Digital asset market lost $1B in the week of Aug. 15

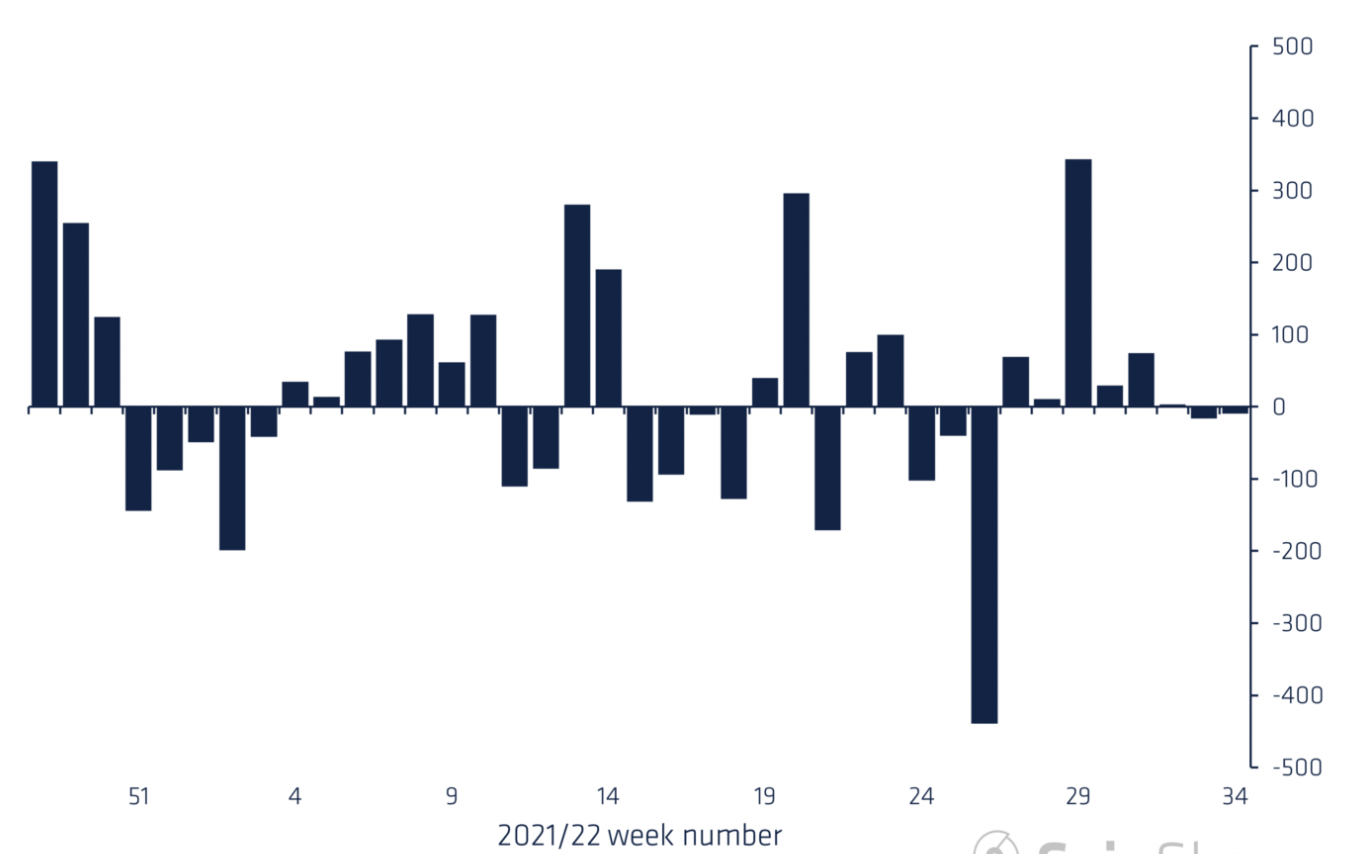

Digital asset investment products lost a total of $1 billion in micro-transactions of up to $9 million between Aug. 15 and Aug. 21, down 55% from annual averages to second-lowest level in 2022 scaled down. report indicates

Most of the losses are from the US, Germany and Sweden. Countries recorded outflows of $10 million, $2.4 million and $2.1 million respectively. Smaller inflows of $2.5 million from Brazil and $1.9 million from Switzerland were recorded.

Regardless of inflows, the market fell to its second-lowest level of the year, indicating low levels of investor participation. Last week’s price rally may also have sparked selling from investors looking for short-term gains.

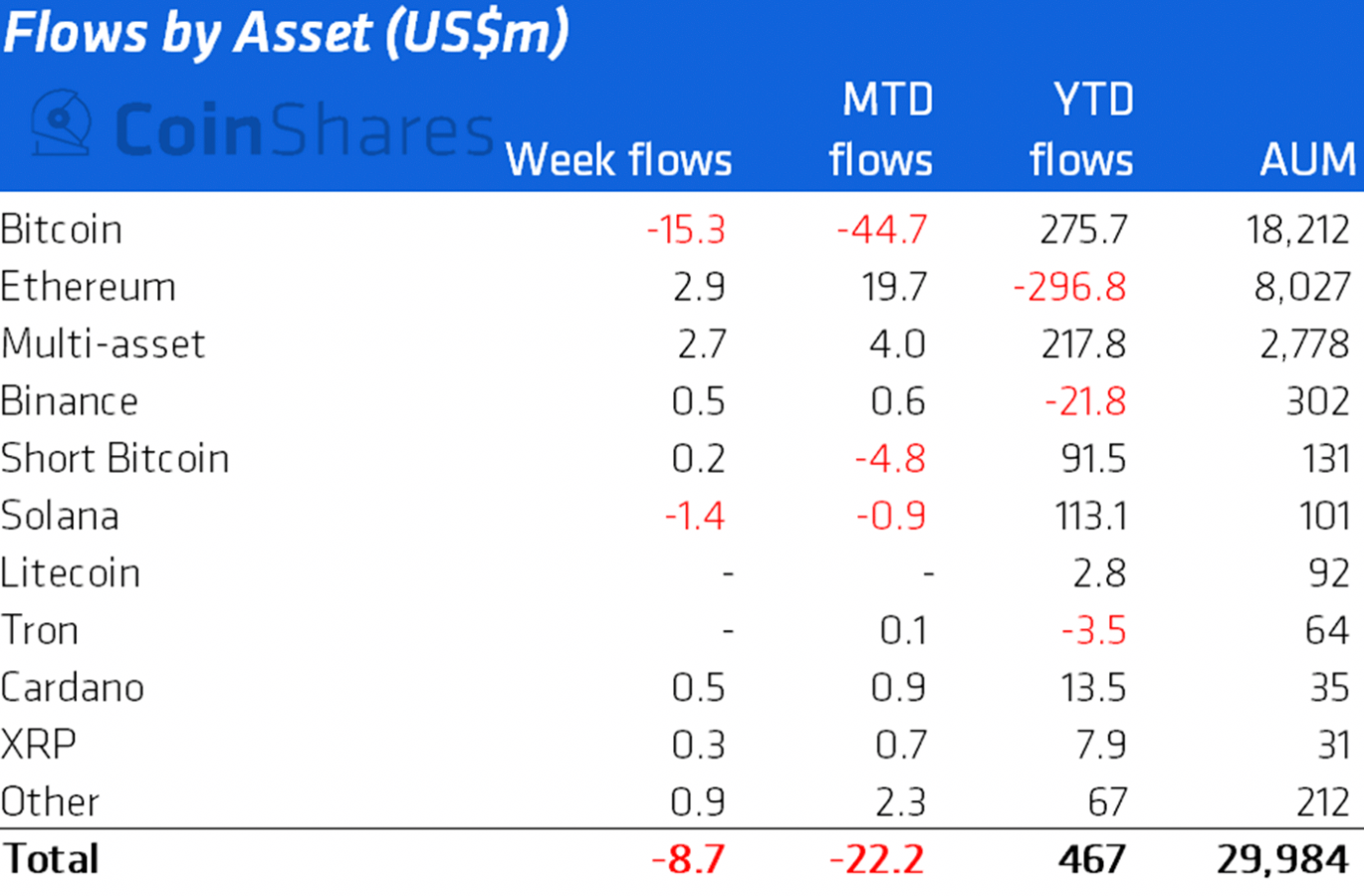

Flow by asset

Bitcoin recorded three consecutive weeks of outflows, losing a total of $15 million between August 15th and 21st.recorded spill It was $29 million and $21 million for the weeks from August 8 to August 14 and from August 1 to August 7, respectively. Short-Bitcoin, on the other hand, recorded minor inflows of up to $200,000.

Ethereum, on the other hand, saw a shift in negative sentiment, registering inflows of up to $3 million. The asset has rounded out the weeks with inflows since mid-June, which may reflect a merger, with nine weeks of inflows equating him to $162 million.

As for other altcoins, Cardano recorded a modest inflow of $500,000, while Solana ended the week with an outflow of $1.4 million. Blockchain stocks also paralleled the outflow across the market, and in total he lost $1.6 million.

Flow by region

The market as a whole recorded losses, but the numbers show different flows to and from exchanges based on region.

European exchanges recorded significant inflows totaling $20 million. Meanwhile, exchanges from North and South America experienced outflows worth $36 million last week.