DAI supply has fallen by 13% this week

Over the past week, MakerDAO has experienced a decline in total locked value (TVL), DAI supply, and annual fee income, indicating potential problems for one of the world’s largest stablecoin issuers. is shown.

Additionally, the value of MKR decreased by 25% over the same timeframe. Despite the DAI’s return to parity with the US dollar recently, growing uncertainty over whether the peg condition will persist has caused MakerDAO’s TVL drop over the past seven days.

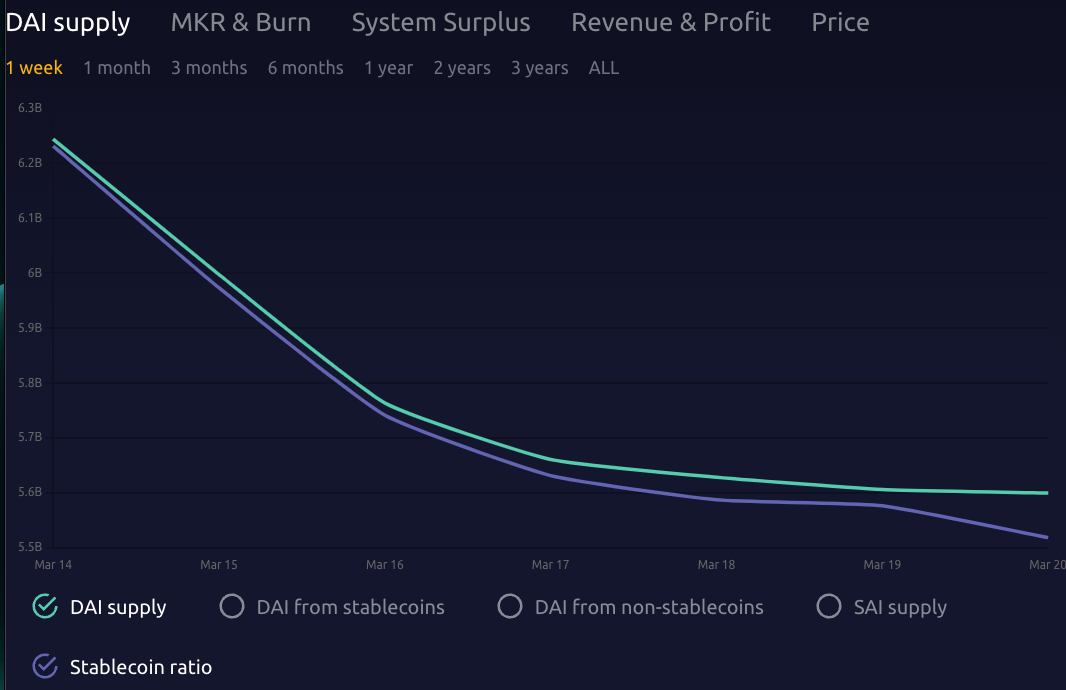

On-chain data suggests that the decline in MakerDAO’s asset value can be traced to a decline in secured loans on the platform. The decline in loans appears to have been driven by concerns about the sustainability of the DAI stablecoin, whose supply fell by 13% last week, according to data from Marker Burn.

Downward pressure on DAI

As a result, the supply of DAI has also decreased, with Maker Burn data showing a 13% decrease since March 13th. Currently, the DAI stablecoin supply is 5.6 billion tokens. If the supply of DAI were to drop, it could be due to lower demand, as we’ve seen over the past week, or a burgeoning flight to other cryptocurrencies such as Bitcoin and Ethereum. is showing. last week.

What this potentially means for MakerDAO’s annual income spread

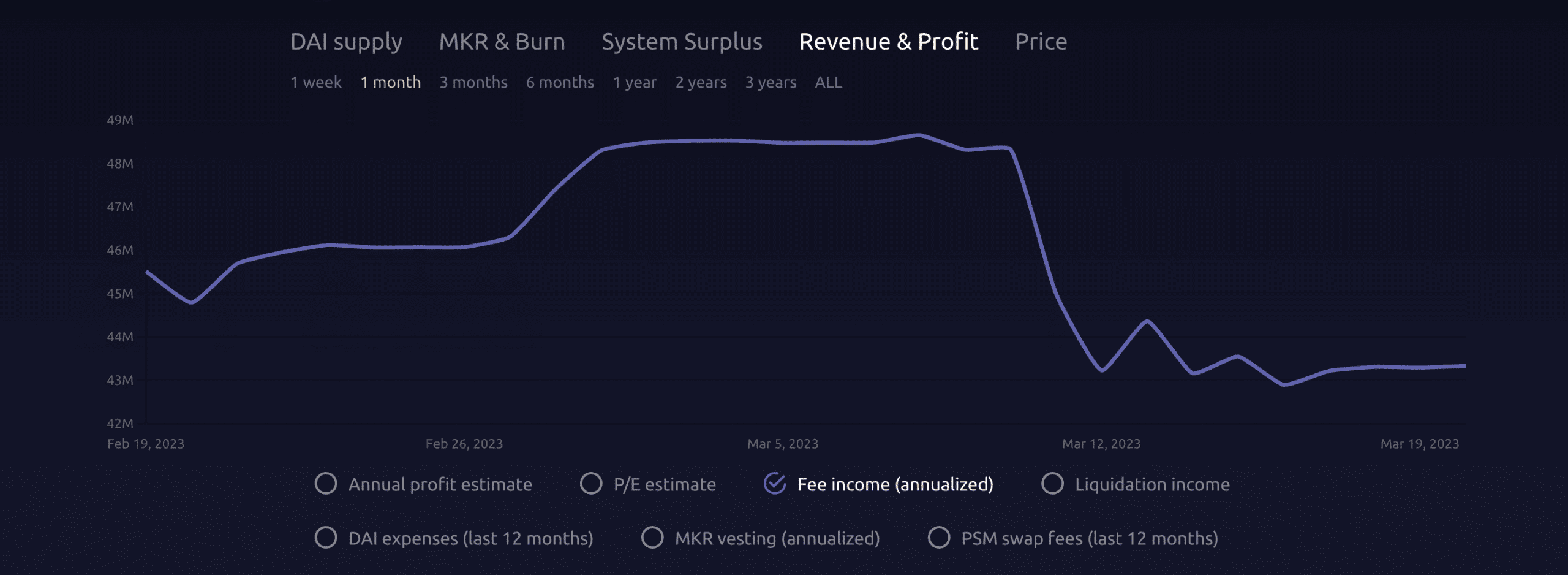

MakerDAO’s annual fee income has decreased due to the reduced supply of DAI over the past week. MakerDAO generates income through fees when a user opens a Collateralized Debt Position (CDP) and generates his DAI, which is paid in her MKR tokens.

Since the Stability Fee is paid in DAI and converted to MKR, a reduction in the DAI supply could lead to a reduction in the Stability Fee, which in turn reduces the amount of MKR tokens distributed as fee income. Maker Burn data shows MakerDAO’s annual fee income has declined by 10% since the collapse of Silicon Valley Bank.

As stablecoins such as DAI decrease, Tether increases.

According to CryptoSlate data, Tether’s USDT supply has reached $74 billion for the first time since May 2022.

Last month, Tether’s supply increased by about 5 billion due to regulatory scrutiny and banking problems faced by stablecoin competitors such as BUSD and USDC.

In contrast, USDC, BUSD, and DAI supplies have fallen this year, while USDT supply has increased by 10%, with USDT’s market dominance reaching 56.4% last week, its highest point since July 2021. rice field.