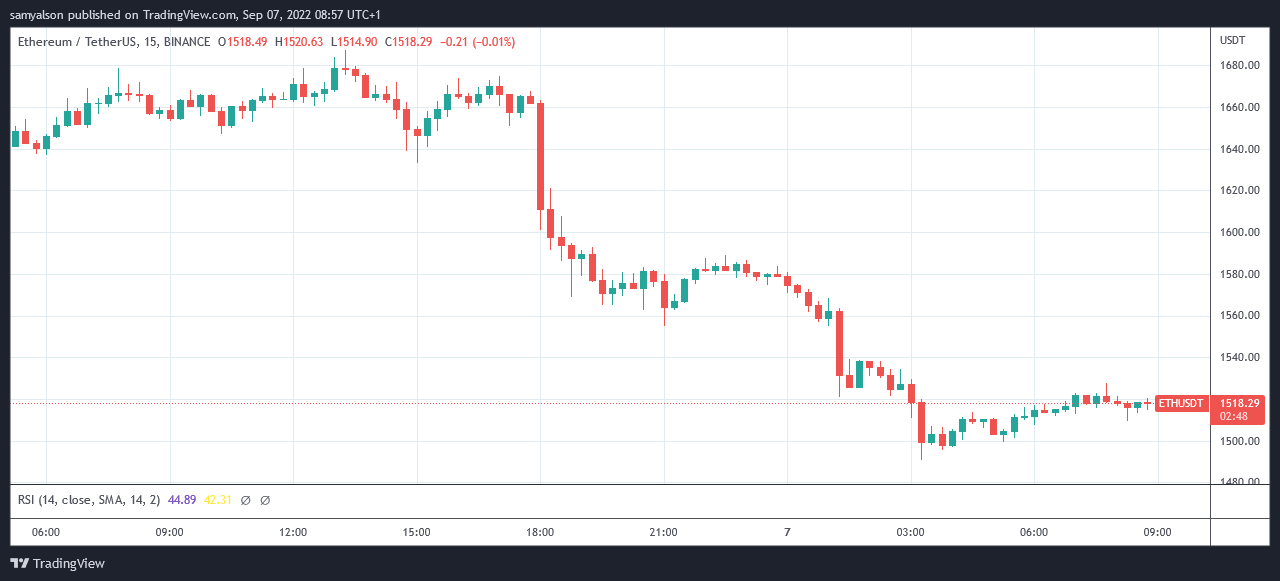

ethereum

Ethereum (ETH) fell 8.65%, trading at $1.51 at 07:00 UTC after losing most of its gains over the past week. Anticipation of Bellatrix’s upgrade (the last significant upgrade before the merger) drove the price of ETH higher in the early hours of September 6th. However, technical issues after the upgrade launched put bearish pressure on the price of ETH.

Despite a 4.11% drop in price over the past week, ETH has consistently outperformed Bitcoin over the past 30 days as the Merge approaches. The merge also ballooned the staked ETH to an all-time high of 14.26 million, worth about $21.6 billion at current prices.

The price of ETH started to plummet around 17:00 UTC and dropped to around $1,560 by 20:00 UTC. The price recovered slightly after that, but continued to fall shortly thereafter, dropping below $1,500 at around 02:30 UTC on September 7th.

top 5 price increases

voyager token

VGX is up 20.94% over the last 24 hours, posting its biggest profit of the day. The token is trading at around $0.92 at the time of writing, up 67.99% over the past seven days.

Voyager was the first lender to file for bankruptcy after Three Arrows Capital went bankrupt, but the company is currently considering a takeover bid, with a September 6 deadline. Voyager had previously rejected FTX’s offer to buy out loans and assets at market prices, except for its exposure to 3AC. Proponents of the token believe VGX could soon try his $1 despite the company’s liquidity crisis.

binary X

BNX posted its biggest gain of the day, trading at $1.36, up 5.85% over the past 24 hours. The price of the token rose sharply around 12:30 UTC on September 6th, but has been falling since then. It is currently unknown what caused the token price to skyrocket.

voxel

VOXEL is up 5.2% over the last 24 hours and is trading at $0.28 at the time of writing. The token is up 24.12% over the past week, but its current trading price is significantly lower than when he was trading around $0.42 in mid-August.

radio kaka

After trading roughly flat over the past week, the token has registered a 2.09% gain over the past 24 hours, trading at $0.00038. This is despite the token price dropping sharply around 17:00 UTC, reflecting the drop in BTC and ETH prices. The token is down 15.39% over the past week.

helium

HNT was up 2.05% over the past 24 hours and was trading at $3.88 at the time of publication. However, the token has fallen 30.36% over the past week. Questions have plagued the community since a developer suggested moving the project from the native blockchain to Solana late last month.

top 5 losers

DeFi chain

DFI posted its biggest single-day loss, down 23.22% over the past 24 hours, trading at $1.03 at the time of publication. Token he experienced a sharp rise on Sept. 3, but all gains were wiped out by losses that day.

SSV network

SSV is down 16.98% over the last 24 hours and is trading around $14 at the time of writing. However, the token has registered a 5.53% gain over the past week, and the current decline can be attributed to volatility.

synapse

SYN recorded a 16.62% loss in the last 24 hours. The token was trading at $1.29 at press time after eliminating all gains since Sept. 5. The reason behind the token’s volatility is unknown at this time.

Lido DAO Token

LDOs also suffered losses as a result of the drop in ETH price. It has lost 16.55% over the last 24 hours and is trading at $1.82 at the time of writing. Over the past month, the token price has fallen by 21.66%.

ethereum classic

At the time of writing, Ethereum Classic (ETC) lost its week-long gains, trading down 16.16% to $34.32 per day.

Earlier this week, ETC’s price rose as ETH miners moved into the network ahead of a merge that would turn Ethereum into a proof-of-stake network.