Decade old whales selling Bitcoin hoard again; last time was during LUNA collapse

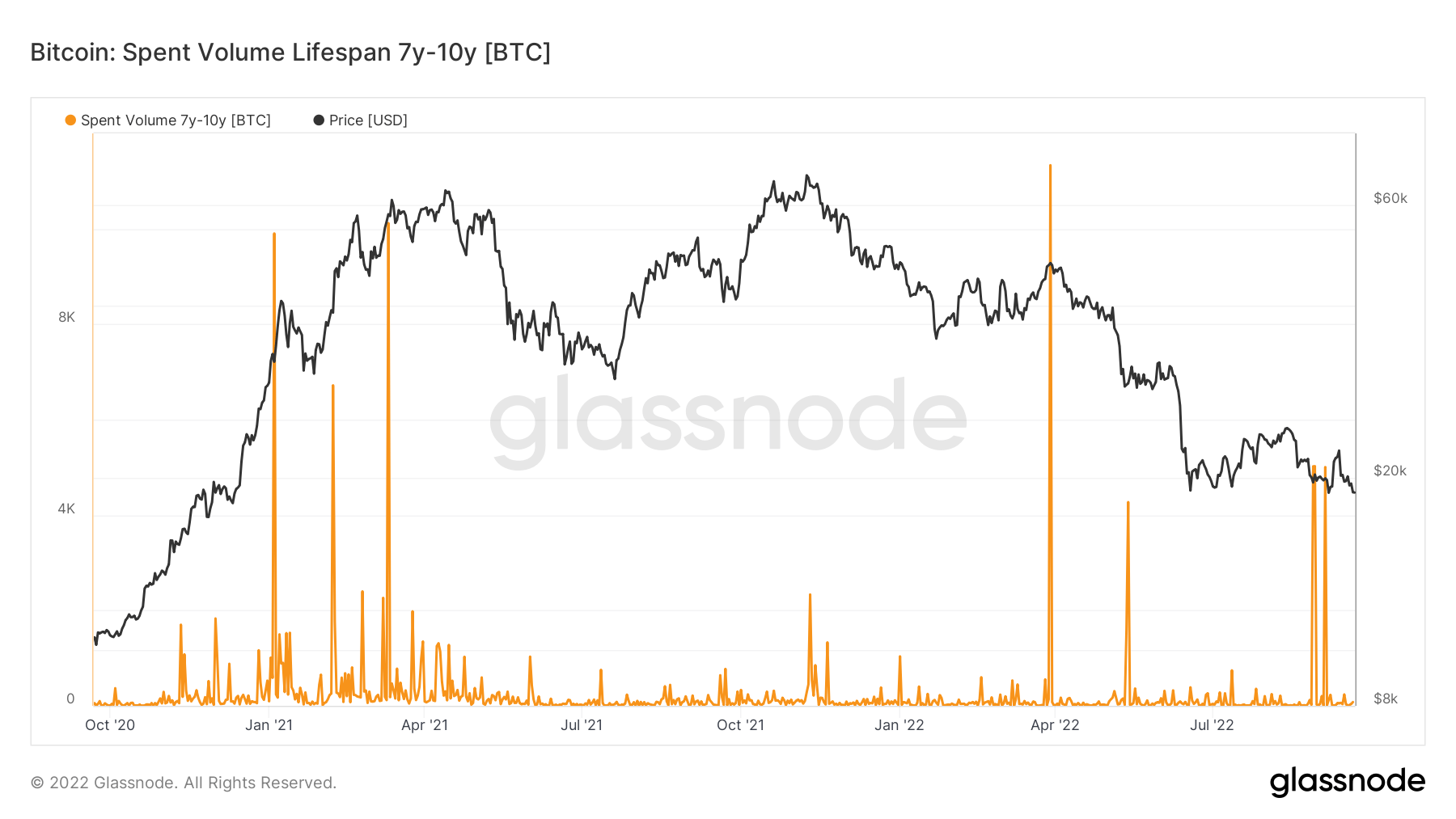

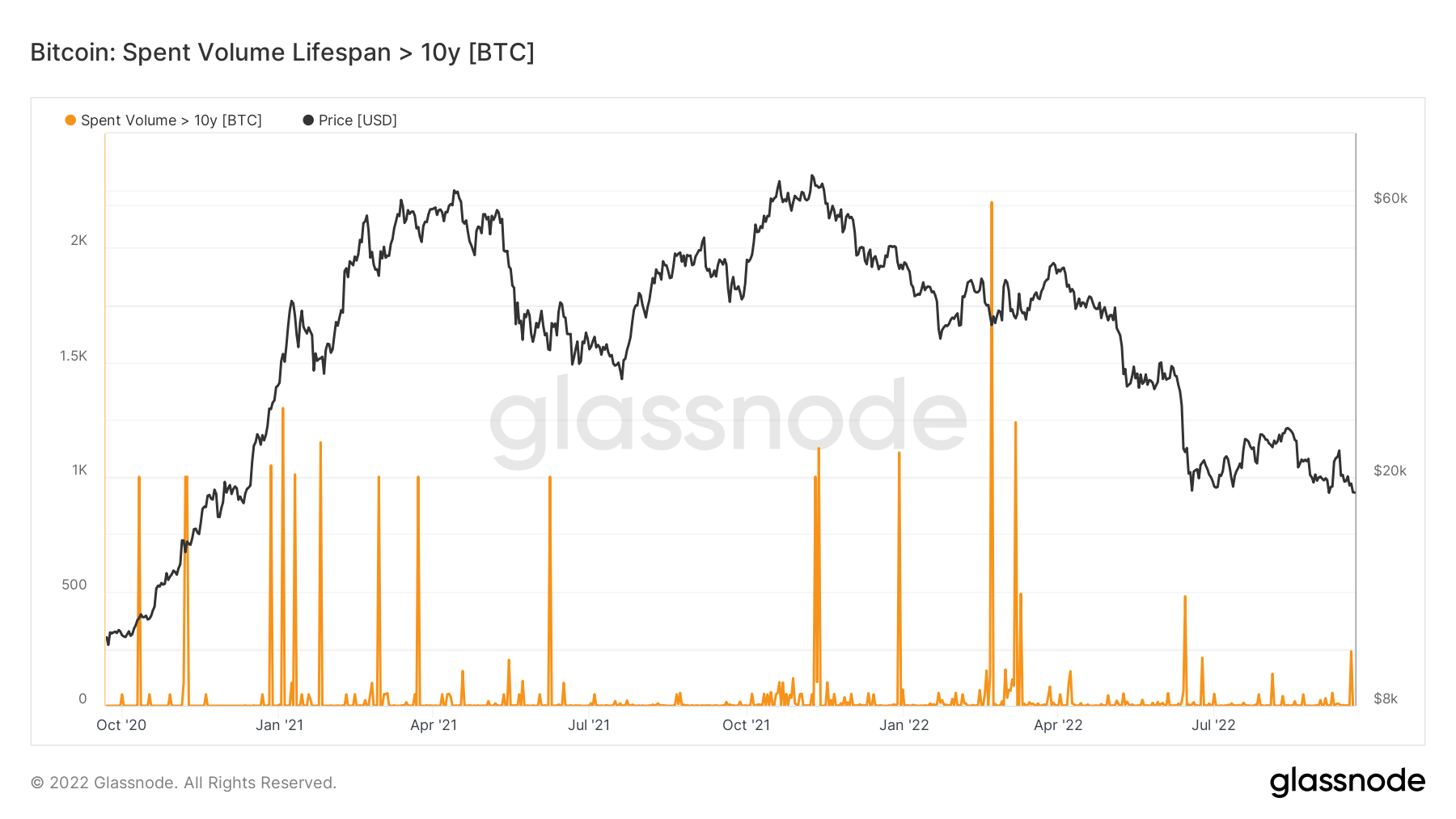

Long-term whales holding bitcoin (BTC) for more than 7 to 10 years have sold bitcoin for the first time since Terra (LUNA) collapsed in May, as shown by the Spent Volume Age Bands (SVAB). doing.

Spent Volume Age Bands (SVAB) is an isolation of on-chain transfer volume based on coin age. Each band represents the percentage of usage previously moved within the time period indicated in the legend.

The top chart shows total remittances for coins that were last active between 7 and 10 years old, while the bottom chart shows the same data for coins that have been stagnant for over 10 years. .

Both charts start in October 2020 and show sell by month. The impact of the Terra crisis can be seen on both charts, with a spike in consumption in May. The same spike is seen in his September 2022, especially with Bitcoin last moved 7-10 years before him.

Are you quitting whales?

Whales are considered smart money within the Bitcoin ecosystem as they have been able to sustain almost all bear market cycles. Moreover, these owners have survived countless blocksize wars and FUD attacks.

Whales aged 7-10 recorded the fifth and sixth largest trades of the year in September.

Whales over the age of 10 did not hit annual highs, but the chart shows a notable increase in sales. Whales aged 10+ understand market cycles better than any cohort, so their selloff reflects bearish sentiment.

Whale decline

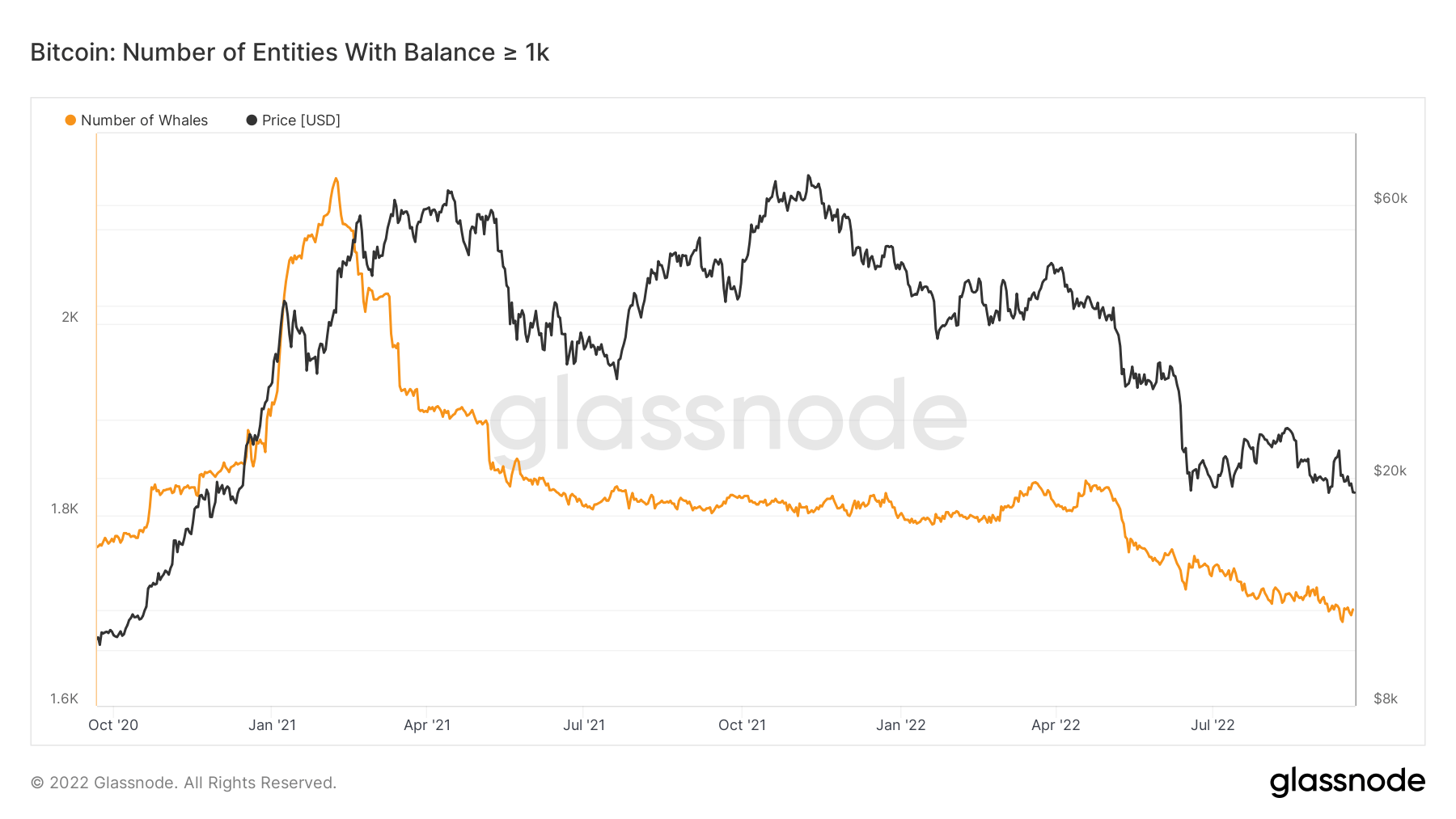

In addition to sales, the numbers also show a decline in whale numbers.

Individuals with at least 1,000 bitcoins are called whales, and their numbers have been declining since the peak of the 2021 bull cycle that occurred in January 2021. Nevertheless, most whales he cashed out in January.

The decline in whale numbers recorded between January 2021 and July 2021 is understandable by the 2021 bull market. From July 2021 to April 2022, the number of whales increased and the price of Bitcoin stabilized somewhat between $60,000 and $40,000.

The decline in whale numbers recorded between January 2021 and July 2021 is understandable by the 2021 bull market. From July 2021 to April 2022, the number of whales increased and the price of Bitcoin stabilized somewhat between $60,000 and $40,000.

However, Bitcoin continued its decline after April 2022. Even as prices fell, whale numbers fell from he 2,150 to 1,695. The last part is especially interesting because whales tend to wait for winter prices.

on the bright side

Despite low prices, the decline and mass sale of whales has shown bearish sentiment, but there are also bright spots. A sale and disappearance of a whale means that their bitcoin is distributed to multiple people.

This means that Bitcoin is increasingly concentrated in a small number of individuals. In the long run, having a more decentralized Bitcoin will benefit retailers and improve the security of the network.