Debunking the FUD surrounding Bitcoin transaction fees

Bitcoin FUD comes in all forms and scales, from unlimited energy consumption to rampant crime.

Since 2017, the World Economic Forum has warning Bitcoin will eventually consume more power than the entire world. Governments around the world are campaigning against bitcoin mining, warning about its impact on climate change.

Regulators are also waging war on Bitcoin. Law enforcement agencies and central banks have argued that while providing infrastructure for money laundering and crime, it is not a secure network because it is vulnerable to attack and manipulation.

But all these claims are not only unfounded, they are completely false.

It can be discussed in many different ways, but Bitcoin transaction fees offer the simplest explanation.

Bitcoin transaction fees are the lifeblood of the Bitcoin network, protecting it in the short and long term.

Critics of the network worry that fees alone will no longer be enough to keep miners from turning off their machines, as block subsidies decrease with each halving. When miners leave the network en masse, it slows down the network significantly, making it highly vulnerable to attack.

These claims are highly hypothetical and equally unlikely. The security of the Bitcoin network has remained strong since its inception over a decade ago. None of the major events the network has ever experienced have been able to crack its security foundation.

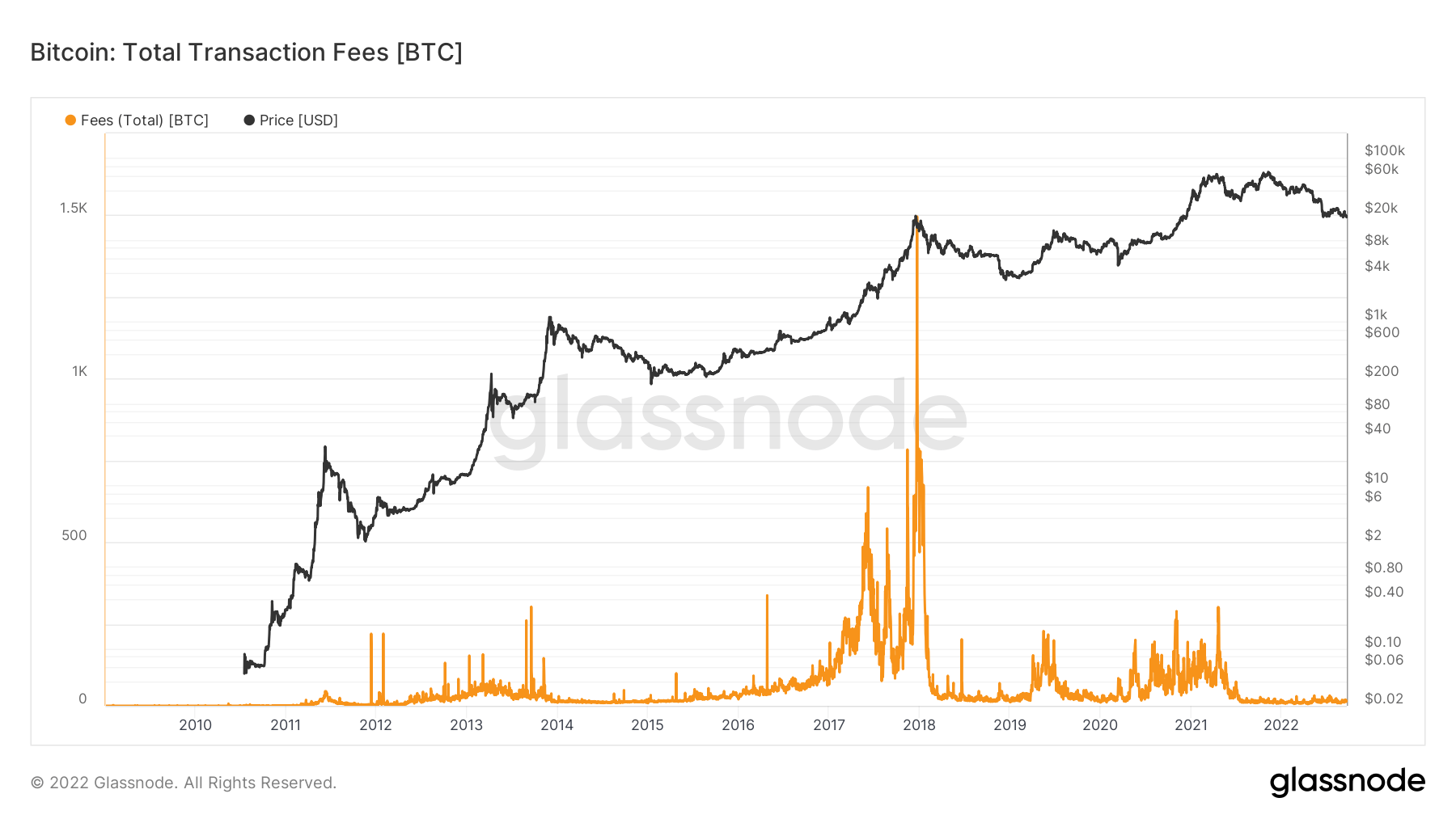

In 2017, the network faced one of its first major congestion problems as Bitcoin approached $20,000. Trading fees soared to all-time highs as the massive sale took place. Once the adjustment began, transaction fees began to drop significantly, and many wondered if the sharp drop in miner revenue would affect the network.

Since 2017, the Bitcoin network has settled trillions of dollars’ worth of transactions for a meager fee. Miner fees remain relatively stable throughout 2022. As Lightning Network and SegWit become more popular, congestion will be even less.

Those concerned about Bitcoin security think it’s only a matter of time before Bitcoin is attacked.

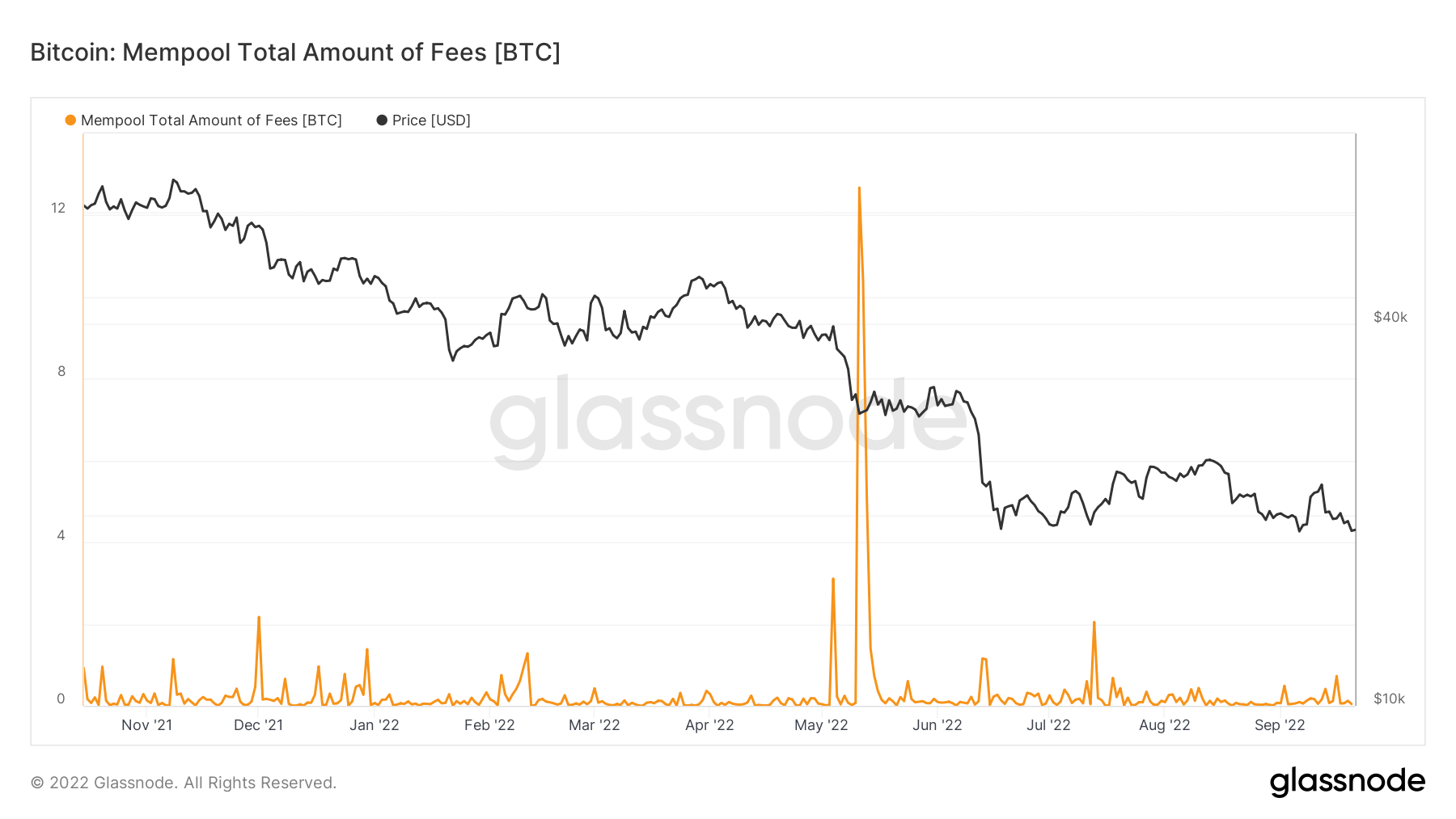

However, any type of attack on the Bitcoin network will undoubtedly lead to significant increases in mempool fees. Users will start competing for higher and higher fees for the next block, making it more expensive for attackers to control the network.

This is evident in the giant spike that occurred during the collapse of Terra (LUNA) in May of this year. The total pending transaction fees on mempool increased more than 10x as users raced to start selling before the price of Bitcoin dropped too low. Those willing to pay higher fees had their transactions processed and their losses contained, while those whose transactions got stuck in his mepool were forced to wait for the congestion to clear. .

This is a testament to the security of your network. Transaction fees are the lifeblood of keeping the network up and running, a defense mechanism that keeps the network safe during periods of high volatility.